TD Bank could face more severe penalties after drug money laundering allegations, says analyst

Bank could face worst-case scenario after report connects TD to illicit fentanyl profits

TD Bank Group could be hit with more severe penalties than previously expected, according to a banking analyst, after a report that the investigation it faces in the U.S. is tied to laundering illicit fentanyl profits.

National Bank of Canada analyst Gabriel Dechaine said in a note that the worst-case scenario of the multiple U.S. investigations TD faces needs reassessing after the Wall Street Journal reported the link on Thursday.

The newspaper said the U.S. Justice Department investigation is focused on how Chinese drug traffickers allegedly used TD to launder at least $653 million US, and bribed TD employees to do so.

TD did not comment directly on the report, but said its anti-money laundering defences had been deficient.

"Criminals constantly seek to use banks to launder money. Regrettably, our U.S. (anti-money laundering) program did not effectively thwart these activities. This is unacceptable, and we must and we will do better," said spokesperson Elizabeth Goldenshtein in a statement.

She said the bank continues to co-operate with law enforcement and regulators, and that a comprehensive effort is underway to strengthen its anti-money laundering program.

Dechaine said the severity of the allegations means TD could not only face fines well above the $500 million to $1 billion that many investors have anticipated, but also more severe regulator-imposed limitations on its business activities.

"We believe investors need to put greater weight on worst-case scenarios for the stock," he said in a note.

Fines could hit $2B, analyst says

The cumulative fines could easily hit $2 billion, while regulators could put in place restrictions, including limits on its balance sheet growth, that could affect bank operations for years, said Dechaine.

In a worst-case scenario, the issue could erode TD's future earnings potential by more than $1 billion, he said, noting he has dropped his price target for the bank's shares listed on the Toronto Stock Exchange (TSX) by almost nine per cent to $84.

The link to drug trafficking comes the same week TD announced it had taken an initial provision of $450 million US in connection to the ongoing U.S. regulatory inquiry into its anti-money laundering compliance program.

The bank said on Tuesday its discussions with three U.S. regulators and the Department of Justice are ongoing, and it anticipates additional financial penalties.

Separately, Canada's financial-crime watchdog Fintrac levied a $9.2-million penalty against the bank on Thursday for non-compliance with money laundering and terrorist financing measures.

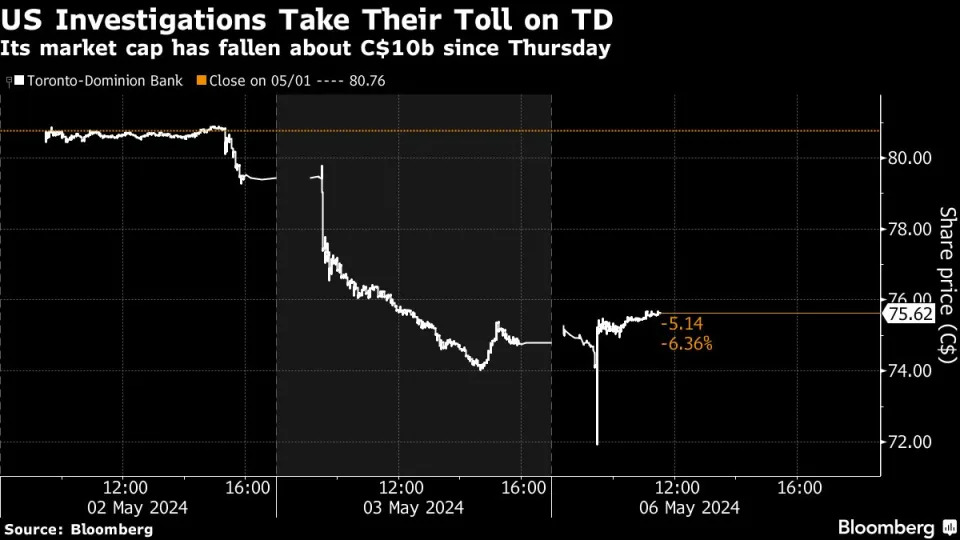

TD Bank's stock price was down more than four per cent in midday trading Friday to $75.85 on the TSX.

CBC's Journalistic Standards and Practices

TD Bank could face billions in fines following money-laundering probe

TD is not alone in its potential involvement with money laundering, as CIBC and RBC have also recently been fined.

According to a note issued to clients, National Bank analyst Gabriel Dechaine said total penalties for money-laundering allegations could easily hit $2 billion.

Canada’s TD Bank may be facing billions of dollars in fines as Canadian and American regulators crack down on money-laundering schemes that came to light over the past year.

National Bank analyst Gabriel Dechaine said total penalties for money-laundering allegations could easily hit $2 billion, according to a note issued to clients, while non-monetary penalties are expected to impact the bank’s operations for years.

TD is not alone in its potential involvement with money laundering, as CIBC and RBC have also recently been fined by Canada’s financial crime regulator for failing to comply with anti-money laundering measures. But while the banks will always be at risk of unknowingly facilitating organized crime, experts say they could be doing more to prevent it.

“It comes down to training and hiring the right people,” said Stephen Scott, a Calgary-based anti-money-laundering compliance and investigations consultant. “It takes one person per branch really to do (illegal) transactions.”

Currently, the U.S. Justice Department is investigating how Chinese drug traffickers allegedly used TD and other banks to launder at least $653 million (U.S.) in proceeds from fentanyl sales, including by bribing the bank’s employees to do so, the Wall Street Journal reported.

The money-laundering probes first became public last spring after it was found that U.S. regulators barred the sale of First Horizon Bank to TD over concerns of suspicious customer transactions. Since then, TD has been generally quiet about the status of the investigations, until it announced in late April that it had set aside $450 million (U.S.) in provisions for possible penalties imposed by U.S. regulators.

Last week, Fintrac, Canada’s financial-crime watchdog, also issued a penalty against TD — this one amounting to $9.2 million — for failing to comply with anti-money-laundering and terrorist financing measures. Among the violations, according to Fintrac, was that the bank did not report suspicious transactions that it had reason to believe were tied to illicit activity. TD has already paid the fine in full, according to Fintrac’s statement on Thursday.

(Fintrac also levied $1.3 million and $7.4 million penalties against CIBC and RBC, respectively, for non-compliance at the end of last year).

TD said a “comprehensive overhaul” of its AML program is ongoing, with $500 million already spent in remediation and platform enhancements.

“Criminals relentlessly target financial institutions to launder money and TD has a responsibility and an obligation to thwart their illegal activity,” Bharat Masrani, CEO of TD, said in a statement on Friday. “I regret that there were serious instances where the Bank’s AML program fell short and did not effectively monitor, detect, report or respond.”

A recent Star investigation revealed how criminals like Italy’s ’Ndrangheta mafia have reportedly been taking advantage of Canada’s largest banks. The stories usually have one factor in common: a corrupted insider.

“Whether they coerce somebody that was already working there, whether they planted somebody in the banking system, we don’t know, but, as I said, the scale of this operation suggests that they must have had inside help,” Richard Powers, professor at the Rotman School of Management at the University of Toronto, said in relation to TD’s involvement in the fentanyl trafficking investigation.

Scott believes the banks could be doing more to understand criminality, rather than just worrying about “checking boxes” to comply with regulators.

“Rather than really getting into the meat and potatoes of what crime is and how money laundering really happens, I think they’re focusing more on complying with the regulations and, you know, not getting audited by Fintrac.”

Clarification — May 7, 2024

This story has been updated to clarify that TD was not the only bank that allegedly laundered at least $653 million (U.S.) in proceeds from fentanyl sales, according to the Wall Street Journal.

With files from The Canadian Press

TD Risks ‘Lost Decade’ in US Money-Laundering Scandal, Jefferies Says

(Bloomberg) -- A veteran Canadian bank analyst says Toronto-Dominion Bank’s role in an alleged money-laundering scheme has made the “worst-case scenario” more likely — a huge fine for the lender and years of restrictions on its US growth.

The US Department of Justice is investigating the bank over its ties to a $653 million drug money-laundering case in New York and New Jersey, a person familiar with the matter told Bloomberg last week. The probe is focused on how Chinese crime groups used Toronto-Dominion and other banks to hide money from US fentanyl sales, the Wall Street Journal reported on May 2.

That’s in addition to another case in which one of the bank’s New Jersey branch employees was charged with accepting bribes to facilitate the laundering of drug money.

“With the bank allegedly a focal institution in a drug money-laundering scheme, the worst-case scenario has become more likely with TD potentially entering a lost decade,” Jefferies analyst John Aiken said in a note to clients Monday. “Growth in the US will likely be constrained and the timeline for a fix is extended by several years.”

Toronto-Dominion plunged into the US regional banking market nearly two decades ago when it acquired a majority stake in Banknorth Group, and it has been a serial acquirer since, focusing on markets in the eastern US. But the bank has been sidelined by its regulatory woes. A year ago, it abandoned a proposed acquisition of Memphis, Tennessee-based First Horizon Corp. because it couldn’t get timely regulatory approval.

The bank announced an initial $450 million provision for regulatory penalties last week before the Journal’s report and said there’s more to come, as there are investigations from multiple regulators. The “simple math” implies Canada’s second-largest bank will have to pay $2 billion, Aiken said.

“However, as there is absolutely no certainty around how the regulators are going to proceed, the standard deviations around this estimate is likely measured in billions, rather than hundreds of millions,” Aiken wrote.

Toronto-Dominion has lost about C$10 billion ($7.3 billion) in market capitalization since Journal reported the connection to the drug-money case on Thursday. Friday’s 5.8% drop in the share price in Toronto was the worst since March 2020.

The shares rebounded a bit on Monday, rising about 1% to C$75.51 as of 11:39 a.m. in Toronto.

The apparent compliance failures at TD may cast a shadow over the management team and lead shareholders to demand a shuffle, Aiken added. There’s already been a change at the top of its US retail division, with Leo Salom taking over that role in 2022. Few members of the executive committee members have been in their jobs for a significant period of time, Aiken said.

‘Unacceptable’ Failure

“Criminals relentlessly target financial institutions to launder money and TD has a responsibility and an obligation to thwart their illegal activity,” Chief Executive Officer Bharat Masrani said in a statement late Friday. “I regret that there were serious instances where the Bank’s AML program fell short and did not effectively monitor, detect, report or respond. This is unacceptable and not in line with our values.”

Masrani said the bank has already invested hundreds of millions in enhancements to its US and global anti-money laundering controls, which has included hiring hundreds of new employees and technology investments.

Keefe Bruyette & Woods analyst Mike Rizvanovic cut his price target to C$88 from C$92, adding that while last week’s selloff appeared to be overdone, the stock will take time to recover.

Bank of Nova Scotia analyst Meny Grauman noted that there’s likely too much bad news being priced into shares.

“The overhang on the stock is likely to remain a reality for the foreseeable future, but we believe that last week’s selloff simply went too far,” Grauman said in a note.

“This business may very well be growth constrained for some time, but based on what we know there is simply no basis to believe that TD’s US earnings power has totally evaporated.”

Read More: TD Risks Profit Hit in Money-Laundering Probe, Analysts Say

--With assistance from Christine Dobby.

(Updates with additional information and analyst commentary beginning in the fifth paragraph)

Most Read from Bloomberg Businessweek

TD Bank Probe Tied to Laundering of Illicit Fentanyl Profits

The Canadian bank is contending with three other U.S. probes into its anti-money-laundering controls

Updated ET

A Justice Department investigation into TD Bank’s internal controls focuses on how Chinese crime groups and drug traffickers used the Canadian lender to launder money from U.S. fentanyl sales.

The investigation was launched after agents uncovered an operation in New York and New Jersey that laundered hundreds of millions of dollars in proceeds from illicit narcotics through TD and other banks, according to court documents and people familiar with the matter. In that case and at least one other, prosecutors also allege the criminals bribed TD employees.

While TD disclosed a Justice Department probe into its anti-money-laundering practices last year, the focus on money laundering related to illegal drug sales hasn’t been previously reported.

TD’s anti-money-laundering practices have been under scrutiny for years.

The bank said Tuesday that in addition to the Justice probe, it is the subject of three other anti-money-laundering investigations in the U.S. TD set aside $450 million to resolve one of those inquiries and said it expects additional penalties. On Thursday, a Canadian banking regulator fined TD the equivalent of $6.7 million for failing to file suspicious activity reports and document risks related to money laundering and terrorist activity, among other things.

The issues have already stalled TD’s ambitious expansion plans. TD built one of the largest U.S. regional banks over the past two decades with a flurry of acquisitions. Early last year, it was on the cusp of extending its reach into the Southeast with a $13.4 billion deal to buy Tennessee’s First Horizon. But regulators’ concerns over how TD tracked and flagged suspicious customer transactions helped scuttle the deal, The Wall Street Journal reported a year ago.

A TD spokeswoman said in a statement Thursday that it is cooperating with law-enforcement officials and regulators and strengthening its anti-money-laundering program.

She said criminals constantly seek to use banks to launder money and the bank’s systems didn’t effectively thwart these activities. “This is unacceptable, and we must and we will do better,” she said.

TD’s shares closed down 1% Thursday following the Journal’s report.

‘Financial Institution No. 1’

Illicit forms of fentanyl, a synthetic opioid that can be as much as 50 times more potent than heroin, have contributed to a surging number of overdose deaths. Since 2021, more than 100,000 Americans have died annually from overdosing on drugs that are often mixed with fentanyl, according to the Centers for Disease Control and Prevention.

As law-enforcement authorities mobilized to counter the threat posed by fentanyl, their attention turned to networks of Chinese money-brokers that Mexican cartels use to launder their proceeds. Officials say these networks pioneered a trade-based method of laundering cash out of the U.S. But investigations in recent years also revealed they made extensive use of the U.S. banking system.

The U.S. government relies on banks to help detect and prevent money-laundering. The Bank Secrecy Act requires financial-services companies to report suspicious activity within 30 days of discovery.

The Justice Department’s investigation into TD’s anti-money-laundering practices is led by the U.S. Attorney’s Office in New Jersey, people familiar with the matter said.

The probe stems in part from a criminal case into an operation that laundered at least $653 million in proceeds from illicit narcotics, according to court documents. Federal prosecutors in New Jersey in 2021 unsealed a complaint charging Da Ying Sze, who went by “David,” with coordinating the money-laundering scheme.

Sze pleaded guilty to charges related to the money-laundering conspiracy in 2022. The U.S. Attorney’s Office in New Jersey declined to comment.

In 2021, agents from the Drug Enforcement Administration and Internal Revenue Service’s criminal investigations unit tailed suspected participants in the money-laundering operation through the streets of Flushing, Queens, and observed them taking large bags of cash into bank after bank. The suspects operated across multiple financial institutions, often using accounts under the name of small local businesses.As the investigation evolved, prosecutors came to focus on the money launderers’ use of one bank in particular, identified in court documents as “Financial Institution No. 1.”

That institution was TD, people familiar with the matter said.

Under surveillance

During one day of surveillance, agents followed members of Sze’s organization in a box truck as they stopped at three separate TD branches. Prosecutors alleged that Sze and others provided gift cards and other bribes worth at least $57,000 to employees of the bank. He concealed the laundered funds by purchasing cashier’s checks and wired funds to thousands of individuals and entities in the U.S., Hong Kong and elsewhere, prosecutors say.

In a separate 2023 case, the U.S. Attorney’s Office in New Jersey charged Oscar Marcelo Nunez-Flores, an employee at a TD branch in Scotch Plains, with taking bribes and using his position to facilitate the laundering of millions of dollars in drug proceeds. A lawyer for Nunez-Flores declined to comment on the charges, which remain pending.

The Treasury Department’s Financial Crimes Enforcement Network, which serves as the U.S.’s money-laundering watchdog, has since 2018 warned financial institutions under its supervision of the threat posed by networks of Chinese money-laundering organizations. In a national money-laundering risk assessment released this year, FinCEN said the groups have become increasingly prevalent and now represent one of the most significant money-laundering threats facing the U.S. financial system.

Write to Dylan Tokar at dylan.tokar@wsj.com, Justin Baer at justin.baer@wsj.com and Vipal Monga at vipal.monga@wsj.com

Copyright ©2024 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the May 3, 2024, print edition as 'TD Bank Probe Tied to Fentanyl Profits'.

No comments:

Post a Comment