Re The CRA in the news again Deja Vu anyone???

Ministerial Correspondence Unit - Justice Canada<mcu@justice.gc.ca> | Sun, Oct 8, 2023 at 6:55 PM |

| To: David Amos <david.raymond.amos333@gmail.com> | |

Thank you for writing to the Honourable Arif Virani, Minister of Justice and Attorney General of Canada. Due to the volume of correspondence addressed to the Minister, please note that there may be a delay in processing your email. Rest assured that your message will be carefully reviewed. We do not respond to correspondence that contains offensive language. ------------------- Merci d'avoir écrit à l'honorable Arif Virani, ministre de la Justice et procureur général du Canada.

Nous ne répondons pas à la correspondance contenant un langage offensant. | |

Chrystia Freeland<Chrystia.Freeland@fin.gc.ca> | Sun, Oct 8, 2023 at 6:55 PM |

| To: David Amos <david.raymond.amos333@gmail.com> | |

The

Department of Finance acknowledges receipt of your electronic

correspondence. Please be assured that we appreciate receiving your

comments. | |

Duguid, Terry - M.P.<Terry.Duguid@parl.gc.ca> | Sun, Oct 8, 2023 at 6:55 PM | ||||||||

| To: David Amos <david.raymond.amos333@gmail.com> | |||||||||

This is an automated message to acknowledge that we are in receipt of your email.

Thank you for contacting the office of Terry Duguid, Member of Parliament for Winnipeg South. Our office reads all incoming email however due to the high volume we receive, not every email will receive a reply and priority is given to those residing in Winnipeg South.

For immigration casework inquiries, please check the processing time of your application here: https://www.canada.ca/

You can check on the status of your application at the IRCC portal: https://ircc-tracker-

Yours sincerely,

Office of Terry Duguid, M.P Winnipeg South

| |||||||||

Newsroom<newsroom@globeandmail.com> | Sun, Oct 8, 2023 at 6:55 PM |

| To: David Amos <david.raymond.amos333@gmail.com> | |

Thank you for contacting The Globe and Mail. If your matter pertains to newspaper delivery or you require technical support, please contact our Customer Service department

at 1-800-387-5400 or send an email to customerservice@globeandmail. If you are reporting a factual error please forward your email to publiceditor@globeandmail.com Letters to the Editor can be sent to letters@globeandmail.com This is the correct email address for requests for news coverage and press releases. | |

David Amos<david.raymond.amos333@gmail.com> | |

| To: PABMINMAILG@cra-arc.gc.ca, marie-claude.bibeau@parl.gc.ca, Diane.Lebouthillier@parl.gc.ca, MediaRelations-RelationsMedias@oto-boc.gc.ca, pm <pm@pm.gc.ca>, premier <premier@ontario.ca>, Newsroom <Newsroom@globeandmail.com>, "jagmeet.singh" <jagmeet.singh@parl.gc.ca>, "Bill.Blair" <Bill.Blair@parl.gc.ca>, nathalie.sturgeon@globalnews.ca, "Jason.Proctor" <Jason.Proctor@cbc.ca>, "John.Williamson" <John.Williamson@parl.gc.ca>, "Ross.Wetmore" <Ross.Wetmore@gnb.ca>, "blaine.higgs" <blaine.higgs@gnb.ca>, "rob.moore" <rob.moore@parl.gc.ca>, "Robert. Jones" <Robert.Jones@cbc.ca>, "Melanie.Joly" <Melanie.Joly@parl.gc.ca>, "Mark.Blakely" <Mark.Blakely@rcmp-grc.gc.ca>, "martin.gaudet" <martin.gaudet@fredericton.ca>, "Mitton, Megan (LEG)" <megan.mitton@gnb.ca>, "michael.macdonald" <michael.macdonald@thecanadianpress.com>, sheilagunnreid <sheilagunnreid@gmail.com>, "silas.brown" <silas.brown@globalnews.ca>, Jaime.Battiste@parl.gc.ca, Kody.Blois@parl.gc.ca, Andy.Fillmore@parl.gc.ca, Darren.Fisher@parl.gc.ca, Sean.Fraser@parl.gc.ca, Mike.Kelloway@parl.gc.ca, Darrell.Samson@parl.gc.ca, "heather.bradley" <heather.bradley@parl.gc.ca>, kelly@kellyregan.ca, Sean.Casey@parl.gc.ca, Robert.Morrissey@parl.gc.ca, lawrence.macaulay@parl.gc.ca, "Mike.Comeau" <Mike.Comeau@gnb.ca>, "Holland, Mike (LEG)" <mike.holland@gnb.ca>, Gudie.Hutchings@parl.gc.ca, Yvonne.Jones@parl.gc.ca, Ken.McDonald@parl.gc.ca, Seamus.ORegan@parl.gc.ca, Churence.Rogers@parl.gc.ca, scott.simms@parl.gc.ca, Dan.Vandal@parl.gc.ca, kevin.lamoureux@parl.gc.ca, Terry.Duguid@parl.gc.ca, Larry.Bagnell@parl.gc.ca, Michael.McLeod@parl.gc.ca | |

| Cc: motomaniac333 <motomaniac333@gmail.com>, "fin.minfinance-financemin.fin" <fin.minfinance-financemin.fin@canada.ca>, mcu <mcu@justice.gc.ca>, "Katie.Telford" <Katie.Telford@pmo-cpm.gc.ca>, "Nathalie.G.Drouin" <Nathalie.G.Drouin@pco-bcp.gc.ca>, NightTimePodcast <NightTimePodcast@gmail.com>, nsinvestigators <nsinvestigators@gmail.com>, "pierre.poilievre" <pierre.poilievre@parl.gc.ca>, paulpalango <paulpalango@protonmail.com> | |

Is the carbon tax an easy scapegoat for high food prices?

Affordability arguments in favour of killing the tax ignore the impact climate change has on food prices

It remains one of the boldest and most consequential decisions of his time in office. It's also one of the most loudly contested — even after two federal elections that might have been expected to settle the issue.

This week, the House voted on yet another Conservative motion calling on MPs to condemn the carbon tax — the Official Opposition's fifth such motion in the last 12 months. This time, the Conservatives were able to win the support of one Liberal backbencher — Ken McDonald, who represents the Newfoundland riding of Avalon — illustrating the public consternation Liberal climate policies are facing in Atlantic Canada.

But the Conservatives are also hammering away with television ads that blame the carbon tax for the high price of groceries, an argument that might hold particular power as Canadians prepare to celebrate Thanksgiving.

Conservative

Leader Pierre Poilievre's statements about the impact carbon pricing

has on affordability ignore one big factor: the rebates. (Ben Nelms/CBC)

Conservative

Leader Pierre Poilievre's statements about the impact carbon pricing

has on affordability ignore one big factor: the rebates. (Ben Nelms/CBC)

"Mr. Speaker, when one taxes the fuel of the farmers who make the food and the fuel of the truckers who ship the food, then one taxes all those who buy the food," Conservative Leader Pierre Poilievre told the House this week, ably reenacting his party's ads.

This period of high inflation certainly presents a fresh political test for any climate policy that creates a new cost for industry or consumers. But in the debate about food prices, the carbon tax is being saddled with an outsized and undeserved role — one that, ironically, distracts from the very real impact climate change and extreme weather are having, and will have, on the cost of groceries.

What's really driving up food prices?

It's not that the carbon tax has no impact on food prices and inflation. It's just not obvious that it is having a particularly large impact.

The Bank of Canada has estimated that the carbon tax increases inflation by 0.15 per cent. Trevor Tombe, an economist at the University of Calgary who has studied the impact of the carbon price on consumer costs, points to Statistics Canada data that suggests its impact on food prices is less than one per cent.

That's not nothing, and every dollar counts when it comes to the cost of essentials, particularly for those on low incomes.

But concerns about the impact of the carbon tax also tend to ignore the fact that the policy has two parts — a fuel charge collected by the federal government and a rebate that returns 90 per cent of the revenue generated by the levy to Canadian households. (The remaining 10 per cent is directed toward businesses, farmers and Indigenous communities.)

Unlike any number of other federal and provincial policies that might be said to contribute to the cost of food — from corporate taxes to food safety regulations — the federal carbon tax comes with a rebate.

The parliamentary budget officer has consistently found that nearly all households receive more from the rebate than they pay in direct and indirect costs. Only households in the highest income quintile are projected to pay out more than they receive — because they consume more. Repealing the carbon tax could actually leave many Canadians worse off.

Recent polling suggests a sizeable number of Canadians like the idea of reducing or eliminating the carbon tax. Maybe the same would be true of a poll about any kind of tax. Regardless, the Liberals might need to redouble efforts now to make the case for one of Trudeau's signature policies.

But any discussion of food prices has to include the impact of climate change — the very problem that the carbon tax is meant to help combat.

An analysis from Statistics Canada published last November linked "erratic weather" — including droughts, heat waves, flooding and heavy rainfall — with increases in the prices of meat, fruit, vegetables, sugar and coffee. In June, economists at RBC reported that, while food price inflation was expected to slow, a return to pre-pandemic prices was unlikely — in part because "extreme weather events are becoming more frequent across different regions and could meaningfully limit farm production."

Mud

and debris covers a farm on the Nicola River that was destroyed by

flooding in November, west of Merritt, B.C., on Wednesday, March 23,

2022. (Darryl Dyck/The Canadian Press)

Mud

and debris covers a farm on the Nicola River that was destroyed by

flooding in November, west of Merritt, B.C., on Wednesday, March 23,

2022. (Darryl Dyck/The Canadian Press)

Other sources of inflation cited by RBC include Russia's invasion of Ukraine, supply chain disruptions and labour shortages. And Canada is hardly alone in feeling the impact on food prices.

Kelleen Wiseman, academic director of the master of food and resource economics program at the University of British Columbia, said price increases from extreme weather events typically are temporary. But Mike von Massow, a professor of food economics at the University of Guelph, said "the impact of climate [on food prices] is at least an order of magnitude bigger than the impact of the carbon tax."

"I think that there is little doubt that extreme weather, the increasing frequency and severity, is not only causing food price inflation but will lead to ongoing greater instability in food prices," vow Massow said. "It'll be much more difficult to predict where we're going because of the unpredictability of these weather events."

In hopes of containing prices, the federal government has put its focus on major retailers. Von Massow said that what's really needed is a broader "food system discussion" that brings all the players together to talk about building a resilient, integrated system that can withstand the forces that climate change is unleashing.

Why is the carbon tax taking the blame?

Tombe, who has also dismissed the utility of blaming retailers, has suggested it would make more sense to look at dismantling the supply management system for dairy and poultry in Canada. Regardless of how one feels about that proposal, it's at least interesting to note that no political party is choosing to make supply management a target right now — while scorn is being heaped on the carbon tax.

Across the federal parties, support for supply management is virtually unanimous. Killing it might lower prices of milk, eggs and chicken for consumers. But the major parties apparently have calculated that the political and practical benefits of the system outweigh its costs — that the trade-offs are worth it.

Supply management retains broad support in mainstream Canadian politics, even though it drives up the cost of food. (Nicola MacLeod/CBC)

The presence of the rebate minimizes the degree to which the federal carbon tax requires any kind of trade-off. But to the degree carbon pricing does increase costs for fuel and other goods, the trade-off is reducing the greenhouse gas emissions that cause climate change.

Economists have long argued that putting a price on carbon is the least expensive way to drive emissions down. And Trudeau is hardly alone in accepting that logic. According to the World Bank, 23 per cent of global emissions are now covered by some kind of pricing policy — up from 13 per cent in 2016.

The federal carbon tax might someday come to be as politically untouchable as supply management. For now, the Conservatives seem to believe it's in their interests to direct anger at the carbon tax — even while they seem unable to say what they would do instead to reduce emissions.

But if climate policy is going to be scapegoated every time the price of groceries goes up, Canada is going to have a very hard time sustaining a serious response to climate change.

Don Corey

The carbon tax provides a source of funds to pay for another Trudeau income redistribution scheme. There has been no demonstrable impact on reducing carbon emissions (contrary to what some here are saying), so it is a tax that does nothing other than to add to our daily cost of living. Scrap it!

Ted Thompson

Reply to Don Corey

Bingo....the defenders here say removing the tax will hurt low income and seniors = wealth distribution.

Jon Moddle

Reply to Ted Thompson

So you're against helping low income families and giving back to those in need?

Don Corey

Reply to Ted Thompson

Exactly. I'm a senior, but I'll survive without Trudeau's so called carbon cheque.

Brad Hansen

Reply to Jon Moddle

Why not let them keep their money in the first place? Why the shell game?

Jon Moddle

Reply to Brad Hansen

They get more back this way, why are you against that?

Brad Hansen

Reply to Jon Moddle

You keep believing that...carry on.

Jon Moddle

Reply to Brad Hansen

It's a fact, so yes I will.

Brad Hansen

Reply to Jon Moddle

Not according to the PBO.

Jon Moddle

Reply to Brad Hansen

You should read that again.

David R. Amos

Reply to Don Corey

Me too but I have no choice in the matter without a SIN

https://www.cbc.ca/news/canada/newfoundland-labrador/mcdonald-carbon-tax-vote-23-1.6988126

N.L. Liberal MP votes against carbon tax a 2nd time, says Guilbeault wrong messenger for policy

Ken McDonald was the only member of Parliament to break rank during the vote on Wednesday

Ken McDonald, MP for Newfoundland and Labrador's Avalon riding, voted with the federal Conservatives on Wednesday on a non-binding motion to repeal the carbon tax, the only member of the Liberal, NDP or Bloc Québécois caucuses to do so. Speaking with CBC News on Thursday, he said he believes the policy will cost the Liberals votes in the next election.

"Everywhere I go, people come up to me and say, you know, 'We're losing faith in the Liberal party," McDonald said in an interview with the CBC's Power & Politics.

"I think they will lose seats not just in Newfoundland, not just in Atlantic Canada, but indeed right across the country if they don't get a grasp on this the way that I think they should.… And if if an election were called today, I'm not sure if the Liberal party would actually form the government."

McDonald also said he didn't think federal Environment Minister Steven Guilbeault is the right messenger for the carbon tax in Atlantic Canada.

"He's not, because he's so entrenched in it," McDonald said. "And I get it, where he came from, and his whole idea of making a big difference in climate change, but you can't do it all overnight. You can't make it more expensive on people than what they can handle. And that's exactly what's happening right now."

The federal Liberals need to look at it from the perspective of people in rural Atlantic Canada, he said.

"The government has to put a lens on it, a rural lens, for the sake of a better word, and try and come up with a plan that's satisfactory and appealable to people who live in rural," he said. "Maybe no plan will be appealable to rural, I don't know. But I think the government has to try, and if they do that, I think they got a chance of moving past it."

It's not the first time McDonald has sided against the party on the carbon tax. He voted against it in October 2022, prompting a standing ovation from the Conservatives.

McDonald said Thursday he also voted against the policy to show support for Newfoundland and Labrador Premier Andrew Furey, who has asked the federal government to do more to minimize the tax's impact on the province and Atlantic Canada.

Fellow N.L. MP says Opposition motion doesn't help Canadians

In Corner Brook on Thursday, Gudie Hutchings, Liberal MP for N.L.'s Long Range Mountains riding, noted McDonald was the only one who didn't vote with the government.

"The Bloc voted with us, the NDP voted with us as well. I believe in policies and private members' bills and Opposition Day motions and motions that are going to make a difference for Canadians. This one isn't," said Hutchings.

Prime

Minister Justin Trudeau, right, and Conservative Leader Pierre

Poilievre went back and forth Thursday in the House of Commons regarding

McDonald's decision to vote against the government. (Sean Kilpatrick/The Canadian Press)

On Thursday in the House of Commons, Conservative Leader Pierre Poilievre said McDonald's vote shows the policy doesn't help Canadians.

"This carbon tax is not worth the cost, and it's not just me saying it. The Liberal member for Avalon has said, and I quote 'We are punishing rural areas of our country and the most vulnerable people in society," said Poilievre, who called on Prime Minister Justin Trudeau to listen to Furey's call to "axe the tax."

Trudeau defended the policy, saying the impact of climate change is clear.

"In all the conversations I had with rural Canadians across the country this summer, they were devastated by the impacts of record wildfires, of floods, of droughts, of heat waves," Trudeau said.

"They see the impact of climate change, and they know that we need to continue to fight climate change while putting money back in their pockets. That's exactly what our price on pollution does."

Download our free CBC News app to sign up for push alerts for CBC Newfoundland and Labrador. Click here to visit our landing page.

With files from Colleen Connors, Power & Politics and CBC Ottawa

'Best-before date' looms over Liberals if Canadians don't get a break, says MP Ken McDonald

Liberal MP hopes federal government will claw back taxes on gas and heating oil

Parliament is back in session after a summer of increased wildfires, inflation, spikes in the cost of living, and housing shortages across the country.

Newfoundland and Labrador hasn't been immune to many of these problems. The rising cost of rent and lack of available housing is putting pressure on the province and its municipalities to find a quick solution.

There's also been a rise in the popularity of opposition Conservative Leader Pierre Poilievre, according to numerous opinion polls that point to a widening lead over Justin Trudeau and the federal Liberals.

Although Avalon MP Ken McDonald says his party needs to get a handle on ahead of the next election or possibly risk losing government.

"I think we have to come up with some policies and some programs that help to ease the pain of what people are facing today," McDonald told CBC News.

"That's something that happens regularly. And I don't know if the best-before date is gone, yet, on the Liberal Party. But it's getting there if Canadians are not seeing a break real soon."

In October of last year, McDonald was the only Liberal to stand in support of a Conservative motion to exempt home heating fuel from the federal carbon tax.

About 48,000 homes in Newfoundland and Labrador use oil as their primary source of heating, and with the rising cost over the last few years some residents' wallets have been squeezed dry — the carbon tax makes the fuel that much more expensive by 17 cents more per litre.

That's on top of the federal government's Clean Fuels Strategy, which adds 14 cents to a litre of gas. The provincial Liberals dropped its own tax on gas on July 1 when the federal strategy came into play.

Tories are hitting pocketbook issues, MP says

Poilievre's campaign has been centred around one slogan: "Axe the tax." His focus during visits to Newfoundland and Labrador over the last 18 months has been on lowering the cost of home heating oils.

McDonald believes that's why the opposition leader may be out in front.

Pierre

Poilievre, leader of the Conservative Party of Canada, has been touring

Newfoundland and Labrador with promises to cut the tax on home heating

fuels. (Danny Arsenault/CBC)

Pierre

Poilievre, leader of the Conservative Party of Canada, has been touring

Newfoundland and Labrador with promises to cut the tax on home heating

fuels. (Danny Arsenault/CBC)

"That, I think, hits home to everybody because everybody realizes that whether it be through the Clean Fuels Strategy or the rise in the cost of home heating oil, you name it, it's partially because of some taxes that have been put on to those particular items," he said.

"When you hurt people in the pocketbook, they remember it. When you promise to not hurt them in the pocketbook, or to eliminate a tax that they're now paying, that bodes well with the every day Canadian when it comes to their pocketbook issues."

McDonald said he is not nervous and the mood within his party is "pretty good" heading into the fall session, and following a national Liberal caucus retreat in London, Ont.

McDonald said he and others put their concerns on the table.

"What some of us, myself included, have mentioned … is either give a break on the home heating fuel tax and the Clean Fuel Strategy for a certain length of time. I think people would look at that as being favourable," he said.

"Will it ever come back again? I don't know. Will the government actually do something in that regard? We keep talking about it. We talk about it to ministers, we talk about it at caucuses. Some of us are really hoping that we do something to ease the burden, especially on people that live in rural communities."

With files from On The Go

Atlantic Liberal MPs press Trudeau for rural carbon tax carve-out

MPs say their constituents need more relief from the rising cost of living

MP Ken McDonald, who represents the riding of Avalon in Newfoundland and Labrador, said many of his constituents feel abandoned by the federal government.

He brought their concerns to the attention of Prime Minister Justin Trudeau during the national Liberal caucus meetings this week in London, Ont.

"I told him exactly as it is," McDonald said. "We're punishing the rural areas of our country and the most vulnerable people in our society."

McDonald is pushing for a special policy for rural Canadians that would include carbon tax rebates higher than those the backstop program currently offers.

Ken

McDonald, Liberal MP for Conception Bay South in Newfoundland and

Labrador, pitched a rural carbon tax carve-out to the prime minister at

the national Liberal caucus meeting in London, Ont. (Olivia Stefanovich/CBC)

Ken

McDonald, Liberal MP for Conception Bay South in Newfoundland and

Labrador, pitched a rural carbon tax carve-out to the prime minister at

the national Liberal caucus meeting in London, Ont. (Olivia Stefanovich/CBC)

The federal carbon tax applies in provinces and territories that don't have carbon pricing systems that Ottawa considers sufficient to lower greenhouse gas emissions.

The government already gives a supplement to residents of rural and small communities that increases the amount of rebates in their province by 10 per cent to account for increased energy needs and reduced access to transportation options.

Under the program, residents in Newfoundland and Labrador receive payments every three months: $164 for people who live alone, $82 for a spouse or common-law partner, $41 per child under the age of 19 and $82 for the first child in a single-parent family.

In Nova Scotia, those amounts are even lower. Liberal Atlantic caucus chair Kody Blois said those payments aren't high enough.

"There should be a higher rural rebate," said Blois, who represents the Nova Scotia riding of Kings—Hants.

"The policy is the right intent, but I think we need to have some adjustments."

Kody

Blois, chair of the national Liberal rural caucus and Nova Scotia

Liberal caucus, says he wants higher carbon tax rebates for rural

Canadians. (Mark Crosby/CBC)

Kody

Blois, chair of the national Liberal rural caucus and Nova Scotia

Liberal caucus, says he wants higher carbon tax rebates for rural

Canadians. (Mark Crosby/CBC)

McDonald said Trudeau acknowledged there's an issue in rural areas and said the government will see if there's something it can do.

"People will be very upset when the ballot box comes up the next time if we don't," McDonald said.

"That's what the prime minister is hearing loud and clear."

McDonald said he was moved to speak up after hearing about the struggles of rural Canadians. He said one constituent called him to say she can't afford home heating oil anymore.

"She said, 'I go around my house with a blanket wrapped around me.' And she said, 'The only time I get to have beef or chicken is if my niece or nephew invites me out to Sunday dinner,'" he said.

McDonald said he tells that story to everyone he talks to in government.

"I think government is starting to understand it," McDonald said.

"At first, some people said to me, like, there's nobody living like that … And I said, 'If you don't think people are living like that, you're not living in the real world.'"

Prime

Minister Justin Trudeau wrapped up national Liberal caucus meetings in

London, Ont. on Thursday without announcing any relief for rural

Canadians struggling to pay for fuel. (Sylvain Lepage/CBC News)

Prime

Minister Justin Trudeau wrapped up national Liberal caucus meetings in

London, Ont. on Thursday without announcing any relief for rural

Canadians struggling to pay for fuel. (Sylvain Lepage/CBC News)

In Newfoundland and Labrador, he said, many consumer goods come in on aircraft or ferries, which burn fuel.

McDonald said he isn't surprised by the Liberals' plummeting poll numbers because Conservative Leader Pierre Poilievre's "axe the tax" campaign is telling people what they want to hear.

He said Trudeau needs to travel across the country, shake some hands and let people know he still has their backs.

"I hope the government is going to listen and do something or the government will be in trouble," McDonald said.

McDonald said while Ottawa must do its part to reduce greenhouse gas emissions, the burden of that effort shouldn't fall on the backs of the most vulnerable.

"I will continue to stand up for the constituents, which I represent, whether it's favourable to the government or unfavourable," McDonald said.

"I want to make sure they have their voice heard."

---------- Forwarded message ----------

From: David Amos <david.raymond.amos333@gmail.

Date: Wed, 7 Dec 2022 18:44:28 -0400

Subject: I read the news up north today and called both offices of the

Liberal MP Michael McLeod to remind him of the last email I sent him

on All Hallows Eve

To: justin.trudeau@parl.gc.ca, David.Yurdiga@parl.gc.ca,

Michael.Kram@parl.gc.ca, Luc.Berthold@parl.gc.ca,

Bernard.Genereux@parl.gc.ca, Joel.Godin@parl.gc.ca,

jacques.gourde@parl.gc.ca, Richard.Lehoux@parl.gc.ca,

info@peoplespartyofcanada.ca, Richard.Martel@parl.gc.ca,

Pierre.Paul-Hus@parl.gc.ca, Alain.Rayes@parl.gc.ca,

mrisdon@westernstandardonline.

lettertoeditor@epochtimes.com, newsdesk@epochtimes.com,

ottawa@epochtimes.com, calgary.ca@epochtimes.com,

wendy.tiong@epochtimes.com, oldmaison <oldmaison@yahoo.com>, jbosnitch

<jbosnitch@gmail.com>, "darrow.macintyre" <darrow.macintyre@cbc.ca>,

newsroom@ntdtv.com, feedback@ntdtv.com, jenny.chang@ntdtv.com,

joe.wang@ntdtv.com, bgrant@thehill.com, nacharya

<nacharya@thehill.com>, Peggy.Regimbal@bellmedia.ca,

patrickking@canada-unity.com, james@canada-unity.com,

novaxpass@outlook.com, martin@canada-unity.com, tdundas10@gmail.com,

jlaface@gmail.com, davesteenburg269@gmail.com, brown_tm3@yahoo.ca,

leannemb <leannemb@protonmail.com>, harold@jonkertrucking.com,

keepcanada@protonmail.com, andyjohanna01@hotmail.com,

janiebpelchat@icloud.com, janetseto@protonmail.com,

johndoppenberg@icloud.com, stiessen1979@gmail.com,

77cordoba@outlook.com, pierrette.ringuette@sen.parl.

Patrick.Brazeau@sen.parl.gc.ca

larry.campbell@sen.parl.gc.ca, Bev.Busson@sen.parl.gc.ca,

info@lionelmedia.com, liveneedtoknow@gmail.com, tips@steeltruth.com,

media@steeltruth.com, press@deepcapture.com, washington field

<washington.field@ic.fbi.gov>, bbachrach <bbachrach@bachrachlaw.net>,

"Bill.Blair" <Bill.Blair@parl.gc.ca>, "barbara.massey"

<barbara.massey@rcmp-grc.gc.ca

Norman Traversy <traversy.n@gmail.com>, news <news@dailygleaner.com>,

nobyrne <nobyrne@unb.ca>, tracy@uncoverdc.com, James@jamesfetzer.com,

editor@americanthinker.com, nharris@maverick-media.ca, nouvelle

<nouvelle@acadienouvelle.com>, news-tips <news-tips@nytimes.com>,

danajmetcalfe@icloud.com, lauralynnlive@protonmail.com,

rglangille@gmail.com, paulpalango <paulpalango@protonmail.com>,

NightTimePodcast <NightTimePodcast@gmail.com>, nsinvestigators

<nsinvestigators@gmail.com>, editor@ssimicro.com, inuvikdrum@nnsl.com,

kivalliqnews@nnsl.com, editor@nunavutnews.com

Cc: Jaime.Battiste@parl.gc.ca, Kody.Blois@parl.gc.ca,

Andy.Fillmore@parl.gc.ca, motomaniac333 <motomaniac333@gmail.com>,

Darren.Fisher@parl.gc.ca, Sean.Fraser@parl.gc.ca,

Bernadette.Jordan@parl.gc.ca, Mike.Kelloway@parl.gc.ca,

Darrell.Samson@parl.gc.ca, Lenore.Zann@parl.gc.ca, "heather.bradley"

<heather.bradley@parl.gc.ca>, geoff.regan@parl.gc.ca,

kelly@kellyregan.ca, Michael.Duffy@sen.parl.gc.ca,

Sean.Casey@parl.gc.ca, Robert.Morrissey@parl.gc.ca,

lawrence.macaulay@parl.gc.ca, "Furey, John" <jfurey@nbpower.com>,

wharrison <wharrison@nbpower.com>, "Mike.Comeau" <Mike.Comeau@gnb.ca>,

"Holland, Mike (LEG)" <mike.holland@gnb.ca>,

Gudie.Hutchings@parl.gc.ca, Yvonne.Jones@parl.gc.ca,

Ken.McDonald@parl.gc.ca, Seamus.ORegan@parl.gc.ca,

Churence.Rogers@parl.gc.ca, scott.simms@parl.gc.ca,

Jim.Carr@parl.gc.ca, Dan.Vandal@parl.gc.ca,

kevin.lamoureux@parl.gc.ca, Terry.Duguid@parl.gc.ca,

Larry.Bagnell@parl.gc.ca, Michael.McLeod@parl.gc.ca

https://www.nnsl.com/news/nwt-

NWT MP says Bill C-21 must not impede rights of Northern hunters

by NNSL Media December 7, 2022

“There are aspects of (the bill) right now that are a bit blurry for

me and a little bit concerning,” says Northwest Territories Member of

Parliament Michael McLeod. NNSL file photo

The federal government’s proposed legislation that aims in part to

prohibit hundreds of previously legal firearms may be called for a

final vote as soon as this month, but NWT MP Michael McLeod says he is

not yet satisfied with the bill in its current form.

McLeod, a member of the governing Liberal party, said he has long

supported his party’s effort to toughen gun laws since being elected

in 2015 and pointed out that he likes some provisions of the current

draft of Bill C-21. Aspects he approves of include red and yellow flag

laws that would allow court-order prohibitions, handgun freezes,

attention to illegal smuggling and trafficking and stiffer maximum

penalties for gun crimes.

However, he said definitions need to be clearer around what

constitutes “military-style assault weapons” and there needs to be a

better understanding as to why there are some non-semi-automatic guns

on the prohibition list.

He added that Public Safety Canada needs to better acknowledge common

gun use in the North and should improve consultation with Northerners

before a vote is held, particularly Indigenous people, as per Section

35 of the Constitution, the United Nations Declaration of Indigenous

Peoples and specific self-governing agreements.

“There are aspects of (the bill) right now that are a bit blurry for

me and a little bit concerning,” he said. “I don’t know what is being

suggested when it comes to changing the definition of assault weapons.

“I have spoken to the minister in charge, (Public Safety Minister)

Marco Mendicino, and I’ve indicated to him that he doesn’t have my

full support until I really understand this and until I’m completely

convinced (the bill) won’t affect hunters, sport shooters and trappers

in the North.

“I have also indicated that I’m not satisfied that his people have

done a good enough job to consult.”

‘Heated debate’

McLeod admitted he has a personal interest in the issue as he has been

a longtime collector of firearms, so he considers himself well versed

in the need for specifics when placing prohibitions on guns.

“There are already some guns that are not semi-automatics that are on

the list and we need to know why,” he said. “Most of them are because

they exceed the 10,000 joule (projectile limit) but we are trying to

scrub the list to make sure that nothing gets on that list that people

are using for hunting in the North.”

Because of his experience and perspective, there can be “heated”

debate within his own party, he said.

“A lot of times when we have discussions within caucus, I’m the one

with the most guns and probably the one with the most knowledge about

guns,” he said. “We have a large part of the MPs in caucus that… see

guns from a city/urban standpoint and look at it through that lens.

But there are lots from the rural or remote and northern parts of the

country that look at guns and view it in a different light.

“We don’t see it as a weapon but we see it as a tool.”

Raquel Dancho, Conservative MP and vice-chair of the House of Commons

public safety and national security committee that has been examining

the bill, said her party has been opposed to the bill from the

beginning. However, her opposition became stronger in recent weeks as

the government attempted during clause-by-clause reading in committee

to add non-restricted hunting rifles among those proposed to be

prohibited and to redefine a ‘military assault rifle’ with any

semi-automatic gun with the capacity to carry a magazine.

She has called the move “the largest assault on hunters in Canada” and

has charged that the federal government is going after “Grandpa Joe’s

hunting rifle instead of gangsters in Toronto.”

“The problem with that of course is that (the proposed bill)

encapsulates hundreds and hundreds of models of common firearms and

shotguns used for duck hunting or farming,” she said.

“Trudeau has been consistent in saying that he will never come for

hunters and now they are.

“If this legislation stands, it leaves a backdoor open that any listed

hunting rifle can be banned with the stroke of a pen.”

‘Hammered’ with emails

Dancho said that having a voice from provincial or territorial

leadership against the legislation — as Manitoba, Saskatchewan and

Alberta have done — could make a difference in presenting a stance

against the bill.

“I would also empower every voter who would like to see hunting remain

in Canada to reach out to the Liberal MP ASAP,” she said. “MPs are

currently getting hammered with thousands of emails on this.”

For his part, McLeod said he has received both support and opposition

to the bill and that he situates himself somewhere in the middle.

Scott Cairns, past president of the Yellowknife Shooting Club, said

he’s concerned that the bill amendments will likely lead to many club

members owning prohibited guns due to the popular use of

non-restricted, semi-automatic guns. Often these firearms are

beneficial to hunters wanting to get shots off quickly when ducks or

geese come into sight or when trying to quickly take down larger game

like deer or caribou.

“Because of the type of gun, the semi-automatic and the fact that they

are extra popular among users makes this a very sweeping prohibition,”

he explained.

“What the federal government is now saying with this law is that they

are taking firearms that were bought over the counter for normal use

and by the stroke of a pen saying that you are not allowed to sell,

use or trade away. It is not acceptable to me and should not be

acceptable to anyone.”

Possession acquisition licence

Cairns said that legal firearm owners already go through a rigorous

and invasive procedure to be able to possess in the first place, which

is among the opposition by gun owners regarding the proposed bill.

To legally own a gun in the Northwest Territories, one must seek out a

Possession acquisition licence (PAL) by first paying a $300 fee and

then taking a Canada Firearm Safety course led by a credible

instructor.

Once passing the course, one must fill out a five-page application

form to send to the RCMP.

Before a permit can be issued, the RCMP thoroughly researches an

applicant’s history, which can include marital and mental health

history and criminal record backgrounds.

After contact with references, a non-restricted firearm licence may

then be issued.

GNWT Department of Justice spokesperson Ngan Trinh said this week that

the territorial government is reviewing recent amendments to the bill

but admitted that questions remain surrounding the proposed

legislation, including on how proposed buyback program would work.

“Community safety and crime reduction is a shared responsibility with

the federal government and we will work with our partners including

Public Safety Canada and the RCMP to assess any implications from the

ban,” Trinh said.

Messages for this story were left with Justice Minister R.J. Simpson

and cabinet as well as the Northwest Territories RCMP on Dec. 1. They

did not respond by press deadline.

—By Simon Whitehouse, Northern News Services

Contact Us

Our publishing company, Northern News Services Limited and our

affiliated company, Canarctic Graphics Limited, a full-service printer

have offices in Nunavut and Northwest Territories.

Publisher: Mike W. Bryant

Print Shop Manager: Sean Crowell

Managing Editor: James McCarthy

Circulation Director: Edison Mathew

ALL DEPARTMENTS/ALL PAPERS

P.O.Box 2820

Yellowknife NT X1A 2R1

Phone (867) 873-4031

Fax (867) 873-8507

BUREAUS:

Nunavut News – Reporter Trevor Wright

Phone – 1-867-979-5990

Email: editor@nunavutnews.com

Nunavut News Advertising & Print Sales: Laura Whittle

Email: advertising@nunavutnews.com

Phone: (867) 766-8260

Fax: (867) 873-8507

Kivalliq News Editor: Stewart Burnett

Phone: (867) 645-3223

Fax: (867) 645-3225

Email: kivalliqnews@nnsl.com

Inuvik Drum, Mackenzie Delta, NT (Reporter): Eric Bowling

Ph.(867) 777- 4545

Fax (867) 777-4412

Email: inuvikdrum@nnsl.com

Hay River Hub, NT (Reporter): Ezra Black

Ph.(867) 874-2802

Fax (867) 874-2804

Email:advertise@hayriverhub.

Email: editor@ssimicro.com

Canarctic Graphics Limited

P.O. Box 2758

Yellowknife, NT X1A 2R1

Ph. (867) 873-4371

Fax (867) 920-4371

Methinks the Standing Committee on Public Safety and National Security

are gonna have a Hell of a hearing on All Hallows Eve N'esy Pas?

---------- Forwarded message ----------

From: David Amos <david.raymond.amos333@gmail.

Date: Fri, 7 Oct 2022 15:13:53 -0300

Subject: Re The CRA in the news again Deja Vu anyone???

To: dmilot@milotlaw.ca, contactus@taxationlawyers.ca,

acampbell@legacylawyers.ca, jdp@tdslaw.com, "Nathalie.Drouin"

<Nathalie.Drouin@justice.gc.ca

"erin.otoole" <erin.otoole@parl.gc.ca>, pm <pm@pm.gc.ca>, premier

<premier@ontario.ca>, Newsroom <Newsroom@globeandmail.com>,

"jagmeet.singh" <jagmeet.singh@parl.gc.ca>, "Bill.Blair"

<Bill.Blair@parl.gc.ca>, "Brenda.Lucki" <Brenda.Lucki@rcmp-grc.gc.ca>,

mcu <mcu@justice.gc.ca>, nathalie.sturgeon@globalnews.

"Jason.Proctor" <Jason.Proctor@cbc.ca>, "John.Williamson"

<John.Williamson@parl.gc.ca>, "Ross.Wetmore" <Ross.Wetmore@gnb.ca>,

"blaine.higgs" <blaine.higgs@gnb.ca>, "rob.moore"

<rob.moore@parl.gc.ca>, "Robert. Jones" <Robert.Jones@cbc.ca>,

"steve.murphy" <steve.murphy@ctv.ca>, "Melanie.Joly"

<Melanie.Joly@parl.gc.ca>, "Mark.Blakely"

<Mark.Blakely@rcmp-grc.gc.ca>, "martin.gaudet"

<martin.gaudet@fredericton.ca>

<megan.mitton@gnb.ca>, "michael.macdonald"

<michael.macdonald@

Cc: motomaniac333 <motomaniac333@gmail.com>, sheilagunnreid

<sheilagunnreid@gmail.com>, "silas.brown" <silas.brown@globalnews.ca>,

christian.lorenz@

---------- Forwarded message ----------

From: "Lorenz, Christian" <Christian.Lorenz@cbsa-asfc.

Date: Fri, 7 Oct 2022 17:32:23 +0000

Subject: Automatic reply: Attn Jeff Pniowsky I was readig about you in

CBC today perhaps we should talk ASAP?

To: David Amos <david.raymond.amos333@gmail.

This email is not routinely monitored.

I am in my new role as Regional Director, Europe, Africa and Middle

East, and can be reached at: christian.lorenz@

effective 15 August 2022.

Thank you.

**

Cette addresse courriel n'est pas surveillée régulièrement.

Je suis dans mon nouveau rôle comme Directeur Régional, Europe,

Afrique et Moyen-Orient, et peux être rejoint au:

christian.lorenz@

Merci.

---------- Forwarded message ----------

From: David Amos <david.raymond.amos333@gmail.

Date: Fri, 12 Mar 2021 15:00:03 -0400

Subject: Re The CRA in the news again Deja Vu anyone???

To: dmilot@milotlaw.ca, contactus@taxationlawyers.ca,

acampbell@legacylawyers.ca, jdp@tdslaw.com, "Nathalie.Drouin"

<Nathalie.Drouin@justice.gc.ca

"erin.otoole" <erin.otoole@parl.gc.ca>, pm <pm@pm.gc.ca>, premier

<premier@ontario.ca>, Newsroom <Newsroom@globeandmail.com>,

"jagmeet.singh" <jagmeet.singh@parl.gc.ca>, "Bill.Blair"

<Bill.Blair@parl.gc.ca>, "Brenda.Lucki" <Brenda.Lucki@rcmp-grc.gc.ca>,

mcu <mcu@justice.gc.ca>

Cc: motomaniac333 <motomaniac333@gmail.com>, Nathalie Sturgeon

<sturgeon.nathalie@

<Jason.Proctor@cbc.ca>, "John.Williamson"

<John.Williamson@parl.gc.ca>, "Ross.Wetmore" <Ross.Wetmore@gnb.ca>,

"blaine.higgs" <blaine.higgs@gnb.ca>, "rob.moore"

<rob.moore@parl.gc.ca>, "Robert. Jones" <Robert.Jones@cbc.ca>,

"steve.murphy" <steve.murphy@ctv.ca>

https://davidraymondamos3.

Sunday, 7 March 2021

RCMP threaten a BC church with Canada Revenue Agency investigation???

NOW THATS TOO TOO FUNNY INDEED

https://www.cbc.ca/news/

Canada Revenue Agency accused of blaming victims as 'gross negligence'

cases drag on

B.C. retiree who won appeal of $139K penalty claimed she didn't know

what was filed on her behalf

Jason Proctor · CBC News · Posted: Mar 11, 2021 5:45 PM PT

About the Author

Jason Proctor @proctor_jason

Jason Proctor is a reporter in British Columbia for CBC News and has

covered the B.C. courts and mental health issues in the justice system

extensively.

https://www.tdslaw.com/person/

Jeff Pniowsky

Jeff focuses his practice in the areas of tax litigation and dispute

resolution in the tax audit and appeals process, tax advisory

services, and complex commercial litigation.

(204) 934-0586

jdp@tdslaw.com

https://www.canlii.org/en/ca/

Signed at Ottawa, Canada, this 2nd day of March 2021.

“Sylvain Ouimet”

Ouimet J.

CITATION:

2021 TCC 14

COURT FILE NO.:

2016-1686(IT)G

STYLE OF CAUSE:

MARGO DIANNE BOWKER

AND HER MAJESTY THE QUEEN

PLACE OF HEARING:

Vancouver, British Columbia

DATE OF HEARING:

February 10, 11, 12 and 13, 2020

REASONS FOR JUDGMENT BY:

The Honourable Justice Sylvain Ouimet

DATE OF JUDGMENT:

---------- Forwarded message ----------

From: David Amos <david.raymond.amos333@gmail.

Date: Fri, 7 Oct 2022 14:47:27 -0300

Subject: Fwd: Attn Jeff Pniowsky I was readig about you in CBC today

perhaps we should talk ASAP?

To: hmartinez@tdslaw.com, cdacosta@tdslaw.com

Cc: motomaniac333 <motomaniac333@gmail.com>

---------- Forwarded message ----------

From: Danielle Delorme <ddelorme@tdslaw.com>

Date: Fri, 7 Oct 2022 17:40:00 +0000

Subject: Automatic reply: Réponse automatique : Attn Jeff Pniowsky I

was readig about you in CBC today perhaps we should talk ASAP?

To: David Amos <david.raymond.amos333@gmail.

I will be out of the office Friday, September 30th and returning

Tuesday, October 11th.

I will not be checking emails during this time.

If you requrie assistance before October 11th, please contact either:

Colleen Da Costa 204-934-2340 cdacosta@tdslaw.com

Heather Martinez 204-934-2379 hmartinez@tdslaw.com

Thank you,

Danielle Delorme

Click the following link to unsubscribe or subscribe to TDS e-communications:

Unsubscribe at https://tdslaw.us3.list-

Subscribe at https://www.tdslaw.com/

---------- Forwarded message ----------

From: David Amos <david.raymond.amos333@gmail.

Date: Fri, 7 Oct 2022 14:32:11 -0300

Subject: Attn Jeff Pniowsky I was readig about you in CBC today

perhaps we should talk ASAP?

To: jdp@tdslaw.com, mcu <mcu@justice.gc.ca>

Cc: motomaniac333 <motomaniac333@gmail.com>, "Jason.Proctor"

<Jason.Proctor@cbc.ca>, "blaine.higgs" <blaine.higgs@gnb.ca>,

Diane.Lebouthillier@cra-arc.

Andrew.Baumberg@cas-satj.gc.ca

<Ellen.Desmond@crtc.gc.ca>, Christian.Lorenz@cbsa-asfc.gc.

Allison.St-Jean@tc.gc.ca, media@tc.gc.ca, hc.media.sc@canada.ca,

mary-liz.power@canada.ca, media@cbsa-asfc.gc.ca,

Chris.Lorenz@cbsa-asfc.gc.ca, "christopher.rupar"

<christopher.rupar@justice.gc.

https://www.cbc.ca/news/

New Brunswick·CBC Investigates

How to keep secrets from the public: Don't write anything down

https://www.cbc.ca/news/

Judge slams CRA and Justice Department for 'egregious' conduct in epic

Tax Court battle

Decision likely to affect dozens of Canadians appealing gross

negligence penalties from tax agency

Jason Proctor · CBC News · Posted: Oct 07, 2022 4:00 AM PT |

A tax Court judge has slammed the Canada Revenue Agency for failing to

comply with pre-trial court rules and orders. (Chris Wattie/Reuters)

A Tax Court judge has slammed the Canada Revenue Agency and the

Justice Department for "egregious" conduct that threatened to deny

three taxpayers the right to a fair trial in an epic battle over

millions of dollars worth of tax penalties.

In a scathing decision that could have widespread implications, Judge

Patrick Boyle found the CRA committed an "intentional and deliberate"

pattern of ignoring court rules to "frustrate" the right that all

Canadians have to get a full picture of an opponent's case before

heading to court.

The three taxpayers — a Manitoba psychiatrist, an Ontario nurse and a

B.C. Air Canada pilot — were appealing three million dollars' worth of

gross negligence penalties levelled against them, for rejected returns

filed through a pair of disgraced tax consultancy firms.

But after years of pre-trial delays resulting from the CRA's repeated

failure to comply with his orders, Boyle took the extraordinary

measure of allowing the appeals without having a trial on the merits

of the case this week, to "protect the integrity of the judicial

process."

Canada Revenue Agency accused of blaming victims as 'gross

negligence' cases drag on

"I find the [CRA's] egregious approach to pre-trial discovery in these

appeals to prejudice all three appellants who have been denied," Boyle

wrote in his ruling.

"These abuses of the discovery process ... have caused considerable

delay and expense to three Appellants in respect of their appeals.

They have also led to an inefficient use of public resources financed

by all Canadians."

'With great power comes great responsibility'

Boyle's decision is the latest chapter in a saga that has seen

hundreds of Canadians slapped with gross negligence penalties after

filing returns through DeMara Consulting and Fiscal Arbitrators.

The principals of both companies were jailed for tax fraud for

promoting schemes Boyle says "resemble in many respects the

de-taxation practices of sovereign citizens, though with less of the

non-fiscal cultish aspects."

Hundreds of Canadians filed appeals in Tax Court after the CRA

levelled gross negligence penalties against them in association with

returns filed through a pair of disgraced tax consultancies. (Minichka

/ Shutterstock)

According to court records, B.C.-based DeMara's scheme was called "the

remedy" and essentially involved claiming personal expenditures and

debts as expenses and capital losses for a non-existent business.

Canada's Income Tax Act gives CRA the ability to levy penalties

against Canadians who make false statements and omissions on their tax

returns, either knowingly or under circumstances that amount to gross

negligence.

The penalties in the DeMara and Fiscal Arbitrators case have reached

into the millions, leading to a huge backlog of appeals that have been

making their way through tax court since 2013.

Tax agency obtains 'jeopardy order' for debt from Downton

Abbey-loving billionaire

Jeff Pniowsky, the Winnipeg-based lawyer who represented all three

plaintiffs, said fighting a decade-long court battle with the threat

of financial ruin hanging over their heads has cost his clients "years

of happiness."

"This was fundamentally a case about justice. Justice for the

taxpayers who had to endure years of gamesmanship and chicanery by one

of Canada's most powerful institutions: the CRA," Pniowsky told the

CBC.

Pniowsky, who has four children, said Boyle's ruling reminded him of a

line from one of his family's favourite superhero movies: Spiderman.

"With great power comes great responsibility," he said.

"It's clear from this case that the CRA and the Justice Department

have lost sight of that common-sense principle."

'Unprepared, unco-operative or untruthful'

Boyle's detailed 53-page ruling goes through the history of the case,

and the circumstances that led to each of the orders he found the CRA

later ignored.

The fight centred on pre-trial discovery, and the rights of the

taxpayers to examine a CRA representative or "nominee" who was

"knowledgeable" about their case.

The CRA has the ability to levy gross negligence penalties against

taxpayers who lie on their income tax forms. The penalties have been

devastating for some. (Graeme Roy/The Canadian Press)

The first person the agency put forward was "unaware of any criminal

investigation and had not informed himself" about any involvement of

the CRA's criminal investigators in the case.

The second nominee was a lead criminal investigator who "did not even

inform himself ... whether any investigation was undertaken of any of

these three appellants."

At one point, Boyle called the investigator "thoroughly unprepared,

unco-operative or untruthful."

The judge said the CRA and its lawyers twisted the words of an order

that boiled down to a demand for the agency to hand over any documents

relating to any investigations that touched on the three appellants.

"I variously described this as 'outrageously misleading and

inappropriate,' 'this might be contemptuous,' ... 'deeply, deeply

disturbed,' 'highly inappropriate' and 'I don't think you were

reasonably mistaken,'" Boyle wrote.

It is an ex-reference: B.C. judge removes 'dead parrot' joke from

class-action ruling

The judge also zeroed in on the CRA's failure to tell the defence that

the second page of a three-page "Investigation Abort Report" against

one of the plaintiffs had gone missing. The report was handed over in

the middle of hundreds of documents. The missing page explained why a

criminal investigation was dropped.

The CRA claimed it had no "specific obligation" to point out missing

pages — a position Boyle found "shocking."

"Courts do not consider discovery to be a game, and it is particularly

disappointing when the Crown is the offending party," the judge said.

He said the omission gave credence to the idea the CRA "is hiding

something from them, from the Court and from Canadians about how these

investigations have been conducted.

'Stop, or I'll yell stop again!'

The judge pointed out that the CRA is "represented by the Department

of Justice which is essentially Canada's largest national law firm and

employs a large number of tax litigation lawyers who are wholly

familiar" with the court's rules.

Boyle said making yet another order for compliance would be pointless.

The judge compared his battle to get the CRA to comply with his orders

to a skit by Monty Python, whose troupe members are seen here from

left to right: John Cleese, Terry Gilliam, Terry Jones, Graham

Chapman, Michael Palin and Eric Idle. (PBS/Python (Monty) Pictures

Ltd./The Associated Press)

He was reminded of a skit by legendary English comedy troupe Monty Python.

"To make such an order would conjure up memories of the Pythonesque

skit of the British bobby of another era yelling at a scofflaw: 'Stop!

Stop!—Stop, or I'll yell 'stop' again!'" the judge wrote.

The three appeals were supposed to be the lead plaintiffs for a much

larger group of appeals. The judge said those people will have to

speak with their lawyers to determine how the ruling applies to them.

Pniowsky says he believes the decision is the first of its kind

against the CRA. He predicted fallout both in other DeMara and Fiscal

Arbitrators cases and in the wider world of tax litigation.

"Intoxicated with a sense of moral righteousness, the government

apparently determined or acted like these Canadians were not worthy of

basic procedural rights, thereby committing the same wrongs they

accused the taxpayers of: gross neglect, wilful blindness and at times

deceptive conduct," he said.

ABOUT THE AUTHOR

Jason Proctor

@proctor_jason

Jason Proctor is a reporter in British Columbia for CBC News and has

covered the B.C. courts and the justice system extensively.

CBC's Journalistic Standards and Practices

https://www.tdslaw.com/

Jeff Pniowsky

Jeff focuses his practice in the areas of tax litigation and dispute

resolution in the tax audit and appeals process, tax advisory

services, and complex commercial litigation.

(204) 934-2586

jdp@tdslaw.com

Winnipeg

(204) 934-0586

Profile

Jeff is a partner with TDS who focuses his practice in the areas of

tax litigation and dispute resolution in the tax audit and appeals

process, tax advisory services, as well as complex commercial

litigation. Formerly a senior Tax Litigator with the Federal

Department of Justice acting on behalf of the Canada Revenue Agency

(CRA) for almost 10 years, Jeff now serves local and national clients

with a wealth of experience in litigating at all levels of both the

Provincial and Federal courts, including the Supreme Court of Canada.

His work has included challenges to complex tax avoidance techniques

involving large corporate transactions, international taxation and

interpretation of tax treaties. Jeff has advised the Aggressive Tax

Planning Division of CRA involving some of the most significant tax

matters in the Prairie region. He also sat on the National Tax

Avoidance committee for Justice Canada.

In addition, Jeff has extensive experience dealing with tax

enforcement and other regulatory compliance issues including

disclosure requirements and was a member of national Documentary

Requirements Committee. He is also considered an authority on

solicitor and client privilege issues relating to documentary

disclosure, having litigated several matters in this area as well as

being called upon to act as an adjudicator in a privilege

determination.

---------- Forwarded message ----------

From: David Amos <david.raymond.amos333@gmail.

Date: Sun, 7 Feb 2021 23:52:35 -0400

Subject: Diane.Lebouthillier and her old buddy John Ossowski should

remember my email and a couple of their own documents EH Madame

Desmond and Christian Lorenz ?

To: "Diane.Lebouthillier" <Diane.Lebouthillier@cra-arc.

John.Ossowski@cbsa-asfc.gc.ca, megan.maloney@crtc.gc.ca,

bell.regulatory@bell.ca, martine.turcotte@bell.ca, Newsroom

<Newsroom@globeandmail.com>, Nathalie Sturgeon

<sturgeon.nathalie@

<Nathalie.Drouin@justice.gc.ca

<traversy.n@gmail.com>, jswaisland@landingslaw.com,

Andrew.LeFrank@cbsa-asfc.gc.ca

Cc: motomaniac333 <motomaniac333@gmail.com>, "Ellen.Desmond"

<Ellen.Desmond@crtc.gc.ca>, Christian.Lorenz@cbsa-asfc.gc.

Allison.St-Jean@tc.gc.ca, media@tc.gc.ca, hc.media.sc@canada.ca,

mary-liz.power@canada.ca, media@cbsa-asfc.gc.ca,

Chris.Lorenz@cbsa-asfc.gc.ca, "christopher.rupar"

<christopher.rupar@justice.gc.

----- Original Message -----

From: martine.turcotte@bell.ca

To: motomaniac_02186@hotmail.com

Cc: bcecomms@bce.ca ; W-Five@ctv.ca

Sent: Thursday, August 19, 2004 9:28 AM

Subject: RE: I am curious

Mr. Amos, I confirm that I have received your documentation. There is

no need to send us a hard copy. As you have said yourself, the

documentation is very voluminous and after 3 days, we are still in the

process of printing it. I have asked one of my lawyers to review it

in my absence and report back to me upon my return in the office. We

will then provide you with a reply.

Martine Turcotte

Chief Legal Officer / Chef principal du service juridique

BCE Inc. / Bell Canada

1000 de La Gauchetière ouest, bureau 3700

Montréal (Qc) H3B 4Y7

Tel: (514) 870-4637

Fax: (514) 870-4877

email: martine.turcotte@bell.ca

Executive Assistant / Assistante à la haute direction: Diane Valade

Tel: (514) 870-4638

email: diane.valade@bell.ca

A copy of this letter and all related correspondence will be added to

the public record of the proceeding.

If you have any questions or concerns, please feel free to contact me

at (613) 697-4027 or megan.maloney@crtc.gc.ca.

In the meantime, the Commission is currently continuing its review of

this costs application.

Yours Sincerely,

originally signed by

Megan Maloney

Legal Counsel

PIAC Welcomes New Board Members

Adds Expertise in Telecommunications, Broadcasting and Class Actions

OTTAWA – The Public Interest Advocacy Centre (PIAC), today announced

the recent election of four new directors to its Board, all experts in

either telecommunications, broadcasting or class actions:

Konrad von Finckenstein is a lawyer and consultant based in

Ottawa. He was previously Chair of the Canadian Radio-television and

Telecommunications Commission (CRTC), an Honourable Justice of the

Federal Court of Canada and the Commissioner of Competition at the

Competition Bureau of Canada. In addition, he has held senior posts in

the Government of Canada in positions related to international trade,

telecommunications, competition and electronic commerce. Mr. von

Finckenstein has been elected as PIAC’s Chair of the Board.

Suzanne Lamarre is a lawyer and engineer with the firm of

Therrien, Couture and is a former Commissioner of the CRTC. Maitre

Lamarre works in the areas of telecommunications, radiocommunications

and broadcasting law as a strategic advisor on regulatory and

governmental matters at both the national and international level.

Monica Auer is a lawyer and the Executive Director of Canada’s

Forum for Research & Policy in Communications (FRPC), a non-partisan

organization focused on Canada’s communications system. She previously

worked at the CRTC and the Canadian Broadcasting Corporation (CBC).

Ms. Auer has been elected as PIAC’s Vice-Chair.

Jonathan Schachter is a Toronto based lawyer with Sotos LLP, with

his practice areas including class actions, consumer protection

litigation, competition and price fixing, privacy litigation,

professional liability litigation, and trademarks and intellectual

property litigation and arbitration.

“PIAC’s extensive work on behalf of consumers before the CRTC requires

the utmost guidance and insight,” said John Lawford, Executive

Director and General Counsel of PIAC. “We are therefore thrilled to

add to our Board persons with unparalleled experience to guide our

communications advocacy, as well as an expert in consumer class

actions as this sector becomes more litigious,” he added.

PIAC is a federally incorporated not-for-profit and registered charity

that advocates for consumer interests, and in particular vulnerable

consumer interests, in the provision of important public services.

PIAC is known for its representation of consumer, low-income and

seniors groups before the CRTC, arguing for better services, more

choice and consumer protection for customers of Internet, wireless,

telephone and broadcasting services.

For more information, please contact:

John Lawford

Executive Director and General Counsel

Public Interest Advocacy Centre (PIAC)

(613) 562-4002 ×25

> http://davidraymondamos3.

>

> Tuesday, 14 February 2017

>

> RE FATCA, NAFTA & TPP etc ATTN President Donald J. Trump I just got

> off the phone with your lawyer Mr Cohen (646-853-0114) Why does he lie

> to me after all this time???

>

> ---------- Forwarded message ----------

> From: Michael Cohen <mcohen@trumporg.com>

> Date: Tue, 14 Feb 2017 14:15:14 +0000

> Subject: Automatic reply: RE FATCA ATTN Pierre-Luc.Dusseault I just

> called and left a message for you

> To: David Amos <motomaniac333@gmail.com>

>

> Effective January 20, 2017, I have accepted the role as personal

> counsel to President Donald J. Trump. All future emails should be

> directed to mdcohen212@gmail.com and all future calls should be

> directed to 646-853-0114.

> ______________________________

> This communication is from The Trump Organization or an affiliate

> thereof and is not sent on behalf of any other individual or entity.

> This email may contain information that is confidential and/or

> proprietary. Such information may not be read, disclosed, used,

> copied, distributed or disseminated except (1) for use by the intended

> recipient or (2) as expressly authorized by the sender. If you have

> received this communication in error, please immediately delete it and

> promptly notify the sender. E-mail transmission cannot be guaranteed

> to be received, secure or error-free as emails could be intercepted,

> corrupted, lost, destroyed, arrive late, incomplete, contain viruses

> or otherwise. The Trump Organization and its affiliates do not

> guarantee that all emails will be read and do not accept liability for

> any errors or omissions in emails. Any views or opinions presented in

> any email are solely those of the author and do not necessarily

> represent those of The Trump Organization or any of its

> affiliates.Nothing in this communication is intended to operate as an

> electronic signature under applicable law.

>

>

>

>

> ---------- Forwarded message ----------

> From: "Min.Mail / Courrier.Min (CRA/ARC)" <PABMINMAILG@cra-arc.gc.ca>

> Date: Wed, 24 May 2017 13:10:52 +0000

> Subject: Your various correspondence about abusive tax schemes - 2017-02631

> To: "motomaniac333@gmail.com" <motomaniac333@gmail.com>

>

> Mr. David Raymond Amos

> motomaniac333@gmail.com

>

>

> Dear Mr. Amos:

>

> Thank you for your various correspondence about abusive tax schemes,

> and for your understanding regarding the delay of this response.

>

> This is an opportunity for me to address your concerns about the way

> the Canada Revenue Agency (CRA) deals with aggressive tax planning,

> tax avoidance, and tax evasion by targeting individuals and groups

> that promote schemes intended to avoid payment of tax. It is also an

> opportunity for me to present the Government of Canada’s main

> strategies for ensuring fairness for all taxpayers.

>

> The CRA’s mission is to preserve the integrity of Canada’s tax system,

> and it is taking concrete and effective action to deal with abusive

> tax schemes. Through federal budget funding in 2016 and 2017, the

> government has committed close to $1 billion in cracking down on tax

> evasion and combatting tax avoidance at home and through the use of

> offshore transactions. This additional funding is expected to generate

> federal revenues of $2.6 billion over five years for Budget 2016, and

> $2.5 billion over five years for Budget 2017.

>

> More precisely, the CRA is cracking down on tax cheats by hiring more

> auditors, maintaining its underground economy specialist teams,

> increasing coverage of aggressive goods and service tax/harmonized

> sales tax planning, increasing coverage of multinational corporations

> and wealthy individuals, and taking targeted actions aimed at

> promoters of abusive tax schemes.

>

> On the offshore front, the CRA continues to develop tools to improve

> its focus on high‑risk taxpayers. It is also considering changes to

> its Voluntary Disclosures Program following the first set of program

> recommendations received from an independent Offshore Compliance

> Advisory Committee. In addition, the CRA is leading international

> projects to address the base erosion and profit shifting initiative of

> the G20 and the Organisation for Economic Co-operation and

> Development, and is collaborating with treaty partners to address the

> Panama Papers leaks.

>

> These actions are evidence of the government’s commitment to

> protecting tax fairness. The CRA has strengthened its intelligence and

> technical capacities for the early detection of abusive tax

> arrangements and deterrence of those who participate in them. To

> ensure compliance, it has increased the number of actions aimed at

> promoters who use illegal schemes. These measures include increased

> audits of such promoters, improved information gathering, criminal

> investigations where warranted, and better communication with

> taxpayers.

>

> To deter potential taxpayer involvement in these schemes, the CRA is

> increasing notifications and warnings through its communications

> products. It also seeks partnerships with tax preparers, accountants,

> and community groups so that they can become informed observers who

> can educate their clients.

>

> The CRA will assess penalties against promoters and other

> representatives who make false statements involving illegal tax

> schemes. The promotion of tax schemes to defraud the government can

> lead to criminal investigations, fingerprinting, criminal prosecution,

> court fines, and jail time.

>

> Between April 1, 2011, and March 31, 2016, the CRA’s criminal

> investigations resulted in the conviction of 42 Canadian taxpayers for

> tax evasion with links to money and assets held offshore. In total,

> the $34 million in evaded taxes resulted in court fines of $12 million

> and 734 months of jail time.

>

> When deciding to pursue compliance actions through the courts, the CRA

> consults the Department of Justice Canada to choose an appropriate

> solution. Complex tax-related litigation is costly and time consuming,

> and the outcome may be unsuccessful. All options to recover amounts

> owed are considered.

>

> More specifically, in relation to the KPMG Isle of Man tax avoidance

> scheme, publicly available court records show that it is through the

> CRA’s efforts that the scheme was discovered. The CRA identified many

> of the participants and continues to actively pursue the matter. The

> CRA has also identified at least 10 additional tax structures on the

> Isle of Man, and is auditing taxpayers in relation to these

> structures.

>

> To ensure tax fairness, the CRA commissioned an independent review in

> March 2016 to determine if it had acted appropriately concerning KPMG

> and its clients. In her review, Ms. Kimberley Brooks, Associate

> Professor and former Dean of the Schulich School of Law at Dalhousie

> University, examined the CRA’s operational processes and decisions in

> relation to the KPMG offshore tax structure and its efforts to obtain

> the names of all taxpayers participating in the scheme. Following this

> review, the report, released on May 5, 2016, concluded that the CRA

> had acted appropriately in its management of the KPMG Isle of Man

> file. The report found that the series of compliance measures the CRA

> took were in accordance with its policies and procedures. It was

> concluded that the procedural actions taken on the KPMG file were

> appropriate given the facts of this particular case and were

> consistent with the treatment of taxpayers in similar situations. The

> report concluded that actions by CRA employees were in accordance with

> the CRA’s Code of Integrity and Professional Conduct. There was no

> evidence of inappropriate interaction between KPMG and the CRA

> employees involved in the case.

>

> Under the CRA’s Code of Integrity and Professional Conduct, all CRA

> employees are responsible for real, apparent, or potential conflicts

> of interests between their current duties and any subsequent

> employment outside of the CRA or the Public Service of Canada.

> Consequences and corrective measures play an important role in

> protecting the CRA’s integrity.

>

> The CRA takes misconduct very seriously. The consequences of

> misconduct depend on the gravity of the incident and its repercussions

> on trust both within and outside of the CRA. Misconduct can result in

> disciplinary measures up to dismissal.

>

> All forms of tax evasion are illegal. The CRA manages the Informant

> Leads Program, which handles leads received from the public regarding

> cases of tax evasion across the country. This program, which

> coordinates all the leads the CRA receives from informants, determines

> whether there has been any non-compliance with tax law and ensures

> that the information is examined and conveyed, if applicable, so that

> compliance measures are taken. This program does not offer any reward

> for tips received.

>

> The new Offshore Tax Informant Program (OTIP) has also been put in

> place. The OTIP offers financial compensation to individuals who

> provide information related to major cases of offshore tax evasion

> that lead to the collection of tax owing. As of December 31, 2016, the

> OTIP had received 963 calls and 407 written submissions from possible

> informants. Over 218 taxpayers are currently under audit based on

> information the CRA received through the OTIP.

>

> With a focus on the highest-risk sectors nationally and

> internationally and an increased ability to gather information, the

> CRA has the means to target taxpayers who try to hide their income.

> For example, since January 2015, the CRA has been collecting

> information on all international electronic funds transfers (EFTs) of

> $10,000 or more ending or originating in Canada. It is also adopting a

> proactive approach by focusing each year on four jurisdictions that

> raise suspicion. For the Isle of Man, the CRA audited 3,000 EFTs

> totalling $860 million over 12 months and involving approximately 800

> taxpayers. Based on these audits, the CRA communicated with

> approximately 350 individuals and 400 corporations and performed 60

> audits.

>

> In January 2017, I reaffirmed Canada’s important role as a leader for

> tax authorities around the world in detecting the structures used for

> aggressive tax planning and tax evasion. This is why Canada works

> daily with the Joint International Tax Shelter Information Centre

> (JITSIC), a network of tax administrations in over 35 countries. The

> CRA participates in two expert groups within the JITSIC and leads the

> working group on intermediaries and proponents. This ongoing

> collaboration is a key component of the CRA’s work to develop strong

> relationships with the international community, which will help it

> refine the world-class tax system that benefits all Canadians.

>

> The CRA is increasing its efforts and is seeing early signs of

> success. Last year, the CRA recovered just under $13 billion as a

> result of its audit activities on the domestic and offshore fronts.

> Two-thirds of these recoveries are the result of its audit efforts

> relating to large businesses and multinational companies.

>

> But there is still much to do, and additional improvements and

> investments are underway.

>

> Tax cheats are having a harder and harder time hiding. Taxpayers who

> choose to promote or participate in malicious and illegal tax

> strategies must face the consequences of their actions. Canadians

> expect nothing less. I invite you to read my most recent statement on

> this matter at canada.ca/en/revenue-agency/

> statement_from_

>

> Thank you for taking the time to write. I hope the information I have

> provided is helpful.

>

> Sincerely,

>

>

> The Honourable Diane Lebouthillier

> Minister of National Revenue

>

>

| 2 attachments — Scan and download all attachments View all images | |||

| |||

| |||

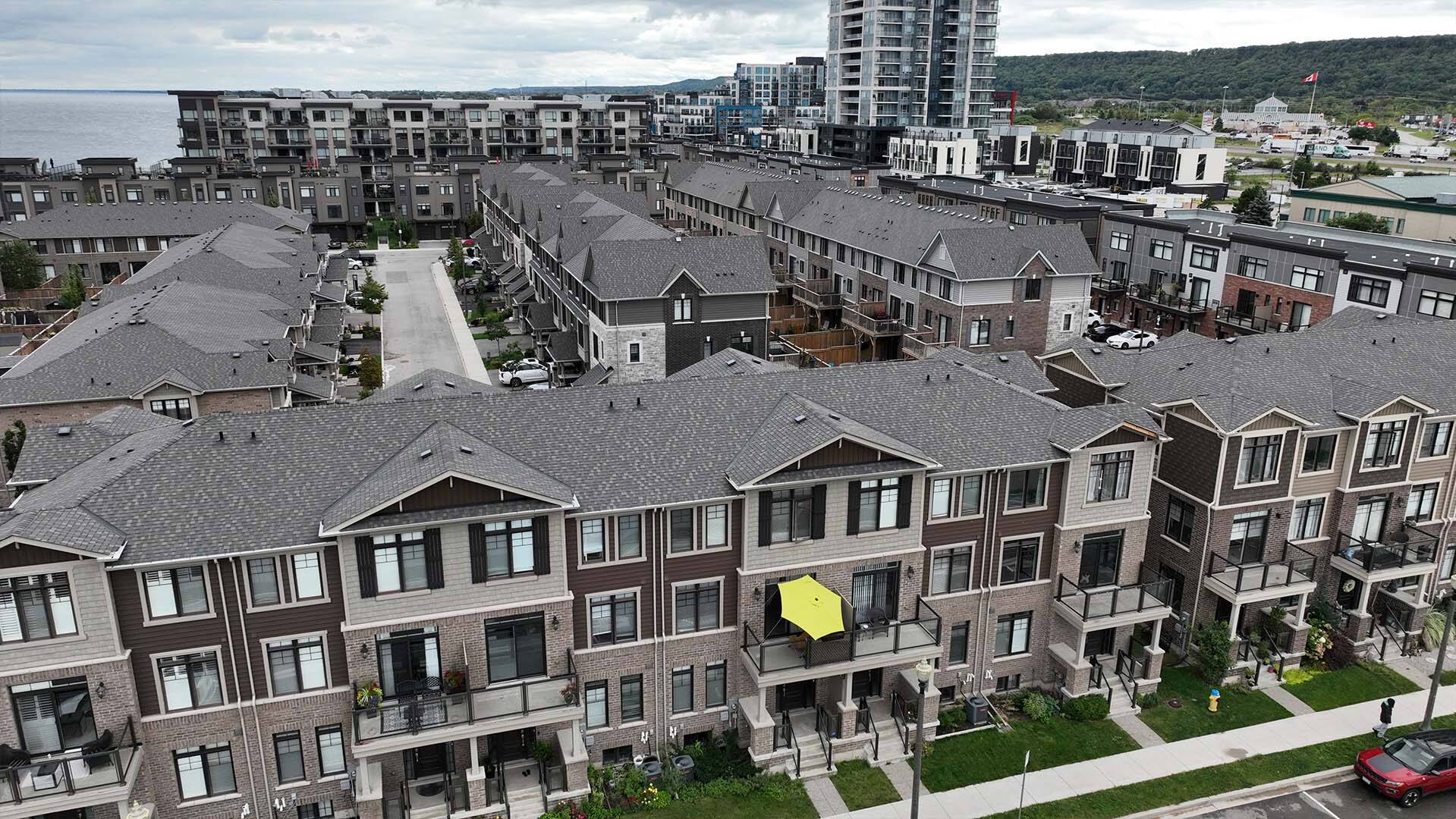

A 47-year mortgage? They're out there — and even longer ones could be coming

Banking regulator says about $250B worth of home loans are either currently or soon to be negatively amortized

This month, the Office of the Superintendent of Financial Institutions will unveil new capital adequacy guidelines for banks and mortgage insurers. Among the expected changes will be some aimed at reining in a surge of negative amortized loans.

About one out of every five home loans at three big Canadian banks are now negatively amortizing, which happens when years get added to the payment term of the original loan because the monthly payments are no longer enough to cover anything but the interest.

On a standard 25-year home loan, under normal circumstances, a certain percentage of the mortgage payment goes to the bank in the form of interest, while another chunk is allocated toward paying down the principal. That way, as the borrower makes their payments, they owe less and less money over time.

But because of the large and rapid run-up in interest rates in the last year and a half, that balance has been thrown out of whack.

It happened to Michael Girard-Courty. He bought a duplex in Joliette, Que., last year on a 25-year, variable rate loan. The monthly payment was well within his budget, at $1,156. But since he signed on the dotted line, the Bank of Canada has hiked interest rates multiple times, which means that more and more of his payment is allocated toward interest — not toward paying down the loan at the pace he'd planned.

As things stand now, "only $23 goes to pay the capital of my mortgage and the rest is all in interest," he told CBC News in an interview. "And my mortgage went from 25 years to 47."

While he hopes to be able to change that, either through lower rates or higher payment amounts, the investment he bought in the hopes of accelerating his retirement has quickly turned into a liability that's on track to stick around for longer than he'd planned to work.

"It's not a fun situation and I never expected to be in it," he said. "I don't know how it's going to end up."

Michael