Re Nova Scotia Power calls for end to feuding with provincial government

David Amos<david.raymond.amos333@gmail.com> | Sun, Dec 18, 2022 at 10:53 PM |

| To: Peter.Gregg@nspower.ca, PREMIER <PREMIER@gov.ns.ca>, "blaine.higgs" <blaine.higgs@gnb.ca> | |

| Cc: "michael.macdonald" <michael.macdonald@thecanadianpress.com>, "Michael.Gorman" <Michael.Gorman@cbc.ca>, brian.gifford@eastlink.ca | |

Hey Former Attorney General Mikey Murphy say Hoka Hey to TJ Burke and the RCMP

New report gives breakdown of Nova Scotia Power's Fiona outage statistics

Region that includes Pictou, Antigonish experienced longest outages on average: 6.18 days

The organization, unlike telecommunications companies, is required to provide a detailed public report on large outage events.

The report found that nearly 425,000 unique customers were impacted by an outage because of the late September event. However, there were more than 750,000 total customer interruptions, meaning many customers experienced multiple outages during the restoration period.

Nova Scotia Power spokesperson Jacqueline Foster said at the peak of the outages, 405,000 customers were without power, the highest on record. She said the impact from high winds and falling trees was unprecedented, and the extent of the damage was five times that of Hurricane Dorian, which hit Nova Scotia in September 2019.

She said in situations of widespread outages, the company triages its restoration efforts.

"Nova Scotia Power prioritizes restoration to situations impacting public safety, followed by critical transmission infrastructure, EMO infrastructure priorities, and then focuses on restoring power to the greatest number of customers as quickly as possible," said Foster in an email statement.

The average restoration time was just over 100 hours, or about four days. Just over 50 per cent of customers had their power restored within 48 hours of crews starting their work.

However, restoration times varied between regions. The northeast region, which includes Pictou and Antigonish, experienced the longest outages in the province.

There were 16.81 days between the first outage and full restoration in that region. After 48 hours of work to restore power, only about 18 per cent of customers had their power back. It also had the longest average restoration time at 6.18 days.

The Eastern Shore experienced the second longest average restoration time at 5.22 days.

Cape Breton East, which includes Sydney, also experienced long outages compared to the rest of the province. There were 16.63 days from their first outage to full restoration. Nearly 20 per cent of customers had their power back after 48 hours of restoration work.

In the metro region, which includes Halifax, the average restoration time was 2.87 days. and Almost 70 per cent of customers had their power back after 48 hours of work.

In all regions, it took at least two weeks from the time of the first outage to have power restored for all customers.

A tree fell on a vehicle on Binney Street in west-end Halifax because of Fiona. (Nova Scotia Power)

A tree fell on a vehicle on Binney Street in west-end Halifax because of Fiona. (Nova Scotia Power)

Foster said Nova Scotia Power undertook extensive preparations for the storm, deploying 800 workers on the ground in advance, the most to date.

She said the company has been heavily involved in post-storm clean-up, proactively removing over 4,000 weak or damaged trees.

(PDF KB)

(Text KB)CBC is not responsible for 3rd party content

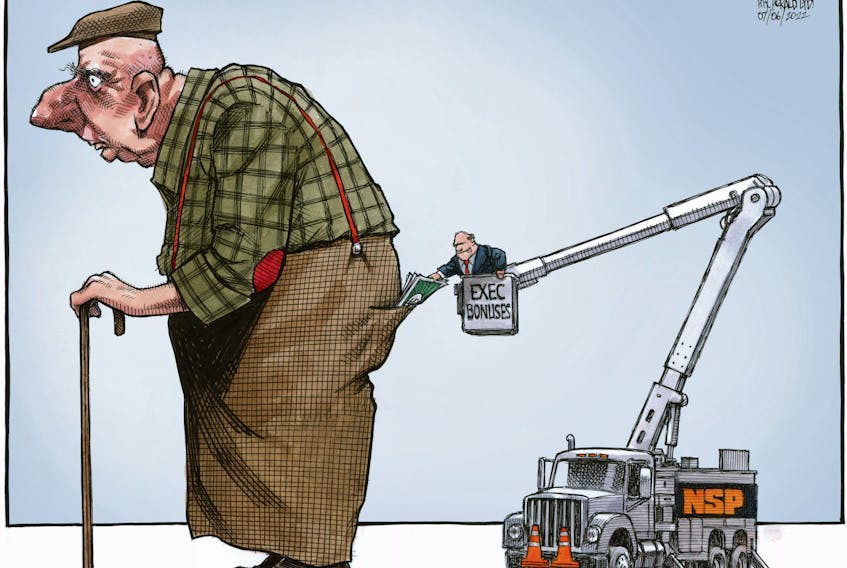

Nova Scotia Power's credit rating has been downgraded — again

Rating agency cut NSP's long- and short-term debt rating on Tuesday

The DBRS Morningstar cut NSP's long- and short-term debt rating on Tuesday.

It cited increased risk created by the provincial government's imposition of a cap on rates, spending and profits in the middle of hearings on all three issues by the Nova Scotia Utility and Review Board (UARB).

S&P Global downgraded Nova Scotia Power last month. It also blamed "unprecedented political interference" by the Nova Scotia government.

Ratings agency react to political intervention

The UARB, an independent regulator, was still weighing evidence in a general rate application for a two-year, 14 per cent power rate increase when the province intervened.

"DBRS Morningstar believes meeting the provincially mandated renewable generation targets will be challenging given the financial restraints on [Nova Scotia Power] over the near term, as well as the heightened regulatory risk on the company's ability to receive rate increases to recover and earn a reasonable return on any new investments," the rating agency said Tuesday.

The downgrades are in response to Bill 212, passed by the Progressive Conservative government in November. For two years it limits electricity rate increases to 1.8 per cent for everything other than fuel and energy efficiency program costs. It also caps profits and requires increased revenue to be dedicated to strengthening the electrical grid.

DBRS Morningstar dropped NSP long-term debt one notch from A-low to BBB- high and commercial paper — the equivalent of a corporate IOU — a notch from R-1 low to R-2 high.

It said the decision follows "the deterioration in the regulatory environment" for NSP and discussions with company management.

The rating agency said it was encouraged Nova Scotia Power and intervenors representing customer groups reached a negotiated settlement after the provincial rate cap was imposed.

Customers face rate increase

The settlement reconfigures what rates will cover — for example it increases the amount that will go to pay higher fuel costs.

But the settlement submitted to the UARB amounts to the same 14 per cent increase on the table before the province intervened to "protect ratepayers" through Bill 212.

Premier Tim Houston has called on the Utility and Review Board to reject the settlement.

Conditions needed to restore NSP credit rating

DBRS Morningstar said in order to upgrade the rating it needs to see the next general rate application "conducted free of any interference and with the [UARB's] full independence on the determination of rates."

Another condition is "meaningful progress on the replacement of coal-fired plants with renewable sources in order to meet the mandated targets."

Nova Scotia Power reacts

On Tuesday evening, Nova Scotia Power spokesperson Jackie Foster said in a statement the latest downgrade "demonstrates the ongoing fallout from the government's passage of Bill 212."

Last week, the utility company estimated the credit rating downgrades will cost between $20 million and $30 million annually in higher interest payments once existing debt is renewed.

Higher interest cost cannot be passed on to ratepayers for two years because of Bill 212. After that the company intends to recover them from ratepayers.

On Dec. 13, NSP president Peter Gregg wrote to several provincial cabinet ministers asking for a meeting.

In an interview with CBC News at the time, he said "We need to work closely with the provincial government, put our differences aside, work through the differences, whatever it takes.

"I do believe we have the same interests, but we've got to stop this fighting," he said.

The premier's office says it will decide in the new year whether it will sit down with the company.

"This additional action by a credit rating agency reinforces the seriousness of the current situation and this is exactly why we are requesting a meeting with government, so we can work move forward and work productively together to find meaningful, long-term solutions for Nova Scotians," Foster said in the statement.

CBC's Journalistic Standards and PracticesProvince orders Nova Scotia Power to use biomass to generate electricity

Forestry industry welcomes move, environmentalist decries 'terrible announcement'

Nova Scotia Power will use more biomass to generate electricity for the next three years, under regulatory changes by the province that are angering environmentalists and being lauded by the forestry industry.

The changes to renewable electricity regulations in the Electricity Act that were announced Monday call for the utility to purchase 135,000 megawatt hours of renewable energy in 2023, 2024 and 2025, which is all but certain to come from biomass. Previously, there was no required amount.

A spokesperson for the utility said it is equivalent to approximately 3.6 per cent of the total renewable energy that will be supplied to customers in 2022.

The news comes as Emera, the parent company of Nova Scotia Power, expects the Brooklyn Energy biomass-fuelled power plant to be repaired and operational again by the end of January, almost a year after the site was damaged.

'It's a farce'

"This is just a really terrible announcement for the environment," said the Ecology Action Centre's Ray Plourde.

"It's a disaster for the atmosphere and it's a disaster for biodiversity."

Plourde pointed to a recent decision by the government of Australia to no longer consider electricity generated by biomass as renewable energy. The problem with considering it a renewable resource, he said, is that such a view is based on the notion that the greenhouse gasses produced by burning biomass will someday be absorbed by future trees.

"It's a farce," said Plourde.

"It's a sick joke at a time when we need real climate solutions."

But Natural Resources Minister Tory Rushton said biomass is a resource that can be used at a time when fossil fuel prices remain volatile, until more wind and solar projects are ready to come online.

Rushton said sawmills around the province have lots of wood chips and other byproducts from forestry operations that can be used to meet the new requirements. It also provides a destination for waste wood still in forests following post-tropical storm Fiona, said Rushton.

Helping fill renewables gap

The regulations prohibit cutting whole trees to generate electricity and only allow products left over from sustainable timber harvest and primary processing to be used.

"What I see is a renewable resource that we have sitting in our province right now, with biomass that can certainly assist Nova Scotia Power with meeting their renewable targets," Rushton said in an interview.

Nova Scotia Power is required to generate at least 40 per cent of its electricity from renewable sources, although that has been a challenge because of delays getting the full amount of power from Labrador via the Maritime Link. The utility is required to hit 80 per cent renewable-generated electricity by 2030.

Stephen Moore, executive director of Forest Nova Scotia, said the requirement is good news for his members.

A boost for industry

Moore said the organization has been petitioning the government to find new markets for the glut of byproducts sitting in mill yards and the waste wood that remains in the forests following Fiona.

"There is certainly a substantial amount of this stuff sitting around the province right now," he said.

It's too soon to know how much wood will be required to meet the new regulations, but Moore said it's a "crucial move" that would provide a strong foundation for the sector as it continues to look for new markets. He noted that practising ecological forestry produces byproducts that need to go somewhere.

But Plourde said it would be better for the environment if those materials were put toward making pressboard or biochar, or used for district heating, which is more efficient than burning biomass to generate electricity.

Rushton understands the practice is controversial, but there is a worldwide energy crunch related to fossil fuels and that needs to be considered while transitioning to cleaner fuel sources, he said.

Whether biomass will be required to generate electricity beyond 2025 remains to be seen, but Rushton said that conversation will happen.

"I think you see that with having the window put in there," he said.

CBC's Journalistic Standards and Practices|

Raymond Plourde

Maggy Burns

Executive Director | Ecology Action Centre

maggy.burns@ecologyaction.ca

Stacy Corneau

(613) 620–2592

corneau.stacy@gmail.com

‘A farce, a sick joke’: Nova Scotia amps up burning of biomass for electricity

Last week, the Labour government in Australia moved to change a 2015 regulation classifying woody biomass as a ‘renewable’ source of energy alongside wind and solar.

In dropping biomass from the list of renewables, Australia’s climate change and energy minister, Chris Bowen, said the change was in step with “strong and longstanding community views” following a public consultation that attracted more than2900 submissions. Environmental groups lauded the decision.

Contrast that decision in Australia with one announced yesterday by the Houston government here in Nova Scotia.

With a stroke of the pen, it has established a new regulation that requires Nova Scotia Power to generate at least 153,000 megawatt hours of electricity a year from biomass for the next three years.

Biomass includes residual or “waste” pulpwood, branches, bark, and wood chips that is the by-product of sawmills or natural disasters such as hurricanes.

The only limit to how much the utility can burn is a financial one. Natural Resources and Renewables minister Tory Rushton says the government is limiting Nova Scotia Power to spending an additional $4 million a year “to avoid further power rate increases” for citizens.

It’s clear from a fuel update the company filed last September with the Utility and Review Board that Nova Scotia Power was planning to significantly ramp up the amount of electricity generated from biomass. The fuel update estimated that between 2022 and 2024 Nova Scotia Power would receive 2,700,000 megawatt hours less hydroelectricity from Muskrat Falls than was previously forecast.

This under-delivery means Nova Scotia Power can’t reduce its greenhouse gas emissions (GHG) from coal and natural gas generating stations until more wind farms and other renewable sources of energy are built or imported.

Meanwhile, unlike Australia, biomass in Nova Scotia and Canada is still classified as ‘renewable’ despite compelling arguments from environmentalists who say clearcutting on privately owned (70% in N.S.) and Crown land means biomass often emits more carbon than burning coal.

A letter to that effect signed by several top climate scientists was presented to world leaders gathered at the biodiversity conference in Montreal this month.

Renewable Energy Minister Tory Rushton defended the move to burn more biomass.

“For us, this is about putting more renewable energy on the system for a short period of time until we can establish more hydro and wind for the long-term,” said Rushton. “ I’m also the minister responsible for Natural Resources so I know there’s no longer a market for pulpwood since Northern Pulp closed. And the residual wood left on the ground after hurricane Fiona creates an opportunity to have money paid for that wood to stay in the province.”

Biomass use to increase 51.7%

On the Port Hawkesbury Paper property, the amount of biomass used to generate electricity over the next two years is forecast to increase a staggering 51.7%. The co-gen boiler that produces steam for the newsprint mill and electricity for the grid is owned by Nova Scotia Power.

In 2020-21, this biomass boiler contributed 138,620 megawatt hours, or about 3% of the total electricity supplied to the provincial grid*.

According to the fuel update Nova Scotia Power filed last September, this forecast increase in biomass burning “is driven by economics and GHG compliance requirements.” In other words, it’s cheaper to buy biomass from saw mills and wood lots than it is to buy coal, and, GHG emissions from coal will cost money under environmental regulations while GHG emissions from biomass don’t even get counted.

“This is a really terrible announcement for the environment, a disaster for the atmosphere and for biodiversity,” said Ray Plourde, senior wilderness coordinator for the Ecology Action Centre, continuing:

The government pretends that burning forest biomass is magically non-carbon emitting based on a fantasy theory that in 100 years, the carbon will be re-absorbed by future trees that may or may not grow, so they don’t need to count biomass emissions at all.

But we don’t have 100 years to wait for that to happen and there is no guarantee that it will.

Biomass is not a climate solution, but it’s being embraced by our government in policy and practice because it’s easy to do (burn trees instead of coal) and it helps the forestry sector with a glut of so called ‘waste wood.’ Its significant negative impacts on the climate and biodiversity are conveniently ignored. It’s a farce, a sick joke at a time when we need real climate solutions.

Ray Plourde

Brooklyn Power

Brooklyn Power, the 35 MW biomass boiler owned by Emera near Liverpool, has been out of commission since last February, when it was damaged by a winter storm. But Emera says Brooklyn will be back in service by the middle of next month.

On average, Nova Scotia Power plans to buy 12.5 % more electricity from Brooklyn than in the past. In 2020-21, Brooklyn contributed 144,000 megawatt hours of electricity to the grid. The forecast filed in the September fuel update will bump that up to 162,000 megawatt hours for 2023 and 2024.

The biomass plant at Brooklyn was once the most expensive source of electricity for ratepayers and ought to be closed, according to an audit done for the Utility and Review Board by the firm Bates White five years ago. But the old plant that dates from Bowater Mersey days is now relatively less expensive when you factor in the rising price of fossil fuels and the fines associated with carbon pollution.

Rushton considers biomass a short-term “opportunity” for the forestry sector, while environmentalists view it as both a loophole and a wrong-headed choice to deal with climate change.

“Our forests have much more potential and value than to be burned for the generation of electricity,” says Mike Lancaster, the coordinator for a citizen advocacy group called the Healthy Forest Coalition:

Using forest biomass for the generation of electricity is an extremely inefficient use of our forests. Even the best systems generally lose around 80% of the potential energy, running at 20% efficiency.

When sourced from truly ecological-based forestry practices (i.e. no harvesting during the peak of nesting season for birds, no harvests take more than 20% of the forest, etc.), biomass for heating is a better use of our forests. For example, most modern wood stoves get in the range of 65-80% efficiency. Our industry needs an avenue for the byproducts of sawmilling, but using those residuals for local heating would be a better use.

Mike Lancaster

Rushton said burning wood is a better choice than burning coal to generate electricity because carbon emissions from biomass are lower as long as the wood is harvested sustainably.

Rushton said the new regulation outlaws cutting whole trees for biomass and the province is implementing the ecological forestry model on Crown lands, as recommended by the Lahey Report. But he acknowledges that while the province can enforce regulations when it comes to how wood gets harvested on Crown lands, which make up less than 30% of Nova Scotia’s forests, it does not have that authority when it comes to land owned by small woodlot owners and large private companies. They have just been handed a Christmas gift.

* This article has been revised to better describe the biomass situation at Port Hawkesbury.

Jennifer Henderson is a freelance journalist and retired CBC News reporter.Nova Scotia Power will be using more sustainably harvested biomass over the next three years under a new renewable electricity standard.

The new standard, in the Renewable Electricity Regulations under the Electricity Act, requires the utility to purchase 135,000 megawatt hours of readily available renewable energy in 2023, 2024 and 2025.

Biomass is likely to be the only readily available option during that time. It is available due to the closure of the Northern Pulp mill and damage from hurricane Fiona.

“Biomass is renewable, readily available and burns cleaner than coal,” said Tory Rushton, Minister of Natural Resources and Renewables. “Adding more sustainably harvested biomass for a few years is a small thing we can do in the short term to bring more renewables onto the grid while longer term solutions are built.”

The regulations prohibit cutting whole trees to generate electricity. They only allow biomass in the form of low-quality residual wood and chips that are leftover from sustainable timber harvesting and primary processing.

Suppliers will have increased costs for fuel or to restart operations. Therefore, the utility will be required to pay suppliers an additional $30 per megawatt hour beyond existing contracts. However, the utility has a limit of $4.05 million per year from 2023 to 2025 to avoid creating a burden for ratepayers as the Province encourages the use of more renewable energy.

Quick Facts:

- renewable electricity standards require a specific amount of electricity to be produced from renewables sources such as wind, solar, biomass and hydro

- the current standard requires Nova Scotia Power to generate at least 40 per cent of electricity from renewables

- due to delays with the Maritime Link, the standard was adjusted to an average of 40 per cent from 2020 to 2022; data will be reviewed early in 2023 to determine whether that target was met

- the utility will likely reach about 70 per cent renewables by 2026 with reliable hydro electricity through the Maritime Link and new onshore wind projects

- the renewable electricity standard will increase to 80 per cent in 2030

Additional Resources:

Amendment to the Renewable Electricity Regulations: https://novascotia.ca/just/regulations/regs/2022-338-ELEC-Renewable_Electricity.pdf

Nova Scotia Power calls for end to feuding with provincial government

'We've got to stop this fighting,' Nova Scotia Power president says

Nova Scotia Power is calling for a meeting "as soon as possible" with the provincial government, saying a broken relationship threatens its ability to meet renewable energy targets — and its bottom line.

"We need to work closely with the provincial government, put our differences aside, work through the differences, whatever it takes," Nova Scotia Power president Peter Gregg said Friday.

"I do believe we have the same interests, but we've got to stop this fighting."

Gregg asked for the meeting in a Dec. 13 letter to the ministers of finance, environment and climate change and natural resources and renewables.

The company's call for a truce comes in the midst of a contentious regulatory hearing into its application for a 14 per cent power rate increase over two years.

Premier Tim Houston's office said Friday the government will decide in the new year whether it will meet with the utility.

"I will reiterate our government's position on power rates," spokesperson Catherine Klimek said in a statement. "We're committed to protecting ratepayers as best we can and ensure they have access to clean, reliable electricity at a fair price."

'Already difficult situation'

Gregg's blunt letter outlines Nova Scotia Power's objections to the conduct of the Houston government that includes Bill 212, the law that imposed a 1.8 per cent cap on non-fuel costs.

It was passed before the Nova Scotia Utility and Review Board had finished reviewing the evidence.

"We remain deeply concerned that political intervention in the regulatory process, lack of consultation with NSP on energy and climate policy and continued comments in the media not only highlight the lack of a productive working relationship, but they also risk further exacerbating an already difficult situation," Gregg wrote.

Bill 212 required the revenue generated by the increase to be spent only on upgrading the electrical grid and stops spending on renewable projects needed to transition off coal.

Bill

212 required the revenue generated by a 1.8 per cent increase to be

spent only on upgrading the electrical grid and stopped spending on

renewable projects needed to transition off coal. (Andrew Vaughan/The Canadian Press)

Bill

212 required the revenue generated by a 1.8 per cent increase to be

spent only on upgrading the electrical grid and stopped spending on

renewable projects needed to transition off coal. (Andrew Vaughan/The Canadian Press)

The company paused work on large-scale battery storage, a wind-power procurement and upgrading the grid connection with New Brunswick, a first step in the Atlantic Loop — a regional energy corridor.

"We are concerned that there is a disconnect between what the government would like to achieve in their climate plan and Bill 212 which restricts the investments the utility can make in order to help facilitate the achievement of the goals," he wrote.

Nova Scotia Power is supposed to close its coal-fired generation plants by 2030, when 80 per cent of its electricity must come from renewable sources.

"It doesn't seem achievable at this point," Gregg said. "I'm not confident we can reach that.

"Can I get myself to a place that we could ultimately do it? Yes. But again … we need to be shoulder to shoulder with the province on this."

Credit rating crash will cost up to $30M a year

Another source of friction is the credit rating downgrade triggered by the rate cap.

Nova Scotia Power says the company will pay up to $30 million more in higher interest payments annually once existing debt is refinanced.

"The NSP team made every effort to advise your government that the unprecedented interference into an independent regulatory process would result in the credit downgrade that has now happened," Gregg wrote.

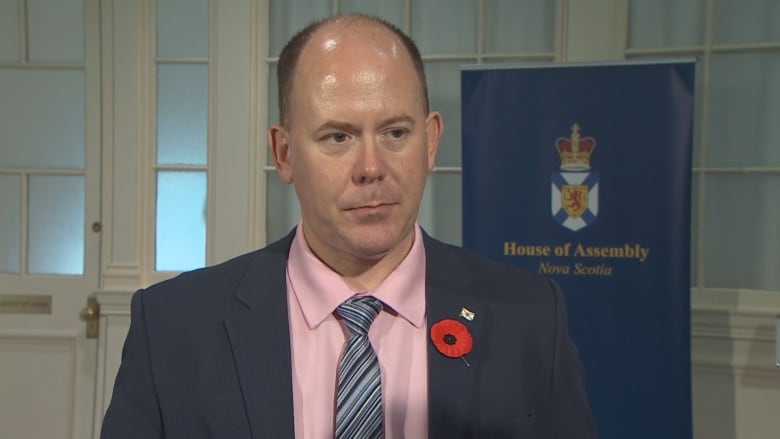

Premier

Tim Houston's office said on Friday the government will decide in the

new year if it will meet with Nova Scotia Power, reiterating that the

priority is 'protecting ratepayers.' (Robert Short/CBC)

Premier

Tim Houston's office said on Friday the government will decide in the

new year if it will meet with Nova Scotia Power, reiterating that the

priority is 'protecting ratepayers.' (Robert Short/CBC)

The province is unapologetic, saying the company can take lower profits.

Gregg called that misleading since, like every other regulated utility, profits are set by a regulator to attract money needed for capital projects. He said Nova Scotia Power has spent $3.7 billion on its electrical system in the last 12 years.

"The expectation of a reasonable return for investors is what allows for the raising of capital at the lowest possible cost," Gregg wrote.

The province has shown no interest in peace. It accused the company of greed and incompetence this week in a closing submission in the rate case.

(PDF KB)

(Text KB)CBC is not responsible for 3rd party content

PO Box 910 ◠Halifax, Nova Scotia ◠Canada ◠B3J 2W5 1 of 3 December 13, 2022 Ministers Rushton, MacMaster and Halman, On behalf of the Nova Scotia Power (NSP) team and our customers, I am requesting a meeting to discuss the very important issues facing our province. I know we have a shared commitment to doing the right thing for Nova Scotians, not only today but into the future. However, we remain deeply concerned that political intervention in the regulatory process, lack of consultation with NSP on energy and climate policy and continued comments in the media not only highlight the lack of a productive working relationship, but they also risk further exacerbating an already difficult situation. In the face of the climate crisis and the important work ahead, it’s in the best interests of Nova Scotians if we find solutions together. As you know, Bill 212 directly resulted in a strong response from capital markets and extraordinary credit downgrade for NSP, directly and indirectly imposing additional costs on NSP customers. Leading up to the passage of Bill 212, the NSP team made every effort to advise your government that the unprecedented interference into an independent regulatory process would result in the credit downgrade that has now happened. It is estimated that the downgrade will cost Nova Scotians $20-30 million annually once all existing debt is refinanced. Unfortunately, this situation is not stabilized and any further political interference continues to present additional risk and could lead to more actions from rating agencies and more unnecessary costs for customers. I’d also like to address recent comments in the media by Minister Rushton. Suggesting that NSP should simply use “profit†to cover the increased costs resulting from Bill 212 is misleading. This is not the way costs are managed in investor-owned regulated utilities. Consistent with every single regulated utility in North America, all costs are recovered in customer rates, including costs that are imposed by government actions, like those associated with Bill 212. It is important to understand that as a rate-regulated, cost of service utility, our business is appropriately held to a standard by the regulator that ensures every decision and cost is in the best interest of customers. This is unlike almost any other private company, including power developers and independent power producers in the province. Any return to shareholders is set by the regulator at a level that is considered “reasonable†with the goal to minimize costs to customers while still enabling the attraction of the capital needed for investment in the system. The capital investments we make, the costs we incur, and any profit earned are scrutinized for reasonableness by the regulator. Any return that is paid to � PO Box 910 ◠Halifax, Nova Scotia ◠Canada ◠B3J 2W5 2 of 3 shareholders is not guaranteed, it must be earned through prudent management of costs, and this is an integral part of the rate-setting process done by the regulator. The expectation of a reasonable return for investors is what allows for the raising of capital at the lowest possible cost, and this is what then enables us to invest in the system and to build a modern resilient grid that will facilitate the adoption of more renewables, increase reliability for customers, enable the closure of coal units and invest in new technologies -- all at the lowest cost for customers. Just as a steady income is required for an individual to obtain a mortgage, a predictable return is required for a utility to raise capital. Without that return, investors will not provide the capital necessary to operate and improve the system. Over the past twelve years, NSP has invested a total of $3.7 Billion of capital in the electricity system of the province. That is over $310 million invested in the system each year to benefit our customers. This is level of investment that takes place when investors have confidence in our company and in the independent regulator, and it is an amount that far exceeds the reasonable ‘profit’ set and controlled by the independent regulator. We understand that no one wants to see an increase in electricity rates but it’s a reality given the need to invest in a cleaner and more resilient energy system. It is also a reflection of the current economic conditions, where the combined impacts of high global fuel prices and inflation are driving the costs higher in all jurisdictions. The current General Rate Application before the regulator is the first in ten years. It’s a critical time at the utility and the political intervention of Bill 212 just delays needed investment and creates a “bow wave†of costs down the road for customers, meaning that in future the costs and necessary rate increases will be higher than if we tackle these challenges together now. The NSP team works incredibly hard for Nova Scotians each and every day. We’ve been executing on a strategy to build a greener energy system in NS for almost 20 years – it’s not just what we do, it’s part of our culture. While the Government’s climate plan has a lot of the right ideas, as the owners and operators of the province’s energy grid, we have an important role to play in Nova Scotia’s energy transition. This is a role that we take very seriously and it's a reality that extends beyond the issues of the day. We are concerned that there is a disconnect between what the government would like to achieve in their climate plan and Bill 212 which restricts the investments the utility can make in order to help facilitate the achievement of the goals. � PO Box 910 ◠Halifax, Nova Scotia ◠Canada ◠B3J 2W5 3 of 3 There is important and urgent work ahead for Nova Scotia. We need your government to engage with us directly in a more positive and productive way as we move forward. We want to work constructively with you and your colleagues to develop meaningful, long-term, and enduring solutions for the province. We can achieve better outcomes for customers if we work together. That’s what Nova Scotians expect of both of us. I respectfully ask that we meet as soon as possible. Yours truly, Peter Gregg President & CEO Nova Scotia Power Cc: Premier Tim Houston Deputy Minister for NRR Deputy Minister of Finance Deputy Minister of Environment and Climate Change

Nova Scotia government lashes out at Nova Scotia Power — again

Houston government doubles down on criticisms of utility in closing submission to regulators

The province used the filing to justify its imposition of a 1.8 per cent rate cap on non-fuel costs, accusing the company of gouging ratepayers while providing unreliable service.

The Nova Scotia Utility and Review Board is deciding on a proposed rate settlement reached between the company and representatives of major customer groups after the provincial government imposed the rate cap through Bill 212.

In its 19-page closing submission to the board, the Department of Natural Resources and Renewables said the company was "delinquent" in failing to adequately trim trees to keep fallen branches from taking out power lines during storms.

"The impact of NSP's failure to sufficiently invest in vegetation management was keenly felt by ratepayers following Hurricane Fiona, which struck the evening the [general rate application] hearing concluded. Thousands of Nova Scotians were left without power for days or weeks," the department said.

Nova Scotia Power has said the rate cap will leave it $70 million short of what it needs to run the utility and earn its guaranteed nine per cent rate of return.

Premier

Tim Houston has called for the Nova Scotia Utility and Review Board to

reject the settlement agreement reached between Nova Scotia Power and

customer group representatives. (Brian MacKay/CBC)

Premier

Tim Houston has called for the Nova Scotia Utility and Review Board to

reject the settlement agreement reached between Nova Scotia Power and

customer group representatives. (Brian MacKay/CBC)

The province accused the company of sacrificing ratepayers for profits.

"There is no reasonable justification to allow NSP to receive greater profits when Nova Scotians are facing significant inflationary pressures, and NSP is failing to deliver reliable service," the department said.

"During harsh economic times, it is unreasonable to impose further hardship on ratepayers to enhance corporate returns."

It also highlighted the failure of the Muskrat Falls hydro project in Labrador to deliver contracted amounts of hydro electricity, forcing Nova Scotia Power to buy higher-priced fuel to provide power.

"Ratepayers are being asked to pay for investments in failed or disappointing projects at the same time they face inflated costs for replacement fuels. Moreover, when these increased fuel costs are deferred, NSP again benefits from interest on fuel deferrals. NSP profits from poor investments at the same time ratepayers are forced to pay more for NSP's mistakes," the department said.

The department also repeated a call made by Premier Tim Houston to reject the settlement agreement reached between Nova Scotia Power and customer group representatives.

Provincial

government highlighted the failure of Muskrat Falls Generating Project

in Labrador to deliver promised hydro electricity, forcing Nova Scotia

Power to buy higher-priced fuel to provide power. (CBC)

Provincial

government highlighted the failure of Muskrat Falls Generating Project

in Labrador to deliver promised hydro electricity, forcing Nova Scotia

Power to buy higher-priced fuel to provide power. (CBC)

"The terms of the settlement agreement increase rates and contravene the purpose, spirit, and intent of Bill 212."

In her closing submission lawyer Nancy Rubin, representing large industrial customers, said the settlement accommodates the material impact of Bill 212 and "is reasonable, fair, equitable and in the best interest of ratepayers."

Limitations

Consumer advocate Bill Mahody said the deal imposes limits on some items Nova Scotia Power was seeking.

A proposed storm rider to pay for extreme weather was given a three-year term, turning it into a trial period. And a proposed decarbonization deferral account is limited to writing off Nova Scotia Power's fossil fuel plants.

"The Settlement Agreement represents the outcome of discussions among the vast majority of active participants in this matter, and it has the support of all ratepayer advocates," Mahody said in his submission.

"Further, the Settlement Agreement is comprehensive, addressing virtually all of the matters in contention before the Board."

CBC's Journalistic Standards and Practices

Critic of 'overly generous' Nova Scotia Power profits worried about rate cap

'I don't think anybody anticipated that the province would impose a restriction like this,' says business prof

"I don't think anybody anticipated that the province would impose a restriction like this," says University of Toronto business professor Laurence Booth.

"I was shocked."

Booth provided expert testimony for the Nova Scotia Utility and Review Board during regulatory hearings into Nova Scotia Power's application for higher rates in September — before the province imposed a 1.8 per cent rate cap on non-fuel costs.

The province said it was acting to protect ratepayers.

Legislation also limited Nova Scotia Power profits and required revenue generated by the 1.8 per cent increase be spent only on strengthening the electrical grid. The province suggested the company eat extra costs not covered in rates by lowering its profits.

A critic of overly generous profits

"I do sympathize with the provincial government," Booth said.

Booth said Canadian utilities have long reaped overly generous returns for too little risk — a criticism he levelled at Nova Scotia Power in testimony during the rate application.

But Booth says political intervention like this is "a repeated problem" in the United States and rare in Canada, where utilities recover their costs in return for slightly lower rates of return.

Laurence Booth is a business professor at the University of Toronto. (CBC)

Laurence Booth is a business professor at the University of Toronto. (CBC)

"I think in many cases that's a little bit generous, but that's the regulatory compact."

Booth says the province stepped on an independent regulator doing its job, sorting through a very expensive transition away from fossil fuels mandated by federal and provincial governments.

Nova Scotia Power is entitled to recover the cost of the coal-fired plants built to generate electricity and the renewable energy sources required by governments.

Credit rating shot

"The result is electricity users in Nova Scotia are going to be paying twice, once for the coal plants that are no longer used and useful, and again for alternative production," Booth said.

"Nova Scotia Power has got legitimate grief here and the board is stuck between a rock and a hard place, trying to implement policy in a reasonable way consistent with what every other regulatory board in Canada has done and they've just been sideswiped."

The rate cap triggered a credit rating downgrade, shutting Nova Scotia Power out of the commercial paper market — basically an IOU issued by corporations with excellent credit ratings — to cover short-term spending.

Its long-term credit is now one notch above junk bond status.

"What I fear is that the rating agencies like Dominion Bond Rating Services and Standard & Poor's, they're going to say, well, perhaps Canada isn't the safe, conservative regulatory environment that we thought it was, and they'll revise their opinion not just for Nova Scotia, but for every other utility in Canada," he said.

After the province imposed its rate cap, Nova Scotia Power and lawyers representing its major customer groups and some advocacy groups reached a settlement that would see rates increase by 14 per cent over two years which includes higher fuel costs incurred by the utility.

Deadline Wednesday for final submissions in rate case

Nova Scotia Power insists the settlement adheres to the rate cap.

The proposed rate is currently before the Nova Scotia Utility and Review Board.

The deadline for final submissions is Wednesday.

Premier Tim Houston has called on regulators to reject the proposed increase, but has not said what the government will do if regulators accept the settlement.

CBC's Journalistic Standards and Practices

https://www.cbc.ca/news/canada/nova-scotia/nova-scotia-power-credit-rating-woes-continue-1.6679629

Nova Scotia Power credit rating woes continue

Source of short-term financing cut off by credit rating downgrade, company says

Last month, rating agency S&P Global dropped the utility's credit rating to just above junk bond status and downgraded another credit category, known as Canadian commercial paper, which provides short-term financing to businesses and government agencies.

The downgrade was in response to Bill 212, passed by the Progressive Conservative government in November, that limits electricity rate increases to 1.8 per cent for everything other fuel and energy efficiency program costs.

Increased revenue must be dedicated to strengthening the electrical grid and profits are also capped by the law. It was imposed in the midst of rate hearings held by the Nova Scotia Utility and Review Board (UARB).

S&P saw the "unprecedented political intervention as significantly detrimental to NSPI's credit quality because it impairs the regulator's ability to act independently to protect the utility's credit quality, undermining the regulatory construct and the utility's cash flow predictability."

Nova Scotia Power says "for the first time in the company's history," it has now been excluded from the commercial paper market. That market deals in unsecured debt issued by a company for short-term costs like payroll or accounts payable.

"NS Power is currently in the process of attempting to regain access to the commercial paper market," the company said in evidence filed this week with the UARB.

"However, if the company is unsuccessful, this will make short-term borrowing more expensive for NS Power as access to the commercial paper market has saved customers significant financing costs as compared to traditional loans and revolving credit lines."

Greg Blunden, chief financial officer of parent company Emera, says Nova Scotia Power usually has about $400 million in short-term borrowing which now costs one per cent or more in higher interest.

He said that would be between $3 million and $4 million "of incremental interest expense that we would pay that we otherwise would not have paid."

Nova Scotia Power also told regulators it is on the precipice of losing its investment-grade credit rating.

Province unmoved

"A loss of investment grade credit rating status would have a significant and dramatic impact on Nova Scotia Power's ability to access capital and the associated borrowing costs to be borne by customers."

Blunden said the downgrade comes as no surprise.

"Investors are nervous, they're uncomfortable," he said. "They see this as unprecedented in North America in our sector and as a result of that are really challenging us and asking themselves whether or not they should move their capital to other jurisdictions and I think we're seeing that."

The province is aware, but unmoved by the consequences for Nova Scotia Power's credit rating downgrade.

"I do understand that our legislation has put Nova Scotia Power into that position," acknowledged Minister of Natural Resources and Renewables Tory Rushton on Thursday. "Nova Scotia Power has made more than $125 million profit for the last 12 years, every year. Every other company right now, with the times that we're in, has had to make changes. I expect Nova Scotia Power to be no different."

Protecting ratepayers

Rushton repeated the talking point he has used, along with Premier Tim Houston, since the rate cap was introduced: the government is acting to protect ratepayers.

Even with the rate cap, Nova Scotia Power and its customer groups have agreed to a 14 per cent rate increase over two years, which must be approved by the UARB.

Houston has written to the regulator, urging the UARB to reject the settlement.

Despite the lower value of Nova Scotia Power, Blunden says Emera has no intention of unloading it.

"We're not going to sell Nova Scotia Power," he said.

"It's our home. We care very much about the business. We care very much about our customers. We're committed to Nova Scotia."

CBC's Journalistic Standards and PracticesPremier calls on regulators to reject 14% electricity rate hike agreement

'I do not believe, based on what I know, that the proposed agreement is in the best interest of ratepayers'

Nova Scotia Premier Tim Houston is calling on provincial regulators to reject a settlement agreement between Nova Scotia Power and customer groups that would see electricity rates rise by nearly 14 per cent over the next two years.

"It is our shared responsibility to protect ratepayers and I can't state strongly enough how concerned I am that the agreement before you does not do that," Houston wrote in a letter to the Nova Scotia Utility and Review Board late Monday.

Houston urged the three-member panel to "set the agreement aside and reach its own conclusion on the aforementioned application."

"I do not believe, based on what I know, that the proposed agreement is in the best interest of ratepayers," he said.

The letter does not spell out what his Progressive Conservative government would do if the board accepts the settlement reached last week between Nova Scotia Power and lawyers representing residential, small business and large industrial customer classes.

Other groups also endorsed the deal, although Nova Scotia Power's biggest customer — Port Hawkesbury Paper — did not sign on.

'We're protecting the ratepayers'

Natural Resources Minister Tory Rushton said the province was not part of the negotiations leading up to the settlement.

"As a government or department we had no intel on those conversations that were taking place," he said Tuesday. "So, we saw the information the same as the public did late last week, and right now we're protecting the ratepayers of Nova Scotia. We want to make sure that that voice is still heard at the UARB level."

Tory Rushton is Nova Scotia's minister of natural resources and renewables. (Robert Short/CBC)

Tory Rushton is Nova Scotia's minister of natural resources and renewables. (Robert Short/CBC)

Rushton said he didn't want to presuppose what the UARB will say.

"But I think the premier's been very loud and clear and I believe I have been, too. The ratepayers are at the top of our mind. We have different tools at our [disposal] and we'll certainly do what we can and need to [do] to protect those ratepayers."

The settlement agreement

If approved by regulators, rates would rise by 6.9 per cent in 2023 and 6.9 per cent in 2024 — almost the same amount on the table when hearings before the review board ended in September.

The Houston government later intervened with legislation, known as Bill 212, that capped rates to cover non-fuel costs by 1.8 per cent. It did not cap rates to cover fuel costs or energy efficiency programs.

Nova Scotia Power president Peter Gregg addresses the legislature's law amendments committee in October. (Michael Gorman/CBC)

In a statement announcing the agreement, Nova Scotia Power president Peter Gregg claimed the settlement adhered "to the direction provided by the provincial government through Bill 212."

Consumer advocate Bill Mahody, representing residential customers, told CBC News the proposed 13.8 per cent increase was "a reasonable rate increase given the revenue requirement that was testified to at the hearing."

Settlement 'remarkably' similar to NSP application

The premier disagrees, noting that the settlement and rate application that triggered the rate cap are "remarkably consistent."

He objects to the increased amount of fuel costs rolled into rates next year before the annual true up of actual fuel costs, which are automatically passed on to ratepayers.

"If Nova Scotia Power is effectively paid in advance, what motive do they have to hedge and mitigate the adjustment eventually required," Houston asked in his letter.

He also objected to the inclusion of a storm rider in rates to cover extreme weather, which he said pushed the risk of climate change on to ratepayers.

Premier second-guesses Muskrat Falls approval

Houston also second-guessed the board for approving Nova Scotia Power's participation in the Muskrat Falls hydro project in Labrador.

"The fact that Nova Scotians have paid over $500 million for this project with minimal benefit, and no one has been held accountable, is wrong," he said. "It was this board of the day that approved the contracts and entered the final project into rates."

These

steel towers support the 1,100-kilometre Labrador-Island transmission

line from Muskrat Falls to Soldiers Pond on Newfoundland's Avalon

Peninsula. (Terry Roberts/CBC)

Ratepayers are committed to paying $1.7 billion for the Maritime Link to bring the green source of electricity into the province.

Although the Maritime Link was built on time and on budget by an affiliated company, only a fraction of Muskrat Falls hydro has been delivered because of ongoing problems in Newfoundland.

"I find it remarkable that those contracts did not include different risk sharing mechanisms; they should have had provisions for issues in oversight of project management. Nevertheless, it was approved, and is causing significant harm to ratepayers in the form of increased rates."

Houston notes that because of non-delivery from Muskrat Falls, Nova Scotia Power has been forced to buy much more expensive coal to burn to generate electricity.

Opposition reaction

Opposition parties in Nova Scotia reacted to Houston's letter.

NDP Leader Claudia Chender dismissed it as bluster.

"It exposes his Bill 212 as not really helping Nova Scotians in the way that he said it would," she said. "Nothing in the settlement agreement contravenes that bill. But it seems that he's upset that he's been found out. And so here we are with another intervention in an independent regulatory body."

Liberal Leader Zach Churchill said the government should intervene to help ratepayers directly.

"We just think that it makes more sense to do that directly by supporting ratepayers through heating assistance, rebate programs and expanding the eligibility for that or to provide funding directly to ratepayers instead of intervening in the energy market in this way," he said.

The premier's office said that no one was available when asked about an interview on Tuesday.

"The letter speaks for itself," the office responded.

Nova Scotia Power issued a statement Tuesday. It did not directly address Houston's claims.

"The settlement agreement is now with the NS Utility and Review Board," the utility said.

"The UARB process is designed to ensure customers are represented with strong advocates and independent oversight. The UARB will determine whether the settlement results in just and reasonable rates and is in the public interest."

(PDF KB)

(Text KB)CBC is not responsible for 3rd party content

Mr. Stephen McGrath, Chair Utility and Review Board 1601 Lower Water Street Halifax, Nova Scotia B3J 3P6 November 28, 2022 Dear Mr. McGrath, I recently became aware of a proposed settlement with respect to matter number: M10431. I have been taken aback by what I have seen and, rest assured, the Province of Nova Scotia will make its full position clear in its closing statement, however, given the urgency of the situation and high degree of public concern and interest, I felt it important to share my thoughts with you immediately. I do not believe, based on what I know, that the proposed agreement is in the best interest of ratepayers. As such, on behalf of the Province of Nova Scotia, I would respectfully ask that the UARB set the agreement aside and reach its own conclusion on the aforementioned application. It is so critically important that a key missing voice is heard, and that is the voice of Nova Scotians and those focused only on protecting the ratepayers. I see standing up for Nova Scotians as my responsibility as Premier. The UARB mandate places a similar obligation on you: “The Board’s role is to ensure customers receive safe and reliable service at just and reasonable rates.†It is our shared responsibility to protect ratepayers and I can’t state strongly enough how concerned I am that the agreement before you does not do that. Below, I will raise some of the basic concerns we identified from our initial review of the settlement proposal. My comments are based on my understanding that the proposed settlement would see Nova Scotia Power receive a rate increase (including fuel costs) of at least 6.9% in 2023 and another 6.9% in 2024, totalling 13.8%. Incidentally, this increase is remarkably consistent with the 13.7% rate increase Nova Scotia Power was originally seeking in this GRA, before the Legislature unanimously passed Bill 212, limiting the non-fuel rate increase to no more than 1.8% over 2023- 2024. I understand that Nova Scotia Power would argue the differences between their new 13.8% increase and the initial 13.7% but find it interesting that the numbers are essentially the same.� 2 Specifically, the proposed 13.8% increase, appears to be made up as follows: ◠Non-Fuel Rate increase allowed under Bill 212: 1.8% ◠Fuel Cost increases: 8.1% ◠Additional rate increase labeled as “DSM Rider:†3.9% Impacts on ratepayer groups vary, with the residential sector to face a 13.8% impact; large industrials at 9.7%; and small business hit hardest at more than approximately 16%, but in overall cash terms, this would be an increase to ratepayers of approximately $220 million per annum by 2024. We have observations, questions and concerns with respect to the following sections of the proposed settlement: Fuel Costs It is important to keep in mind that the additional fuel costs falling to ratepayers are largely due to the rising cost of coal and gas required to replace the undelivered Maritime Link/Labrador Island Link (LIL) energy. To begin to achieve this, Nova Scotia Power proposes that an extra 8.1% in fuel costs should be added to rates, in increments of 1.5% in 2023 and 6.6% in 2024. Beyond the 8.1%, an additional $200 million in fuel costs is proposed to be deferred to 2024, with the AA/BA process adding these costs in for 2024 and for 2025. Under the proposed agreement, these future rate increases will occur on top of Nova Scotia Power’s proposed 13.8% stated rate increase. I have the following concerns with the fuel aspect of the proposed agreement. 1. The fuel adjustment mechanism is meant to be an adjustment. If Nova Scotia Power is effectively paid in advance, what motive do they have to hedge and mitigate the adjustment eventually required? 2. Bearing in mind that the failures of Muskrat Falls are driving the need to purchase more fuel at record high prices, wouldn't prepaying the adjustment essentially reward Nova Scotia Power and further punish ratepayers for the issues related to the management of the Muskrat Falls project? 3. While the need to smooth spiking global coal prices through fuel deferrals is both understandable and necessary, Nova Scotia Power’s proposal effectively ignores the newly legislated Bank of Canada interest rate plus 1.75%, setting it instead at Nova Scotia Power’s weighted average cost of capital. This enables Nova Scotia Power to earn a return on equity (profit), and effectively turn this fuel deferral into a whole new asset. It has not been adequately demonstrated why this is in the best interests of Nova Scotia’s ratepayers. I worry that allowing not only a recovery of the adjustment but also an additional ability to earn an outsized “investment return†on it seems unfair and will likely do nothing to encourage efforts to mitigate the adjustment� 3 Non-Fuel Costs The 1.8% legislated non-fuel rate cap appears to be used in its entirety in 2023. This was not the intent of the legislation under any reasonable, fair interpretation. In addition, it appears that another 3.9% rate increase is proposed under the clause for “increased DSM costs.†Since Nova Scotians can reduce their bills through greater efficiency and DSM activity, the Government included in Bill 212 a clause to permit new increases in DSM to be added to rates. However, Nova Scotia Power’s proposal not only includes these new increases in DSM costs (less than 1%) in rates, but proposes to increase rates by an extra 3%, for increases in DSM since 2014, despite this amount having been included in the bills Nova Scotians have paid for almost a decade. This clearly circumvents the intention of Bill 212, as rates have already incorporated approximately $40 million in DSM costs. It seems these extra funds would effectively flow as a $40 million annual increase in the profits of Nova Scotia Power. Customer Charges It appears that some of the 1.8% non-fuel side increase will also be charged as an increase in the fixed monthly Customer Charge (rising from $10.83 to $19.17/month for the residential class), imposed on all, rather than charged out as a cost in the $/kwh rate. While recovering the same amount of revenue from ratepayers, this fixed charge will hit families with a small monthly bill harder, notably renters. These fixed monthly bill increases will also be damaging to those lowering their bills through solar or efficiency. From my reading, this means that every residential customer automatically has an increase on their monthly bill from $10.83 today to $19.17, for an immediate monthly increase of at least $8.34. Therefore, if you formerly had a monthly bill of $50, it would now rise by $8.34, plus the 8.1% (fuel) hike plus 3.9% (DSM), for a total new bill of roughly $63. For this home, that means a total rate increase of more than 25%. This is unacceptable. Further Rate Pressures The settlement contains a storm rider, where Nova Scotia Power is able to recover costs above $10.4 million/year for Level 3 and 4 storms in the years 2023-25. As a result, a major storm could raise rates by another 2%. This storm rider does not encourage proper maintenance of the distribution grid and seems to allow Nova Scotia power to push climate change risk onto ratepayers, with the result that it could continue to underperform, without taking accountability.� 4 The agreement also ignores the intent of the amendments to the Act under Bill 212, where the 1.8% rate increase was to be committed to much needed reliability improvements for Nova Scotians, and it provides no information on what reliability investments will be made to justify this increase. In addition, the proposed decarbonization deferral account would absorb undepreciated coal/thermal assets and enable Nova Scotia Power to earn its return on equity on the full amount of assets added to this account, creating another possible increase in rates. Returns to NSP The parties agreed to a 9.0% return on equity for rate-setting purposes, which is 0.25% less than the maximum allowed by legislation. However, Nova Scotia Power will actually be allowed to earn up to the maximum allowed by legislation (9.25%). My reading of this settlement would suggest that Nova Scotia Power has opened multiple avenues to greater earnings: the 3% rate hike from past DSM; equity returns on deferred fuel costs; increased fixed customer charges; and the storm rider. Intent of Legislation The entire purpose of Bill 212 was to protect Nova Scotians. On early review, it appears the intent of this agreement is to circumvent this legislation. Mandate of UARB Having laid all of this out, I am once again reminded of the mandate of the UARB. It is one we have in common: Protect Nova Scotians. I believe the above-noted points demonstrate that this proposed agreement does not protect Nova Scotians. It is likely to harm them, particularly those lower income Nova Scotians and small businesses. It is incumbent upon me to raise these concerns with you as I know government’s in the past have not expressed those concerns when they perhaps should have. The Muskrat Falls project comes to mind. The fact that Nova Scotians have paid over $500 million for this project with minimal benefit, and no one has been held accountable, is wrong. It was this Board of the day that approved the contracts and entered the final project into rates. I find it remarkable that those contracts did not include different risk sharing mechanisms; they should have had provisions for issues in oversight of project management. Nevertheless, it was approved, and is causing significant harm to ratepayers in the form of increased rates. I would ask whom the Board feels should be held responsible for this mess and while it appears that they didn’t adequately protect Nova Scotians with foresight in thought, will they step up to protect ratepayers now?� 5 As you are aware, because we are not realizing the benefits of this project, Nova Scotia Power is forced to buy much more coal than was forecast, and at a time when coal is six times its previous market price. If there was proper oversight, it wouldn’t have come to this; and at the very least, with the expertise involved of all parties, there should have been foresight to hedge on coal. We should be holding a microscope to ensure Nova Scotia Power is doing everything they can to mitigate fuel prices. I would encourage you to heed that suggestion. We respectfully ask that you set aside this agreement and proceed with your deliberations. Yours truly, Hon. Tim Houston Premier of Nova Scotia Cc: Blake Williams, Nova Scotia Power Bill Mahody, Consumer Advocate Nelson Blackburn, Small Business Advocate Nancy Rubin, Industrial Group and Dalhousie University Maggy Burns, Ecology Action Centre Brian Gifford, Affordable Energy Coalition James MacDuff, Municipal Electric Utilities

Nov 25, 2022

This news release constitutes a

“designated news release” for the purposes of Emera’s prospectus

supplement dated August 12, 2021 to its short form base shelf prospectus

dated August 5, 2021

HALIFAX, Nova Scotia –Emera Inc.

(TSX: EMA) and its wholly-owned subsidiary Nova Scotia Power (NS Power)

announced today that NS Power has filed a proposed settlement agreement

for its 2022-2024 General Rate Application (GRA) with the Nova Scotia

Utility and Review Board (UARB). The settlement, which addresses both

fuel and non-fuel rates, was reached between NS Power and key customer

representatives, including Nova Scotia’s Consumer Advocate, the Small

Business Advocate, large customers represented by the Industrial Group,

municipal utilities, Dalhousie University as well as advocates for the

environment and low-income customers.

If approved by the

UARB, the settlement will implement Bill 212, the provincially

legislated cap on non-fuel rates for 2023 and 2024. The agreement

addresses the recovery of fuel costs over the settlement period and

would also establish a Demand Side Management (DSM) rider. Combined,

these amounts would result in rate increases of 6.9% each year for 2023

and 2024. In addition, any under or over recovery of fuel costs would be

addressed through the UARB’s established Fuel Adjustment Mechanism

(FAM) process.

“Reaching this settlement is a remarkable

demonstration of stakeholders’ and customer representatives’ commitment

to working together to reach constructive solutions for customers,” says

Peter Gregg, President and CEO of NS Power. “Working within the

constraints of Bill 212, this settlement addresses all outstanding items

of the GRA, and provides important price predictability for customers

at this time of high inflation and broad economic challenge.”

Other

elements of NS Power’s GRA addressed in the settlement include

agreement on a storm rider for the years 2023-2025, providing clarity

around the recovery of costs for major storms and extreme weather events

in future. It also establishes an equity thickness of 40 per cent for

rate-making purposes and will result in $137 million in forecasted

incremental non-fuel revenues over the settlement period, compared to

$240 million filed within the GRA. A full copy of the proposed

settlement agreement can be found at www.uarb.ca or www.nspower.ca/rateapplication.

“This

is a positive step forward,” said Scott Balfour, President and CEO,

Emera Inc. “Achieving successful and balanced regulatory outcomes within

strong regulatory compacts is critical to our ability to deliver first

and foremost to our customers, but to all other stakeholders as well.”

Today’s

agreement is the latest in a series of regulatory settlements across

Emera’s portfolio that demonstrate the strength of Emera’s teams and

strategy as well as Emera’s ability to work collaboratively with

stakeholders to reach outcomes that are in the best interest of

customers. In the last 24 months, New Mexico Gas, Tampa Electric and

Peoples Gas have also concluded important rate cases through settlement

agreements with customer representatives.

—30—

Forward Looking Information

This

news release contains forward-looking information within the meaning of

applicable securities laws. By its nature, forward-looking information

requires Emera and NS Power to make assumptions and is subject to

inherent risks and uncertainties. These statements reflect Emera

management’s and NS Power management’s current beliefs and are based on

information currently available to Emera management and to NS Power

management. There is a risk that predictions, forecasts, conclusions and

projections that constitute forward-looking information will not prove

to be accurate, that Emera’s and NS Power’s assumptions may not be

correct and that actual results may differ materially from such

forward-looking information. Additional detailed information about these

assumptions, risks and uncertainties is included in Emera’s and NS

Power’s securities regulatory filings, including under the heading

“Enterprise Risk and Risk Management” in Emera’s and in NS Power’s

annual Management’s Discussion and Analysis, and under the heading

“Principal Financial Risks and Uncertainties” in the notes to Emera’s

and to NS Power’s annual and interim financial statements, which can be

found on SEDAR at www.sedar.com.

About Emera Inc.

Emera

Inc. is a geographically diverse energy and services company

headquartered in Halifax, Nova Scotia, with approximately $40 billion in

assets and 2021 revenues of more than $5.7 billion. The company

primarily invests in regulated electricity generation and electricity

and gas transmission and distribution with a strategic focus on

transformation from high carbon to low carbon energy sources. Emera has

investments in Canada, the United States and in three Caribbean

countries. Emera’s common and preferred shares are listed on the Toronto

Stock Exchange and trade respectively under the symbol EMA, EMA.PR.A,

EMA.PR.B, EMA.PR.C, EMA.PR.E, EMA.PR.F, EMA.PR.H, EMA.PR.J and EMA.PR.L.

Depositary receipts representing common shares of Emera are listed on

the Barbados Stock Exchange under the symbol EMABDR and on The Bahamas

International Securities Exchange under the symbol EMAB. Additional

information can be accessed at www.emera.com or at www.sedar.com.

About Nova Scotia Power

Nova

Scotia Power Inc. is a wholly-owned subsidiary of Emera Inc. (TSX-EMA),

a diversified energy and services company. Nova Scotia Power provides

95% of the generation, transmission and distribution of electrical power

to approximately 540,000 residential, commercial and industrial

customers across Nova Scotia. The company is focused on new technologies

to enhance customer service and reliability, reduce emissions and add

renewable energy. Nova Scotia Power has over 2000 employees and $4.5

billion in operating assets. Learn more at www.nspower.ca.

Media:

Dina Seely

Emera Inc.

902-428-6951

media@emera.com

Jackie Foster

Nova Scotia Power

(902) 225-4735

Rates could rise 14% over 2 years under settlement between Nova Scotia Power, customers

Settlement still needs to be approved by the Nova Scotia Utility and Review Board

If approved by regulators, rates would rise by 6.9 per cent in 2023 and 6.9 per cent in 2024 — the same amount on the table when hearings before the Nova Scotia Utility and Review Board (UARB) ended in September.

The settlement now goes to the UARB for approval.

"It'll be over to the board to determine whether or not the settlement itself is in the public interest, and everyone who participated in the hearing will have an opportunity to make representations on that point," said consumer advocate Bill Mahody, who represents Nova Scotia Power residential customers before regulators.

The agreement announced Thursday night takes into account the 1.8 per cent cap on non-fuel costs imposed through Bill 212 by the province's Progressive Conservative government after the hearings.

That legislation does not limit fuel adjustment costs, which Nova Scotia power was seeking for the next two years to cover the rising price of oil, gas and coal used to generate electricity. The utility had warned that adjustment could boost residential rates between 9.6 and 12 per cent.

The new agreed-on increase covers those fuel costs and includes increased spending on energy efficiency programs, which the province has also allowed.

Lawyers representing residential, small businesses and large industrial customers signed on to the settlement. As did the Ecology Action Centre and the Affordable Energy Coalition.

"The 6.9 per cent in the circumstances represents a reasonable rate increase given the revenue requirement that was testified to at the hearing," said Mahody.

Province not part of negotiations

The province did not participate in the negotiations.

In a statement Thursday night, the Department of Natural Resources and Renewables said it was unaware of the specific details and will have to review the terms of the agreement.

"We put legislation in to protect ratepayers, and we will continue to protect them. Anything that results in higher rates and potentially circumvents the purpose of our legislation will certainly require a close look," the department said.

In a news release, Nova Scotia Power president Peter Gregg said "we appreciate the collaboration of customer representatives to reach the proposed settlement filed today, as we adhere to the direction provided by the provincial government through Bill 212."

"There's no question this is a hard time for Nova Scotians and great attention must be paid to the current concerns over the rising cost of living, while also ensuring we maintain the most basic needs for a reliable electrical system," Gregg said.

Nova Scotia Power has withdrawn a proposed "earning sharing mechanism" that would have given the company half of excess profits earned above its approved rate of return, which is nine per cent.

Rate cap legislation

In accordance with the province's rate cap legislation, the rate of return has been capped at 9.25 per cent. The company had asked for a maximum of 9.5 per cent.

The settlement allows for a storm rider — or additional charge — on bills to pay for extreme weather, but the rider now ends in three years.

A so-called decarbonization account has been limited to writing off the cost of retiring coal plants pending further consultation with customer groups.

The elephant in the room that remains for ratepayers is fuel costs.

Rates in the settlement agreement do cover the outstanding fuel bill — estimated at $516 million in 2023 and 2024.

The settlement confirms that Nova Scotia Power will apply next year to begin to recover those costs, with an expectation that recovery will be spread out over time.

The settlement comes in the same week Nova Scotia Power had its credit rating cut two notches by S&P Global.

The rating agency blamed the rate cap, which it said was an act of unprecedented political interference in a regulated utility.

CBC's Journalistic Standards and Practices

Premier says he won't back down after Nova Scotia Power credit rating downgraded

NDP leader worries higher borrowing costs will be passed on to consumers

The utility's parent company, Emera, warned a weaker credit rating will lead to increased costs to borrow money. It said that could ultimately result in higher prices for customers.

Rating agency S&P Global announced the downgrade on Monday, citing the province's move to limit power-rate increases to 1.8 per cent this year and next.

The agency said the cap will increase the utility's business risks.

Houston shrugged off such concerns.

"I'm not in the business of managing their relationships with their stakeholders," he said. "They can do that. They are highly paid executives, they have a lot of stakeholders and they should manage those relationships."

The premier said Nova Scotia imposed the cap to protect people from high utility rates. (Andrew Vaughan/The Canadian Press)

The premier said Nova Scotia imposed the cap to protect people from high utility rates. (Andrew Vaughan/The Canadian Press)

Houston said the province imposed the cap to protect people from "very high utility rates."

Earlier this year, the company had applied for a nearly 14 per cent rate hike over two years.

"There is a very concerted effort by Nova Scotia Power and Emera to frighten people to try to get the government to back down and I will be very clear we are not backing down on this," Houston said. "My only obligation is to the ratepayers of the province."

'It's going to cost us more'

However, opposition politicians said the fact Nova Scotia Power now has the lowest corporate investment grade in North America is a concern for ratepayers.

"Once again the Houston government didn't do their homework," said Kelly Regan, Liberal MLA for Bedford-Birch Cove. "We really would have preferred they would have sat down with Nova Scotia Power."

New Democratic Party Leader Claudia Chender said ideas her party has presented to change the way Nova Scotia Power operates have been ignored.

"Our power bills are still going to skyrocket because Nova Scotia Power passes through a lot of their costs," Chender said. "If it costs the company more, it's going to cost us more."

Houston said his government is simply standing with ratepayers and has made sure a double-digit power rate increase will not happen for the next two years.

Cap on electricity prices drives down Nova Scotia Power's credit rating

S&P Global says new law hurts Nova Scotia Power's ability to operate

S&P Global says the business risks facing Nova Scotia Power Inc. increased significantly with passage of Bill 212, which capped rates, profits and spending in the midst of a rate hearing by the Nova Scotia Utility and Review Board.

"We expect that utilities operate under a regulatory construct that is sufficiently insulated from political intervention to protect their credit risk profile, even during periods of economic stress," S&P Global said in the Nov. 21 credit report.

"We believe NSPI's ability to operate at a consistent financial level, in-line with that of its peers, has declined."

The rating agency downgraded Nova Scotia Power by two notches to BBB minus — the lowest corporate investment grade in North America.

That weaker credit rating will push up the cost of borrowing, said Greg Blunden, chief financial officer of Nova Scotia Power parent company Emera.

Customers will eventually pay, says CFO

"The implications for Nova Scotia Power — and then ultimately our customers — is every time we go to the market to raise money, whether that's for new capital investments or to refinance existing bonds, it's going to come at a significantly higher price than it otherwise would have," Blunden said.

"And those costs are going to be costs that are ultimately going to be borne by our customers over the next number of decades," he said.

Higher interest costs will not be passed onto ratepayers during the rate cap, which limits non-fuel related increases to 1.8 per cent in 2023 and 2024, excluding some energy efficiency measures.

Increased revenue must be dedicated to strengthening the electrical grid, according to the law.