RE City of St. John's rejects owner's pleas to tear down burnt-out house. Now she says she's stuck

David Amos<david.raymond.amos333@gmail.com> | Wed, Aug 16, 2023 at 12:24 AM |

| To: mayor@stjohns.ca, atlanticIunit@cbc.ca, ariana.kelland@cbc.ca, tiffanyelton@gmail.com, joethorne@stewartmckelvey.com | |

| Cc: motomaniac333 <motomaniac333@gmail.com>, premier <premier@gov.nl.ca>, corporate.communications@firstam.com, cgaska@firstam.com, investor.relations@firstam.com | |

https://davidraymondamos3. Tuesday, 15 August 2023 City of St. John's rejects owner's pleas to tear down burnt-out house. Now she says she's stuck https://www.cbc.ca/news/ | |

City of St. John's rejects owner's pleas to tear down burnt-out house. Now she says she's stuck

'What's crushing me is I'm one small business lady in their town — who cares if I'm OK in the end?'

"I don't need a puffer anymore," she said, explaining her breathing has improved since moving out. It's a bright spot in an otherwise dreary situation.

"I live in my mother's basement. And then also I run a business, so I do a lot of production from home as well. So it's been a little bit difficult there and she wants her TV room back at some point."

Elton is stuck with her 776-square-foot home in central St. John's. She can't live in it, she can't sell it for someone to occupy, and without an affordable builder and money for a costly teardown, she has few options.

"It hurts to see your house like this. Like all the kitchen cabinets, I sold them. They're gone. I've been taking the doors off, just getting all the stuff out and selling what I can, piece by piece, whatever I can sell," she said.

- Read the original CBC Investigates report here: When a house isn't a home

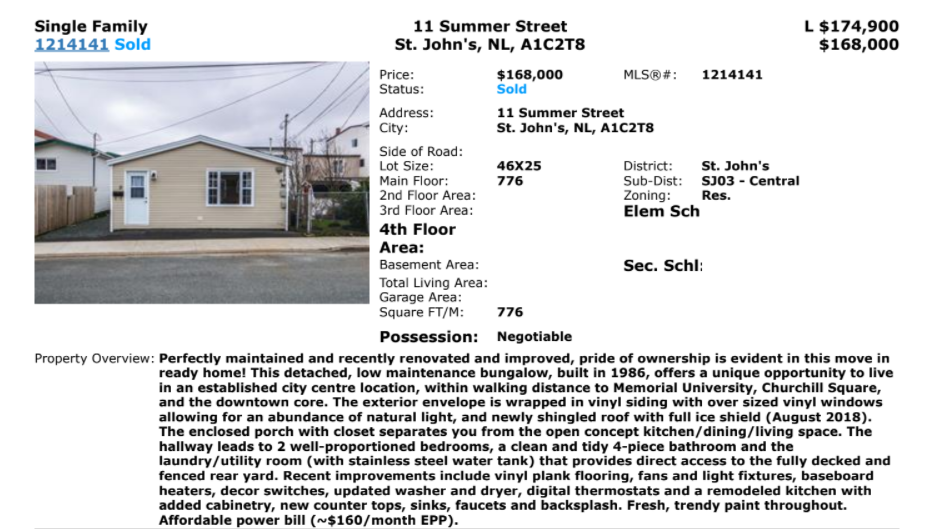

Elton purchased the home on Summer Street in July 2020 for $168,000. The following spring, she discovered an opening at the front of her house which led her down a frustrating fact-finding mission that still hasn't concluded.

A CBC News investigation in January 2022 revealed Elton's home was originally a double-car garage that had been in a fire and rebuilt as a home by covering up the charred walls with new drywall.

The property was sold as a home years before, despite the city having never inspected the property following its conversion. It had exchanged hands multiple times since the 1980s, and the city had been collecting property tax on what it considered to be a residential property.

A metal casing still hangs inside Tiffany Elton's attic signaling that the property was once a commercial garage. (Paul Pickett/CBC)

A metal casing still hangs inside Tiffany Elton's attic signaling that the property was once a commercial garage. (Paul Pickett/CBC)

After Elton alerted the city to the problem, she was handed a long list of fine notices. The property doesn't have an occupancy certificate and now cannot be lived in.

"I need it torn down. I think the city should have to tear it down because they're the ones who got me in this mess," Elton said.

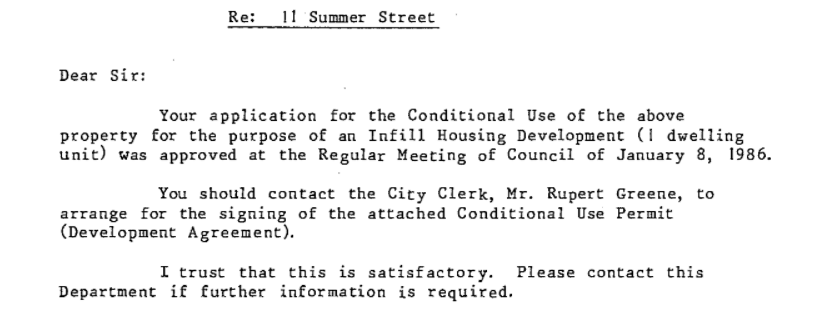

In 1986, the owners applied to have the garage converted into a home, and the city council of the day approved the conversion.

However, there is no record on file that indicates the city ever received a permit application to do that work or inspected the property after its conversion to a residence.

The city does not have a record of the fire at the property, although it is evident that there was one. The only permit application made to the city was for window and siding replacement in 2006.

As the city never received an application for a permit to work on the property, there is no record of an inspection ever being done or an occupancy permit being issued.

In January, Elton's lawyer Joe Thorne wrote the city a letter urging them to demolish the property for her.

"While many of these problems can be laid at the feet of others, the city bears some responsibility as well," Thorne wrote.

"The cost of the demolition work is a significant burden to Ms. Elton but would be very little to the city."

Request denied

The city denied the request and said it didn't fall under the criteria it sets out for demolition, including when a property is condemned or becomes a public nuisance.

"Further, the city denies any negligence or negligent misrepresentation on its part. As previously set out, no permits were ever sought or issued for any work at 11 Summer St. with the exception of windows in or about 2006," a city lawyer wrote in a letter to Elton's lawyer.

"The city had no knowledge that the extensive changes were actually made to the property. All compliance letters state that a request does not result in an inspection of the property. While your client is able to pursue any claim she chooses, the city will strongly resist any claim in this matter."

The City of St. John's declined to comment on the matter.

Tiffany

Elton stands outside her former home on Summer Street. The property is

for sale, but whoever buys it next can only tear it down. (Ariana Kelland/CBC)

Tiffany

Elton stands outside her former home on Summer Street. The property is

for sale, but whoever buys it next can only tear it down. (Ariana Kelland/CBC)

"My city has been dragging me through [this] for three years and, I feel like, treating me like I am at fault when I did not do this, and it feels nefarious. It feels like they're sticking me with this when it was their mistakes," Elton said.

"And what's crushing me is I'm one little small business lady in their town — who cares if I'm OK in the end? It's their money that they're protecting, and I think it's the principle of the matter to them. It would be admitting fault in a way to help me out of this."

The cost to tear down 11 Summer St. is around $20,000.

Leaving the property opens Elton up to the potential of liability — her home insurance dropped her because it's not actually a home.

"It's still my responsibility. I'm still paying property taxes on it as well, so as long as it's standing, it's a worry for me and a stressor for me."

Thorne was, however, able to advocate for Elton to settle with title insurance to discharge the mortgage, reversing a previous decision.

Court too costly

Elton explored the option of bringing the former owner and others to court.

She has found a duct for a propane stove cut through the burnt wood in the living room, suggesting the person who installed it knew the property had been in a fire. However, she's been advised taking the matter to court would be extremely costly.

"And in going to court, you have to bring everybody to court who were a part of it," she added.

In an email to questions from CBC News last year, the previous owner stated they were not aware of any issues with the home in the 10 years they owned the property.

After

being contacted by a previous tenant of the property, Tiffany Elton

found a propane stove had been installed in the living room. Whoever

installed it would have had to cut through the burnt wood to do so. (Ariana Kelland/CBC)

After

being contacted by a previous tenant of the property, Tiffany Elton

found a propane stove had been installed in the living room. Whoever

installed it would have had to cut through the burnt wood to do so. (Ariana Kelland/CBC)

Now 42, Elton has drained whatever savings she had and has no house to call her own. She is now trying to sell the property as is, for someone to tear down.

"It's your biggest purchase and there's no way out. There's no way out," Elton warned.

"Nobody has that much money in savings to take it to court to find a solution. So whatever you buy, you're stuck with it."

IMHO Mr Thorne and the Mayor should talk and FCT should sue the lawyer who failed to do his job on their behalf and their client Madame Elton

Peter Stride

Disgraceful behaviour by the city..like she

says this was approved by the Council years ago...and home inspections

are not that forensic.

David Amos

Reply to Peter Stride

I agree

Andrew Bickmore

Did she have a home inspection done prior to purchasing the property? A home inspection would have found some of the shortcomings and deficiencies with the property.

Tiffany Elton

Reply to Andrew Bickmore

I did.

David Amos

Reply to Tiffany Elton

Sue the dude

David Amos

Reply to Tiffany Elton

Do you have a mortgage?

David Amos

Reply to Tiffany Elton

Say Hey to Mayor Danny Breen for me

David Amos

Reply to Tiffany Elton

I just called and introduced myself correct?

St. John's woman facing prospect of full teardown of garage-turned-home

Tiffany Elton is bracing for costly remediation as lawyer steps in pro bono

Tiffany Elton purchased her first home in July 2020, but soon learned the property had significant issues — the biggest being that the structure had been a fire-damaged commercial garage.

Contractors have provided her with two options to deal with myriad structural and electrical defects outlined by the City of St. John's, after Elton approached the municipality with her concerns.

Both remediation and rebuilding, she said, cost about the same as the purchase price she paid nearly two years ago.

"I need $160,000 and I need to tear down and rebuild the house in 4½ months because the deadline (with the city) is fast approaching," Elton said in a recent interview.

"There seems to be three separate building issues. One being that it was a garage, so it is still structurally a garage. Then there's across the front foundation where the garage door was. Then there's the fire issues."

Elton purchased what she believed was a recently renovated bungalow but soon began unraveling details about the history of 11 Summer St. after rodents found a way into her home.

She discovered the building was a commercial garage that had been converted to a residential home decades before, without the proper permits from the city. The garage had been in a significant fire, and the structure was charred black.

Elton was issued a long list of fine notices by the City of St. John's after she alerted them to the issues. She has until September to rectify all of the defects. If she doesn't, she could have to pay up or get out.

Joe Thorne, a partner in the St. John's office of Stewart McKelvey, offered Elton his services pro bono. (Paul Pickett/CBC)

Joe Thorne, a partner in the St. John's office of Stewart McKelvey, offered Elton his services pro bono. (Paul Pickett/CBC)

"Sometimes when you notify an authority about an issue, it backfires," said lawyer Joe Thorne, a partner in the St. John's office of Stewart McKelvey.

"Calling in the city was intended to address a certain issue that she had and now the city has gone in and said, 'Well, there's no occupancy permits for this house and you have major structural issues.'"

Thorne took on Elton's case pro bono after seeing her story profiled by CBC Investigates in January.

"Honestly, my heart just went out to her," he said.

"She's really been was a victim of her circumstances, and whether or not someone is legally responsible for that, she is a victim of the process and I really wanted to help out if we could."

Thorne said Elton tried to protect herself during the home buying process by getting a home inspection, a lawyer, and title insurance. But she's still left in a unenviable position.

Legal assistance

Thorne said he has been investigating the previous owners of the home and whether anyone knew or ought to have known about the fire damage.

Elton said many people came forward to her following the story with information on the history of the property, which could be helpful in the future.

In an email to CBC News in January, the previous owner said she had no idea that the property had been a garage that was significantly damaged by fire.

They owned it for 10 years before selling to Elton. The property has changed hands multiple times since its conversion 35 years ago.

Bringing a case to court would be a lengthy and costly process, and Elton says she doesn't have much time left.

In 1986, the owners applied to have the garage converted into a home and the city council of the day approved the conversion.

However, there is no record on file that indicates the city ever received a permit application to do that work or inspected the property after its conversion to a residence.

Despite that, the city has acknowledged that the property was able to be sold as a residential home for decades.

A metal casing still hangs inside Elton's attic, signalling that the property was once a commercial garage. (Paul Pickett/CBC)

A metal casing still hangs inside Elton's attic, signalling that the property was once a commercial garage. (Paul Pickett/CBC)

As the city now knows the extent of the damage to Elton's house, it is requiring significant work to be done.

"You're dealing with a municipality and they've got their policies and procedures and they need to make sure that homes are safe for occupancy and all those things," Thorne said.

"But there also needs to be room to consider, you know, Tiffany herself and not just the property, but the person behind the property, who owns the property."

Elton said the city has helped by providing a letter for her title insurance company that outlines the issues with the property.

She said she understands the city is limited by its own acts and codes, but that doesn't remedy her predicament.

The City of St. John's declined a request for an interview.

Help from the public

While the challenges ahead may seem insurmountable, Elton said, she is encouraged by small steps along the way.

After many failed attempts, Thorne and his team convinced an adjuster from the title insurance company to assess the property.

And in the weeks following her story airing, her small business got an uptick in sales.

But nothing, she said, has been more helpful than getting free legal help.

"As you can imagine, it's an emotional roller-coaster. So it's been tough getting through it all," Elton said.

"But just to have that counsel is excellent."

Reply to David Amos

Title insurance, is it really worth anything?

David Amos

Reply to Jeff Davis

If you get lucky and run into an ethical lawyer

Good for Joe. I hope it ends well

David Amos

Reply to Glenn Foster

Me too

I am under the impression that the home inspector who inspected the property and the lawyer who conducted the homework should be on the hook if they failed with their jobs. Isn't there a reason they were hired and paid in thousands?

David Amos

Reply to Nel Ndoku

Good question and what about the Title Insurance?

Lloyd Luby

The city has a "don't tell, don't ask" philosophy when it comes to permitting. When asked, they will say you have to have a permit to renovate, but don't flag the inquiry for a follow up. Even if you obtain a renovation permit, they don't request a follow up inspection to see that you adhered to the permitted renovations. That also applies to occupancy permits it would seem where no permit requested; no problem. (though through some unknown mechanism the city has been made aware of some unpermitted renos, mostly decks in heritage zones where the homeowner has gotten bitten - perhaps a neighbour ratted them out.) Someone, those 35 years ago failed to obtain the correct permits along the way, and whoever sold it as permitted to inhabit is at fault according to logic. The lawyer and realtor at the time are also culpable. Perhaps such details should also be included in the title search to ensure that if a building changes as this one did, (or if it didn't) it will be known to have required a permitted for that change. That's not to say that the city shouldn't do better at enforcing such requirements for permits.

Paul Parsons

Reply to Robert Reader

You must be a city of St. John's employee. A lot of truth to what Mr. Luby said.

David Amos

Reply to Paul Parsons

Ditto

A person I know recently applied for a mortgage, and between the inspections from the bank, and the insurance company, the place was thoroughly looked over....especially the insurance guy looked over the place with a fine toothed comb.....

Steve Dueck

Reply to John Smith

Too bad the same didn't happen with this lady's inspection. The inspector should be identified so that others will know to stay away from this person when looking for a good, thorough, inspection.

Olivia Massey

Reply to Steve Dueck

If you read the original article that was published in January you will see that the inspector suggested and Ms. Elton, the current owner, was willing to pay for installation of a ceiling hatch to allow access to the attic...the sellers refused the request. But, this is beyond the point of laying blame onto the current owner because if she had rejected the deal subsequent to the inspection, someone else would be dealing with it. The issue now is that the city was grossly negligent regarding permitting and inspections when the building changed from a commercial-use property to a residential-use property and also with regard to every subsequent upgrade in the last 35 years. Furthermore, the permitting and inspections did not occur yet the city easily changed the taxes levied on the property from commercial use to residential use and are now attempting to lay the cost of rectifying the situation they abetted by their negligence onto Ms. Elton.

Nancy Jones

Reply to Olivia Massey:

Perfectly stated.

Olivia Massey

Reply to Nancy Jones

Thank you! It's amazing to me that so many simply want to lay blame on the owner and/or the inspector without acknowledging that the city's laxity abetted the current condition of the property, and, furthermore, that the city is attempting to make Ms. Elton pay for their negligence in basically allowing renovations to occur without permits and inspections...yet the city is collecting taxes on an improved property. We can and we should "fight city hall" when the situation warrants it and I believe Ms. Elton's situation warrants it!

David Amos

Reply to Olivia Massey

I concur

jon mcgrath

Banker scamm

David Amos

Content Deactivated

Reply to jon mcgrath

I don't think so I have no doubt they chased the Title Insurance dudes and the lady will wind up with a debt free property saddled with strange liabilities brought on by a city trying to cover up their wrongs

Jan Barriault

how did her building inspector not flag any problems prior to purchase? maybe her legal guy should look at making case against home inspector??

Olivia Massey

Reply to Jan Barriault

As noted in the original article published in January, Ms. Elton's inspector suggested and Ms. Elton was willing to pay to have a ceiling hatch installed to allow access to and inspection of the attic. The sellers refused to allow it; therefore, the inspector was unable to inspect the attic. However, the point now is not to assess blame...the point is to address the city's lax permitting and lack of inspections of this property over 35 years when the building's usage changed from commercial-use to residential-use. The city issued no permits and performed no inspections yet changed the building's status for tax levies to residential use. Now, the city is attempting to rectify their gross negligence on the back of and from the pocketbook of the current owner, Ms. Elton.

David Amos

Reply to Olivia Massey

Bingo

The silence from the Mayor is deafening.

David Amos

Reply to Barbara Shortall

I noticed that too

how did her building inspector not flag any problems prior to purchase? maybe her legal guy should look at making case against home inspector??

Olivia Massey

Reply to Jan Barriault

As noted in the original article published in January, Ms. Elton's inspector suggested and Ms. Elton was willing to pay to have a ceiling hatch installed to allow access to and inspection of the attic. The sellers refused to allow it; therefore, the inspector was unable to inspect the attic. However, the point now is not to assess blame...the point is to address the city's lax permitting and lack of inspections of this property over 35 years when the building's usage changed from commercial-use to residential-use. The city issued no permits and performed no inspections yet changed the building's status for tax levies to residential use. Now, the city is attempting to rectify their gross negligence on the back of and from the pocketbook of the current owner, Ms. Elton.

David Amos

Reply to Olivia Massey

Bingo

Sholunish Mishmikin

That guy in portapique has room in his garage now that his cruiser is gone, she could move in there

Doug Chafe

Reply to Sholunish Mishmikin

Not the sharpest knife in the drawer are you?

Olivia Massey

Reply to Sholunish Mishmikin:

Your comment isn't funny in any way, shape, or form. And equating the two events is disrespectful to the loss of lives, as well as to the survivors, of the Portapique event. You must suffer from a cerebral disconnect if you think your lame attempt at humour at the expense of the Portapique residents is acceptable.

David Amos

Reply to Olivia Massey

Ask yourself why the nasty comment was not deactivated long ago

When a house isn't a home

Tiffany Elton says she’s living a real estate nightmare after discovering the home she purchased is actually a charred former double garage.

January 20, 2022

It was the rats that first alerted Tiffany Elton to the problem.

The sounds of rodents scratching and squeaking started coming from inside the walls and floors of her 776-square-foot home in central St. John’s last winter.

For the first few months in her new home, Elton thought she’d finally made it. The 41-year-old bought a small bungalow with an affordable mortgage that would be paid off by the time she turned 65.

Now, more than a year later, the small business owner fears she will have to go into bankruptcy and feels unsafe in her own home.

"It's been a nightmare. Physically, I feel it. Emotionally, I feel it," Elton told CBC News.

"I feel heartbreak."

'Perfectly maintained'

Elton purchased the home on Summer Street in July 2020 for $168,000.

The MLS (Multiple Listing Service) listing for the property boasted the house was newly shingled with new vinyl flooring and a remodelled kitchen.

The listing said it was "perfectly maintained and recently renovated and improved, pride of ownership is evident in this move-in ready home."

“The pest control guy found the burn, and he said, ‘You have a bigger problem than just rodents up here.’”

It said the home was built in 1986 and was on a concrete slab foundation.

"The house looked great. I thought it was perfect — new floors, new tile, new cabinets, newly painted and it was staged really well," Elton said.

"I had no reason not to believe it wasn’t true."

A caution at the bottom of all MLS listings indicates that listing information is "from sources believed to be reliable. However, it may be incorrect."

It adds: "This information should not be relied upon by a buyer without personal verification."

Shocking discovery

Once the snow began to melt in the spring of 2021, Elton inspected the outside of her property to see where the rodents could be accessing her house.

She says she quickly realized where they were getting in.

"There was a hole around the [width] of a garage door across the front foundation. It was like the foundation was completely missing," Elton said.

"It was missed and I didn’t notice because the asphalt was built up and the siding was built down.… I could stick a metre stick in it and swing it side to side."

The home inspectors say there were no

visible gap underneath the front of the home at the time of the

inspection, as the foundation was not accessible and could not be

inspected.

After filling the gaps with scrap metal, spray foam and concrete, Elton called in a pest control company. The worker asked for a trap door to be cut to the attic so he could set up rodent traps.

He climbed a ladder into an attic charred black, with specks of burned wood covering the pink insulation.

A large industrial light casing hung precariously from wires in the ceiling, signalling that it was once a garage.

"He said, 'You have a bigger problem than just rodents up here.'"

Elton was in shock.

That shock soon turned to utter disbelief when she started cutting holes in her walls. Nearly every spot she surveyed was charred black.

Flash forward to December 2021, and Elton is showing what she found.

She gingerly takes down a large gold decorative mirror to reveal a taped up hole in the wall of her living room.

Each wall has a strategically placed piece of art to cover similar inspection spots. Aside from the front of the house, where there was once was a garage door, each wall is damaged by fire.

"In my opinion [the walls are] burned worse than the attic. That was a shock, which means the entire envelope of the house is completely burned," she said.

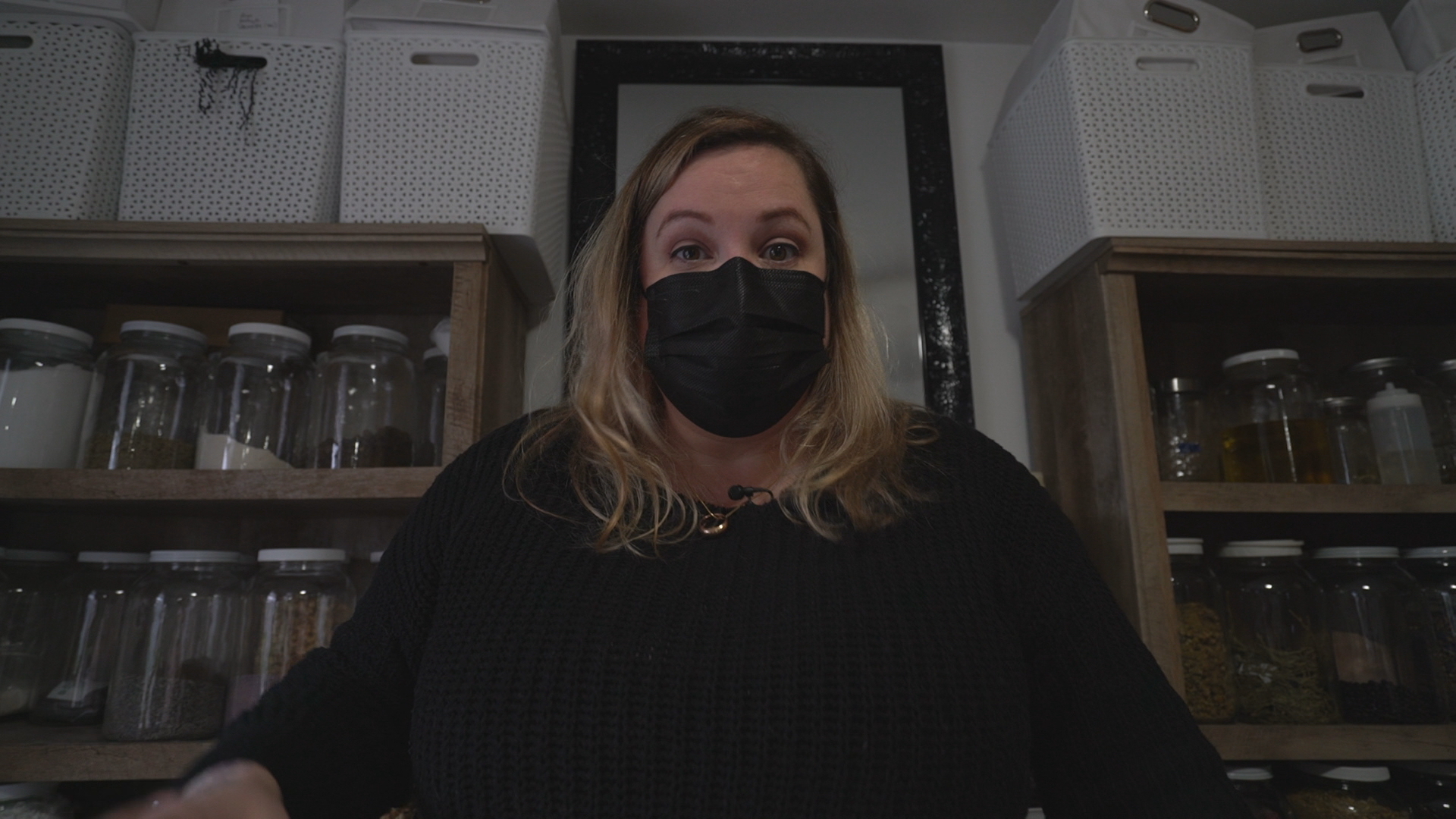

Since that discovery, Elton said she has been sent down a frustrating fact-finding mission in an attempt to save her home, her finances and her jewelry and botanicals business. She uses part of her home as a studio where she makes her handcrafted items for sale.

"[The] more information that I get, the more and more it complicates everything because the structure is likely not safe, it’s not what I bought," she said.

"I didn't buy a burned-out house."

Property does not have occupancy certificate

Elton said she followed the homebuying process without missing a step, but has been let down at every turn and fears her only chance for recourse is to take the matter to court — a costly burden that she says she cannot afford.

The initial home inspection Elton paid for didn’t detect any major deficiencies.

On two occasions, Elton said, she and her home inspector asked the sellers to create a hatch to access the attic in order to complete the inspection — one at their expense, and the other at Elton’s.

Both times, she said, the sellers said no.

Elton said her inspector told her the worst-case scenario would be mould in the attic but that a restoration company could mitigate it for $1,500.

In an email to CBC News, the home inspectors confirmed the sellers denied access to the attic on two occasions.

However, they said mould was just one of many possible issues they flagged.

Documents from the City of St. John's archives show that 11 Summer St. was originally a double-car garage.

In 1986, the owners applied to have the garage converted into a home and the city council of the day approved the conversion.

However, there is no record on file that indicates the city ever received a permit application to do that work or inspected the property after its conversion to a residence.

A lawyer for the City of St. John’s confirmed for Elton by email that the property also does not have an occupancy certificate — that is despite the city having issued a compliance letter, which flags any outstanding permits or assessments owed for the house as part of the purchase process.

The city does not have a record of the fire at the property, although it is evident that there was one. The only permit application made to the city was for window and siding replacement in 2006.

"They have been charging property taxes and allowing this home to be sold with no occupancy permit for years," Elton said.

"So, in my opinion they should be the ones to come forward and say, 'We fooled up, this house isn't a house, this shouldn't have been sold and here's how we intend to fix the situation,' but they're not."

City says situation is ‘unfortunate’

The City of St. John's declined an interview request, but in a statement, called Elton's situation "very unfortunate."

As the city never received an application for a permit to work on the property, there is no record of an inspection ever being done or an occupancy permit being issued.

Compliance letters, like the one needed for a real estate transaction, reference zoning, assessments owed and any current outstanding work orders, the statement said.

"They do not provide occupancy status or trigger an inspection of the building," the statement noted.

Now aware of the issues, the city will not issue Elton a compliance letter, which would allow her to sell the property, until the work is completed.

Her home insurer, upon learning of the issues, has cancelled her policy.

‘You trust the process’

A property condition disclosure form is supposed to alert buyers to defects in a home and protect sellers from liability for issues they told the buyers about before the sale.

The property disclosure form, which is part of the real estate transaction that’s been reviewed by CBC News, indicates that the property has an occupancy certificate and that there were no structural problems.

In an email to questions from CBC News, the previous owner stated that they were not aware of any issues with the home in the 10 years that they owned the property.

The owner said they did not know about any historical fire or commercial use, and followed the same homebuying process Elton did when they purchased the home a decade earlier.

The property has been sold multiple times since its conversion 35 years ago.

It appears that the original owners of the property have died.

Fines on top of fines

Elton contacted the City of St. John's on multiple occasions during 2021 in an attempt to find information on what to do and to find out who may be liable.

The city requested a new inspection be carried out on the property.

Now with access to the attic, a second home inspection at Elton’s expense confirmed what she suspected: the structure was around 50 years old — not 36.

There was no ventilation in the attic and the safety of the structure itself was questionable.

It was recommended that the property be inspected by a structural engineer.

Elton gave the City of St. John’s a copy of the inspection report.

But that backfired when the city slapped Elton with fines for other issues flagged on the report.

"The city gave me notices which were based on the inspection report they had me pay for — I had 15 days to repair the watermain and put a meter on it. I had 30 days to hire a structural engineer or risk fines of $5,000," Elton said.

"I don’t have the money for that right now."

At Elton's request, the city held off until she got a structural engineer to survey the property.

In a report released last month, Parsons Engineering determined that the house was not at a high risk of "imminent failure" but has structural defects resulting from the fire.

The report recommends repairing or sealing the damaged sections to avoid structural issues in the future.

What next?

Elton said uncertainty is taking its toll.

"I make everything for my store in my home, in my studio, so that shuts me down. I don’t want to lose my business. That's my income, I work too hard to stop it," Elton said.

Elton was hopeful her title insurance would cover the costs incurred as a result of the pre-existing damages.

But that route appears to have been exhausted, she said, when insurance company FCT denied her claim in June.

"The policy does not provide coverage for loss arising from building code violations, property defects or vendor misrepresentations unless they can be brought within a covered risk," said a letter from FCT.

She is hopeful a letter outlining deficiencies from the city will allow her to appeal that denial.

FCT directed CBC News requests for more information about the situation back to the letter it sent to Elton last year.

A ‘lemon’

Toronto-based commercial real estate partner Simon Crawford of Bennett Jones said every now and then a homebuyer gets saddled with a "lemon" of a property, even when they do everything right.

"They're faced with the very real problem that they either don't have a valid claim against the seller or insurer or do have a valid claim but now bear the additional burden of having to go to court to pursue that claim, which can be costly and uncertain," Crawford said.

Homebuyers can protect themselves by hiring expert home inspectors who have background knowledge in engineering and architecture, get title insurance or negotiate a written agreement about any unseen defects.

However, Crawford said that last option is easier said than done, especially in a hot real estate market where there is competitive purchasing.

In most cases, he said, homebuyers do not go through due diligence in order to win a bid.

Expecting the worst

Elton said the real estate ordeal has affected her physical and mental health.

"I'm now on high blood pressure medication. I’m only 41. I know that’s because of the anger I’m feeling every day," Elton said.

"I've had to reach out for help, professional help, to help get me through it. I’ve had night terrors, nightmares."

Elton is hoping to find a lawyer who can take her case on contingency. Any legal advice she’s received so far has been a warning that taking everyone to court would be costly and time-consuming.

"I'm preparing for the worst. I expect the worst."

https://www.youtube.com/watch?v=IMNnqA013cE&ab_channel=CBCNL-NewfoundlandandLabrador

Here & Now Thursday, January 20, 2022

The latest news from CBC Newfoundland and Labrador.

Tiffany Elton Needs Help for Her Home

Updates (16)

https://www.cbc.ca/news/canada/newfoundland-labrador/tiffany-elton-home-update-1.6930147

I would like to mention my main message now…

Look for an occupancy permit yourself when buying a home, the compliance letter the real estate lawyer gets from the city allowing the sale does not check for occupancy which is actually needed to buy, sell, own, live in a house in the city. If it does not have one you are on the hook for fixing all the issues to make it eligible for an occupancy permit.

This is the biggest disservice to home buyers and why I’m in this mess.

This has to change.

My house is for sale for land value only, it’d be good for a builder who has the means to tear it down.

That’s not my ideal way out, but it’d be something. I’d love to find an affordable builder who can build me a simple house with a mortgage I can afford. ($200,000 max)

https://www.facebook.com/deardawcy/

deardawcy@gmail.com

https://www.newfoundlandlabrador.com/plan-and-book/shops-and-galleries/36375936

Dear Dawcy & Ritual Botanicals

St. John's

Jan 1 - Dec 31

A small shop of handmade jewellery, items for ritual self-care, candles, and home scents made in Newfoundland. Located on the third floor of Posie Row and Co.

https://www.stewartmckelvey.com/people/thorne-joe/

Suite 1100, Cabot Place

100 New Gower St.

St. John’s, N.L.

A1C 6K3

Language(s) spoken: English

Bar Admission(s): Ontario, 2010; Newfoundland and Labrador, 2013

Legal Assistant(s): Sherry Spracklin

Joe has a wide-ranging general commercial litigation practice, including particular focus on insolvency/restructuring, insurance defence, and municipal law. Joe focuses on common-sense solutions to legal challenges. Joe believes in the adage “litigation is the pursuit of practical ends, not a game of chess.”

Joe has appeared before all levels of court in Newfoundland and Labrador, as well as the Federal Court of Canada, the Quebec Superior Court, the Ontario Small Claims Court, the Ontario Superior Court of Justice, and the Ontario Court of Appeal.

Some of the ways Joe has helped clients include:

- Representing a publicly traded company in defending a claim for millions of dollars made by a former director and officer seeking payment of disputed awards and bonuses.

- Successfully responding to an appeal seeking to disqualify a Court-appointed receiver in an insolvency proceeding.

- Advising creditors, debtors, and insolvency professionals in a wide of array of insolvency and restructuring matters.

- Negotiating resolution of dozens of personal injury claims.

- Assisting municipalities before regional appeal boards and courts in defending council decisions.

- Enforcing foreign and inter-provincial judgments.

https://www.stjohns.ca/en/city-hall/mayor-danny-breen.aspx

Mayor Danny Breen

Danny Breen is the Mayor of the City of St. John's.

Contact the Mayor

709-576-8477

Message from the Mayor

Thank-you to the residents of St. Johns who have given us the privilege to serve as your City Council for the next four years. I am honoured and humbled to be returned for my fourth term on City Council and second term as mayor. I am excited to lead such a talented City Council with diverse backgrounds – one that reflects the demographics of our City. As I said to the new Council on October 12, 2021 at the Swearing-in Ceremony, key to our success will be engaging proactively with the public on the important issues we face, considering all the information (including everyone's thoughts and opinions), making the best decisions possible and communicating our decisions effectively.

I firmly believe that we cannot operate in isolation and must continue to develop and enhance fair and mutually beneficial relationships with other municipalities, business and community partners, and the provincial and federal governments. The more effectively we work together, the better for everyone in St. John's and our neighbouring municipalities.

We have a firm strategic plan in place and strong goals to work towards.

Our goal is to use your tax dollars wisely, ensuring that our organization is effectively and efficiently run. Being a sustainable city - economically, environmentally and financially – calls on us as a Council to create the conditions that drive the economy; protect, preserve and enhance the natural environment. We must consider how people move around our city, and the regional transportation connections and infrastructure for which we have responsibility.

Our city is changing and diversifying, and expectations around inclusion and accessibility will be top of mind for Council.

Ultimately, we have an important role to place in creating a city where people feel connected, have a sense of belonging and are actively engaged in community life.

About the Mayor

Danny Breen was first elected to the St. John's City Council in the Fall of 2009 and was re-elected by acclamation in 2013, representing Ward 1, in the east end of St. John's. He was first elected as Mayor of the City of St. John's in 2017.

Danny has served as Chair of the Public Works Committee, Chair of the St. John's Sport Event Partnership and Chair of the Finance Committee of the Eastern Regional Services Board. He has also served as Chair of the City's Audit and Accountability Committee and the Finance Committee, as well as Co-Chair of the St. John's Regional Fire Services Committee. He also served as Council representative on the Board of Directors of St. John's Sports and Entertainment and continues to serve on many other Council Committees.

He is currently Council lead on Governance and Strategic Priorities; Economic Development; the Big City Mayor's Caucus; and Citizenship Court.

Danny is a Graduate of Memorial University of Newfoundland with a Bachelor of Arts Degree (Political Science). In the past Danny has been actively involved in his community serving on The Board of Directors of the Heart and Stroke Foundation of Canada. He has also been involved in several school councils, minor hockey and many other community organizations.

Danny was born and raised in St. John's, where he resides with his wife Ann. He has two daughters, Erika and Katie, and two grandchildren, Kyla and Neil.

Re How to protect yourself from real-estate title fraud

David Amos<david.raymond.amos333@gmail.com> | Mon, Jan 23, 2023 at 7:22 PM |

| To: bking@kinginternationalgroup.com, info@chicagotitle.ca, info@ctic.ca, info@soloontario.ca, info@stonegatelegalservices.ca, paladinparalegal@gmail.com, cassandra@weatherstonparalegal.com, charlenelewin@sympatico.ca, dan@sfglegal.ca, elaine@pageparalegal.com, shemeshparalegal@gmail.com, lorrie@mcculloughlegalservices.com, inquire@paralegalonbroadview.com, sglass@sfglegal.ca, sarahteal@sarahteallegal.com, teri@landriautlegal.com, denaliparalegal@gmail.com, info@wjburgesslegal.com, Pilonlaw@gmail.com, "claude.poirier" <claude.poirier@snb.ca>, "john.mcnair" <john.mcnair@snb.ca>, Erin.Hardy@snb.ca, "alan.roy" <alan.roy@snb.ca>, "rob.moore" <rob.moore@parl.gc.ca>, "Ross.Wetmore" <Ross.Wetmore@gnb.ca>, "robert.gauvin" <robert.gauvin@gnb.ca>, "robert.mckee" <robert.mckee@gnb.ca>, "andrea.anderson-mason" <andrea.anderson-mason@gnb.ca>, mmcdermm@gmail.com, "freedomreport.ca" <freedomreport.ca@gmail.com>, premier <premier@ontario.ca>, "Bill.Blair" <Bill.Blair@parl.gc.ca>, "Brenda.Lucki" <Brenda.Lucki@rcmp-grc.gc.ca>, "hugh.flemming" <hugh.flemming@gnb.ca>, MRichard@lawsociety-barreau.nb.ca, serge.rousselle@umoncton.ca, kevhache@nb.sympatico.ca, "greg.byrne" <greg.byrne@gnb.ca>, "kris.austin" <kris.austin@gnb.ca>, austin@gnb.ca, "David.Coon" <David.Coon@gnb.ca>, "blaine.higgs" <blaine.higgs@gnb.ca>, Patrick.Windle@snb.ca, windlejim <windlejim@rocketmail.com>, priscilla.hwang@cbc.ca, torontotips@cbc.ca, john.lancaster@cbc.ca | |

| Cc: motomaniac333 <motomaniac333@gmail.com>, mthiele@ottawalawyers.com, hlankin@barristonlaw.com, mcu <mcu@justice.gc.ca>, debsmith@fnf.com, corporate.communications@firstam.com, cgaska@firstam.com, investor.relations@firstam.com | |