None of 40 Sisson Mine conditions met so far, province says

Opponents say decade-old environmental approval is outdated and should start over

The New Brunswick government is acknowledging that none of the 40 conditions imposed on the Sisson Mine project have been met almost a decade after they were attached to the province’s environmental impact assessment approval.

That is giving environmentalists another argument in their case against the massive resource project that would be built northwest of Fredericton.

“The EIA process is a living process, so I’d say the 40 are not complied [with] yet, and we know that 28 of those conditions need to be fulfilled before construction starts,” Environment Minister Gilles LePage told reporters recently at the legislature.

Critics say the conditions were too weak when they were issued in 2015, and now many are a decade out of date.

“We don’t have a lot of faith that this project is going forward with high environmental standards,” said Allyson Heustis, the executive director of the Nashwaak Watershed Association.

“It’s been about 15 years since they’ve been starting this proposed mine, so we’ve officially come out in opposition of the mine as it was proposed.”

Allyson

Heustis, the executive director of the Nashwaak Watershed Association,

says many of the conditions for approval are weak or out of date. (Jacques Poitras/CBC)

Allyson

Heustis, the executive director of the Nashwaak Watershed Association,

says many of the conditions for approval are weak or out of date. (Jacques Poitras/CBC)Among the 40 conditions are a water quality monitoring plan, air quality approval, modelling for potential tailings pond failures, an emergency response plan and a start of construction within five years.

The province extended that deadline twice already, in 2020 and 2022.

LePage extended it again earlier this month for another five years, until 2030.

The mine would extract tungsten and molybdenum, two critical minerals used in energy applications like batteries, and also for military purposes.

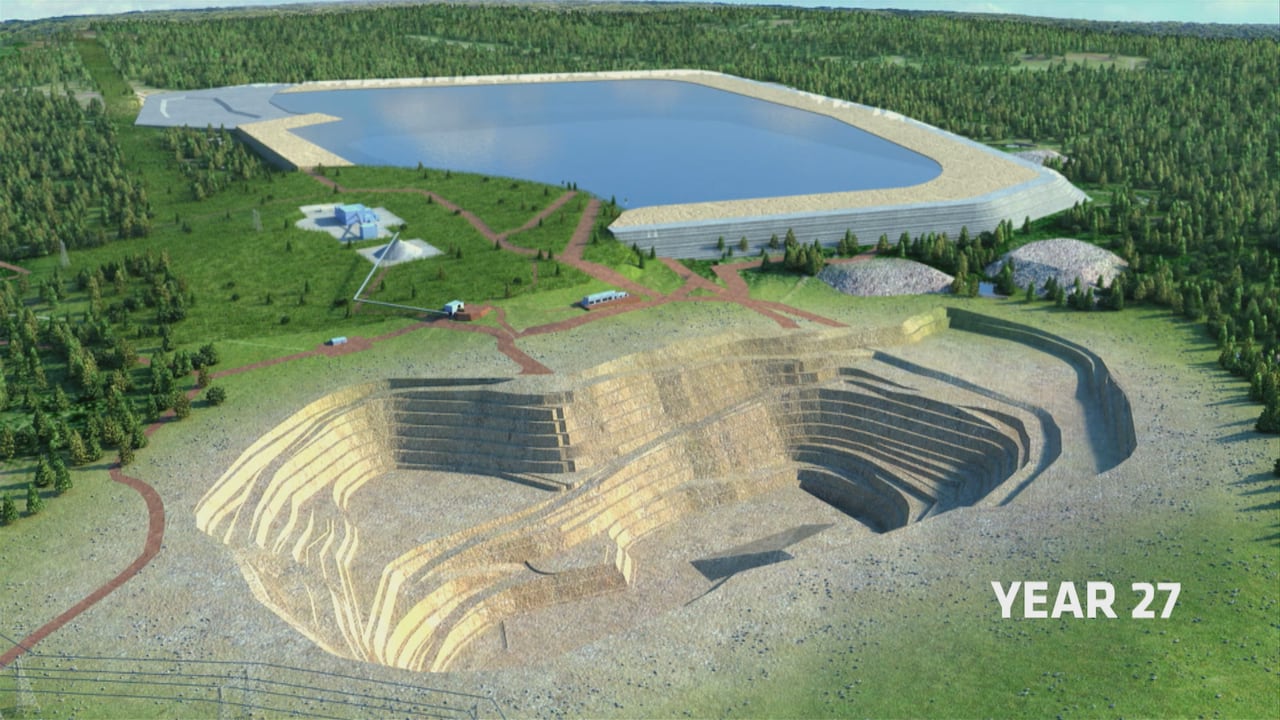

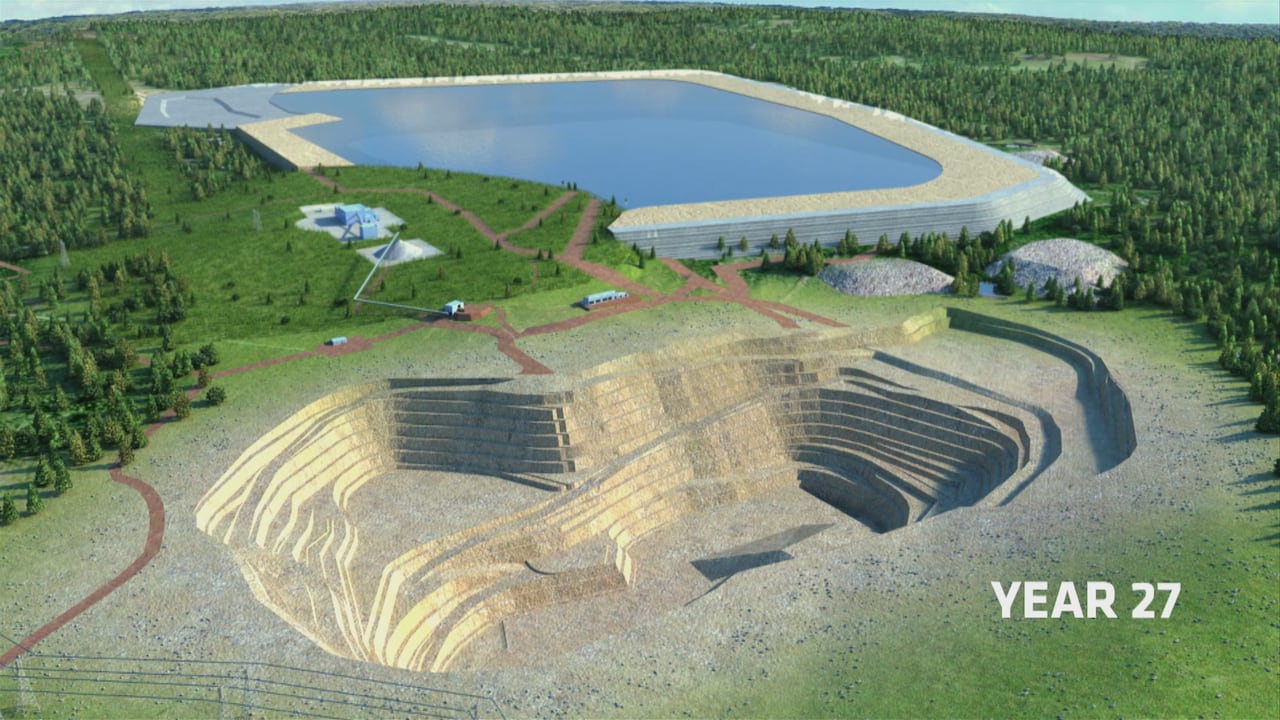

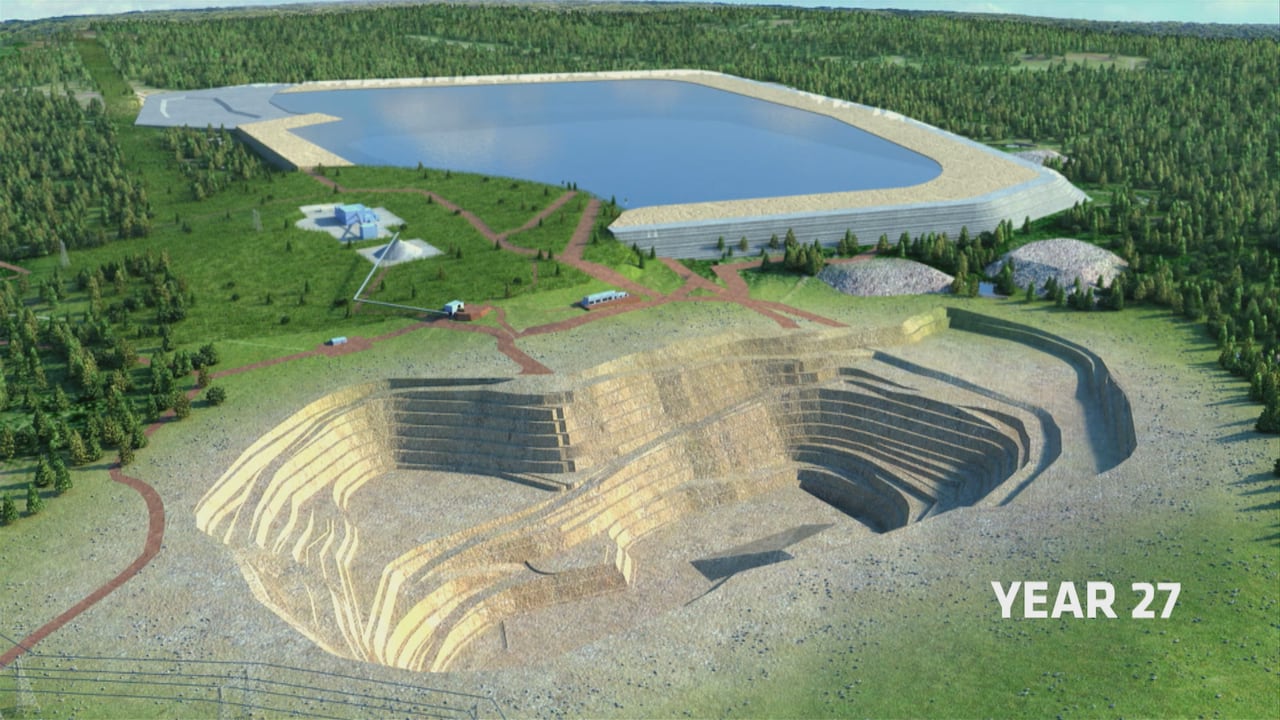

The province estimated a decade ago it would generate $280 million in royalties for the government over the 27 years of operation.

The federal government referred the mine to its Major Projects Office two weeks ago as part of an effort to weaken China’s domination of the global critical minerals market.

Major project designation would allow for the fast-tracking of federal regulatory approvals, though even projects that are not designated can benefit from other forms of government support.

The Susan Holt government is pushing for offtake agreements and a price floor — two measures that would guarantee sales of the mine’s minerals at a viable price.

One reason the mine hasn’t advanced in the decade since its approval has been the low price of the minerals on the world market, which has made investors reluctant to back the project.

Environmentalist Lawrence Wuest, a resident of Stanley, said moving ahead on some of the conditions — like financial guarantees on potential cleanup costs — “would be a feather in their cap to get private investment in the mine.

“Why they haven’t done that — that’s a curious thing,” he said.

Environmentalist

and local resident Lawrence Wuest finds it curious Northcliffe

Resources hasn't moved on some of the conditions. (Mike Heenan/CBC News)

Environmentalist

and local resident Lawrence Wuest finds it curious Northcliffe

Resources hasn't moved on some of the conditions. (Mike Heenan/CBC News)The mine proponent Northcliff Resources said a decade ago the mine would operate for 27 years.

Wuest said the fluctuation in mineral prices could force it to close sooner than that, creating a greater risk of leakage from the tailings pond into the Nashwaak River watershed.

It could also leave the province absorbing those cleanup costs.

“They want this mine there even if it’s economically unfeasible,” Wuest said.

“They want it there as a kind of billboard to the rest of the world and the rest of Canada that New Brunswick is a place where mining can take place.”

LePage told reporters that the 40 conditions will be tied to today’s environmental regulations, not the ones that were in effect a decade ago.

“They’re still valid, but we have to make sure that they are up to date,” he said.

“The standard of the response from the proponent has to be up to date with today’s regulations — municipal, provincial and federal.”

Heustis said that among the changes since 2015 are new wetland mapping and further identification of species at risk in the watershed.

But the critics also say the fundamental design of the project approved in 2015, including the tailings pond, is itself out of date and should require Northcliff to go back to the drawing board for a new EIA.

“There’s been changes in best practices and best available technologies for this kind of an open pit mining operation with a low grade of ore,” Green Leader David Coon said.

If developed the Sisson Mine would be in operation for about 27 years and cost an estimated $579 million. (Submitted by Sisson Mining Ltd.)

If developed the Sisson Mine would be in operation for about 27 years and cost an estimated $579 million. (Submitted by Sisson Mining Ltd.) Wuest called LePage’s commitment “a hollow promise” and said changes to best practices for tailings ponds and dams make the original approval irrelevant.

“There should be a reset of that EIA,” he said.

The 40 conditions are also key to First Nations acceptance of the project.

Wolastoqey chiefs and the province signed an accommodation agreement for the mine in 2017, which Indigenous Affairs Minister Keith Chiasson said remains in effect.

A spokesperson said none of the six chiefs would provide an interview for now.

After the federal announcement earlier this month, they issued a statement saying they will “insist” that “the conditions upon which the mine was established will be maintained.”

At the time of the 2015 EIA conditions, the province was not enforcing water classification regulations under the Clean Water Act.

Those regulations, if applied to the Nashwaak, would have prohibited new sources of pollution in the watershed, Wuest said.

He is pessimistic the province will restart the EIA process but says not doing so may add to the uncertainty for investors.

“I would like to think that this thing is so bad that it could never generate enough investment to go ahead, but given the craziness that’s going on in the world, all bets are off,” Wuest said.

Northcliff says it will make “a final investment decision … around 2027” with construction to follow if it’s approved.

CEO Andrew Ing has not responded to multiple interview requests from CBC News.

Millions of shares connected to N.B. tungsten project trade hands after government announcement

Northcliff Resources stocks surge and then sag amid uncertainty over proposed mine's future

The company behind New Brunswick's proposed Sisson Mine has watched its stock price soar and then partially crash over three days as investors try to work out if anything major actually happened after a week of speculation and announcements about the project.

Andrew Ing, the president of Northcliff Resources Ltd., said in a statement Thursday that he was "excited" the company's long-stalled mine has been referred to the federal government's Major Projects Office for evaluation and help.

But he noted "a construction decision" on Sisson has still not been made.

Earlier this week, word began leaking out that the proposed tungsten and molybdenum mine near Stanley, north of Fredericton, might be on a federal government list of national projects to be prioritized and fast-tracked.

Announcements were scheduled for Thursday, but on Tuesday CBC News confirmed and reported Sisson would be part of the Thursday announcement. That caused a rare buying frenzy of Northcliff Resources stock Wednesday morning.

By midday Thursday, the stock price, which dipped as low as two cents per share last winter had climbed 190 per cent in a matter of hours to hit 66 cents.

According to the Toronto Stock Exchange 9.3 million shares of Northcliff were traded on Wednesday and Thursday, more than 500 times the volume exchanged on the same two days a week earlier

Peter

Thilo Hasler, founder and research analyst for Sphene Capital in

Munich, says the domination of international tungsten markets by China

leaves 'lots of room' for new North American mines. (Submitted by Sphene Capital)

Peter

Thilo Hasler, founder and research analyst for Sphene Capital in

Munich, says the domination of international tungsten markets by China

leaves 'lots of room' for new North American mines. (Submitted by Sphene Capital)However, the tide soon turned. Sellers dominated trades late Thursday, and on Friday and the stock lost more than half of its gains for the week before settling out in the 40-cent range.

But there remains significant interest in the minerals Northcliff hopes to eventually provide.

Tungsten markets are dominated by supplies from China, and recent worldwide trade disputes have sent its price soaring and raised concerns about its long-term availability.

Peter Thilo Hasler, a financial analyst with Splene Capital in Munich, evaluates international tungsten markets and companies. Without commenting directly on the New Brunswick project, he said he believes there is space for new North American suppliers of the mineral.

"There is lots of room," Hasler said in an interview. "To develop new mines in North America is one way out of this dependence on China."

The

Todd Group, a billion-dollar family business based in New Zealand, is

the largest shareholder in Northcliff Resources Ltd. and will make the

ultimate decision on whether New Brunswick's Sisson Mine will proceed. (Submitted by The Todd Group)

The

Todd Group, a billion-dollar family business based in New Zealand, is

the largest shareholder in Northcliff Resources Ltd. and will make the

ultimate decision on whether New Brunswick's Sisson Mine will proceed. (Submitted by The Todd Group)Last week, Hasler said international tungsten prices hit $70 US per kilogram.

Sisson's original feasibility assumed that long-term prices of $35 US per kilogram for tungsten and $33 US for molybdenum would make the mine feasible.

The Sisson mine is under evaluation for fast-tracking, and will still need to receive that designation. (Sisson Mining Ltd. )

The Sisson mine is under evaluation for fast-tracking, and will still need to receive that designation. (Sisson Mining Ltd. )However, that study is now 12 years old and is scheduled to be redone.

It was unclear what was causing the dip in Northcliff's stock price following its initial surge although there did appear to be some confusion over the significance of what the federal government announced.

On Thursday the Prime Minister's Office confirmed to CBC News that projects announced so far, including Sisson, have only been referred for an evaluation for fast-tracking. None have yet won that special designation.

https://davidraymondamos3.blogspot.com/2017/02/tut-tut-tut-cbc-and-their-malicious.html

Wednesday, 15 February 2017

Tut Tut Tut CBC and their malicious moderators are at it again N'esy Pas Hubby Baby Lacriox and Minister Joly?

http://www.cbc.ca/news/canada/new-brunswick/sisson-mine-maliseet-share-price-1.3983051

Sisson mine owners see share price climb 56% in weeks before Maliseet deal

New Brunswick government says deal was announced as soon as possible after being confirmed by First Nations

· CBC News · Posted: Feb 15, 2017 6:30 AM AT

"The timing is interesting and the volume is interesting but I don't want to make an accusation that would be improper,"said Fitch who cautioned it is up to securities regulators to look at trading anomalies."

<oldmaison@yahoo.com>

http://www.cbc.ca/radio/

Brian Maude - Insider Trading

Terry Seguin talks to the Senior Legal Counsel with the Financial and

Consumer Services Commission of New Brunswick about insider trading.

Brian E. Maude

Financial and Consumer Services Commission

85 Charlotte Street, Suite 300

Saint John, NB E2L 2J2

Tel: (506) 658-3020

Fax: (506) 658-3059

brian.maude@nbsc-cvmnb.ca

---------- Original message ----------

From: "Alcorn, Jason (FCNB)" <jason.alcorn@fcnb.ca>

Date: Sat, 7 Jan 2017 02:22:35 +0000

Subject: Automatic reply: RE The Ombudsman warns Commission on

Electoral Reform for NB not to ignore public's cynicism about voting

YEA RIGHT Tell me another one Chucky Murray

To: David Amos <motomaniac333@gmail.com>

Thank you for your email. I am currently out of the office, returning

om Tuesday 10 January 2017. If you require immediate assistance,

please dial (506) 658-3060.

Merci pour votre courriel. Je suis absent du bureau, et je retournerai

mardi le 10 janvier 2017. Pour une assistance immediate, veuillez

composez le (506) 658-3060.

http://www.cbc.ca/news/

David Walters

613-957-3522

david.walters@cra-arc.gc.ca

CRA's new fingerprinting policy could create travel problems for

accused tax evaders

Tax agency calls mandatory fingerprinting 'a powerful deterrent'

By Dean Beeby, CBC News Posted: Feb 21, 2017 9:00 PM ET

The Canada Revenue Agency has begun to record the fingerprints of

every person charged with tax evasion, a move that could severely

restrict foreign travel for anyone accused but not necessarily

convicted of a criminal tax offence.

"Introducing a mandatory fingerprinting policy would serve as a

powerful deterrent to those considering committing a serious tax

offence or those who may contemplate reoffending," says an internal

memorandum justifying the new measure.

"The mobility restriction is an important deterrent, especially for

people engaged in offshore tax evasion."

The agency changed its policy manuals last fall to implement mandatory

fingerprinting following years of inconsistent fingerprint collection

based on the varying advice of local prosecutors.

Diane Lebouthillier

Last year, Minister of National Revenue Diane Lebouthillier's agency

received $444 million over five years to chase down tax evaders,

including those using offshore tax havens. Critics say efforts so far

have let wealth-management companies, which facilitate the use of tax

havens, off the hook. (Sean Kilpatrick/Canadian Press)

The new policy means the fingerprints of all accused tax evaders will

be recorded in the Canadian Police Information Centre (CPIC) database,

accessible by almost 70,000 Canadian police officers but also by some

foreign agencies such as the U.S. Department of Homeland Security and

its border officers.

As the memo notes, U.S. officials checking the CPIC database "may view

a taxpayer charged and/or convicted for tax evasion as inadmissible to

their country."

CBC News obtained a copy of the memo, and the July 7 order authorizing

the new policy, under the Access to Information Act, with several

sections blacked out under security and advice exemptions.

Tracking begins April 1

"Without a national policy on fingerprinting, CRA's convictions were

not always recorded in CPIC," CRA spokesman David Walters said in an

email. "Therefore, some persons convicted of tax evasion were unknown

to law enforcement agencies."

Walters said the agency will rely on qualified police officers to

collect the prints. He said there are no statistics to date on how

many fingerprints have been collected since the change in policy but

formal tracking is to begin April 1.

CRA turning to 'big data' to focus its audits — and catch tax cheats

Tip line leads Canada Revenue Agency to offshore tax cheats

The CPIC database is keyed to fingerprints, which are the prime means

of tracking a person's movements before and after conviction. "Without

fingerprints, the CRA cannot ask law enforcement to carry out such

tracing of movements," the memo says.

The document also says the new policy puts those accused of tax

evasion on a level playing field with people charged with theft, fraud

and financial crimes.

They're not charging many people ... they're mostly settling out of court

- Dennis Howlett of Canadians for Tax Fairness

There are other benefits, it says, including "facilitating the

apprehension of an accused who fails to appear for trial or sentencing

as it allows law enforcement to execute a bench warrant for the arrest

of a person alleged to have committed a tax crime, including any

accused who may leave the country to avoid facing the consequences of

their actions."

Walters says if an accused is acquitted of tax evasion, the agency

will "request" the fingerprints be removed from the CPIC database —

though some law firms specializing in fingerprint "destruction" warn

the images could remain for months, depending on the protocols of the

police service that registered the prints.

The new policy is part of the agency's renewed emphasis on tax cheats,

especially offshore tax evaders, and includes $444.4 million earmarked

in last year's budget to combat tax evasion over five years.

Financial tracking

Since January 2015, financial institutions have also been required to

report directly to the CRA all international electronic fund transfers

of $10,000 or more. In a little more than a year following that

legislative change, the agency received data on more than 17 million

transactions.

The tax agency has also been more frequently accessing the financial

databases of FINTRAC, the federal centre that combats money laundering

and terrorist financing, after critics said the two institutions

weren't sharing enough information.

CRA formally asked FINTRAC for information from its databases on

specific cases 68 times in 2015-2016, more than triple the requests

from 2013-2014.

Howlett

Dennis Howlett of Canadians for Tax Fairness says CRA isn't charging

enough tax evaders, and is instead choosing out-of-court settlements

where the terms and identities aren't disclosed. (CBC)

One of CRA's most persistent critics — the non-profit Canadians for

Tax Fairness, funded largely by unions — questions the effectiveness

of the new fingerprinting policy when the agency turns so seldom to

the justice system to catch big tax cheats.

"They are not charging many people, so the evidence would seem to

indicate they're mostly settling out of court," executive director

Dennis Howlett said in an interview.

"They do need to take some cases to court to clearly establish some

precedents and to strengthen their negotiating hand when they do

settle out of court … We're a bit surprised there aren't more

charges."

Howlett also said CRA is still not pursuing wealth-management firms

that facilitate offshore tax evasion, or corporations that may be

keeping profits in offshore tax havens to evade taxes at home.

---------- Original message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Thu, 16 Feb 2017 18:25:03 -0400

Subject: YO Jana Winter why not ask CBC or Birgitta Jónsdóttir or her

Prime Minister or your President Trump or his lawyer Mr Cohen

(646-853-0114) If I am one of "The real bad guys" in Canada they

seek???

To: janawinter@protonmail.com, Wendy.Olsen@usdoj.gov, "James.Comey"

<James.Comey@ic.fbi.gov>, Diana.Swain@cbc.ca, birgittaj

<birgittaj@althingi.is>, postur <postur@for.is>, "Robert. Jones"

<Robert.Jones@cbc.ca>, vasilescua@sec.gov, friedmani@sec.gov,

krishnamurthyp@sec.gov, "Marc.Litt" <Marc.Litt@bakermckenzie.com>,

"PETER.MACKAY" <PETER.MACKAY@bakermckenzie.

Cc: David Amos <david.raymond.amos@gmail.com>

<president@whitehouse.gov>, mdcohen212@gmail.com, bruce.fitch@gnb.ca,

oldmaison <oldmaison@yahoo.com>, plee@stu.ca, emb.ottawa@mfa.is,

postur@for.stjr.is, aih@cbc.ca, andre <andre@jafaust.com>,

"blaine.higgs" <blaine.higgs@gnb.ca>, premier <premier@gnb.ca>,

"David.Coon" <David.Coon@gnb.ca>

http://qslspolitics.blogspot.

---------- Forwarded message ----------

From: David Amos david.raymond.amos@gmail.com

Date: Tue, 31 Mar 2009 11:34:40 -0300

Subject: Fwd: USANYS-MADOFF AND IMPORTANT INFORMATION FROM US

ATTORNEY'S OFFICE SDNY

To: frank.pingue@thomsonreuters.

johanna.sigurdardottir@fel.

Milliken.P@parl.gc.ca, sjs@althingi.is, emb.ottawa@mfa.is,

rmellish@pattersonlaw.ca, irisbirgisdottir@yahoo.ca,

grant.mccool@thomsonreuters.

"Robert. Jones" Robert.Jones@cbc.ca, marie@mariemorneau.com,

dfranklin@franklinlegal.com, egilla@althingi.is,

william.turner@exsultate.ca, klm@althingi.is, mail@fjr.stjr.is,

Edith.Cody-Rice@cbc.ca, wendy.williams@landsbanki.is,

cdhowe@cdhowe.org, desparois.sylviane@fcac.gc.ca, plee@stu.ca,

jonina.s.larusdottir@ivr.stjr.

fme@fme.is, info@landsbanki.is, sedlabanki@sedlabanki.is, tif@tif.is

Cc: rfowlo@comcast.net, jmullen@townofmilton.org, webo@xplornet.com,

t.j.burke@gnb.ca, oldmaison@yahoo.com, Dan Fitzgerald danf@danf.net,

"spinks08@hotmail.com" spinks08@hotmail.com, gypsy-blog

gypsy-blog@hotmail.com, "nb. premier" nb.premier@gmail.com, nbpolitico

nbpolitico@gmail.com>, "bruce.fitch" bruce.fitch@gnb.ca, "bruce.alec"

bruce.alec@gmail.com

I know that the Yankee law enforcement people are either as dumb as

posts or pure evil. There appears to be few exceptions. The ethical

Ms. Olson is my favourite lady today. Does anyone speaking or acting

in the best interests of the decent folks in Iceland understand my

sincerity and her Integrity YET?

Veritas Vincit

David Raymond Amos

http://www.cbc.ca/news/world/

'The real bad guys' are coming from Canada, not Mexico, Daily Beast

report alleges

Leaked FBI data from 2014-2016 suggests more 'suspected terrorists'

enter U.S. by way of Canada than Mexico

By Diana Swain, CBC News Posted: Feb 11, 2017 9:00 AM ET

http://www.cbc.ca/news/the-

The Investigators with Diana Swain - November 19, 2016

Air Date: Nov 18, 2016 6:44 PM ET

The Investigators with Diana Swain - November 19, 201622:24

Did the spread of fake news on social media play a role in electing

Donald Trump? Diana speaks with a BuzzFeed reporter who revealed a

group of Facebook employees are trying to combat misinformation. Plus,

behind-the-scenes on a collaboration between CBC News and the Toronto

Star about police powers in the digital age. Watch Sat 9:30 pm ET &

Sun 5:30 pm ET on CBC News Network.

http://www.cbc.ca/news/world/

The Investigators with Diana Swain

Air Date: Oct 24, 2016 8:42 AM ET

Episode 2: The ethics and challenges of reporting on data dumps after

another release by Wikileaks hits the U.S. presidential campaign.

Plus, a CBC News investigation into solitary confinement

http://www.cbc.ca/news/world/

The Investigators with Diana Swain

Air Date: Oct 14, 2016 9:57 PM ET

Series premiere: How journalists got the scoop on Donald Trump, and

questions about the privacy of your medical information

---------- Original message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Tue, 14 Feb 2017 10:51:14 -0400

Subject: RE FATCA, NAFTA & TPP etc ATTN President Donald J. Trump I

just got off the phone with your lawyer Mr Cohen (646-853-0114) Why

does he lie to me after all this time???

To: president <president@whitehouse.gov>, mdcohen212@gmail.com, pm

<pm@pm.gc.ca>, Pierre-Luc.Dusseault@parl.gc.

<MulcaT@parl.gc.ca>, Jean-Yves.Duclos@parl.gc.ca,

B.English@ministers.govt.nz, Malcolm.Turnbull.MP@aph.gov.au

pminvites@pmc.gov.au, mayt@parliament.uk, press

<press@bankofengland.co.uk>, "Andrew.Bailey"

<Andrew.Bailey@fca.org.uk>,

fin.financepublic-

<newsroom@globeandmail.ca>, "CNN.Viewer.Communications.

<CNN.Viewer.Communications.

<news-tips@nytimes.com>, lionel <lionel@lionelmedia.com>

Cc: David Amos <david.raymond.amos@gmail.com>

elizabeth.thompson@cbc.ca, "justin.ling@vice.com, elizabeththompson"

<elizabeththompson@ipolitics.

"Bill.Morneau" <Bill.Morneau@canada.ca>, postur <postur@for.is>,

stephen.kimber@ukings.ca, "steve.murphy" <steve.murphy@ctv.ca>,

"Jacques.Poitras" <Jacques.Poitras@cbc.ca>, oldmaison

<oldmaison@yahoo.com>, andre <andre@jafaust.com>

---------- Original message ----------

From: Michael Cohen <mcohen@trumporg.com>

Date: Tue, 14 Feb 2017 14:15:14 +0000

Subject: Automatic reply: RE FATCA ATTN Pierre-Luc.Dusseault I just

called and left a message for you

To: David Amos <motomaniac333@gmail.com>

Effective January 20, 2017, I have accepted the role as personal

counsel to President Donald J. Trump. All future emails should be

directed to mdcohen212@gmail.com and all future calls should be

directed to 646-853-0114.

______________________________

This communication is from The Trump Organization or an affiliate

thereof and is not sent on behalf of any other individual or entity.

This email may contain information that is confidential and/or

proprietary. Such information may not be read, disclosed, used,

copied, distributed or disseminated except (1) for use by the intended

recipient or (2) as expressly authorized by the sender. If you have

received this communication in error, please immediately delete it and

promptly notify the sender. E-mail transmission cannot be guaranteed

to be received, secure or error-free as emails could be intercepted,

corrupted, lost, destroyed, arrive late, incomplete, contain viruses

or otherwise. The Trump Organization and its affiliates do not

guarantee that all emails will be read and do not accept liability for

any errors or omissions in emails. Any views or opinions presented in

any email are solely those of the author and do not necessarily

represent those of The Trump Organization or any of its

affiliates.Nothing in this communication is intended to operate as an

electronic signature under applicable law.

---------- Original message ----------

From: "Hancox, Rick (FCNB)" <rick.hancox@fcnb.ca>

Date: Tue, 14 Feb 2017 14:15:22 +0000

Subject: Automatic reply: RE FATCA ATTN Pierre-Luc.Dusseault I just

called and left a message for you

To: David Amos <motomaniac333@gmail.com>

G'Day/Bonjour,

Thanks for your e-mail. I am out of the office until 24 February. If

you need more immediate assistance, please contact France Bouchard at

506 658-2696.

Je serai absent du bureau jusqu'au 24 fevrier Durant mon absence,

veuillez contacter France Bouchard au 506 658-2696 pour assistance

immédiate.

Thanks/Merci Rick

---------- Original message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Tue, 14 Feb 2017 10:15:04 -0400

Subject: RE FATCA ATTN Pierre-Luc.Dusseault I just called and left a

message for you

To: Pierre-Luc.Dusseault@parl.gc.

"Diane.Lebouthillier" <Diane.Lebouthillier@cra-arc.

"mark.vespucci" <mark.vespucci@ci.irs.gov>, mcu <mcu@justice.gc.ca>,

curtis <curtis@marinerpartners.com>, "rick.hancox"

<rick.hancox@nbsc-cvmnb.ca>

Cc: David Amos <david.raymond.amos@gmail.com>

<djtjr@trumporg.com>, mcohen <mcohen@trumporg.com>,

elizabeth.thompson@cbc.ca, "ht.lacroix" <ht.lacroix@cbc.ca>,

"hon.melanie.joly" <hon.melanie.joly@canada.ca>

Trust that Trump, CBC and everybody else knows that I speak and act

Pro Se particularly when dealing with the Evil Tax Man

https://twitter.com/

http://www.cbc.ca/news/

Transfer of Canadian banking records to U.S. tax agency doubled last year

Documents for thousands of Canadian residents transferred under

controversial FATCA legislation

By Elizabeth Thompson, CBC News Posted: Jan 29, 2017 5:00 AM ET

Banking records of more than 315,000 Canadian residents were turned

over to the U.S. Internal Revenue Service last year under a

controversial information sharing deal, CBC News has learned.

That is double the number transferred in the deal's first year.

The Canada Revenue Agency transmitted 315,160 banking records to the

IRS on Sept. 28, 2016 — a 104 per cent increase over the 154,667

records the agency sent in September 2015.

Lisa Damien, spokeswoman for the CRA, attributed the increase to the

fact it was the second year for the Canada-U.S. information sharing

deal that was sparked by the U.S. Foreign Account Tax Compliance Act

(FATCA).

"The exchange in September 2015 was based on accounts identified by

financial institutions at the time," she said. "The number of reported

accounts was expected to increase in 2016, because the financial

institutions have had more time to complete their due diligence and

identify other reportable accounts."

Trudeau Nuclear Summit 20160331

Prior to coming to power, Prime Minister Justin Trudeau opposed the

agreement to share banking records of Canadian residents with the IRS.

He has since changed his position. (Sean Kilpatrick/Canadian Press)

The transmission of banking records of Canadian residents is the

result of an agreement worked out in 2014 between Canada and the U.S.

after the American government adopted FATCA. The U.S. tax compliance

act requires financial institutions around the world to reveal

information about bank accounts in a bid to crack down on tax evasion

by U.S. taxpayers with foreign accounts.

Dual citizens, long-term visitors affected

The deal requires financial institutions to share the banking records

of those considered to be "U.S. persons" for tax purposes — regardless

of whether they are U.S. citizens.

Among the people who can be considered by the IRS as "U.S. persons"

are Canadians born in the U.S., dual citizens or even those who spend

more than a certain number of days in the United States each year.

Former prime minister Stephen Harper's government argued that given

the penalties the U.S. was threatening to impose, it had no choice but

to negotiate the information sharing deal. The former government said

it was able to exempt some types of accounts from the information

transfer.

CRA

The Canada Revenue Agency transfers banking records of people believed

to be 'U.S. persons' to the IRS. (Sean Kilpatrick/Canadian Press)

The Canada Revenue Agency triggered controversy after it transferred

the first batch of Canadian banking records to the IRS in September

2015 in the midst of the election campaign, without waiting for an

assessment by Canada's privacy commissioner or the outcome of a legal

challenge to the agreement's constitutionality.

Prime Minister Justin Trudeau, Treasury Board President Scott Brison

and Public Safety Minister Ralph Goodale have dropped calls to scrap

the deal, which they had made before the Liberals came to power.

Watchdog wants proactive notification

Privacy Commissioner Daniel Therrien has raised concerns about the

information sharing, questioning whether financial institutions are

reporting more accounts than necessary. Under the agreement, financial

institutions only have to report accounts belonging to those believed

to be U.S. persons if they contain more than $50,000.

Therrien has also suggested the CRA proactively notify individuals

that their financial records had been shared with the IRS. However,

the CRA has been reluctant to agree to Therrien's suggestion.

Racial Profiling 20160107

Privacy Commissioner Daniel Therrien has questioned whether the CRA is

transmitting more banking records to the IRS than is necessary.

(Adrian Wyld/Canadian Press)

NDP revenue critic Pierre-Luc Dusseault said the increase in the

number of files transferred was "surprising," and he questioned

whether financial institutions are only sharing records of accounts

worth more than $50,000.

"I don't see how there would be 150,000 more accounts reportable to

the IRS in one year. It is something I will look into."

Dusseault said the CRA should notify every Canadian resident whose

banking records are shared with the IRS.

Lynne Swanson, of the Alliance for the Defence of Canadian

Sovereignty, which is challenging the information sharing agreement in

Federal Court, said she has no idea why the number of banking records

shared with the IRS doubled.

Youngest MP 20110519

NDP revenue critic Pierre-Luc Dusseault says the CRA should notify

every Canadian resident whose banking records are shared with the IRS.

(Adrian Wyld/Canadian Press)

"It still seems low in comparison to the number of Canadians that are

affected by this," she said. "It is estimated that a million Canadians

are affected by this."

Hopes for repeal

Swanson hopes that U.S. President Donald Trump, or Congress — which is

now controlled by the Republican Party — will scrap FATCA. The

Republican platform pledged to do away with the information collecting

legislation.

"FATCA not only allows 'unreasonable search and seizures' but also

threatens the ability of overseas Americans to lead normal lives," the

platform reads. "We call for its repeal and for a change to

residency-based taxation for U.S. citizens overseas."

Swanson's group is also hoping the Federal Court of Canada will

intervene, although a date has not yet been set for a hearing.

"A foreign government is essentially telling the Canadian government

how Canadian citizens and Canadian residents should be treated. It is

a violation of the Charter of Rights and Freedoms."

Elizabeth Thompson can be reached at elizabeth.thompson@cbc.ca

---------- Original message ----------

From: "Finance Public / Finance Publique (FIN)"

<fin.financepublic-

Date: Fri, 10 Feb 2017 22:05:00 +0000

Subject: RE: Yo President Trump RE the Federal Court of Canada File No

T-1557-15 lets see how the media people do with news that is NOT FAKE

To: David Amos <motomaniac333@gmail.com>

The Department of Finance acknowledges receipt of your electronic

correspondence. Please be assured that we appreciate receiving your

comments.

Le ministère des Finances accuse réception de votre correspondance

électronique. Soyez assuré(e) que nous apprécions recevoir vos

commentaires.

---------- Original message ----------

From: "MAY, Theresa" <theresa.may.mp@parliament.uk>

Date: Thu, 9 Feb 2017 21:10:53 +0000

Subject: Automatic reply: Whereas the UKIP NEVER had any time to talk

to me about the financial industry now I have even less of my precious

time for them just like wannabe Consevative leaders who try to play

dumb

To: David Amos <motomaniac333@gmail.com>

This is the email account for The Rt Hon Theresa May MP's work as

Member of Parliament for Maidenhead. If you live in the Maidenhead

constituency, please ensure that you have included your full address

in your email. We will respond to you as soon as possible.

If your email is for the Prime Minister and not constituency related,

please re-send to Downing Street at: https://email.number10.gov.uk/

Your email will not be forwarded on.

UK Parliament Disclaimer: This e-mail is confidential to the intended

recipient. If you have received it in error, please notify the sender

and delete it from your system. Any unauthorised use, disclosure, or

copying is not permitted. This e-mail has been checked for viruses,

but no liability is accepted for any damage caused by any virus

transmitted by this e-mail. This e-mail address is not secure, is not

encrypted and should not be used for sensitive data.

UK Parliament Disclaimer: This e-mail is confidential to the intended

recipient. If you have received it in error, please notify the sender

and delete it from your system. Any unauthorised use, disclosure, or

copying is not permitted. This e-mail has been checked for viruses,

but no liability is accepted for any damage caused by any virus

transmitted by this e-mail. This e-mail address is not secure, is not

encrypted and should not be used for sensitive data.

---------- Original message ----------

From: "MinFinance / FinanceMin (FIN)" <fin.minfinance-financemin.

Date: Thu, 9 Feb 2017 21:06:39 +0000

Subject: RE: Whereas the UKIP NEVER had any time to talk to me about

the financial industry now I have even less of my precious time for

them just like wannabe Consevative leaders who try to play dumb

To: David Amos <motomaniac333@gmail.com>

The Department of Finance acknowledges receipt of your electronic

correspondence. Please be assured that we appreciate receiving your

comments.

Le ministère des Finances accuse réception de votre correspondance

électronique. Soyez assuré(e) que nous apprécions recevoir vos

commentaires.

---------- Original message ----------

From: "HAMMOND, Philip" <philip.hammond.mp@parliament.

Date: Thu, 9 Feb 2017 21:10:55 +0000

Subject: Automatic reply: Whereas the UKIP NEVER had any time to talk

to me about the financial industry now I have even less of my precious

time for them just like wannabe Consevative leaders who try to play

dumb

To: David Amos <motomaniac333@gmail.com>

Thank you for your email. This acknowledgement has been triggered

electronically and means that your email has been received by my

Parliamentary office.

If you have contacted me about a local matter related to Runnymede and

Weybridge, all correspondence that I receive by email and by post is

treated with equal importance, so as not to discriminate against

constituents who do not have access to e-mail. Therefore, please do

not be disappointed or offended if you do not receive an immediate

reply.

You may know that there is a strict Parliamentary protocol that means

that MPs may only act on behalf of their own constituents. If you are

one of my constituents in Runnymede & Weybridge, please ensure you

have included your full name and postal address in your e-mail. This

will help me to deal with your communication more effectively and you

will receive a reply in due course. Without these details, it will not

be possible to reply.

Please note: If you wish to contact me in my role as Chancellor of the

Exchequer, and are not one of my constituents, please resend your

message to public.enquiries@hmtreasury.

be forwarded.

Many thanks

Rt Hon Philip Hammond MP

Member of Parliament for Runnymede and Weybridge

Chancellor of the Exchequer

UK Parliament Disclaimer: This e-mail is confidential to the intended

recipient. If you have received it in error, please notify the sender

and delete it from your system. Any unauthorised use, disclosure, or

copying is not permitted. This e-mail has been checked for viruses,

but no liability is accepted for any damage caused by any virus

transmitted by this e-mail. This e-mail address is not secure, is not

encrypted and should not be used for sensitive data.

---------- Original message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Thu, 9 Feb 2017 12:50:55 -0400

Subject: Fwd Attn Peter.Murrell of the Scottish National Party I am on

the phone to you right now (902 800 0369) You are welcome George

Osborne Say Hello to the RCMP and Jean Chretien for me will ya?

To: nigel.farage@europarl.europa.

<boris.johnson.mp@parliament.

Cc: David Amos <david.raymond.amos@gmail.com>

UKIP,

Lexdrum House,

King Charles Business Park,

Newton Abbot, Devon

TQ12 6UT

0333 800 6800

Email: mail@ukip.org

https://www.cbc.ca/news/canada/new-brunswick/sisson-mine-chosen-9.6978236

N.B.’s Sisson Mine chosen as one of Carney's major projects

Projects with federal designation can benefit from range of advantages designed to get them moving quickly

A long-delayed mining project in rural New Brunswick has in fact made the list of major projects after urging from the province.

Speaking in British Columbia on Thursday afternoon, Prime Minister Mark Carney said the Sisson Mine north of Fredericton has been chosen for the strategic importance of the minerals it could produce: tungsten and molybdenum.

Premier Susan Holt was quick to follow with excitement.

“And that's a testament to the efforts that our team has made to get the attention of the federal government and demonstrate the resources that we have, the capacity and our readiness to contribute to Canada's economy and future,” Holt told reporters shortly after the announcement.

Projects that earn the nation-building designation can benefit from a range of advantages, including accelerated regulatory approvals, federal funding and other forms of support designed to get them moving quickly.

The project had already won approval from both the provincial and federal governments years ago.

Ottawa said in May it was willing to put up $8.2 million to support the project, and the proponent, Northcliff Resources, said in May the U.S. government was awarding it $20.7 million to advance development.

Prime Minister Mark Carney confirmed the list of major projects on Thursday, including one in New Brunswick. (Pratyush Dayal/CBC)

Prime Minister Mark Carney confirmed the list of major projects on Thursday, including one in New Brunswick. (Pratyush Dayal/CBC)The Carney government’s budget last week included a new “critical minerals sovereign fund” with $2 billion over five years for strategic investments.

Holt said the mine would bring 500 jobs during construction and 300 full-time jobs during operation.

A news release said the expected life of the mine is 27 years, and it could produce 30,000 tonnes of tungsten and molybdenum ore every day.

Holt said the site will see some activity in the coming year for preparation work, but negotiating an equity partnership with First Nations is continuing with the two stakeholders in the project, Northcliff and the Todd Group.

A news release from Northcliff on Thursday afternoon praised the announcement from Carney and said the company is "currently progressing with studies to advance the project."

Holt said the province would continue to work with the elected chiefs to negotiate an agreement “in the spirit of communication.”

Holt spoke to New Brunswick’s history with mines in the past.

“It's a part of our identity," she said, adding that now is the time for this project to proceed.

“But at this moment in time, these minerals, particularly tungsten and molybdenum, are in a critical demand at a time when we're repositioning Canada and its consideration of our defence solutions and partners, when we're repositioning our allies globally.”

Holt said the province is looking for the federal government to help create an offtake agreement, which is essentially a contract with a buyer for when the minerals start being produced.

She added that the province would also like to see a price floor — meaning a minimum price for the minerals — set by the government.

“Those two tools help both attract more investment and secure the value of the resource,” Holt said.

When the project was initially approved by the province, the environmental impact assessment required 40 conditions to be met by the companies developing the mine.

When asked if those still stand, Holt said the province could likely give the company more time to meet them. Their approval was currently set to expire in December.

Holt said the province had secured the support of nearby communities, but when asked, she clarified that this was done around 2014 and 2017, when the mine was initially approved.

“So now that it's back on the radar, the previous support that had been secured from communities back then has been reinvigorated,” Holt said.

Dating back to 2017, the province has estimated the project would produce $280 million in royalties for the province and $245 million in tax revenue.

Holt said an updated estimate depends on the price of the resources, so a clearer number is not yet available and conversations with Northcliff are taking place.

Natural Resources Minister Tim Hodgson announces measures for forestry sector – February 25, 2026

https://www.youtube.com/watch?v=UmVExTyAJ4c

Sask. Premier Scott Moe speaks to reporters during trade mission to India – February 27, 2026

https://www.youtube.com/watch?v=RXeW3yQdqyI

N.B. Premier Susan Holt speaks to reporters during trade mission to India – February 27, 2026

https://www.cbc.ca/news/canada/saskatchewan/scott-moe-mark-carney-india-travel-9.7104039

Sask. Premier Scott Moe to join Prime Minister Mark Carney's trade mission to India

Moe will join Carney in meetings in Mumbai and New Delhi

Saskatchewan Premier Scott Moe is once again joining Prime Minister Mark Carney on a trade mission.

The trade mission is set to depart on Thursday and continue to March 7. Moe is part of the Canadian delegation set to attend meetings in New Delhi and Mumbai, according to the Prime Minister's Office.

It's not the first time that Moe and Carney have travelled together. In January, the pair linked up as the federal government travelled to China.

That trip saw Ottawa emerge with a deal to lift Chinese tariffs on Canadian canola products in exchange for allowing 49,000 Chinese electric vehicles into the Canadian market.

This time Moe will not be the only premier joining Carney's trade mission.

New Brunswick Premier Susan Holt will join Carney, Moe and other federal officials in Mumbai. She will not be part of meetings in New Delhi, according to the Prime Minister's Office.

India has placed its own tariffs on Canadian canola products, which could explain Moe's inclusion on this trip.

Heath MacDonald, Canada's Minister of Agriculture, said the inclusion of the premiers was a "positive move" and that it's something he wants to see more of in the future.

"I think it's extremely important to have the collaboration with the premiers ... especially in my sector," MacDonald said.

Moe and Holt will not travel with the Prime Minister as the trade mission continues to Australia and Japan.

Moe is set to discuss his inclusion in the trade mission at a news conference on Wednesday.

Sask. mine that could make Canada world's biggest uranium exporter faces last hurdle

The proponent, NexGen, is awaiting approval from the Canadian Nuclear Safety Commission

Hearings now underway in Saskatoon could decide the future of Canada’s biggest uranium mining project to date.

NexGen Energy Ltd., a Canadian mining company, entered its second round of hearings for its Rook I mine proposal, which proposes developing an underground uranium mine.

Several Indigenous communities attended to hear about the proposed mine in the Athabasca Basin, about 150 kilometres north of La Loche, close to the Alberta border.

NexGen has been advocating for over a decade to make the Rook I mine initiative possible.

"It’s got the ability to take Saskatchewan and Canada back to being the number one producer of nuclear," NexGen Energy CEO Leigh Curyer told CBC.

"With AI and data centres being constructed, hundreds of billions of dollars [are] being invested into data centres around the world. They’ve got to be powered."

NexGen CEO Leigh Curyer. (Jeremy Warren/CBC)

NexGen CEO Leigh Curyer. (Jeremy Warren/CBC)NexGen estimates the mine would generate $32 billion worth of jobs and infrastructure for Saskatchewan during its duration. Federally, the company estimates $38 billion in revenue over that time.

Next steps

NexGen first submitted the project to the provincial and federal governments in April 2019. The province approved the underground mine in 2023.

The fate of the project now rests with the Canadian Nuclear Safety Commission.

The federal safety agency holds the power to decide if NexGen will be granted a licence to build the mine and mill site in the proposed region. The mill is projected to process about 1,400 tonnes of ore daily.

The agency is holding its second round of hearings this week in Saskatoon. The first round was held in November.

Out of the 48 written statements submitted, NexGen said two were neutral and two were opposed to the mine being built in the area.

Mining on Indigenous land

The proposed mining site is in the traditional territory of multiple First Nations communities, which have expressed support for the project.

All four Indigenous communities in the vicinity of the proposed mine had representatives at the public hearing, including Birch Narrows Dene Nation, Buffalo River Dene Nation, Clearwater River Dene Nation and the Métis Nation-Saskatchewan.

"I think it's an excellent reflection of a resources project and what a very respectful, transparent process can deliver in terms of First Nation communities and resources," Curyer said. "And I think today's hearing is an incredible representation of that."

Curyer said Saskatchewan will help Canada become the world's biggest global uranium and nuclear provider if the mine goes ahead producing up to 14 million kilograms of uranium annually.

NexGen promises the mine will create 350 jobs during construction and another 490 over its 24-year lifespan. The company has committed to hiring 75 per cent Indigenous workers.

"We didn’t want to have janitor jobs that occurred previously in the mines," said Keith Shewchuk, president of Metis Nation-Saskatchewan Local 39.

"We want careers. So there’s many opportunities for our youth and our future generations, my kids and other generations that are going to have those opportunities that were never there before."

Keith Shewchuk, president of Métis Nation-Saskatchewan Local 39. (Jeremy Warren/CBC)

Keith Shewchuk, president of Métis Nation-Saskatchewan Local 39. (Jeremy Warren/CBC)NexGen has been working with Saskatchewan Polytechnic since 2017 to provide community programs to get people living in the area ready to construct the mine and work there, including courses in carpentry, digital readiness and construction.

Environmental concerns

The proposed mine passed the federal government's environmental assessment.

Environmental safety was a big topic of conversation at the public hearing, where concerns were raised about water contamination and the possible impact on traditional hunting areas.

Shewchuk said those concerns are valid, as people in the area still heavily rely on hunting. He told CBC that NexGen has collaborated with communities to learn how to respect the land throughout the creation of the mine and during its run.

"Our people are worried about the fish, the ducks, the rabbits, the water and the moose, because we hunt moose annually," Shewchuk said.

"So we’re worried about how that is going to affect us in the future."

Candace

Salmon, registrar for the Canadian Nuclear Safety Commission, says the

commission will closely monitor and evaluate 13 safety requirements

before granting NexGen a licence to build the proposed mine. (Halyna Mihalik/CBC)

Candace

Salmon, registrar for the Canadian Nuclear Safety Commission, says the

commission will closely monitor and evaluate 13 safety requirements

before granting NexGen a licence to build the proposed mine. (Halyna Mihalik/CBC)That's one of 13 points the Canadian Nuclear Safety Commission needs to evaluate before giving NexGen the go-ahead.

"There are a number of areas the commission will dig into and some of them would be radiation protection," registrar Candace Salmon told CBC.

"They look at a lot of environmental issues such as water, fish and all the habitat. There’s been a lot of conversation about country foods and ensuring the protection of the land for the Indigenous nations and communities."

The commission has 120 days from the end of the hearing to decide if NexGen’s mining project can proceed. The public hearing will conclude on Thursday.

Corrections

- An earlier version of this story indicated NexGen had applied for a licence to build and operate the mine. In fact, the licence application is to build the mine. An earlier version of this story also indicated 42 written statements submitted were positive on the mine proposal. In fact, of 48 written statements submitted, NexGen said two were neutral and two were opposed to the mine being built in the area.Feb 20, 2026 1:07 PM EST

Funding for softwood industry imminent, federal minister says

Support the prime minister promised in face of tariffs has yet to come about

Financial support for Canada’s softwood lumber sector can be expected soon, the federal industry minister told a Fredericton business group on Wednesday.

Mélanie Joly said the support will include funding that will be distributed from banks but backed up by the Business Development Bank of Canada.

In August, Prime Minister Mark Carney promised $1.25 billion for the sector, but that money has yet to be distributed.

While Joly didn’t specify how much money the New Brunswick industry can expect, she told the Fredericton Chamber of Commerce the amount will be based on need.

She also said the funding would take different forms.

“That there is a mix," she said. "There is support for operations, so liquidity support because we know that lots of companies can be stuck in a spiral of debt while they're dealing with really difficult tariffs that are unjustifiable.

"And meanwhile, there is … funding for capital expenditure for them to continue to invest in their companies."

New tariffs

The funding comes after U.S. President Donald Trump announced new tariffs on Sept. 30.

Trump announced a further 10 per cent tariff on softwood lumber, in addition to an already existing 35 per cent tariff, and 25 per cent duty on some finished wood products, including cabinets and upholstered furniture.

These tariffs came into effect Tuesday.

Duties are to increase Jan. 1 to 30 per cent for upholstered furniture and 50 per cent for cabinets and vanities.

In addition to new funds, Joly also said the federal government was working on a buy Canadian program “to have our homes and our major projects … being built with the great softwood from New Brunswick.”

With files from Silas Brown

Minister Joly to address the Fredericton Chamber of Commerce

Media advisory

October 14, 2025 – Fredericton, New Brunswick

The Honourable Mélanie Joly, Minister of Industry and Minister responsible for Canada Economic Development for Quebec Regions, will share her industrial vision at the Fredericton Chamber of Commerce. She will outline national priorities, discuss growth levers for businesses and provide concrete pathways for them to build locally while expanding Canada’s presence in international markets.

Date: Wednesday, October 15, 2025

Time: 1:15 pm (AT)

Location: Fredericton, New Brunswick

Members of the media who would like to attend the event, either in person or virtually, should contact Judy Joe Scheffler at events@frederictonchamber.ca.

For more information: A Conversation with The Honourable Minister Mélanie Joly

Contacts

Gabrielle Landry

Press Secretary

Office of the Minister of Industry and Minister responsible for Canada Economic Development for Quebec Regions

gabrielle.landry@ised-isde.gc.ca

Judy Joe Scheffler

Event Manager

Fredericton Chamber of Commerce

events@frederictonchamber.ca

Anything but Politics with David Myles - S01 E01 - Hon. Mélanie Joly [The Pilot] [Filmed 10/15/2025]

Tuesday, 26 October 2021

Marc Garneau is booted out of cabinet and Mélanie Joly becomes Foreign Affairs minister

---------- Original message ----------

From: "Garneau, Marc - Député" <marc.garneau@parl.gc.ca>

Date: Wed, 13 Oct 2021 14:50:53 +0000

Subject: Automatic reply: "As a church pastor and an attendee, I need

to remember that the government is God's way of maintaining a public

good" Round 2 EH Higgy??

To: David Amos <david.raymond.amos333@gmail.

(An English message follows)

IMPORTANT

Veuillez noter qu’en raison du COVID-19, nous ne recevrons personne au

bureau. Il nous fera plaisir de vous venir en aide par courriel ou par

téléphone (514-283-2013).

Bonjour,

Nous vous remercions d’avoir pris le temps de nous écrire. Tenant

compte du volume élevé de courriels que nous recevons quotidiennement,

il se peut qu’il y ait un délai dans notre réponse. Veuillez noter que

dans le traitement de la correspondance, nous devons prioriser les

citoyens de la circonscription de Notre-Dame-de-Grâce-Westmount, par

conséquent nous vous invitons à inclure votre adresse résidentielle

dans votre communication.

Pour toutes les questions ou situations qui concernent les Affaires

étrangères Canada, veuillez les envoyer au bureau du ministre à

marc.garneau@international.gc.

Nous vous remercions de votre compréhension.

Médias seulement : Pour les demandes des médias, veuillez téléphoner :

1-343-203-7700 ou

media@international.gc.ca<

Pour les demandes du public, soyez assuré(e) que nous lirons votre

message attentivement.

Cordialement,

Bureau de l’honorable Marc Garneau,

Député de Notre-Dame-de-Grâce-Westmount,

Ministre des Affaires étrangères

***

IMPORTANT

Please note that, because of COVID-19, we will not receive anybody at

our office. We will be happy to help you by email or by phone

(514-283-2013).

Dear Sir/Madam:

Thank you for taking the time to write to us. Due to the high volume

of emails that we receive daily, there may be a delay in our response.

Please note that we give priority to correspondence received from the

constituents of Notre-Dame-de-Grâce-Westmount, and as such, we ask

that you include your residential address in your communication.

For matters or questions that relate to Foreign Affairs Canada, kindly

send them to the Minister’s office at

marc.garneau@international.gc.

Thank you for your understanding.

Media only: For requests from the media, please contact:

1-343-203-7700 or

media@international.gc.ca<

For requests from the public, you can rest assured that we will

carefully read your message.

Best regards,

Office of the Honourable Marc Garneau,

MP for Notre-Dame-de-Grâce-Westmount

Minister of Foreign Affairs

---------- Original message ----------

From: marc.garneau@parl.gc.ca

Date: Mon, 17 Jun 2019 18:17:54 +0000

Subject: Automatic reply: Methinks its High Time for legions of

Yankees and Minister Marc Garneau and his many lawyers to do their job

N'esy Pas Maxime Bernier?

To: david.raymond.amos333@gmail.

(An English message follows)

Bonjour,

Nous vous remercions d’avoir pris le temps de nous écrire. Tenant

compte du volume élevé de courriels que nous recevons quotidiennement,

il se peut qu’il y ait un délai dans notre réponse. Veuillez noter que

dans le traitement de la correspondance, nous devons prioriser les

citoyens de la circonscription de Notre-Dame-de-Grâce-Westmount, par

conséquent nous vous invitons à inclure votre adresse résidentielle

dans votre communication.

Pour toutes les questions ou situations qui concernent Transports

Canada, veuillez les envoyer au bureau du ministre à

mintc@tc.gc.ca<mailto:mintc@

Nous vous remercions de votre compréhension.

Médias seulement : Pour les demandes des médias, veuillez téléphoner :

1-613-993-0055 ou media@tc.gc.ca<mailto:media@

Pour les demandes du public, soyez assuré(e) que nous lirons votre

message attentivement.

Cordialement,

Bureau de l’honorable Marc Garneau,

Député de Notre-Dame-de-Grâce-Westmount,

Ministre des Transports

***

Dear Sir/Madam:

Thank you for taking the time to write to us. Due to the high volume

of emails that we receive daily, there may be a delay in our response.

Please note that we give priority to correspondence received from the

constituents of Notre-Dame-de-Grâce-Westmount, and as such, we ask

that you include your residential address in your communication.

For matters or questions that relate to Transport Canada, kindly send

them to the Minister’s office at mintc@tc.gc.ca<mailto:mintc@

Thank you for your understanding.

Media only: For requests from the media, please contact:

1-613-993-0055 or media@tc.gc.ca<mailto:media@

For requests from the public, you can rest assured that we will

carefully read your message.

Best regards,

Office of the Honourable Marc Garneau,

MP for Notre-Dame-de-Grâce-Westmount

Minister of Transport

---------- Original message ----------

From: "Guilbeault, Steven - Député" <Steven.Guilbeault@parl.gc.ca>

Date: Thu, 30 Jul 2020 08:17:16 +0000

Subject: Réponse automatique : YO Melanie Joly ans Pablo Rodriguez

Methinks Steven Guilbeault, his buddy Catherine Tait and all your

former nasty minions in CBC must take courses on playing dumb N'esy

Pas?

To: David Amos <motomaniac333@gmail.com>

Accusé de réception / Acknowledgment of Receipt

Merci d’avoir écrit à Steven Guilbeault, député de

Laurier–Sainte-Marie et ministre du Patrimoine canadien. Ce courriel

confirme la réception de votre correspondance. Veuillez prendre note

que votre demande sera traitée dans les meilleurs délais.

Si votre courriel touche le Patrimoine canadien, veuillez écrire à

hon.steven.guilbeault@canada.

Cordialement,

Le bureau de circonscription de Steven Guilbeault

---------------

Thank you for contacting the office of Steven Guilbeault, Member of

Parliament for Laurier–Sainte-Marie and Minister of Canadian Heritage.

This email confirms the receipt of your message. Please note that your

request will be processed as soon as possible.

If your email is with regards to Canadian Heritage, please email

hon.steven.guilbeault@canada.

With our best regards,

The constituency office of Steven Guilbeault

---------- Original message ----------

From: "Anand, Anita - M.P." <Anita.Anand@parl.gc.ca>

Date: Fri, 7 May 2021 08:18:26 +0000

Subject: Automatic reply: YO Frank Clegg Anita Anand and the Rogers

legal team cannot deny publishing this debate wihile CBC and CTV

denied that I was runing for a seat in Parliament again while suing

the Queen Correct?

To: David Amos <david.raymond.amos333@gmail.

Hello,

Thank you for reaching out to the office of Anita Anand, Member of

Parliament for Oakville. Please rest assured that your message will be

brought to her attention and we will make every effort to respond

promptly.

If you have not already included your address and postal code, please

respond to this email with that information. Please note that our

priority is to respond to inquiries from Oakville residents as this

email account is connected to our constituency office in Oakville, ON.

Inquiries relating to the Ministry of Public Services and Procurement

will be forwarded to the appropriate department for consideration and

response.

For the most up to date information on the Coronavirus (COVID-19), you

may visit www.canada.ca/coronavirus. Check back often, as this site

changes daily with updates.

For direct updates from MP Anand, you may visit the following websites

or sign-up for our email list:

* www.twitter.com/AnitaOakville<

* www.facebook.com/AnitaOakville

* www.instagram.com/

* Sign up for our email list<http://eepurl.com/gW3UrH>

Thank you again for reaching out to the office of Anita Anand.

Sincerely yours,

Anita Anand

Member of Parliament/Députée for Oakville

301 Robinson Street, Oakville, Ontario L6J 1G7

Tel: (905) 338-2008

---------- Original message ----------

From: Randy.Boissonnault@parl.gc.ca

Date: Tue, 24 Jul 2018 15:57:12 +0000

Subject: Automatic reply: Yo Minister Qualtrough RE "Litigation Lmbo"

Please enjoy an email that you and your fellow members of the PCO

ignored for way past too long

To: motomaniac333@gmail.com

Hello,

Thank you for writing to my office. I value hearing from Edmonton

Centre constituents and stakeholders. Your email will be read. My team

and I will be happy to respond.

This email is an automatic response to let you know that your

correspondence has been received. Please do not reply.

As we prioritize responding first to residents of Edmonton Centre,

please provide your postal code, if you have not done so already.

Should you need it, this link will help you confirm who your Member of

Parliament is: https://bit.ly/1BgbGyd.

I will reply as soon as possible whether your issue pertains to you

personally or if you have written to me on a matter related to my

LGBTQ2 responsibilities or other legislative duties.

If another government department or Member of Parliament can better

address your inquiry, we will forward your email to the appropriate

office and invite them to respond to you.

Thank you again for writing to me.

Kind regards,

Randy Boissonnault

Member of Parliament for Edmonton Centre

Special Advisor to the Prime Minister on LGBTQ2 Issues

E-mail: randy.boissonnault@parl.gc.ca<mailto:randy.boissonnault@

Website: http://rboissonnault.liberal.

Facebook: https://www.facebook.com/R.

Twitter and Instagram: @R_Boissonnault

------------------------------------------------------------------------------------

Bonjour,

Merci d'avoir ?crit ? mon bureau. J'appr?cie lire les ?lecteurs et les

intervenants d'Edmonton-Centre. Votre courriel sera lu et mon ?quipe

et moi serons heureux d'y r?pondre.

Ce courriel est une r?ponse automatique pour vous faire savoir que

votre correspondance a bien ?t? re?ue. S'il vous pla?t ne r?pondez

pas.

?tant donn? que nous donnons priorit? aux r?sidents d'Edmonton-Centre,

s'il-vous-pla?t veuillez nous fournir votre code postal si vous ne

l'avez pas d?j? fait.

Au besoin, le lien suivant vous aidera ? confirmer qui est votre

d?put?: https://bit.ly/1CyAl50 .

Je vous r?pondrai d?s que possible si votre enjeux vous concerne

personnellement ou si vous m'avez ?crit sur une question li?e ? mes

responsabilit?s sur les enjeux LGBTQ2 ou ? d'autres t?ches

l?gislatives.

Si un autre service gouvernemental ou un autre membre du Parlement est

dans une meilleure position pour r?pondre ? votre demande, nous

transmettrons votre courriel au bureau appropri? et les inviterons ?

vous r?pondre.

Merci encore de m'avoir ?crit.

Cordialement,

Randy Boissonnault

D?put? d'Edmonton-Centre

Conseiller sp?cial du premier ministre sur les enjeux LGBTQ2

E-mail: randy.boissonnault@parl.gc.ca<mailto:randy.boissonnault@

Site internet: http://rboissonnault.liberal.

Facebook: https://www.facebook.com/R.

Twitter et Instagram: @R_Boissonnault

Saturday, 23 September 2017

While Bill Morneau is in Fat Fred City talking to Perrin Beatty Mulroney' first Minister of National Revenue perhaps they should review a motion I filed in Federal Court before he became a Cabinet Minister

From: "MinFinance / FinanceMin (FIN)" fin.minfinance-financemin.fin@canada.ca

Date: Sat, 23 Sep 2017 15:17:58 +0000

Subject: RE: While Bill Morneau is in Fat Fred City talking to Perrin Beatty Mulroney' first Minister of National Revenue perhaps they should review a motion I filed in Federal Court before he became a Cabinet Minister

To: David Amos motomaniac333@gmail.com

The Department of Finance acknowledges receipt of your electronic correspondence. Please be assured that we appreciate receiving your comments.

Le ministère des Finances accuse réception de votre correspondance électronique. Soyez assuré(e) que nous apprécions recevoir vos commentaires.

-----Original Message-----

From: David Amos

Sent: Saturday, September 23, 2017 9:16 AM

To: greg.byrne@gnb.ca ; Jack.Keir ; rick.doucet ; blaine.higgs ;

Dominic.Cardy ; kelly ; David.Coon ; kristar@frederictonchamber.ca ;

Bill.Morneau@canada.ca ; advocacy@frederictonchamber.ca ;

jeff.saunders@tsdca.com ; alice.dunning@cibc.com ; jason.patchett@cibc.com ;

dean.buzza@rcmp-grc.gc.ca ; jennifer.warren@cibc.com ; fchamber ;

Wayne.Long@parl.gc.ca ; wayne.easter@parl.gc.ca ;

Ginette.PetitpasTaylor@parl.gc.ca ; Matt.DeCourcey

Cc: David Amos ; oldmaison ; andre ; pbeatty@chamber.ca ;

mmcmullen@chamber.ca ; gdubreuil@chamber.ca ; andrew.scheer@parl.gc.ca ;

maxime.bernier

Subject: Fwd: While Bill Morneau is in Fat Fred City talking to Perrin

Beatty Mulroney' first Minister of National Revenue perhaps they should

review a motion I filed in Federal Court before he became a Cabinet Minister

http://davidraymondamos3.blogspot.ca/2017/09/while-bill-morneau-is-in-fat-fred-city.html

Saturday, 23 September 2017

While Bill Morneau is in Fat Fred City talking to Perrin Beatty

Mulroney' first Minister of National Revenue perhaps they should

review a motion I filed in Federal Court before he became a Cabinet

Minister

---------- Original message ----------

From: Brian Gallant briangallant10@gmail.com

Date: Sat, 23 Sep 2017 07:18:27 -0700

Subject: Merci / Thank you Re: While Bill Morneau is in Fat Fred City talking to Perrin Beatty Mulroney' first Minister of National Revenue perhaps they should review a motion I filed in Federal Court before he became a Cabinet Minister

To: motomaniac333@gmail.com

(Français à suivre)

If your email is pertaining to the Government of New Brunswick, please email me at brian.gallant@gnb.ca

If your matter is urgent, please email Greg Byrne at greg.byrne@gnb.ca

Thank you.

Si votre courriel s'addresse au Gouvernement du Nouveau-Brunswick, svp m'envoyez un courriel à brian.gallant@gnb.ca

Pour les urgences, veuillez contacter Greg Byrne à greg.byrne@gnb.ca

Merci.

President's Office

The Honourable Perrin Beatty

President & Chief Executive Officer

613 238-4000

pbeatty@chamber.ca

Michael McMullen

Chief Operating Officer

613 238-4000 ext. 249

mmcmullen@chamber.ca

---------- Original message ----------

From: David Amos motomaniac333@gmail.com

Date: Thu, 14 Sep 2017 09:01:12 -0400

Subject: Fwd: ATTN Ronald J. MacDonald RE Federal Court File No T-1557-15 we just talked again

To: gdubreuil@chamber.ca, Ginette.PetitpasTaylor@parl.gc.ca, wayne.easter@parl.gc.ca, Wayne.Long@parl.gc.ca, Michelle.Boutin@rcmp-grc.gc.ca, Gerald.Butts@pmo-cpm.gc.ca

Cc: david.raymond.amos@gmail.com

Guillaum (Will) Dubreuil

Director, Public Affairs & Media Relations

613.238.4000 (231)

gdubreuil@chamber.ca

---------- Forwarded message ----------

From: "MinFinance / FinanceMin (FIN)" fin.minfinance-financemin.fin@canada.ca

Date: Thu, 14 Sep 2017 12:06:33 +0000

Subject: RE: ATTN Ronald J. MacDonald RE Federal Court File No

T-1557-15 we just talked again

To: David Amos motomaniac333@gmail.com

The Department of Finance acknowledges receipt of your electronic

correspondence. Please be assured that we appreciate receiving your

comments.

Le ministère des Finances accuse réception de votre correspondance

électronique. Soyez assuré(e) que nous apprécions recevoir vos

commentaires.

---------- Original message ----------

From: "MinFinance / FinanceMin (FIN)"

fin.minfinance-financemin.fin@

Date: Thu, 14 Sep 2017 12:06:33 +0000

Subject: RE: ATTN Ronald J. MacDonald RE Federal Court

File No T-1557-15 we just talked again

To: David Amos motomaniac333@gmail.com

The Department of Finance acknowledges receipt of your electronic

correspondence. Please be assured that we appreciate receiving your

comments.

Le ministère des Finances accuse réception de votre correspondance

électronique. Soyez assuré(e) que nous apprécions recevoir vos

commentaires.

---------- Original message ----------

From: David Amos motomaniac333@gmail.com

Date: Thu, 14 Sep 2017 08:05:12 -0400

Subject: Fwd: ATTN Ronald J. MacDonald RE Federal Court

File No T-1557-15 we just talked again

To: jeff.saunders@tsdca.com, alice.dunning@cibc.com,

jason.patchett@cibc.com, dean.buzza@rcmp-grc.gc.ca,

jennifer.warren@cibc.com, kristar@frederictonchamber.ca,

Bill.Morneau@canada.ca, advocacy@frederictonchamber.ca

andrew.scheer@parl.gc.caCc: david.raymond.amos@gmail.com

---------- Original message ----------

From: "MinFinance / FinanceMin (FIN)" fin.minfinance-financemin.fin@canada.ca

Date: Sat, 23 Sep 2017 14:19:46 +0000

Subject: RE: While Bill Morneau is in Fat Fred City talking to Perrin Beatty Mulroney' first Minister of National Revenue perhaps they should review a motion I filed in Federal Court before he became a Cabinet Minister

To: David Amos motomaniac333@gmail.com

The Department of Finance acknowledges receipt of your electronic correspondence. Please be assured that we appreciate receiving your comments.

Le ministère des Finances accuse réception de votre correspondance électronique. Soyez assuré(e) que nous apprécions recevoir vos commentaires.

---------- Original message ----------

From: Brian Gallant briangallant10@gmail.com

Date: Sat, 23 Sep 2017 07:18:27 -0700

Subject: Merci / Thank you Re: While Bill Morneau is in Fat Fred City talking to Perrin Beatty Mulroney' first Minister of National Revenue perhaps they should review a motion I filed in Federal Court before he became a Cabinet Minister

To: motomaniac333@gmail.com

(Français à suivre)

If your email is pertaining to the Government of New Brunswick, please email me at brian.gallant@gnb.ca

If your matter is urgent, please email Greg Byrne at greg.byrne@gnb.ca

Thank you.

Si votre courriel s'addresse au Gouvernement du Nouveau-Brunswick, svp m'envoyez un courriel à brian.gallant@gnb.ca

Pour les urgences, veuillez contacter Greg Byrne à greg.byrne@gnb.ca

Merci.

---------- Original message ----------

From: David Amos motomaniac333@gmail.com

Date: Sat, 23 Sep 2017 10:18:20 -0400

Subject: While Bill Morneau is in Fat Fred City talking to Perrin Beatty Mulroney' first Minister of National Revenue perhaps they should review a motion I filed in Federal Court before he became a Cabinet Minister

To: Bill.Morneau@canada.ca, fin.minfinance-financemin.fin@canada.ca, livesey@rogers.com, Ezra@therebel.media, peacock.kurt@telegraphjournal.com, Jacques.Poitras@cbc.ca, nmoore@bellmedia.ca, David.Akin@globalnews.ca>, kmcparland@nationalpost.com, sfine@globeandmail.com, bowie.adam@dailygleaner.com, pm@pm.gc.ca, len.hoyt@mcinnescooper.com, Frank.McKenna@td.com, Gerald.Butts@pmo-cpm.gc.ca

Cc: david.raymond.amos@gmail.com, justin.trudeau.a1@parl.gc.ca, brian.gallant@gnb.ca, PREMIER@gov.ns.ca, atlantic.director@taxpayer.com, briangallant10@gmail.com, mark.vespucci@ci.irs.gov, TIGTAcommunications@tigta.treas.gov

Hey Perrin Beatty et al

Please enjoy the pdf file hereto attached Page 10 in Tab E of my

Appeal Book tells an intersting tale about Mr Morneau and mean old me.

Obviously I approached the wealthy dude Mr Morneau before polling day

just like I did with you before you won your first seat as an MP from

Montreal N'esy Pas Mr Prime Minister Trudeau "The Younger" ???

So Mr MorneauI wonder if you checked the Federal Court docket when you

were in Fat Fred City nearly two months before I stood in court.

I must say you said some interesting things out of the gate in this interview.

http://www.cbc.ca/news/canada/new-brunswick/programs/informationmorningfredericton/bill-morneau-1.3521168

Bill Morneau

Air Date: Apr 05, 2016 1:00 AM AT

Information Morning - Fredericton

Bill Morneau

02:21 15:15

Federal Finance Minister Bill Morneau is in Fredericton AGAIN TODAY.

Do tell do you LIEbranos dudes have any idea how many emails and

documents etc of mine you have acknowledged since 2003 or how many of

your minions have played dumb with me during during the same period of

time particularly during 5 elections I ran within against you and

Harper too?

Its truly amazing to me that I have been arguing your lawyers in