"Why not become a circus clown?"

Carney's stay with Liberal critic not a conflict, bank says

The Bank of Canada tried to quell questions about its governor's impartiality and judgment Monday, saying Mark Carney was not afoul of conflict rules by vacationing in the summer at the cottage of the Liberal finance critic.

The central bank confirmed a weekend report that Carney stayed at Scott Brison's Nova Scotia cottage while key members of the Liberal party were courting him for the leadership.

Spokesman Jeremy Harrison said there was nothing improper in the visit, and that bank duties were not discussed.

"The Bank of Canada's general counsel, who is responsible for enforcing the bank's conflict of interest policy, has assessed that this visit does not breach the bank's conflict of interest guidelines in any way," Harrison said.

"Neither the Bank of Canada, nor governor Carney, have an actual or potential commercial or business relationship with Mr. Brison."

Harrison added that Carney and Brison had been friends for about a decade and that the visit to the MP's cottage at Cheverie, N.S., cannot "be defined as partisan or political activity."

Brison confirmed the friendship, which began in 2004 when Carney was an associate deputy minister at Finance and the Nova Scotia MP was the Liberal public works minister, but refused to elaborate about the visit.

"We entertain friends often at our Cheverie home. It is not our intention to publicly discuss personal time with friends in our private space," he said.

Carney was at a meeting of finance ministers in Meech Lake, Que. Monday to give an update on the state of the country's economy and the risk posed by the U.S. fiscal situation, but left without talking to reporters.

Carney's future was subject of speculation

Carney is used to being courted, most successfully by the finance minister of Great Britain, who has convinced him to become the next governor of the Bank of England in July.

But the report that Carney had been courted for the Liberal leadership — particularly the suggestion he did not immediately shut down the entreaties — has placed him and the bank in a murky area of ethics, causing some to review his past speeches and policy decisions for signs of taint.

Desjardins Capital Markets economist Jimmy Jean noted the "chatter," but called "reckless" one assertion that the central bank might have "intentionally kept monetary policy too restrictive (recently) such as to tarnish the Conservative party's economic track record."

Finance Minister Jim Flaherty, who appointed Carney to the job in 2008, shut down any questions on the issue when asked Sunday night, and refused comment during a press conference at the finance ministers' meeting Monday.

Several Bay Street economists, who asked not to be quoted, said they saw no evidence that Carney had conducted monetary policy in any way other than impartially.

Carney has acknowledged in the past to being approached by Liberals for the job, but maintained he was not interested, at one time jokingly responding: "Why not become a circus clown?"

In the Globe and Mail article, Carney said he had been approached by "different people, different parties."

The article quotes Carney as saying that he never sought the job and did nothing to encourage suitors.

"Nobody did anything on my behalf. I never asked anybody to do anything. I never made an outgoing phone call. I never encouraged anybody to do anything."

Liberal MP John McCallum, also a former finance critic and private sector economist, said he had a short conversation with Carney in August because he had heard the speculation, which he said he found "unusual."

He said Carney neither confirmed or denied interest.

"I wasn't lobbying, I just casually mentioned it."

The Bank of Canada's conflict-of-interest policy cautions against the "appearance of impropriety," and says employees offered hospitality or other benefits should ask themselves: "Does it feel right?"

Other questions to be considered: "Is there a chance that this could reflect negatively on me or on the Bank? What would a reasonable person think about my actions? Would I be embarrassed if others knew I took this action?"

The policy does not ban outside political activity. "Employees are not excluded from participating in political activities as long as their actions are not likely to be interpreted by the public as being representative of Bank policy."

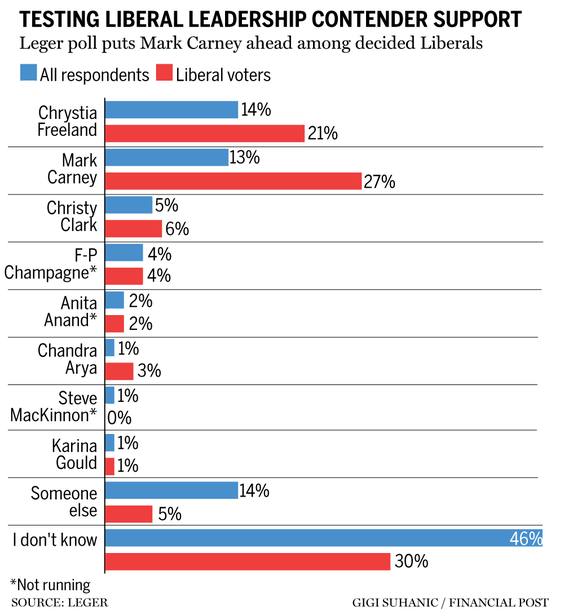

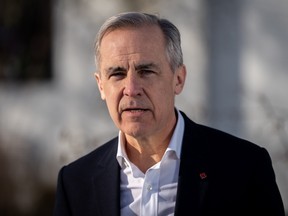

Mark Carney to launch bid for the Liberal leadership in Edmonton on Thursday

Carney soft-launched his campaign for the leadership on The Daily Show with Jon Stewart Monday

Mark Carney will launch his candidacy for the Liberal Party leadership at an event in Edmonton on Thursday, according to a notice from Calgary Skyview MP George Chahal.

The former governor of the Bank of Canada and the Bank of England will join Ottawa MP Chandra Arya, Nova Scotia MP Jaime Battiste and Former Liberal MP Frank Baylis, who have already declared, in the race.

"In an era of global challenges, in a time of economic opportunity, Mark Carney has the experience required and the leadership skills needed to meet those challenges and take advantage of the opportunities," Chahal said in an email to supporters.

"Mark Carney is not a career politician; his commitment has been to country, community, faith and family," he added.

The announcement comes two days after Carney seemingly soft-launched his campaign for the leadership during an appearance on The Daily Show with Jon Stewart on Monday evening.

The Liberal Party will choose their next leader — and Canada's next prime minister — on March 9. Hopefuls have until Jan. 23 to declare their candidacy. People can register with the party to vote in the leadership race up until Jan. 27.

Chahal's announcement bills Carney as a Liberal candidate in the mould of Lester B. Pearson, "a great public servant who sought elected office after an accomplished career."

Despite Alberta being a Conservative stronghold, Carney is launching his campaign in the province to draw attention to his roots there — a place where he grew up and went to high school. Carney was born in Fort Smith, N.W.T.

"Growing up in Alberta has instilled in Mark the spirit of hard work and perseverance that unites us all across the province," the Chahal's announcement said. "This background gives him a unique perspective to best represent the interests of all Canadians."

The news comes a day after Innovation Minister François-Philippe Champagne and former B.C. premier Christy Clark each announced they were not running.

Teasing a Liberal leadership bid, Mark Carney talks change, economy with The Daily Show

'In a situation like this, you need change. You need to address the economy,' Carney tells Jon Stewart

Mark Carney appeared on The Daily Show with Jon Stewart on Monday to talk about what kind of Liberal leadership candidate he would make, Conservative Leader Pierre Poilievre and the economic threat Canada faces from the incoming Trump administration.

During the interview, Stewart tried several times to get the former governor of the Bank of Canada and the Bank of England to formally announce his candidacy in the race to succeed Prime Minister Justin Trudeau, but Carney coyly leapt over those hurdles.

"Sir, may I recommend to you, with your charm and debonair wit, yet strong financial backbone, that you offer yourself as … have you offered yourself as leader," Stewart said.

Carney joked back that he "just started thinking about it" when Stewart brought it up.

Stewart said that should he win the race, he would struggle to secure victory for the incumbent Liberals because he would be saddled with the policies of the last decade.

"Let's say the candidate wasn't part of the government. Let's say the candidate did have a lot of economic experience. Let's say the candidate did deal with crisis. Let's say the candidate had a plan to deal with the challenges in the here and now," Carney said.

"You sneaky; you're running as an outsider," Stewart said.

"I am an outsider," Carney replied.

Stewart held up a side-by-side picture of Trudeau and Poilievre and suggested the Conservative leader looked "like a villain in a Karate Kid movie, there is something very off-putting," before asking Carney what Poilievre is like in person.

"You're not far off," Carney replied, adding that Poilievre is the "type of politician who tends to be a lifelong politician," who worships the market despite having never worked in the private sector and who sees "opportunity in tragedy to push an agenda."

In discussing Trudeau's decision to step down so the Liberal Party could hold a leadership race, Carney said changing leaders gives the party "a chance" to win the next federal election.

Trump tariffs and being absorbed by the U.S.

Stewart suggested that a number of Liberal cabinet ministers have said they are not going to run for the Liberal leadership because "they fear the headwinds in this election."

Carney defended members of cabinet — including Foreign Affair Mélanie Joly, Finance Minister Dominic LeBlanc and Labour Minister Steven MacKinnon — for deciding not to run.

"They are not running, in part because there's a crisis right now because of the threat of the Trump tariffs," Carney said. It's "country before party and personal ambition — and it's absolutely right."

President-elect Donald Trump has promised to impose 25 per cent tariffs on all Canadian imports when he assumes office unless Canada enacts measures to tackle illegal immigration and drug smuggling into the United States

Mark Carney - Canada Not Interested in Trump’s Offer & Liberal Leadership Prospects | The Daily Show

8,249 Comments

When it comes to tariffs, Carney said, "we have to prepare for it," and pointed out that if the United States does not import crude oil from Canada, its next best option is Venezuela

Asked what Canadians make of Canada becoming the 51st state, Carney said: "Bottom line: it's not going to happen, due respect."

"We find you very attractive, but we're not moving in with you. It's not you, it's us," Carney said, adding that Canada and the U.S. can instead "be friends with benefits … but we're not gonna commit all the way."

Those benefits, Carney said, include trade and defence.

Carney on the economy and the carbon tax

"I think in a situation like this you need change. You need to address the economy. We've got an economic crisis because of what Mr. Trump is about to do, or saying he is about to do. We also have challenges in housing, cost of living," he said. "We need to get the economy moving."

Carney said that Canadians have suffered under inflation, that wages have not kept pace with inflation, housing is expensive and there is a broad concern about the coming Trump tariffs.

"And truth be told, the government has been, not as focused on those issues as it could be," he said. "We need to focus on them immediately; that can happen now, and that's what this election is gonna to be about."

Carney was asked if being left holding the "carbon-tax bag" will make running to be prime minister more difficult than it will be for Poilievre.

The former central banker said it's important for Canada to make sure we're addressing climate change, and that Canada is "doing our bit, making our companies more competitive," because after Trump leaves office, the U.S. is probably going to "care about it again."

When that time comes around, Carney said Canada needs to be in a position where it cares about climate change and has done something about it.

"But we need to do it in a way that Canadians today are not paying the price," he said, without defending the carbon tax or pledging to keep the policy.

"The vast majority of our emissions in Canada come from our industry," Carney added. "In fact, almost 30 per cent of our emissions in Canada come from the production and shipment of oil to the United States."

Part of tackling climate change in Canada is "cleaning that up, getting those emissions down, more than changing, in a very short period of time, the way Canadians live," Carney said.

Conservative Deputy Leader Melissa Lantsman issued a statement in response to the appearance, saying that Carney is a "just-like-Justin insider," who is trying to "convince Canadians that he is not responsible for the policies that he and Justin Trudeau forced on Canadians."

As a longtime liberal insider, adviser and chair of Justin Trudeau's so-called Leader's Task Force on Economic Growth, she called Carney "the furthest thing possible from an outsider."

"Carbon Tax Carney is a hypocrite. He can't hide from the truth. He's just like Justin," she said.

Carson Jerema: Mark Carney will march us straight into an American disaster

He isn't taking the Trump threat seriously

Mark Carney needs to stop talking about American President Donald Trump because the likely soon to be prime minister is going to lead us straight into economic oblivion, if not into a full blown annexation crisis. The best way for our leaders to deal with Trump’s toxic threats to absorb Canada, or to wipe out the auto industry, is to essentially stop talking in public immediately. Instead, Liberals are gleeful at the opportunity that after nine years in office, they get to campaign against Trump.

The U.S. president’s comments about taking over Canada haven’t sounded like mere trolling for weeks now, but what does Carney think the Americans actually want? To gain leverage in free trade negotiations with an overly aggressive opening position? Access to Canadian resources? For Canada to tighten up its border security? For Canada to spend more on defence? Free vacations in Banff?

Nope, none of that, according to Carney. What Americans really desire is universal health care.

“I think Americans forgot about the need to provide health care to all their citizens. I think that Americans built their social safety net with enormous holes in it, that tens of millions of people fell through,” he said in Winnipeg on Tuesday. “There’s a backlash, and that backlash is leading to them pushing out against us.”

Liberals remain, bafflingly, committed to the idea that Canada’s health system is somehow the envy of the world, and that any country that lacks a similar policy risks descending into chaos.

At his leadership launch last month, Carney said he would offer “experience versus incompetence,” and his boosters in the media are enthralled with his background as a central banker, but so far, he sounds pretty much like any other Liberal.

Whatever the failures of the American health-care system, Canada’s consistently ranks near the middle or bottom when compared to other similar countries, on metrics such as access, wait times and the number of doctors and nurses. Canada does rank highly on how much it spends, though.

As for whether wealth is shared around enough in the U.S., at least there is wealth. In 2021, median income in Canada was about US$50,000 (C$70,000), compared to US$70,000 (C$99,000) down south. What’s more, the median employment income in every province is lower than every American state, even the poorest ones.

Maybe instead of lecturing about social safety nets, Carney could explain what policies he could bring that would let Canadians enjoy similar wage growth to the Americans.

He could also avoid needlessly antagonizing Trump, because, like it or not, he is who we have to deal with.

When, on Tuesday, Carney did address the American president’s 51st state comments directly, it wasn’t just to affirm Canadian sovereignty or to exercise the sort of strategic non-engagement that would benefit this country. He mocked Trump. “I view this as the sort of Voldemort of comments,” he said, adding, “Like I will not even repeat it, but you know what I’m talking about.”

Then on Wednesday night in Kelowna, B.C., Carney again mocked the president. “Can we influence Trump? A bit. But then we have to pretend we didn’t,” he said to raucous laughter from his supporters. “Don’t repeat that.”

This is clownish behaviour from Carney, and an indication that he doesn’t represent a break from Prime Minister Justin Trudeau, but a continuation of the Liberals’ complete lack of seriousness. For example, shortly after the American presidential election, Trudeau said that electing Trump instead of his opponent, Democrat Kamala Harris, was evidence of widespread sexism in the U.S. He later went on CNN and, brimming with Liberal moral superiority, said, “One of the ways we define ourselves most easily is, well, we’re not American.”

Carney could have looked at the outgoing prime minister’s remarks as ineffective and charted a different path. But, apparently, the likely winner in next month’s Liberal leadership vote thinks Trudeau is worth emulating.

Whether or not Trump deserves derision and scorn — and he does — is entirely beside the point. It is necessary for any Canadian prime minister to deal with whoever is in the Oval Office in good faith, and you can bet Trump is paying attention to what they say. Any astute observer will tell you that the way to deal with Trump is to flatter him, make concessions that allow him to claim a win and otherwise keep quiet.

The president and those around him have made it clear that they intensely dislike Trudeau. That isn’t to say that someone that has more deft with Trump would be more successful at negotiating, but certainly mocking him at every opportunity is ill advised. Trump’s upending of trade relations and lack of respect for sovereignty is beyond unacceptable, but how we handle this moment will determine what happens next.

Carney’s preening about Canada’s “social safety net” may help him win the Liberal leadership, but it is an attitude that is positively dangerous for dealing with the Americans.

National Post

Lawyers Rights Watch Canada (LRWC)

Business No: 860563139RR0001

https://www.youtube.com/watch?v=iBMixy3j5QU

3 Comments

Key moments from the London North Centre all-candidates debate

The five candidates visited CBC London on Tuesday, Oct. 15

This week, CBC London is hosting all-candidates debates in the region's four ridings. Today, the candidates for London North Centre joined London Morning host Rebecca Zandbergen to talk about the issues that matter to their constituents.

They are: Liberal candidate Peter Fragiskatos, Green Party candidate Carol Dyck, Conservative Party candidate Sarah Bokhari, NDP candidate Dirka Prout and People's Party of Canada candidate, Salim Mansur.

Here are the five key moments:

Conservative candidate begins debate with poem

NDP candidate calls London's housing crisis 'crazy'

PPC candidate boasts his party rejects 'fake alarmism' on climate change

Liberal candidate calls out 'parachute candidate'

Addressing poverty must be a non-partisan issue, says Green Party candidate

https://www.youtube.com/watch?v=sI0QElzmL7k&t=2842s

1 Comment

Greg Weston: Can the Liberals really snag Mark Carney for leader?

The Bank of Canada governor is being heavily wooed, but is he ready to give up saving the world economy?

A group of influential federal Liberals is trying to convince Mark Carney to quit his job as the governor of the Bank of Canada to run for the leadership of their party. Seriously.

So far, Carney, who is something of an international economic superstar, hasn't publicly shown any interest in the proposition, but behind closed doors, apparently, he isn't giving a decisive No either.

Social media sites promoting a "draft Carney" movement have popped up on Facebook and Twitter in recent weeks, and Liberal circles have been rife with rumours of his possible candidacy for months.

That Carney would generate so much ado about potentially nothing shouldn't surprise anyone.

At 48, he is whip-smart, handsome, media-savvy, bilingual and thoroughly engaging with a self-deprecating humor.

He can also claim roots across the country: He was born in the Northwest Territories, grew up In Edmonton, and has spent much of his working life in Ontario.

More than anything, though, at a time when the economy continues to dominate Canadian politics, the Harvard-educated economist is seen as one of the world's most respected central bankers, widely credited with helping to steer Canada through the 2008 crash and back to relative prosperity.

In 2010, Time Magazine named Carney one of the world's 100 most influential people. And he recently became the first central bank governor to address a convention of the Canadian Autoworkers union and received standing ovations at both ends of his speech.

Carney now splits his time between running the Bank of Canada and heading the Swiss-based Financial Stability Board, which is charged with overhauling the international banking system to try to prevent another global crisis.

In short, Carney could well be the Liberals' dream candidate — and Stephen Harper's worst nightmare.

Why do it?

The past two election campaigns have turned in part on the Conservative message that in these times of economic turbulence, the country needs a steady hand on the tiller.

On that issue, successive Liberal leaders Stéphane Dion and Michael Ignatieff were found wanting.

Send us your tips

Do you know who's behind the Draft Mark Carney Facebook page or Twitter account? Send your tips to greg.weston@cbc.ca

But how could the Conservatives campaign seriously against someone who has been one of those steady hands?

If anything about Carney's possible candidacy is giving some Liberals pause, it is not so much whether he will run for the leadership, but why on Earth he would even think about it.

Pollster Nik Nanos says Canadian voters are likely to have similar concerns, and that Carney's biggest challenge in entering politics may be explaining his motives for doing it.

Carney has two years left in his terms as both bank governor and head of the international banking reform board.

He would then still be only 50, and the world of international finance and rich corporate directorships would be virtually his for the picking.

Why would he walk away from all that for a chance to become Liberal leader and perhaps some day prime minister?

Now or never

A number of people who know him well say the proposition isn't all that out of the question.

They point out that Carney already left a super-lucrative career at the upper echelons of the Wall Street investment giant Goldman Sachs to join the Canadian public service in 2003, first as deputy governor of the Bank of Canada, then as associate deputy minister of finance. (He wasn't made bank governor until 2008.)

One friend says of Carney: "He comes from a public service ethic — his dad was a school teacher and professor — and he [Mark] honestly likes public service."

Of course, if Carney does decide to give up saving the world for a chance to rescue the Liberal party, he will have to actually run for the leadership — and spend the next three years of his life on the rubber chicken circuit waiting for an election call.

Justin Trudeau is expected to announce his candidacy next week, and at least four others are seriously testing the waters for support and money.

Trudeau has the ability to mount a ferocious grass-roots campaign, fuelled by social media — he has 150,000 followers on Twitter alone — and his own charismatic attraction.

Liberal strategists I spoke to this week seem to agree on two things: If Carney decides to run, he will be a formidable candidate, and he can't wait much longer to begin organizing.

Will the Liberals get their dream candidate to lead them from the electoral wilderness? Or are they just plain dreaming?

ABOUT THE AUTHOR

The making of the boy from Fort Smith

In the first of a week-long special series, Philip Aldrick travels to Canada to find out what made Mark Carney 'the outstanding central banker of his generation’ .

In downtown Toronto, Ki – a slick Japanese-themed bar in the upmarket Brookfield Place – is throwing a party for its regular customers. Complimentary champagne is flowing and free sushi canapes circulating. It’s 6pm and the patio is crammed with bankers.

Craig, a top private equity fund manager, is swigging on a bottle of Sapporo beer. “Do you know how much he left on the table when he took that job?” he asks. “C$20m [£12.5m]. I’ve done some charity work with him, and we estimate he’s worth C$3m to C$4m. But he gave up a fortune.”

The man in question is Mark Carney, the 48-year-old former head of the Bank of Canada and, from next Monday, the new Governor of the Bank of England.

Carney is about to become, by common consent, the third most powerful man in Britain and make history as the first foreigner to take the helm at the Bank in its 319 years.

But mention his name to the banking brotherhood at Ki and the conversation quickly turns to the same subject. Craig, it turns out, may have been conservative. A divisional investment banking head at Royal Bank of Canada puts Carney’s forgone fortune at C$50m.

One person who should know is Tim Hodgson, who worked with Carney at Goldman Sachs, their paths crossing in New York between 1998 and 2000. Later, he became chief executive of the Canada operation in Toronto. Later still, in 2010, he joined Carney as a special adviser at the central bank.

“He made a monstrous economic sacrifice,” Hodgson, now managing partner at Alignvest Capital Management in Toronto, says.

Talk of financial sacrifice for a man who will be on a £624,000 pay and pension package, plus an annual £250,000 living allowance, when he starts at the Bank on July 1 may seem odd but Hodgson argues that understanding the pay “sacrifice” is an important part of understanding Carney and where his ambitions may lie.

Today, The Telegraph launches a unique series on the man who will be Governor. Speaking to friends, economic experts and those in the UK awaiting his arrival, a picture becomes clear of a man who is obsessed with policy, a markets man who is no stranger to the world of banking and a figure who knows his own mind.

To understand how he will approach the job in Threadneedle Street you need to know about his career in Canada and what it tells us about his character.

Carney had been a managing director at Goldman for just a year when he quit to join the Bank of Canada as a deputy governor in 2003. A good Goldman MD in Toronto would be on “at least C$2m a year”, the RBC banker says. As Governor, he earned C$508,000 last year.

“Mark left Goldman right at the inflection point in his career. He was about to go places at Goldman,” Hodgson recalls.

Goldman has a long tradition of bankers moving into public service but Carney was different in one important regard. “By and large those people all did it after they made a lot of money,” Hodgson points out. “Mark left before he made a lot of money.”

Hodgson raises pay not out of prurience but because, to him, it is the most visible proof of what you hear time and time again in conversations about Carney: “He wants to serve.”

Another friend and top banker says: “He’s always kicking my butt – and others – chiding me a bit, saying, 'Hey hotshot, when are you going to make a real difference rather than sitting around in an office all day looking at a screen?’ That’s what he’s like.”

Carney’s sense of public service was instilled in him from an early age by his father. The third of four children in a strong Catholic family, Carney was born on March 16, 1965, in Fort Smith – a backwoods town in the Northwest territories of Canada.

Carney played basketball at his high school in Edmonton and earned a reputation as a very capable ice hockey goalie

They lived in a simple home not far from the school where his father, Bob, was headmaster. His mother, Verlie, would make the children fur-lined parkas to fend off the bitter cold in winter.

When he was six, the family moved to Edmonton, a city of 800,000 and home to the Oilers ice hockey team where the great Wayne Gretzky played throughout Carney’s youth.

Carney joined the local Catholic school, St Francis Xavier, and Bob took a civil service job in cultural affairs with the local government, later becoming a professor of education history at the University of Alberta. After Carney turned 10, Verlie, too, returned to the classroom.

“Our house was filled with books and there was lots of discussion on the issues of the day,” Carney told Readers Digest Canada after it named him Man of the Year in 2011.

School life came easy to the young Carney. He excelled both at sport and academically. At 17, he won a place on Reach for the Top – Canada’s high school version of University Challenge and, hinting at things to come, was made student council treasurer. He was also a “jock”, playing basketball and, on the ice, earning a reputation as a very capable hockey goalie.

Carney excelled academically. At 17, he won a place on Reach for the Top – Canada’s high school version of University Challenge.

Hard work won him a partial scholarship to Harvard and in 1984 he headed south to study English literature and maths. Inspiration led him on a different path, though. After attending lectures by the great Canadian economist, J K Galbraith, he switched courses – graduating with high honours in economics.

Money was always tight. According to his room mate Peter Chiarelli, now managing director of the Boston Bruins ice hockey team: “He was on financial aid and he’d watch his pennies, always worrying about maintaining his grades for his scholarship.”

In the summers back in Edmonton, Carney worked as a labourer for a local hospital. He even took a term off to build up his tuition fund.

He planned to move straight on to a masters and then into academia like his father but the bill run up at Harvard led him to Goldman. “I felt it would be better to work for a few years and pay that off,” he told Reader’s Digest.

Carney was true to his word, quitting the investment bank debt-free after four years in the London and Tokyo offices for a masters and PhD in economics at Oxford in 1991.

There he fused his two great interests – markets and public policy.

“The policy implications of his work were always a key concern of his,” Meg Meyer, his DPhil supervisor, says. “Even as a student it was his goal, after gaining experience in the private sector, to enter policy-making.”

It culminated in his 1995 thesis, The Dynamic Advantage of Competition, an investigation of the channels through which domestic corporate competition can affect a country’s global competitiveness.

In a conclusion establishing him as an arch internationalist, he argued that economies were best served by businesses with a large global presence but a smaller national one.

Controverisally, his main policy proposal was “a guarded preference for foreign acquirers over domestic ones”.

Oxford was also where he met his wife, Diana Fox – the daughter of a wealthy English pig farmer who was studying the economics of third world development.

According to Carney, he was smitten after watching her on the hockey pitch. They married in 1995 as he was finishing his thesis, which he hoped would be the springboard for that longed-for career in academia. But then Goldman came knocking again.

His Goldman career was unconventional. Graduate recruits from Harvard tend to get client-facing roles but Carney’s first stint was in the bank’s less glamorous credit and risk management back office. When he rejoined Goldman in 1995, it was to become a proper “banker” – in the sovereign risk department in charge of bond issuance by the newly capitalist nations of post-Glasnost eastern Europe.

There, he came under the wing of Peter Sutherland, Ireland’s former attorney general who had just completed two years as director-general of the World Trade Organisation. Sutherland, a former BP chairman, would prove to be an early mentor for the rising star.

Colleagues remember Carney as a talented banker but not one who stood out in the rarefied Goldman crowd. Contemporaries rose more quickly and, despite his academic qualifications, Carney did not make managing director for seven years.

Rather than sheer brilliance, those alongside him believe, it was Carney’s unusual career path that laid the foundations for his stellar civil service career to come. His “credit skills” and experience of the sovereign debt markets “made him uniquely qualified to be thinking about global risk”, Hodgson says.

By 1998, Carney was weary of the endless travel and wanted to go home. He put in a transfer request to the Canada desk, then based in New York, and switched to a more traditional corporate finance role. In 2000, the desk was moved to Toronto. At 35, he was back home and ready to start a family.

Public service kept calling, though. In 2003, according to Canadian folklore, Carney spotted a job advert in The Economist for deputy governor at the Bank of Canada and applied. The ad was supposedly a box-ticking exercise because the BoC already had someone in mind. Nobody knew Carney. But, so the tale goes, he was so impressive at interview they had no choice but to hire him.

It’s a nice story but an apocryphal one. Carney had already made an impression on Paul Martin, then finance minister, and David Dodge, Carney’s predecessor as central bank governor, according to Ralph Goodale, deputy leader of Canada’s Liberal party and the country’s finance minister between 2003 and 2006.

They first encountered him as a Goldman adviser over plans to privatise Ontario’s hydroelectric power generator, Hydro One. Although the plan was dropped, Carney made his mark. “They were obviously impressed with the potential,” Goodale says.

The job Carney applied for was the number two post – the senior deputy role – but he didn’t get it. It went to an internal candidate, Paul Jenkins. Still, Dodge had seen enough. Carney was instead parachuted into one of the Bank’s four junior deputy governor posts. Finally, he was in public service.

Carney was swiftly earmarked for bigger things, with Dodge reputedly telling a friend at the time that he had “just hired my successor”.

But he didn’t last long at the Bank. A little over a year after joining, the Liberal government poached him. With Martin as Prime Minister and Goodale as finance minister, Carney was made the finance department’s second highest ranking civil servant, where he set about policy change with vigour.

“Dodge was reluctant to let him go,” Goodale says in his office in Ottawa’s green-roofed, mock gothic Parliament building. “We all agreed that probably at some future point Mark would be the governor of the Bank – that seemed to be where the career path was going. But in the meantime it would be useful to him and very useful to us if he had a stint in the number two position in the department of finance.”

Goodale gave him “my three most challenging tasks”, he says. To sell the government’s remaining 15pc stake in PetroCanada, to design an “effective climate change plan” and to tackle Canada’s “chronic” productivity problem.

Carney’s climate change and productivity programmes were well received but dropped when Conservatives came to power.

However, using his best investment banking instincts, he came up with an innovative sales plan for Petro-Canada that “turned out to be the single most profitable transaction of its kind in Canadian experience”, Goodale says, in words that will reverberate with the UK Coalition as it looks to sell off its £65bn stakes in Lloyds Banking Group and the Royal Bank of Scotland.

Carney structured the deal differently from any previous privatisation. According to Goodale: “The financial media panned it, saying it was going to drive the price down, that the government was going to lose money on the transaction.”

Carney and the government stuck to their guns in the face of withering scepticism and were vindicated by the C$3.1bn sale. From that moment, he cemented his place as the Liberals’ favourite son.

The first real threat to his ambitions at the BoC came in 2006, when the Liberals lost power after a series of corruption scandals. Carney had grown so close to the party that people were openly questioning his political neutrality. With Stephen Harper’s Conservatives in power, there was a big risk he could lose everything he had been working towards.

“I actually wondered if [finance minister Jim] Flaherty and Harper would nix him for that reason – that he had been recruited and risen so successfully under a Liberal administration that he couldn’t possibly fit with their view of the world,” Goodale says. “It’s a tribute to him that he didn’t get sideswiped by politics.”

He needn’t have worried. Flaherty named Carney as Dodge’s successor in 2007, reversing his earlier defeat to Jenkins, the BoC’s internal candidate. He started as Governor in February 2008 – just seven months before the world fell apart.

When Governor of the Bank of Canada he took a ride on a dog sled before the start of a G7 finance ministers meeting in Iqaluit

He saw the crisis coming early. Always one to conduct his own research rather than rely on others, he travelled to the US in 2007 to view the sub-prime storm first-hand. He interviewed traders and examined the assets in AAA-rated CDOs, quickly recognising the scale of the problem.

Those fears were underlined when Canada suffered its own Northern Rock moment in summer 2007. Canada’s banks needed to roll over asset-backed commercial paper (ABCP) but, with the inter-bank markets frozen, there was a panic on.

Carney, still at the finance department, decided the market needed to be restructured to clear the mess and banks would have to bear losses. The only way the plan would work, though, was if all the major players signed up.

“It was a matter of bringing institutions together and Mark was quite influential in terms of playing a significant role in those negotiations,” says Gordon Nixon, RBC chief executive.

However, one bank, TD, was proving an obstacle because it had no ABCP exposure. Carney is reputed to have strong-armed TD chief executive Ed Clark into the deal.

Nixon recalls the exchanges as diplomatically as he can: “Mark is very cool, calm and collected. But when he has a strong view of things, he has a very forceful personality.”

Carney’s successful handling of the ABCP crisis won over even his sceptics in the Conservatives. But harder times lay ahead.

Carney started at the Bank of Canada with a bang. Alert to the dangers of the crisis, he reacted fast. In March 2008, he cut rates by half a percentage point to 3.5pc and in April took them down to 3pc. At that point in the UK, the Bank of England was prevaricating. Worse still, in Europe, Jean-Claude Trichet, the European Central Bank president, astonishingly oversaw a rate rise in July.

In September, Lehman Brothers collapsed and the world teetered on the brink. It was a massive test for Carney, then just a central bank ingenue. Backed by colleagues at the 79-year-old institution, he stepped up with C$110bn of liquidity to tide the banks over while the markets were shut. It was a textbook response and it worked.

As part of a globally co-ordinated programme, the world’s major central banks cut rates as low as they could go. In Canada, that meant to 0.25pc by April 2009. By then, the UK and the US had launched quantitative easing (QE), money printing as it came to be known.

Canada followed with Carney’s now famous “conditional commitment” – pledging that interest rates would be unchanged for a year. The economy, which suffered only a single year of recession – shrinking 2.8pc in 2009 – roared back to life in 2010, growing 3.2pc.

In Britain, Canada’s recovery has accorded Carney almost messianic status. George Osborne burnished the image by describing him as “the outstanding central banker of his generation”. In Canada, they see things rather differently.

In the bar at Ki, the bankers say Carney was a good governor but no saviour. “We didn’t need saving. Our banks were in pretty good shape,” Craig says.

Terry Campbell, president of the Canadian Bankers Association, points out there were no bail-outs and, for the past five years, Canada’s banks have been judged the safest in the world by the World Economic Forum.

David Madani, Canadian economist at Capital Economics, agrees. “He was dealt a good hand and he played it well. What set Canada apart was a stable banking sector, a housing boom, and commodities.”

Carney inherited a well-managed economy and stopped it going off the rails but stable banks, sound household finances and abundant natural resources were not of his making.

His former colleagues at the Bank also stress that he did not operate in a vacuum. “This was not Mark Carney making decisions by himself. This was six people debating the issues. It was a consensus,” David Longworth, a former deputy governor, says. “As with all of us, he listened more than talked.”

Similarly, the “conditional commitment” in April 2009 was not the great “Carney plan” as presented in the UK. Nor was the Canadian central bank any more innovative than those of the UK or the US.

“At one point in December 2008, one of our department chiefs said we should really be thinking about contingency planning. So we started a workstream,” Longworth says.

The conditional commitment came out of that and was one of three options, alongside QE and “credit easing”. As the other two required the central bank to take more risky interventions, the council decided to start with the commitment and trigger the other policies only if necessary. Canada had wriggle room that the UK did not.

What Carney brings to public policy is more subtle than the superhero status Osborne has bestowed on him.

“One of the reasons he is an outstanding central banker is that he has this ability to ask the right questions,” Longworth says. “He’s also always reading new economic theories and brings ideas from there and from his contacts in the markets.”

Goodale adds that “he has confidence and the ability to inspire confidence in others”, alongside his “extraordinary enthusiasm about public policy”.

“He’s got a great personality, too. He’s witty and good humoured,” he says. “That’s one quality in public life that’s a great asset. He’s got that cheerful demeanour that carries him a long way.”

Carney’s Hollywood smile and easy charm are all part of his famed communication skills. Goodale remembers Carney as Canada’s policy man at G7 and G20 meetings of global finance ministers. Carney shone in that environment.

“In those meetings there is always a group of sherpas who are trying to craft the message that will come out of the international discussions and, in every one of those meetings I attended, Mark was sought after by all the other countries to be one of the principal, if not the principal, drafters of the message,” he says.

Carney also demonstrated a remarkable ability at those meetings to find common ground among diverse political views. Goodale believes it was just such an “ability to herd the cats” that played a role in his selection in 2011 as chairman of the Financial Stability Board, the global banking supervisor that first brought Carney to wider world attention.

Ultimately, Carney’s success comes from his firm grounding, friends say. That image – of a “regular guy” – is one he’s keen to cultivate, despite his dapper suits and habit of buying one piece of modern art every year. He has ribbed a Canadian journalist for being “pretentious” by suggesting an interview be held in a sushi bar – proposing a local burger joint, The Works, instead.

The bartender in The Clock Tower pub, Carney’s local, remembers him coming in for a pint about 18 months ago – mixing almost anonymously with the regulars.

But Carney is not “a kick-back-at-the-bar kind of guy”, Hodgson says. After a weekly ice hockey game on Wall Street, Carney would rather talk about global affairs and go home early to his family.

Chiarelli remembers a bit of a “square” at Harvard, who “worked like a bastard” and liked to relax with a glass of milk and a piece of chocolate.

At home in Ottawa’s wealthy Rockcliffe suburb, it’s the same. His close banker friend claims Carney, Diana and their four daughters – aged between five and 11 – “eschew excess”.

“They keep him on an even keel,” he says. If Diana has a commitment with Canada2020, the “progressive” think tank at which she works, Carney makes sure he’s home “to serve dinner”.

“He’s given a really hard time about a lot of things by all of them,” the friend says. “They don’t care if he’s Governor of the Bank of England. You’ll still hear them saying, 'Oh my goodness, how could you be so stupid?’”

To his friends, Carney is driven by an old-fashioned moral imperative. “His decision-making, while clearly ambitious, is all in the context of a personality he can be proud of,” one says.

With such a keen focus on public service, Carney is widely expected to move into politics with the Liberals when his term at the Bank of England ends in 2018.

Last year, facing an internal crisis after dropping into third place, the party approached him to consider the leadership. He declined but maintains strong links through his friend, Scott Brison, a Liberal MP.

Earlier this month, after stepping down from the BoC, he was spotted dining with the current leader’s chief of staff, Gerald Butts.

Ottawans believe he’ll return from the UK in 2018 to become finance minister – a more likely move given his political inexperience.

Others think he’ll use the Bank of England as a springboard to the International Monetary Fund. The Governor job comes with a British passport that gives him the European citizenship required to meet the unofficial qualification for any IMF managing director.

First, of course, he has the small matter of helping to fix the ailing British economy, as one of the most powerful central bank governors in the world.

The challenges Mark Carney faces as Bank of England Governor

In the second of a week-long special series, Philip Aldrick considers the scale of the task for the Bank of England's new governor.

Mark Carney was not overstating things when he told the Canadian media, on being named Bank of England Governor last November, that he was moving to “where the challenges are greatest”.

The UK is not just struggling to recover from the most prolonged downturn in more than 100 years; the authorities have already thrown the kitchen sink at the problem. Carney, Bank of Canada (BoC) governor until earlier this month, may be celebrated as a policy innovator but, as his old BoC colleague David Longworth points out, in the UK “there’s not much left for him to try”.

Interest rates have been at a historic low of 0.5pc for more than four years, the BoE has bought a third of the national debt to the tune of £375bn, banks are being plied with cheap credit, and taxpayers are underwriting risky mortgages.

George Osborne likes to depict his economic strategy as fiscal prudence combined with monetary activism. But, compared with Canada, Britain’s response to the crisis looks less activist and more like a monetary revolution.

In one sense, Carney is woefully underprepared for the challenges that will greet him on his arrival next week. Canada’s experience of the financial car crash of 2008 was as innocent bystander. The UK, in contrast, was at the wheel and travelling way over the speed limit.

Britain’s banks were operating at leverage ratios of as high as 80 times. Canada’s regulators had set a limit of 21 times – lower even than the UK post-crisis standard of 33 times.

Canadian households had manageable levels of debt in 2007, at about 125pc of disposable income, compared with 155pc in the UK. Public borrowing was under control. Canada was running a 1.5pc budget surplus in 2007, while the UK already had a 2.9pc deficit. Above all, Canada had natural resources – in oil, gas, gold, and copper.

What set Carney apart was the fact that he didn’t flinch. He cut interest rates by one percentage point to 3pc within three months of taking the BoC helm in early 2008, having spotted the looming crisis months before his central banking peers, and slashed them to 0.25pc after the Lehman Brothers fallout threatened to capsize the global economy.

In April 2008, he pledged to keep rates at rock bottom for a year – his famous “conditional commitment” – to ensure the country did not become collateral damage in the global pile-up. Craig Alexander, chief economist at Canada’s TD Bank, said: “Carney was bold. You could have had someone who was not as aggressive in staving off a depression.”

But his innovations were small compared with the UK. At the height of the crisis, Canada provided C$110bn (£70bn) of liquidity to lenders. In the UK, the taxpayer’s liabilities on bank bail-outs at one point topped £1 trillion.

Carney’s “conditional commitment” was one of three contingency plans, which included quantitative easing (QE) and credit easing. According to Longworth, who was on the BoC governing council which set the policy, the commitment was chosen because the others were judged to be nuclear options and the economy did not need extreme intervention.

In the UK, there was no choice. The red button was hit again and again.

Since George Osborne unveiled Carney, he has come to be seen as an arch-dove who is prepared to reload the QE drip, regardless of the side-effects.

The Canadian experience, though, is the exact opposite. Carney’s rate cuts and liquidity provision worked. Perhaps, too well. Low rates sparked a housing bubble – the Organisation for Economic Co-operation and Development now reckons Canada’s houses are the third most overvalued in the developed world. Alongside that came a construction boom, as high-rise condominiums rose at a giddy pace in Canada’s major cities.

But, with consumer spending picking up and construction bringing jobs, the economy quickly recovered – growing 3.2pc in 2010 after a 2.8pc slump the previous year.

At the first sign of recovery, Carney turned hawkish. In June 2010, just over year after the low rate commitment, the BoC started raising rates aggressively – hiking them to 1pc over three successive meetings. “The Bank realised that once things had stabilised, there was a window of opportunity to get rates off the floor,” TD’s Alexander said. “It was a smart move, giving them room to manoeuvre if the global picture weakens again without having to resort to QE.”

The window quickly snapped shut, as the deeper problems in the US and Europe tipped the world back into a slowdown, leaving Carney in an awkward trap. The housing bubble continued to inflate, but growth dipped to 1.8pc. At the same time, the strong currency – 20pc overvalued on some measures – was damaging the manufacturing base.

As inflation fell towards the bottom end of the BoC’s 1pc to 3pc target range, Carney faced vocal calls to cut rates. But he stood his ground.

“The Bank of Canada won’t even acknowledge that the currency is overvalued,” Jim Stanford, chief economist at the Canadian Auto Workers Union, said. He applauds outgoing Governor Sir Mervyn King’s recent success in talking sterling down, but laments Carney’s failure even to try.

“What they say to us is that the best thing they can do is stick to the inflation target. Their story is that, if we devalue the currency, it would just create inflation that would undo the good work,” Stanford added, revealing a mindset with which several more hawkish economists in the UK might agree.

“It would certainly be wrong to think of Carney as a dove on inflation. That’s not been our experience.”

In Britain, BoE watchers expect some variation of Carney’s big three ideas – “flexible” inflation targeting, “guidance” in the form of a “conditional commitment” on rates, and clear “communication” for households and the markets. Osborne has allowed room for all three by tweaking the BoE’s remit.

But Canadian economists are sceptical that his policies will have much impact in Britain. “You seem pretty flexible already,” Capital Economics’ David Madani said, in reference to inflation running above target for 81 of the past 96 months.

Inflation in the UK is currently at 2.7pc, making more stimulus unlikely – particularly with mounting evidence that the economy may have grown by 0.5pc in the three months to June. If Carney does plan more stimulus, he also faces a challenge in convincing the eight other members of the Monetary Policy Committee – six of whom are currently voting against increasing QE.

With markets already expecting rates to be unchanged until 2016, “guidance”, TD’s Alexander says, looks like it will be more useful as a way of managing QE exit than providing stimulus.

One area he might be active, though, is in taking more risk onto the BoE's balance sheet – a red line issue for Sir Mervyn until Funding for Lending was launched last summer.

Longworth revealed that the BoC was preparing a form of “credit easing” when QE and the “conditional commitment” were considered in early 2008. It would have seen the BoC “purchase private sector assets outright”, he said. Ultimately, the policy was never triggered – but it indicated a willingness and has fuelled speculation that Carney will switch some of the BoE's £375bn QE portfolio into corporate debt, for example.

Where Canada’s economists do expect Carney to move aggressively is with Britain’s banks. He may have already started. Some believe Carney’s fingerprints are all over the Chancellor’s decision to consider breaking up Royal Bank of Scotland.

Bankers would be wrong to expect Carney to be a friend just because he was one himself, says Tim Hodgson, a former colleague of Carney’s at both Goldman Sachs and the BoC. “There’s no way in the world he’s going to say [banks can go easy on capital]. No way,” he insisted, citing Carney’s famous battle with JP Morgan boss Jamie Dimon and the fact that Canada’s banks were forced to comply with Basel III global capital standards last year – seven years early.

But he will be practical. Hodgson added: “Anyone who thinks he’s going to go easy on the banks doesn’t understand him. But because he understands the business, he’s not afraid to engage constructively with them if he thinks it is the right thing to do for the resilience of the overall financial system.”

Carney, who drafted the tough new global standards on bank capital as chairman of the Financial Stability Board – the central banks’ central bank, has been a firm opponent of the Volcker rule on proprietary trading, for example.

If he behaves like he did in Canada, UK bank bosses can expect regular communication. “Carney is all about engagement,” Hodgson said.

That willingness to intervene was most evident with Canada’s housing bubble. Since 2008, to deflate the bubble, mortgage terms have been cut from 40 years to 25, deposit requirements lifted, and loan-to-income tests toughened. In Canada, buyers have to take out mortgage insurance by law if their deposit is less than 20pc. The rules were tightened so buyers could not get insurance on properties worth more than C$1m (£620,000).

Carney was a driving force behind the scenes. Hodgson recollects him “jaw-boning” bank bosses who were pushing the limits with teaser rates and other incentives. “He – and [the regulators] – called the heads of the banks and said, what are you doing? All you’re doing is making housing more expensive, as people will be able to pay more for a house. This is stupid. Stop.”

The interventions have worked. Household debt has started to fall and house prices have stabilised. Madani reckons there may be a correction coming but, as Alexander says: “You don’t want to slam on the brakes if you’re driving on ice. You want to slow the car down. They’ve handled it well.”

At the Bank, Carney is expected to make it more open and transparent, and to tear down some of the more hierarchical structures, but he will not be “tone deaf” to its 319-year history, Hodgson says.

The big challenge he faces over his five years, though, will be how to exit QE. The danger is market risk; will gilt markets drive government borrowing costs up to unaffordable levels? Will the ocean of dormant money be released in a dangerous inflationary torrent?

If anything, “exit” is the role for which Carney is best prepared. He raised rates aggressively and fast in Canada, and – according to former colleagues – if there is one man who can outsmart the traders, it is Carney.

Reading between the lines of the Chancellor’s Mansion House speech last week, Carney’s task now looks less like that of a rescue worker and more like a health and safety officer whose job is to prevent unnecessary accidents.

“There is a risk that poor communication could lead to stimulus being inadvertently withdrawn too soon,” Osborne said. “More clarity about the future path of interest rates could help keep financial markets more stable.”

With the economy “out of intensive care”, as Osborne put it, market sentiment could change rapidly – pushing up government borrowing costs and making lending for households and businesses more expensive. “Guidance”, in the form of a “conditional commitment”, could smooth the transition, controlling the markets to ensure rates only rose once the economy was strong enough to bear it – “escape velocity”, in Carney’s language.

If the economic data continue to surprise, Carney may have to devise a plan sooner than he expected. Either way, QE exit will be his greatest challenge of all.

Page 7 and 8

Edinburgh Speech - Press Conference - 29th January 2014

Paul

Gilbride, Daily Express: Governor Carney, you gave three examples -

three main examples - for stable, successful currency unions US, Canada

and Australia, and you used them very much as a counterpoint to the

eurozone. Is it entirely a happy coincidence that those three examples

are nation states? If not, what are the reasons why it’s such a stable

currency union in those countries?

Mark Carney, Governor: Well, I won’t make a political judgement. From an economic

perspective,

I think what’s interesting and the point I was trying to make, using

the juxtaposition of the eurozone and those others, is that there's -

it’s not just about being similar, it’s about the institutions. And so

you can be relatively similar.

Now there are - you can disaggregate

the eurozone more and there's greater differences, but it’s more similar

than one would think in terms of industrial structure, not in terms of

productivity differences and things. So you can be similar and it

doesn’t work, and you can be quite different and it can work. And so

what matters is the institutional arrangements that are put in place

around the mobility of factors of production and goods, around various

aspects of a financial union, banking union, and obviously

fiscal arrangements.

Now

nation states put all of those in place. But you will have an attempt -

you have an attempt that is very clearly not yet completed at some risk

to the global economy - the European and global economies - you have an

attempt with the eurozone to putin place a durable currency union - or I

should be more positive, to reinforce the currency union, to reinforce

the euro with additional measures which will likely require some ceding

of national sovereignty, and that’s clearly recognised. But it doesn’t -

I’ll leave it to the political theorists to determine whether at the

end of that the eurozone is a nation state as

opposed to nation states that have these arrangements which create a truly viable economic and currency union.

Paul Gilbride, Daily Express: So do you not have any examples of any currency unions which

aren’t nation states?

Mark Carney, Governor: You only get one question; it’s a shame.

Laughter

Phil Aldrick, The Times: I'm just going back to the lender of last resort issue. Would the

Bank

of England be satisfied that banks like Royal Bank of Scotland and

Lloyds would be regulated by a Scottish regulator if you were providing

lender of last resort facility, given that the opposite has been

happening in the UK with the Financial Services Authority being brought

in house, it seems to be a

retrograde step?

Mark Carney, Governor: I don’t think it’s helpful for me to speculate on post-September

arrangements, so I won’t. I’ll make the most general point which is that we’re obviously very targeted in our provision of lender of last resort facilities. It is that ultimately we’re putting - there are

protections that are taken, but we are putting the sovereign balance sheet on the line. So we’re disciplined in our provision of that. And then we’re quite liberal in the provision of the liquidity

for all the reasons you would expect, to this specific institution

https://thewalrus.ca/mark-carney-was-the-worlds-rock-star-banker-now-hes-ready-for-his-encore/

Mark Carney Was the World’s Rock-Star Banker. Now He’s Ready for His Encore

Carney led two central banks through two world-shifting crises. Does that make him a political contender?

It took over three centuries and a Canadian to make it happen, but when Mark Carney was hired as governor of the Bank of England, in 2013, he became the first foreigner to run the institution since it was founded, in 1694. The response to his appointment was rapturous, bordering on parody. The British press alternately called him a banker from “central casting” and a “rock star.” Carney, stepping away from the same position at the Bank of Canada, was just forty-eight years old. He was brought on to modernize the UK’s ossified banking system, and kudos poured in from the left, the right, and the centre. “Mark Carney is the outstanding central banker of his generation,” former chancellor of the exchequer George Osborne told the House of Commons.

Then, Brexit.

From the moment then prime minister David Cameron floated a referendum to leave the European Union, in the early months of 2013, until the day the exit was made law, Carney was increasingly in the spotlight. He was asked, repeatedly, what impact leaving the EU might have on the economy. Tradition dictated that the bank governor remain above the political fray. Carney, however, was blunt in his assessment that the decision could lead to economic disaster—he even worried publicly about the possibility of a “cliff-edge Brexit.” He did not venture this as offhand opinion: he was, after all, governor of the central bank. Nevertheless, this was seen as taking sides. Suddenly, in certain parts of the country and some segments of its media landscape, he went from being Hugh Grant to Hannibal Lecter.

The fact that Carney’s original assessment would be proven right wasn’t politically relevant. Nor did it stem the criticism, even after he was asked by the Conservative government, not once but twice, to extend his original five-year contract so as to maintain stability and continuity in the Brexit rollout. The drama—which ended for Carney last year, his tenure finally complete—may have been theatrical, but it also highlighted the many ways that electoral politics can be a dirty, unpredictable business in which intellectual analysis and raw emotion do not always share the same cab. For Carney, it’s an experience that may yet come in handy.

In the months since Carney arrived back in Ottawa, where he now lives with his wife, British economist Diana Fox, and their four daughters, he’s landed a few plum positions: he’s taken a seat on the board of digital-payment unicorn Stripe, and he’s now heading up asset-management firm Brookfield’s expansion into social and environmental investing. He has also continued his role as United Nations special envoy on climate action and finance. Still, there have been whispers about what, exactly, he plans to do next. With the release of his first book this spring, Value(s): Building a Better World for All, they only got louder.

In early April, Carney was a keynote speaker at the Liberal party’s federal convention. During his speech, he committed himself to the cause, stating, “I’ll do whatever I can to support the Liberal party in our efforts to build a better future for Canadians.” It’s a line that has drawn many close readings in the media. The Canadian Press reported that his appearance was a “political coming out party of sorts” that marked “the first public dipping of his toe into partisan waters.” Pundits, and their unnamed inside sources, speculated that Carney could be on the next ballot, with some venturing that he could soon be minister of finance. Others have even gone further, naming him a potential successor to Justin Trudeau as Liberal leader and, if voters say so, prime minister. Still, Carney isn’t committing either way. At a recent virtual event held by the University of Toronto’s Rotman School of Management, he was asked whether politics was in his future. Carney played it coy: “I never say never.” He is certainly primed for a leap into a leadership position, but is that a job he actually wants?

On February 1, 2008, Carney, then forty-two, got a promotion: he was to become governor of the Bank of Canada. Even with his impressive CV, it represented a rapid ascent for the relatively young man who grew up in Edmonton: undergrad at Harvard, doctorate at Oxford, and success as an investment banker with Goldman Sachs in London, Tokyo, New York, and Toronto. He switched from Goldman to the public sector in 2003, landing roles at the Bank of Canada and the Department of Finance before being named governor—the youngest central banker in all of the G20.

Almost immediately, a calamity hit. Carney was still familiar with the world of Wall and Bay Streets, and he perhaps sensed, ahead of other central bankers, that the financial realm, faltering since 2007, was in jeopardy. Just a month into his tenure, while EU member states were raising interest rates to reflect a healthy economy, he cut Canada’s overnight rate by fifty basis points—a kind of fiscal booster shot that anticipated and, for Canada at least, moderated the trouble to come: the disastrously overleveraged state of credit default swaps and obligations that would ultimately overwhelm global markets and bring about the Great Recession.

There’s a chasm between the day-to-day job of being a bank governor and what the public might imagine they actually do—at least to the extent that anyone thinks about bank governors at all. Craig Wright, chief economist at RBC for over two decades, explains that the main job is to hit the inflation target the bank and the government deem advisable, which, in Canada since the early nineties, has been somewhere between 2 and 3 percent. On average, says Wright, Carney always found that 2 percent sweet spot. “That’s what you aim for in normal times,” Wright says. “Mark has been through a couple of abnormal times.”

In some ways, a bank governor is a bit like the captain of a giant steamship crossing the Atlantic—let’s call it the SS Stability. Know your charts, set a judicious course, keep a close eye on things, and it should be smooth sailing. Unless, of course, there’s a hurricane (credit crunch) or rogue wave (recession), at which point all hell breaks loose, your crew starts to panic, and every decision, big or small, is monumental. If you choose wrong, you’re going down.

Angelo Melino has been on faculty at the University of Toronto’s department of economics since 1981 and briefly worked for Carney as a special adviser to the Bank of Canada in 2008/09. “He was a very good crisis leader. I mean, he’s not a large man, but you would not know that if you were in a room with him,” Melino says. “He was very good at inspiring people to work hard. Everyone saw that this was a crisis, and he showed that he was a good leader and a very good decision maker.”

This became even clearer a few years later, when Carney was poached by the Bank of England. It was an institution that, by most accounts, needed to have the boardroom doors thrown open to the sunlight. Carney was hired to do the door-flinging. He was to oversee changes in communications policy at the famously tight-lipped bank as well as bring about reforms in technology, diversity, digital currency, briefing frequency, and even the printing of plastic versus paper money. It was a bigger role that came with more attention. A lot more attention. Intelligence, charm, and diligence could parry some, but not all, of the daggers. “I think it’s safe to say that the level of scrutiny in public roles in the UK is intense and unrelenting,” he says with a laugh during our call.

But, though he initiated an era of modernity at the bank, there remains debate in the financial community as to his overall effectiveness. Phillip Inman is the economics editor of the Observer. “If you talk about a crisis, then Mark Carney is your man,” he says. “He didn’t have to deal with the worst of the Euro crisis that happened just before he arrived, but it was still being felt when he arrived in 2013. Then, of course, we had the Brexit vote, in 2016, and he was a model of calm while everyone else was losing their heads.”

The story of Carney’s time in the UK is, in many ways, wrapped up with the story of Brexit. According to the Times, before taking up his post as governor, he sought assurance that there were no plans to hold a referendum on leaving the European Union (something that the Bank of England later denied). It did not take clairvoyance to predict the chaos and fractiousness such a process would bring about, regardless of the outcome.

According to Inman, it is important to remember the milieu in which Carney was operating: the financial sector considered Brexit earth shattering. “Not just an economic disaster,” he says. “A cultural disaster. A step backward in almost every way you can think of. And Carney had to stay calm and act quickly.” This was particularly crucial, says Inman, due to the Bank of England’s slow response to the 2008 recession—something that led to a lagged recovery and an awful lot of criticism.

Though Carney impressed early on, Inman says, his response to the latter stages of Brexit proved subpar. Like most other central bankers, he says, Carney’s technical tool kit was quickly found wanting. This, Inman argues, was where Carney’s naïveté about Britain was exposed. “Events never panned out as he predicted: wage growth never got high enough. He was a poor forecaster,” Inman says. “He had interest rates at rock bottom, he was doing all he could to facilitate growth and wages growth, but the mistake he made was that it takes more than that to jump-start recovery.” He adds that Carney’s policy of “forward guidance”—offering long-range direction on interest rate movement to promote economic stability—also proved contentious. Carney would announce that rates would soon go up to reflect increases to inflation and a healthier economy. But time would pass and nothing would change. “Month after month, year after year,” says Inman, “we would get Carney’s forecast of inflation rising and interest rates coming in to calm it down. And [the increases] never happened. Even when you start to get a sustained recovery, which didn’t happen until 2017, this is four years after he’s joined the bank. We had four years of ‘It’s coming.’” Carney was, in Inman’s opinion, misreading the situation before him.

Of course, some have always claimed there’s a whiff of smoke and mirrors to the work of economists. I remember, from earlier reporting days, Ralph Klein’s chief of staff, Rod Love, joking about economists: their ways, their mysteries, their arcane lexicon. It came with the punchline, Don’t get me wrong, I love economists. They’ve predicted seven of the last two recessions.

UK Labour MP Pat McFadden may have been feeling similarly inspired in 2014, when he likened the Bank of England under Carney to an “unreliable boyfriend” for the mixed signals it was sending over the timing of future rate hikes: “One day hot, one day cold.” It was a characterization that stuck even after Carney ditched forward guidance as a policy. “He was quite thin-skinned about it,” says Inman. “I would attend press conferences and ask him direct questions, and he was very prickly when you asked questions that appeared to impugn his forecasting or his social conscience or any of the things that he felt he should be praised for. As in, ‘Who are you to question my authority?’ Very sharp and dismissive. When everything’s going well, he seems very confident and it’s all lovely. But, when things are not going so well, in a one-to-one personal situation, he’s quite prickly. And his reputation inside the bank was quite authoritarian.” Carney was reported to have earned some infamy among bank staff. According to BNN Bloomberg, “Being on the receiving end of sudden flashes of fury became known as ‘getting tasered.’”

With the honeymoon period over, Carney’s manner and performance were regularly questioned by the media, with the caveat that a public figure receiving a mauling by the British press is like winter in Edmonton: the question is not if or when but how bad and for how long. Philip Aldrick, economics editor and columnist for the Times, was one such critic. After Carney’s tenure ended, Aldrick wrote that “the quantitative easing he oversaw at the Bank widened inequality and provided [chancellor of the exchequer] George Osborne with a cover for austerity.”

The bottom line, says Inman, is that Carney’s legacy at the Bank of England is simply more conventional and conservative than Carney and his advocates may believe it to be. “I just think he was more of the same,” says Inman, “rather than somebody who was a bit of a new broom.”

Carney insists that he enjoyed his experience in the UK but admits it was a fishbowl existence he was unaccustomed to. Everything from his marathon times to his expense claims received public airing. “In Canada, I was recognized, but I basically had a normal life,” he tells me. “In the UK, I did not. It was exceptionally difficult to do anything that was not in the public eye, so there was a level of scrutiny that was remarkable. As it turned out, with the Brexit cliffhanger, I ended up doing seven years, so I was there longer than I originally intended. If there’s an unasked question, by that point I’d been a G7 central bank governor for thirteen years, and you only get one life. I enjoyed it. It was a privilege. It was very intense. But it was enough.”

Thirteen years, two banks, two crises. How do you follow that kind of record? So far, one of Carney’s primary areas of focus has been his new book, Value(s): Building a Better World for All. At nearly 600 pages, it is learned, passionate, well researched, reasonably well written, and surprisingly accessible for a text encompassing politics, economics, history, and philosophy. All orbit around the ideas of value and values: how we find them in the market and how we promote them among ourselves. Yet it also presents something of a mystery: Whom, exactly, is this book for? It feels too colloquial to serve as an academic text, too academic to appeal to a general readership. Suffice it to say, at the literary or emotional level, the book is no Obama memoir. “I’m not hanging by the phone for the call from Oprah,” he jokes. In a way, the book seems to represent the duality of Carney’s public persona: part policy wonk happiest at Davos, part hometown hero keen to introduce himself and his ideology to the wider world.

Prosperity, Carney argues, is most likely going to be greatest when we can balance economic growth with social values.

It’s difficult to reduce Value(s) to a bite-size summary, but one thing it expresses consistently and in various ways is that Carney is not a free-market fundamentalist. In this, he falls into the traditional liberal camp: markets are run by humans and humans have emotions, biases, failings. The book is undergirded by an almost plaintive appeal to the decency in each of us as individuals and all of us as a collective. Prosperity, he argues, is likely going to be greatest for most when we can balance economic growth with a broader set of social values. That means limits; that means regulations. “When left alone, ultimately the market will consume the social capital that is needed to support the market,” he tells me. “You’ve got to be careful to balance things so you don’t lose the dynamism and innovation that only the market can provide. But some things aren’t trade-offs, right? We’re in a COVID crisis. With the people in the old-age home across the street, it’s not their lives versus the economy.”

It’s not just that the free market is too volatile when unregulated, Carney argues in his writing, but that it is also prone to systemic and episodic failures, which, combined with human frailty, means we must keep both a collar and a leash on this powerful beast. His call for a regulated and equitable financial system doesn’t appear to be a self-conscious bit of politicking: after all, if he didn’t hold these beliefs, Carney could have remained in the private sector, earned his millions, and we’d have never heard his name in the first place. Which raises the question that, if this is all part of the bigger picture he’s painting, what’s the next brush stroke? “In retrospect, everything might look quite logical and well planned out,” Carney says of his career. “But I’ve just gone to things where I felt it was a challenge and it interested me.” One potential challenge that has been simmering for some time, however, may be coming to boil.

John Ibbitson has been a political writer and columnist for the Globe and Mail since 1999. Mark Carney has been on his radar, to one degree or another, since he first appeared as a young governor at the Bank of Canada. Even then, Carney was rumoured to have political aspirations.