Trump indictment "political prosecution," attorney Joe Tacopina saysDonald Trump's New York attorney Joe Tacopina on Good Day New York reacted to the news of the Trump indictment, which was the first against a former U.S. president, and discussed when Trump may surrender.Automatic reply: YO Joe Tacopina I just called FYI 20 Years ago today the US Secret Service threatened to take me to GITMO 2 years ago tomorrow the US Naval Intelligence called me then offended me

YO Joe Tacopina I just called FYI 20 Years ago today the US Secret Service threatened to take me to GITMO 2 years ago tomorrow the US Naval Intelligence called me then offended me

Automatic reply: YO Donald Trump Jr. and Alvin L. Bragg, Jr. DEJA VU or What?

YO Donald Trump Jr. and Alvin L. Bragg, Jr. DEJA VU or What?

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Automatic reply: RE FATCA ATTN Pierre-Luc.Dusseault I just called and left a message for you |

| ||||||||||

---------- Forwarded message ----------

From: "Morris, Pat (OPP)" <Pat.Morris@opp.ca>

Date: Wed, 26 Oct 2022 14:01:57 +0000

Subject: Automatic reply: Methinks Rohan Kumar Pall and his pals

should not be surprised by Robert Bernier and his fellow Ottawa cops

trying to play dumb todasyu N'esy Pas Frank Au?

To: David Amos <david.raymond.amos333@gmail.

CAUTION -- EXTERNAL E-MAIL - Do not click links or open attachments in

unexpected emails.

?Hello, from October 24h to October 26th, I will be working out of the

office and unable to receive or return messages most of the time.

Acting Supt. Kirsten Clarke will be acting for me in POIB. I will

return on October 27th.

Thank you

Pat Morris

Superintendent

Bureau Commander

Provincial Operations Intelligence Bureau

---------- Forwarded message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Fri, 17 Mar 2017 13:02:25 -0400

Subject: DEJA VU or what? Fwd: RE FATCA ATTN Pierre-Luc.Dusseault I

just called and left a message for you

To: Pierre-Luc.Dusseault@parl.gc.

"Diane.Lebouthillier" <Diane.Lebouthillier@cra-arc.

"mark.vespucci" <mark.vespucci@ci.irs.gov>, mcu <mcu@justice.gc.ca>,

curtis <curtis@marinerpartners.com>, "rick.hancox"

<rick.hancox@nbsc-cvmnb.ca>, premier <premier@gnb.ca>, "blaine.higgs"

<blaine.higgs@gnb.ca>, "Matt.DeCourcey" <Matt.DeCourcey@parl.gc.ca>,

oldmaison <oldmaison@yahoo.com>, andre <andre@jafaust.com>,

"David.Coon" <David.Coon@gnb.ca>, "Jacques.Poitras"

<Jacques.Poitras@cbc.ca>, "sylvie.gadoury"

<sylvie.gadoury@radio-canada.

"peacock.kurt" <peacock.kurt@

<plee@stu.ca>, jason.markusoff@macleans.

<Ezra@therebel.media>, jesse <jesse@jessebrown.ca>, "jessica.hume"

<jessica.hume@ontario.ca>, premier <premier@ontario.ca>, radical

<radical@radicalpress.com>, Brian Ruhe <brian@brianruhe.ca>,

"Paul.Lynch" <Paul.Lynch@edmontonpolice.ca>, sunrayzulu

<patrick_doran1@hotmail.com>, themayor <themayor@calgary.ca>, pol7163

<pol7163@calgarypolice.ca>

Cc: David Amos <david.raymond.amos@gmail.com>

elizabeth.thompson@cbc.ca, "ht.lacroix" <ht.lacroix@cbc.ca>,

"hon.melanie.joly" <hon.melanie.joly@canada.ca>, "hon.ralph.goodale"

<hon.ralph.goodale@canada.ca>, djtjr <djtjr@trumporg.com>

http://www.canadalandshow.com/

Is Rebel Media’s embrace of free speech leading to rampant

anti-semitism and virulent racism?

Also, Atlantic Canadian journalists are coming under fire, and the

refugee influx will likely ramp up in the next few months.

Macleans Alberta correspondent Jason Markusoff joins us.

http://www.cbc.ca/news/

Canadians should be told if their banking info shared with IRS, says MP

Canada Revenue Agency says banks should tell their clients

By Elizabeth Thompson, CBC News Posted: Mar 17, 2017 5:00 AM ET

The Canada Revenue Agency should notify Canadian residents when their

bank account information is being shared with the U.S. Internal

Revenue Service, says the NDP's revenue critic.

Pierre-Luc Dusseault says informing Canadian residents their

information is being sent to the IRS could prevent others from landing

in the same predicament as Jeffrey Pomerantz, a Vancouver area man

facing a $1.1-million lawsuit for failing to file a form reporting his

bank accounts outside the U.S.

Dusseault said there could be more lawsuits because of the "large

number" of files regarding Canadian bank accounts being transferred

under an intergovernmental agreement between the U.S. and Canada.

The deal was negotiated in the wake of the U.S. adopting the Foreign

Account Tax Compliance Act (FATCA).

"I would emphasize again the need for the CRA to notify Canadian

taxpayers when they transfer their files to the IRS, a foreign

government department," said Dusseault. "This notification may avoid

that kind of situation."

Department hits Vancouver-area man with $1.1M lawsuit over bank form

Transfer of banking records of Canadian residents to U.S. taxman doubles

Canada's Privacy Commissioner Daniel Therrien has already recommended

that Canadian residents be notified when their bank account

information is transferred, Dusseault pointed out.

In September 2016, the CRA shared information about 315,160 bank

accounts — double the number it shared a year earlier in the first

year of the agreement.

However, Revenue Minister Diane LeBouthillier's office said it is the

responsibility of individual banks to let clients know if information

about their bank accounts might be transferred.

Youngest MP 20110519

Pierre-Luc Dusseault, NDP MP for Sherbrooke, says the transfer of

information about banking records could lead to more Canadian

residents being pursued by U.S. authorities. (Adrian Wyld/Canadian

Press)

"The legislation implementing the Canada-U.S. Intergovernmental

Agreement (IGA) requires that Canadian financial institutions

communicate with account holders of pre-existing accounts if there is

information suggesting that they are a U.S. citizen or resident (e.g.,

their client file contains a U.S. contact address or phone number,)"

said spokesperson Chloé Luciani-Girouard.

"These clients would therefore be on notice that their information may

be exchanged with the U.S. Internal Revenue Service."

CRA will respond to requests

While the government has no plans to inform people whose bank account

information has been shared, those who want to know can contact their

financial institution or the CRA, Luciani-Girouard said.

"The CRA will respond to any request to confirm whether information

relating to a particular individual or entity has been reported and

provided to the U.S. under FATCA. To date, fewer than 10 such requests

have been received by the CRA," she added.

Tax law has more Americans living abroad renouncing citizenship, lawyer says

The information-sharing agreement was in the spotlight Thursday

following a CBC report that Pomerantz, a dual Canadian-U.S. citizen,

is being sued by the U.S. Justice Department for $860,300 US in civil

penalties, late payment penalties and interest.

While Pomerantz filed income tax returns to both Canada and the U.S.,

the Justice Department said he failed to file a Foreign Bank and

Financial Accounts report to the U.S. Treasury's Financial Crimes

Enforcement Network (FinCEN) for three tax years.

During those years, Pomerantz had accounts with the Canadian Imperial

Bank of Commerce and in Switzerland with Sal Oppenheim JR & Cie, in

addition to a corporation in the Turks and Caicos Islands, the U.S.

Justice Department said in its lawsuit.

In a separate case, Pomerantz is challenging an audit by the IRS.

Court challenge

Lynne Swanson, part of a group challenging the bank account

information sharing agreement in Federal Court, said the Pomerantz

case is an example of how the bank account information agreement can

make some Canadian residents vulnerable.

IRS-Political Groups

The CRA transferred 315,160 Canadian bank records to the IRS in

September 2016. (Susan Walsh/Associated Press)

"I don't think they should be transferring any information. Period.

Full stop," she said.

"If they are transferring it, of course, they should be telling people

that they have transferred it and what they have transferred. But I

don't think they should be transferring anything."

Elizabeth Thompson can be reached at elizabeth.thompson@cbc.ca

299 Comments

David Raymond Amos

Gee I wonder if Elizabeth Thompson or Diane LeBouthillier and

Pierre-Luc Dusseault bothered to read the email i sent them and many

others on St Valentine's Day?

---------- Forwarded message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Tue, 14 Feb 2017 10:15:04 -0400

Subject: RE FATCA ATTN Pierre-Luc.Dusseault I just called and left a

message for you

To: Pierre-Luc.Dusseault@parl.gc.

"Diane.Lebouthillier" <Diane.Lebouthillier@cra-arc.

"mark.vespucci" <mark.vespucci@ci.irs.gov>, mcu <mcu@justice.gc.ca>,

curtis <curtis@marinerpartners.com>, "rick.hancox"

<rick.hancox@nbsc-cvmnb.ca>

Cc: David Amos <david.raymond.amos@gmail.com>

<djtjr@trumporg.com>, mcohen <mcohen@trumporg.com>,

elizabeth.thompson@cbc.ca, "ht.lacroix" <ht.lacroix@cbc.ca>,

"hon.melanie.joly" <hon.melanie.joly@canada.ca>

Trust that Trump, CBC and everybody else knows that I speak and act

Pro Se particularly when dealing with the Evil Tax Man

https://twitter.com/

http://www.cbc.ca/news/

Transfer of Canadian banking records to U.S. tax agency doubled last year

Documents for thousands of Canadian residents transferred under

controversial FATCA legislation

By Elizabeth Thompson, CBC News Posted: Jan 29, 2017 5:00 AM ET

Banking records of more than 315,000 Canadian residents were turned

over to the U.S. Internal Revenue Service last year under a

controversial information sharing deal, CBC News has learned.

That is double the number transferred in the deal's first year.

The Canada Revenue Agency transmitted 315,160 banking records to the

IRS on Sept. 28, 2016 — a 104 per cent increase over the 154,667

records the agency sent in September 2015.

Lisa Damien, spokeswoman for the CRA, attributed the increase to the

fact it was the second year for the Canada-U.S. information sharing

deal that was sparked by the U.S. Foreign Account Tax Compliance Act

(FATCA).

"The exchange in September 2015 was based on accounts identified by

financial institutions at the time," she said. "The number of reported

accounts was expected to increase in 2016, because the financial

institutions have had more time to complete their due diligence and

identify other reportable accounts."

Trudeau Nuclear Summit 20160331

Prior to coming to power, Prime Minister Justin Trudeau opposed the

agreement to share banking records of Canadian residents with the IRS.

He has since changed his position. (Sean Kilpatrick/Canadian Press)

The transmission of banking records of Canadian residents is the

result of an agreement worked out in 2014 between Canada and the U.S.

after the American government adopted FATCA. The U.S. tax compliance

act requires financial institutions around the world to reveal

information about bank accounts in a bid to crack down on tax evasion

by U.S. taxpayers with foreign accounts.

Dual citizens, long-term visitors affected

The deal requires financial institutions to share the banking records

of those considered to be "U.S. persons" for tax purposes — regardless

of whether they are U.S. citizens.

Among the people who can be considered by the IRS as "U.S. persons"

are Canadians born in the U.S., dual citizens or even those who spend

more than a certain number of days in the United States each year.

Former prime minister Stephen Harper's government argued that given

the penalties the U.S. was threatening to impose, it had no choice but

to negotiate the information sharing deal. The former government said

it was able to exempt some types of accounts from the information

transfer.

CRA

The Canada Revenue Agency transfers banking records of people believed

to be 'U.S. persons' to the IRS. (Sean Kilpatrick/Canadian Press)

The Canada Revenue Agency triggered controversy after it transferred

the first batch of Canadian banking records to the IRS in September

2015 in the midst of the election campaign, without waiting for an

assessment by Canada's privacy commissioner or the outcome of a legal

challenge to the agreement's constitutionality.

Prime Minister Justin Trudeau, Treasury Board President Scott Brison

and Public Safety Minister Ralph Goodale have dropped calls to scrap

the deal, which they had made before the Liberals came to power.

Watchdog wants proactive notification

Privacy Commissioner Daniel Therrien has raised concerns about the

information sharing, questioning whether financial institutions are

reporting more accounts than necessary. Under the agreement, financial

institutions only have to report accounts belonging to those believed

to be U.S. persons if they contain more than $50,000.

Therrien has also suggested the CRA proactively notify individuals

that their financial records had been shared with the IRS. However,

the CRA has been reluctant to agree to Therrien's suggestion.

Racial Profiling 20160107

Privacy Commissioner Daniel Therrien has questioned whether the CRA is

transmitting more banking records to the IRS than is necessary.

(Adrian Wyld/Canadian Press)

NDP revenue critic Pierre-Luc Dusseault said the increase in the

number of files transferred was "surprising," and he questioned

whether financial institutions are only sharing records of accounts

worth more than $50,000.

"I don't see how there would be 150,000 more accounts reportable to

the IRS in one year. It is something I will look into."

Dusseault said the CRA should notify every Canadian resident whose

banking records are shared with the IRS.

Lynne Swanson, of the Alliance for the Defence of Canadian

Sovereignty, which is challenging the information sharing agreement in

Federal Court, said she has no idea why the number of banking records

shared with the IRS doubled.

Youngest MP 20110519

NDP revenue critic Pierre-Luc Dusseault says the CRA should notify

every Canadian resident whose banking records are shared with the IRS.

(Adrian Wyld/Canadian Press)

"It still seems low in comparison to the number of Canadians that are

affected by this," she said. "It is estimated that a million Canadians

are affected by this."

Hopes for repeal

Swanson hopes that U.S. President Donald Trump, or Congress — which is

now controlled by the Republican Party — will scrap FATCA. The

Republican platform pledged to do away with the information collecting

legislation.

"FATCA not only allows 'unreasonable search and seizures' but also

threatens the ability of overseas Americans to lead normal lives," the

platform reads. "We call for its repeal and for a change to

residency-based taxation for U.S. citizens overseas."

Swanson's group is also hoping the Federal Court of Canada will

intervene, although a date has not yet been set for a hearing.

"A foreign government is essentially telling the Canadian government

how Canadian citizens and Canadian residents should be treated. It is

a violation of the Charter of Rights and Freedoms."

Elizabeth Thompson can be reached at elizabeth.thompson@cbc.ca

| 4 attachments — Scan and download all attachments View all images | |||

| |||

| |||

| |||

| |||

RUMORED DETAILS OF MY ARREST

Donald J. Trump<contact@win.donaldjtrump.com> | Fri, Mar 31, 2023 at 10:54 AM | |||||||||||||||||

| To: david.raymond.amos333@gmail.com | ||||||||||||||||||

| ||||||||||||||||||

Wednesday, 13 June 2018

Methinks there should be a Special Place in Hell for the Evil Bastards in CBC N'esy Pas?

Former U.S. president Donald Trump indicted in New York

Charges come as Trump makes another run for the White House

Manhattan grand jury on Thursday voted to indict Donald Trump on charges involving payments made during the 2016 presidential campaign to silence claims of two extramarital sexual encounters, the first criminal case ever against a former U.S. president and a jolt to Trump's bid to retake the White House in 2024.

A spokesperson for the Manhattan district attorney's office confirmed the indictment. The district attorney's office issued a statement saying a date for arraignment has not been selected.

Trump was asked to surrender Friday but his lawyers said the Secret Service needed additional time to make security preparations, two people familiar with the matter told The Associated Press. The people, who couldn't publicly discuss security details, said Trump is expected to surrender early next week.

District Attorney Alvin Bragg left his office Thursday evening without commenting.

The specific charges are not yet known, as the indictment remains under seal. CNN reported Trump faces more than 30 counts related to business fraud.

Prosecutors in New York investigated money paid to adult film performer and director Stormy Daniels and ex-Playboy model Karen McDougal to keep both women from going public with claims that they had sexual encounters with Trump before he became president.

New York District Attorney Alvin Bragg, centre, leaves his office on Thursday. (Jeenah Moon/Reuters)

Trump, a Republican who's running for the White House again in 2024, called the decision to indict him "political persecution and election interference at the highest level," in a lengthy statement released minutes after the indictment was announced.

Trump called it the next step in a campaign from the left "to destroy the Make America Great Again movement."

"The Democrats have lied, cheated and stolen in their obsession with trying to 'Get Trump,' but now they've done the unthinkable — indicting a completely innocent person in an act of blatant Election Interference," he said.

Trump accused Bragg of doing the "dirty work" of U.S. President Joe Biden, and "ignoring the murders and burglaries and assaults he should be focused on."

Alina Habba, a lawyer for Trump, said the former president is a victim "of a corrupt and distorted version of the American justice system and history. He will be vindicated."

In a statement confirming the charges, defence lawyers Susan Necheles and Joseph Tacopina said Trump "did not commit any crime. We will vigorously fight this political prosecution in court."

Demonstrators in New York City hold a banner after Trump's indictment on Thursday. (Jeenah Moon/Reuters)

Trump's former lawyer, Rudy Giuliani, said on Twitter that Bragg has made "irresponsible and politically motivated efforts to take [Trump] down," calling it "a sad day for America."

The indictment is an extraordinary development after years of investigations into Trump's business, political and personal dealings. It is likely to galvanize critics who say he lied and cheated his way to the top and embolden supporters who feel the Republican is being unfairly targeted by a Democratic prosecutor.

For any New York defendant, answering criminal charges means being fingerprinted and photographed and spending some time being detained. But there's no playbook for booking an ex-president with Secret Service protection.

In bringing the charges, Bragg is embracing an unusual case that had been investigated by two previous sets of prosecutors, both of which declined to take the politically explosive step of seeking Trump's indictment.

In the weeks leading up to the indictment, Trump railed about the investigation on social media and urged supporters to protest on his behalf, prompting tighter security around the Manhattan criminal courthouse.

Trump faces other potential legal perils as he seeks to reassert control of the Republican Party and stave off a slew of one-time allies who are seeking or are likely to oppose him for the presidential nomination.

The district attorney in Atlanta has for two years been investigating efforts by Trump and his allies to meddle in Georgia's 2020 vote count. And a U.S. Justice Department special counsel is investigating Trump's storage of classified documents at his Mar-a-Lago home in Florida and his efforts to reverse his election loss.

With files from Reuters

Deja Vu Anyone???

https://www.cbc.ca/news/politics/trump-nafta-canada-mexico-1.4692046

Trump wants separate, 1-on-1 NAFTA talks with Canada, Mexico, adviser says

A Canadian official says bilateral NAFTA talks are happening already

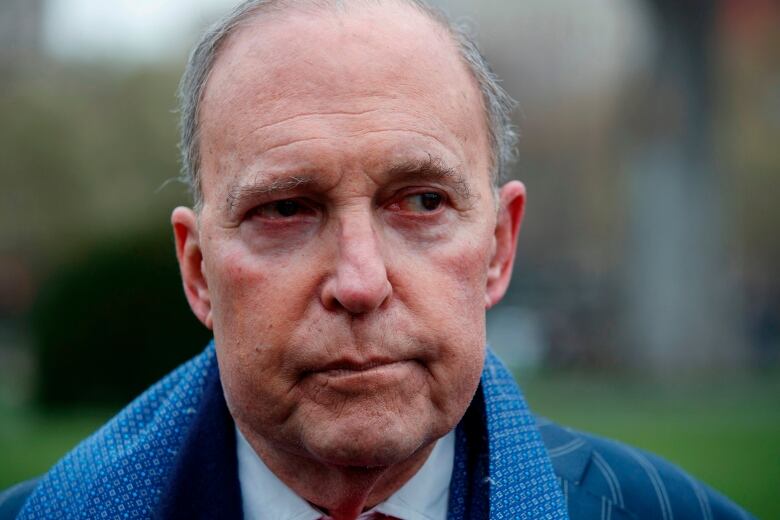

Larry Kudlow, director of the U.S. president's National Economic Council, said Trump is now "very seriously contemplating a shift in NAFTA negotiations."

"His preference now, and he asked me to convey this, is to actually negotiate with Mexico and Canada separately," he told Fox News Tuesday.

Kudlow said he spoke yesterday with one of Canada's "top people, right next to the prime minister" about the president's "new thinking," and is now awaiting a response from Canada that could come as early as today. He did not name the official.

"I'm waiting to hear what their reaction is going to be, frankly," he said.

A senior Canadian official said the government is aware of Kudlow's comments and similar remarks made by the president in past.

Canada's position, the official said, is that the negotiations are for a trilateral agreement. Discussions between individual NAFTA partners already happen regularly — so in that sense one-on-one talks are already happening, the official added.

Andrew Leslie, the parliamentary secretary to the foreign affairs minister in charge of Canada-U.S. relations, said there has been speculation about separate negotiations for 18 months, but Canada remains focused on a trilateral agreement.

"As Canada has maintained right from the beginning, we believe in a trilateral NAFTA, we believe that together it's been a win-win-win for our three economies and all three nations have prospered," he said.

François-Philippe Champagne, Canada's international trade minister, echoed Leslie's comments.

"We know that a trilateral agreement has provided millions of good jobs on both sides of the border and it also reflects the supply chain," he said on Parliament Hill Tuesday.

"You have to look at the integrated nature of our supply chain — (for) more than 24 years, the supply chains have been integrated — which have provided better prices for consumers, better opportunities for manufactures and, obviously, workers."

'We remain committed in continuing negotiating trilaterally'

Mexico's Ambassador to Canada Dionisio Pérez Jácome said his country is focused on working toward a renegotiated NAFTA rather than a bilateral agreement with the U.S., regardless of the tariffs imposed by the United States.

"Mexico has been very clear what we want out of this negotiation," he told CBC News Network's Power & Politics on Tuesday.

"It is based on our constitutional principles, it is based on the values that define who we are and what we believe in, on the defence of an open fair and trade international system. And that position is not going to change due to declarations of rhetoric or to these type of measures."

Asked if he thought it was possible for the three countries to agree on a renegotiated NAFTA, Pérez Jácome said it can happen — but only if the right deal can be struck.

"We will continue to engage in a very positive (way), in good faith, in trying to reach an agreement. We believe it's possible to reach an agreement," he told host Vassy Kapelos. "In our case, we would never sacrifice quality for speed."

Kudlow said that a bilateral approach would be a way to address significant differences between the countries.

"Canada is a different country than Mexico, they have different problems and you know, (Trump has) believed that bilateral has always been better," Kudlow said.

"He hates large treaties. I know this is just three countries, but still, you know, often times when you have to compromise with a whole bunch of countries you get the worst of the deals."

Kudlow said Trump is not going to withdraw from NAFTA, but wants to try a different approach. The president has in the past floated the idea of bilateral deals if NAFTA talks fail.

Former ambassador to the U.S. Derek Burney said bilateral talks are both feasible and desirable.

"I think that we should agree to explore, if for no other reason than to inject a constructive note into our trade dialogue with the U.S.," he said.

Depending on the outcome, any deal coming out of a series of bilateral talks could supplant or incorporate NAFTA, said Burney, who was chief of staff to former prime minister Brian Mulroney during the final negotiations of the Canada-U.S. free trade deal.

Mounting tensions

Kudlow's remarks came as tensions mount over the U.S. decision to end an exemption on steel and aluminum tariffs that initially had been granted for Canada, Mexico and the EU.

Canada countered by announcing it would slap an estimated $16.6 billion in duties on some steel and aluminum products and other goods from the U.S., including maple syrup, beer kegs, whisky and toilet paper.

White House chief economic adviser Larry Kudlow says Trump wants separate talks with Canada and Mexico. (Evan Vucci/Associated Press)

White House chief economic adviser Larry Kudlow says Trump wants separate talks with Canada and Mexico. (Evan Vucci/Associated Press)

Prime Minister Justin Trudeau and Foreign Affairs Minister Chrystia Freeland announced the plan last week, just hours after U.S. Secretary of Commerce Wilbur Ross confirmed the U.S. would impose tariffs of 25 per cent on imported steel and 10 per cent on imported aluminum, citing national security interests.

At a news conference announcing the new duties, set to kick in July 1, Trudeau said he abandoned a proposed meeting with Trump in Washington last week after the White House insisted that he first agree to a five-year "sunset clause" in a renegotiated NAFTA.

In a daily briefing today, White House press secretary Sarah Huckabee Sanders said Trump's desire to hold one-on-one talks is not a sign that NAFTA is dead.

"It's not done, but the president is open to having individual deals," she said. "He's looking at the best way to make sure he gets the best deal possible for American workers and whether or not that's through NAFTA or other means, those options are on the table."

Trump NAFTA FATCA Cohen David Amos

BREAKING: PRESIDENT TRUMP INDICTED

Donald J. Trump<contact@win.donaldjtrump.com> | Fri, Mar 31, 2023 at 12:57 AM | |||||||||||||||||||

| To: david.raymond.amos333@gmail.com | ||||||||||||||||||||

| ||||||||||||||||||||

No comments:

Post a Comment