Holt says 'surprise' federal tax holiday could cost province $62M

Federal minister says government will work with provinces affected

Premier Susan Holt says the federal tax holiday on some goods announced Thursday could cost New Brunswick $62 million in revenue.

"We're trying to figure out what this means," Holt said on Information Morning Fredericton on Friday.

The development came a week after New Brunswick released an update forecasting a deficit of $92.1 million for the 2024-25 fiscal year.

Prime Minister Justin Trudeau announced a two-month tax holiday on a list of goods Thursday that would run from Dec. 14 to Feb. 15, 2025.

"That was a surprise," Holt said about the announcement made with about a day's notice.

New Brunswick is one of five provinces with a harmonized sales tax, a combination of a federal and provincial tax on goods and services. The federal government collects the revenue and sends the provincial portion to the province.

On Thursday, a spokesperson for Finance Minister Chrystia Freeland said that if the tax-break plan goes ahead, the entire HST would be removed.

Prime

Minister Justin Trudeau and Deputy Prime Minister Chrystia Freeland

visit Vince’s Market, a grocery store in Sharon, Ont., on Nov. 21. (Chris Young/Canadian Press)

Holt said the lost tax revenue can't be made up through finding "efficiencies" in the budget.

She said New Brunswick will be talking to the federal government about how it will offset the cost.

"We can't take a $62-million unexpected hit to our budget," Holt said. "So I'm optimistic that the federal government will help keep us whole."

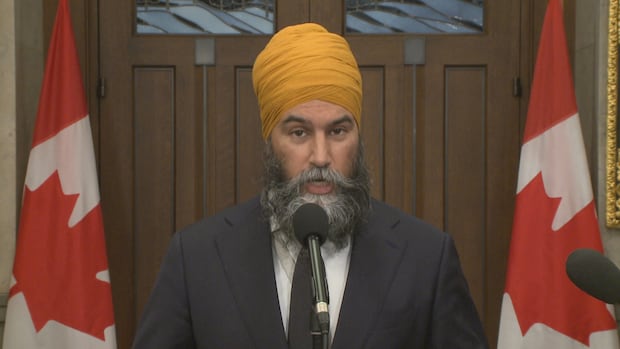

Dominic LeBlanc, the federal intergovernmental affairs and public safety minister, speaking with Radio-Canada on Friday. (Patrick Lacelle/Radio-Canada)

Dominic LeBlanc, the federal intergovernmental affairs and public safety minister, speaking with Radio-Canada on Friday. (Patrick Lacelle/Radio-Canada)

Dominic LeBlanc, the federal intergovernmental affairs minister and Beauséjour MP, told Radio-Canada's La matinale radio program on Friday that he realizes it's complicated for provincial budgets.

LeBlanc said the federal government will work with provinces on the issue.

The potential loss in tax revenue comes as a new government has pledged to implement several multimillion-dollar programs.

Retention pay for nurses is expected to cost $74 million, some of which Holt has said was already budgeted. A planned 10 per cent rebate on power bills will cost another $90 million, she said.

The tax revenue loss, and the spending promises, were raised in the legislature Friday.

"So now we have a government that's said we're going to keep all of our commitments, and we're going to balance the books," Opposition Leader Glen Savoie said. "So what is going to have to remove in order to live up to that commitment?"

He later asked if Holt would abandon the promised power rebate.

"We made a commitment to New Brunswickers and they elected our team in record numbers," Holt said in response.

With files from Information Morning Fredericton and Radio-Canada

"Representatives of two provincial governments with HSTs spoke to CBC News on the condition that neither they nor their provinces be identified because of the sensitivity of the issue.

Newfoundland and Labrador Premier Andrew Furey endorsed the federal plan for the "tax vacation" out of the gates.

Furey, who is one of just two Liberal premiers in the country, said on the social media platform X he welcomed the proposal to remove the HST from many goods and services for two months."

Reply to David Amos

Provinces always work with the feds.

David Amos

Reply to Peter Hill

Pass the popcorn

Peter Hill

Reply to David Amos

They all signed onto daycare.

David Amos

Reply to Peter Hill

I don't care even my grandkids are too old for that

Reply to David Amos

So you agree the provinces support federal programs. Thanks.

David Amos

Reply to Peter Hill

I never said that However who are the feds to decide to not collect our sales tax?

Newfoundland and Labrador Premier Andrew Furey endorsed the federal plan for the "tax vacation" out of the gates.

Furey, who is one of just two Liberal premiers in the country, said on the social media platform X he welcomed the proposal to remove the HST from many goods and services for two months."

Peter Hill

All of a sudden axing taxes is wrong.

Dave Sellers

Reply to Peter Hill

When you are $1.7 trillion in debt..it could be considered questionable..

Peter Hill

Reply to Dave Sellers

So the last government cutting the gst was the wrong thing to do.

David Amos

Reply to Peter Hill

When its done wrong its wrong

Dave Sellers

Reply to Peter Hill

Stay on track Pete..we are talking about the present government.

Peter Hill

Reply to David Amos

Yes, permanent cut which created a structural deficit was the worst way to do it. Agreed.

John Hoagie

Content Deactivated

Reply to Peter Hill

But, but, but Harper.

Peter Hill

Reply to Dave Sellers

Yes, I agree they’re doing it right and the last government did it wrong.

Eric Hamilton

Reply to Peter Hill

When you have debt and yearly deficits it is always wrong to cut revenue unless you think you can capture more market share and make up the cuts with increased sales.

Peter Hill

Reply to Eric Hamilton

Yup, it’s only okay when conservatives do it.

Eric Hamilton

Reply to Peter Hill

Did I stutter or mention a political party.

Peter Hill

Reply to Eric Hamilton

It’s a political move by a political party.

Eric Hamilton

Reply to Peter Hill

So you think the federal government is trying to buy our vote.

Eric Hamilton

Reply to Eric Hamilton

The federal government is going to take this money back next year.

Peter Hill

Reply to Eric Hamilton

It’s only okay when conservatives do it, already said that.

Eric Hamilton

Reply to Eric Hamilton

So you think this political party is wrong to give hard working Canadians a tax cut

Eric Hamilton

Reply to Eric Hamilton

if it is a political move why did the provinces not know of this.

Eric Hamilton

Reply to Eric Hamilton

Do you know if this tax cut will carry on with other political parties.

Eric Hamilton

Reply to Eric Hamilton

How many political parties does it take to change a light bulb.

"Axe the Christmas tax"....has a nice ring to it.

Good work Trudeau!

Eric Hamilton

Reply to Jamie Smith

It does sound good doesn’t it. “Axe the Christmas tax”

It has a good ring to it.

I can see the bumper sticker now.

Mr. Trudeau dressed as Santa chopping down a Christmas Tree.

Kat Shaw

Reply to Jamie Smith

Please.... I'm tired of the axe slogan.

serge montague

Reply to Kat Shaw

How about, "open and transparent" slogan

Kat Shaw

Reply to Kat Shaw

On billboards, on the podium as he speaks, nearly whenever he speaks.

Kat Shaw

Reply to Kat Shaw

Is his extra middle name Axel. /s

serge montague

Reply to Kat Shaw

You do have the option of not listening to him, don;t you ?

David Amos

Reply to Jamie Smith

Bah Humbug

Reply to Eric Hamilton

Content Deactivated

David Amos

Content Deactivated

Bigtime

Jamie Smith

Content Deactivated

He is too busy yelling at that figure in the mirror.

Eileen Kinley

Content Deactivated

Yes but last I heard he didn't say he would vote against it.

David Amos

Content Deactivated

I heard that too

serge montague

Content Deactivated

while our PM is busy with selfies

Tom Campbell

Content Deactivated

All of the vitrolic posts that are allowed to stand and this one isn't

David Amos

Content Deactivated

Go Figure

Tom Campbell

Let the hollering about axing taxes swing 180 degrees.

Peter Hill

Reply to Tom Campbell

Seems many are upset there weren’t t shirts made up for it first.

David Amos

Reply to Peter Hill

I heard on the radio that it was their idea a while back

Peter Hill

Reply to David Amos

Good on Pierre for forcing it. Lol

Reply to Peter Hill

Well after watching trudeaus drama videos telling us all how lucky we were, some of us want a tshirt

David Amos

Content Deactivated

I want his fancy socks

Graham McCormack

Axe the tax! Axe the tax!

How dare they axe the tax!! LOL, too predictable.

David Amos

Reply to Graham McCormack

Its just another one of those things they do that nobody seems to appreciate

Peter Hill

All the axe the tax people are upset the tax is getting axed.

serge montague

Reply to Peter Hill

Axed...I thought it was a temp. "carveout" that trudeau vowed he would never do..............again.

David Amos

Reply to Peter Hill

Welcome back to the circus

Peter Hill

Reply to serge montague

So you don’t want the tax axed, noted.

Reply to Peter Hill

Reply to John Richard

Reply to Jos Allaire

https://www.cbc.ca/news/politics/canadian-seniors-liberals-250-cheque-1.7391473

Some seniors outraged over being left out of federal plan to dole out $250 cheques

Excluding nonworking Canadians stigmatizes vulnerable people, disability advocate says

Some Canadian seniors say they're feeling abandoned by the Liberal government's latest inflation relief measure after learning they don't qualify for it.

Prime Minister Justin Trudeau said Thursday that his government would send $250 cheques to the 18.7 million people in Canada who worked in 2023 and earned $150,000 or less.

Those cheques, which the government is calling the "Working Canadians Rebate," are expected to be delivered in "early spring 2025," Trudeau said. Anyone who was not working in 2023, such as people who were retired or receiving social assistance, is ineligible.

The $250 cheques will cost about $4.68 billion, a Finance official told CBC News.

Neil Pierce, a 69-year-old Edmonton resident, called the cheques a "political handout."

He said he is "astonished" that the federal government plans on giving "money to people who were working and, in some cases, making an awful lot of money."

Neil Pierce, 69, said he was 'astonished' to learn who is eligible for the payments. (Submitted by Neil Pierce)

Neil Pierce, 69, said he was 'astonished' to learn who is eligible for the payments. (Submitted by Neil Pierce)

As a retiree and recipient of Old Age Security (OAS) and Canada Pension Plan (CPP) payments, Pierce is ineligible for the cheque.

"I feel that a lot of us are left behind through this announcement," he said. "The rich are getting richer, and the poor are getting poorer as a result."

Pierce said his 99-year-old mother, who also receives CPP and OAS payments, was "excited" when she first heard the news but was disappointed when he explained to her that she wouldn't get a cheque.

Elizabeth Mary Donlevy — a 93-year-old from Woodstock, Ont. — said she was "incensed" after hearing the prime minister say the measure would apply only to Canadians working last year.

"Every time I think about this, I think of the discrimination that goes on constantly against seniors," she said. "He's penalizing people for being over 65."

- Is the federal government's tax break on groceries enough? How are you cutting food costs at home? That's the first topic on Cross Country Checkup this Sunday. Leave your reply here and we may read it on the Nov. 24 show

Donlevy said the announcement suggests seniors should be "out there working on getting a living so that we are eligible for his largesse."

She said that for some seniors on fixed incomes, $250 "would mean a whole lot," while people with six-figure incomes might take it for granted.

"If they make that amount of money ... I admire them and I hope they get everything they can, but it shouldn't be at the expense of seniors," she said.

Steven Laperrière, general manager of Regroupement des activistes pour l'inclusion au Québec (RAPLIQ) — a Montreal-based advocacy group for people with disabilities — said he has "mixed emotions" about the program because a lot of vulnerable people won't be eligible.

"You're stigmatizing them a little bit further," he said. "And it's very frustrating to interpret it like that, but that's how they're receiving this."

"You're telling them, 'Well, sorry guys ... it's not your fault you can't work or you're not finding any work because of your disability, but you cannot have that cheque.'"

Cheques meant to 'recognize hardworking' Canadians: PM

NDP Leader Jagmeet Singh said Thursday that his party will support the affordability measures and work with the Liberals to temporarily lift the logjam in Parliament to get the bill through.

That didn't stop New Democrat Peter Julian, MP for New Westminster—Burnaby, from criticizing the measure during question period on Friday after asking why some vulnerable people would be excluded.

"The Liberals' new plan misses the mark," he said. "Liberals are letting people on fixed incomes down yet again."

At a news conference Friday afternoon in Brampton, Ont., Trudeau said his government has been "extraordinarily present in helping the most vulnerable Canadians," citing a 10 per cent increase to OAS and an increase to the Canada child benefit.

He said he regularly hears from working Canadians who are struggling to make ends meet.

"We're not reducing any of the other programs we're delivering to the most vulnerable but recognizing hardworking Canadians," he said. "It's about seeing Canadians as the hardworking nation-builders they are and giving them that support that they need at this time of challenge."

With files from John Paul Tasker, Jenna Benchetrit and Rosemary Barton

What the GST holiday means for consumers — and why some economists are worried

Federal government said it will slash GST for 2 months, send $250 to some households

After the federal government announced on Thursday that it would introduce a holiday season tax break on some goods, some Canadians welcomed the move, while others said they saw right through it.

"I think it's going to be helpful for some people, which is really nice," said Leemor Valin, who was shopping in Toronto.

"I really feel strongly that part of what makes this country so amazing are all the services we provide to all different kinds of people," she said. "So I'm happy to pay taxes myself. I think that it's really important, but I'm happy to hear [that] maybe it'll help some people in tougher times."

- Is the federal government's tax break on groceries enough? How are you cutting food costs at home? That's the first topic on Cross Country Checkup this Sunday. Leave your reply here and we may read it on the November 24th show.

In addition to the GST holiday, the federal government plans to cut a $250 cheque for working Canadians who made $150,000 or less in 2023, starting sometime in the spring. But Jack Knight, who was shopping at Vince's Market, the grocery store in Sharon, Ont., where Prime Minister Justin Trudeau made his announcement, said the policies are "just bribery."

"All these parties do this. When it comes close to the election, they start handing out the gold bars," Knight, a resident of Barrie, Ont., said. "It doesn't wash with the public, I don't think."

On Thursday, the federal government announced that it would slash the GST on some eligible goods and services — prepared foods, restaurant meals, children's toys, books and Christmas trees, among other items — between Dec. 14 and Feb. 15, 2025.

Lisa Amato, who was shopping at Vince's Market, said it was too little, too late, and that the government should consider cutting the tax forever, "or at least until the economy improves." But Marilyn Reid, a senior who described herself as tired, said it would definitely help her with her shopping.

When Canadians start taking advantage of the two-month tax break, some small businesses say it will give them a much-needed holiday boost during a weak year for consumer spending. A handful of economists, meanwhile, worry about what a spending rush will mean for the economy.

What small businesses are saying

Standing next to a wall of colourful stuffed animals, Toronto business owner Sam Care said she's glad about Ottawa's move — and expects a chaotic rush of shopping at her toy store, Playful Minds.

"People are looking for deals," Care said. "The economy is, you know, it's tougher out there for a lot of families. And I think families are really going to take advantage of this."

She has a few questions about the impact on her business: Will her store be empty until Dec. 14? Will she have to adjust her staffing schedule? How much inventory will she need?

"If it's only going to be a two-month period, are people going to stock up or buy now for later? I don't know. Everything is up in the air right now," Care said.

Sam

Care, the owner of Toronto toy store Playful Minds, says she's glad the

federal government brought in the new policy and expects that it will

lead to a holiday rush at her store. (Shawn Benjamin/CBC)

Sam

Care, the owner of Toronto toy store Playful Minds, says she's glad the

federal government brought in the new policy and expects that it will

lead to a holiday rush at her store. (Shawn Benjamin/CBC)

Dan Kelly, president of the Canadian Federation of Independent Business, said in a statement that the organization welcomes any tax-cutting measure. But he said that "narrow, temporary sales tax holidays can add confusion and administrative complexity for small business owners."

"While a temporary sales tax cut will help boost demand in some sectors, like restaurants, in the slow post-holiday period, Canadians and Canadian businesses really need permanent tax relief," Kelly's statement said.

Care said that she would have welcomed a heads-up from the government but added that she and her staff will be prepared. "It will be a little bit of time because we have products in our store that [are] not tax-exempt, so we have to go figure out everything and double check everything," she said.

"So it will be a little bit of work behind the scenes, for sure."

Does it go far enough on affordability?

Gillian Petit, a senior research associate at the University of Calgary's economics department, said that while the policy will help people save money at the checkout, it might actually go further for those with higher household incomes.

"They have more income, so they consume more," she said. "Persons with lower incomes are also going to save on the GST, but they're not going to save as much in dollar values. They have less income, so they consume less."

With the $250 rebate reserved for people who were employed in 2023, those who might need it most are excluded, Petit said. "If we really wanted to address affordability, we would target persons who are struggling with affordability [or] persons who are spending a large amount of their incomes on basic necessities."

At one food bank in Toronto, most clients are looking for basic groceries. Foods like fresh fruits and vegetables, meat, eggs and bread are already tax-exempt across the country.

Kitty

Raman Costa, executive director of the Parkdale Community Food Bank in

Toronto, says Ottawa's tax holiday doesn't go far enough on providing

affordability. (James Dunne/CBC)

Kitty

Raman Costa, executive director of the Parkdale Community Food Bank in

Toronto, says Ottawa's tax holiday doesn't go far enough on providing

affordability. (James Dunne/CBC)

The GST holiday will "provide Canadians with a small break, but it's not nearly enough to provide a meaningful impact on affordability," said Kitty Raman Costa, executive director of the Parkdale Community Food Bank.

More working people are using the food bank compared with past years, she said.

"These are long-term challenges that will require long-term support. It would definitely be great for us to see more of a dedicated approach to supporting these Canadians facing income insecurity and financial insecurity."

Measures could trigger inflation in spring

Reacting to the announcement, some economists said that the GST break could have inflationary consequences for the economy down the line.

Benjamin Reitzes, a managing director at the Bank of Montreal, wrote in a note on Thursday that headline inflation would likely decelerate in December and January (because the GST break starts mid-month), and then reaccelerate in February and March.

He said the stimulus package — combined with other factors like a cautious U.S. Federal Reserve and a potential upward revision to the GDP — likely means that the Bank of Canada will cut its key interest rate by 25, not 50, basis points at its next meeting.

Christmas

trees are among the items that won't be subject to the GST for two

months, starting on Dec. 14. Other items include prepared foods,

restaurant meals, children's toys and books. (Daniel Thomas/CBC)

Christmas

trees are among the items that won't be subject to the GST for two

months, starting on Dec. 14. Other items include prepared foods,

restaurant meals, children's toys and books. (Daniel Thomas/CBC)

Rob Gillezeau, an assistant professor of economic analysis and policy at the University of Toronto, called the government's move "a nightmare" for economists, saying that the temporary tax break will distort people's spending behaviour.

He said that research out of the United States, where some individual states sometimes implement tax holidays, have shown that they aren't effective as an affordability measure.

"What is the worst thing we could do with $6 billion? Maybe this is not the absolute worst, but it's really, really down there. It's disappointing," Gillezeau said.

The tax holiday will cost the federal treasury an estimated $1.6 billion in foregone revenue, and the $250 cheques will cost about $4.68 billion, a Department of Finance official told CBC News following the announcement.

Gillezeau echoed Petit in saying that the lowest income earners and people who don't have any income are excluded from the policy. "I don't know how you justify that from an affordability perspective," he said.

The two measures combined — "sending cheques out to a whole bunch of folks, plus getting all of this spending narrowed in this one short window" — could have an inflationary impact, he warned.

With files from Anis Heydari, Nisha Patel, Shawn Benjamin and James Dunne

Some provinces say they could lose millions of dollars to federal tax break

In the five provinces with an HST, the entire tax will be removed for duration of proposed federal break

A federally-imposed "tax holiday" could end up being costly for some provinces, and officials from two provincial governments said they were "blindsided" by the prime minister's announcement Thursday that the federal government is suspending the sales tax for some goods.

On Thursday, Prime Minister Justin Trudeau said he would seek to lift the GST and HST from some goods until mid-February in a bid to alleviate some of the affordability pressures people have been experiencing in the post-pandemic era.

Five Canadian provinces have a harmonized sales tax — a combination of provincial and federal taxes on goods and services administered by the federal government. Ottawa sends the provincial portion of the sales tax back to the respective provinces.

A spokesperson for Finance Minister Chrystia Freeland confirmed that if the tax break plan goes ahead, the entire HST would be removed in the provinces that harmonize the sales tax — the Atlantic provinces and Ontario.But officials from two provinces say they were given less than 24 hours' notice that the entire sales tax would be removed.

They also said it's not clear whether they'll receive any compensation from the federal government for the lost tax revenue.

Representatives of two provincial governments with HSTs spoke to CBC News on the condition that neither they nor their provinces be identified because of the sensitivity of the issue.

Responses vary by province

Newfoundland and Labrador Premier Andrew Furey endorsed the federal plan for the "tax vacation" out of the gates.

Furey, who is one of just two Liberal premiers in the country, said on the social media platform X he welcomed the proposal to remove the HST from many goods and services for two months.

New Brunswick Premier Susan Holt was more circumspect.

"We're trying to understand what it is, what it might cost," Holt said Thursday. "Is this something where we're going to be sacrificing provincial tax revenue, so it's going to be a hit on provincial revenues in this fiscal year?"

Ontario already has eliminated the provincial portion of the HST from some of the goods proposed for the federal tax vacation, including children's clothing, shoes, diapers, books and newspapers.

In a media statement, Premier Doug Ford's office said "the best thing the Liberal government can do right now is ditch, or at the very least pause, any hike in the carbon tax which is set to increase for the sixth time on April 1."

Nova Scotia is currently in an election campaign so its provincial government is in caretaker mode.Prince Edward Island did not immediately respond to a request for comment.

Trudeau government to send $250 cheques to most people, slash GST on some goods

GST/HST holiday will last from Dec. 14 to February

Prime Minister Justin Trudeau announced Thursday a suite of new measures meant to alleviate some of the affordability pressures people have been experiencing in the post-COVID era — including a two-month GST holiday on some goods and services.

The Liberal government will also send $250 cheques to the 18.7 million people in Canada who worked in 2023 and earned $150,000 or less.

Those cheques, which the government is calling the "Working Canadians Rebate," will arrive sometime in "early spring 2025," Trudeau said.

The GST/HST holiday will start on Dec. 14 and run through Feb. 15, 2025.People will be able to buy the following goods GST-free:

- Prepared foods, including vegetable trays, pre-made meals and salads, and sandwiches.

- Restaurant meals, whether dine-in, takeout or delivery.

- Snacks, including chips, candy and granola bars.

- Beer, wine, cider and pre-mixed alcoholic beverages below 7 per cent alcohol by volume (ABV).

- Children's clothing and footwear, car seats and diapers.

- Children's toys, such as board games, dolls and video game consoles.

- Books, print newspapers and puzzles for all ages.

- Christmas trees.

With these exemptions, all food in Canada will be essentially tax-free.

"For two months, Canadians are going to get a real break on everything they do," Trudeau said at a media event in Newmarket, Ont.

"Our government can't set prices at the checkout but we can put more money in peoples' pockets. That's going to give people the relief they need. People are squeezed and we're there to help."

If a family spends $2,000 on the eligible goods in the two-month period, they can expect to save about $100, according to government figures.

In provinces with the HST — where the GST is harmonized with provincial sales tax — the savings will be larger, the government said.

Provinces with the HST include Ontario, Newfoundland and Labrador, Nova Scotia, New Brunswick and Prince Edward Island.

Prime Minister Justin Trudeau visits Vince’s Market, a grocery store in Sharon, Ontario, on Nov. 21, 2024. (Chris Young/Canadian Press)

In Ontario, for example, the same $2,000 basket of eligible purchases will result in estimated savings of $260 over the two-month period, the government said.

These savings will come with a big price tag for the federal government.

The tax holiday will cost the federal treasury an estimated $1.6 billion in foregone revenue. The $250 cheques will cost about $4.68 billion, a Finance official told CBC News.The two affordability measures come as the government grapples with persistent unpopularity in the polls and after two stinging defeats in recent byelections.

The CBC's Poll Tracker suggests Trudeau's Liberals are about 17 percentage points back from the first-place Conservatives. That gap has narrowed somewhat in recent weeks.

The renewed focus on the cost of living is designed to bolster the government's support among people who have been feeling the pinch after prices on almost everything have increased in recent years due to inflation.

But there's a risk this new stimulus could juice inflation, which has only recently come down to the Bank of Canada's two per cent target.

Economists agree that unprecedented government stimulus around the world during the pandemic contributed, in part, to elevated inflation as consumers flush with cash chased scarce goods.

The Bank of Canada also has said that if Ottawa had pulled back on COVID-related stimulus earlier, inflation likely would not have been as bad as it has been.

Trudeau claimed Thursday that these measures are "not going to stimulate inflation."

Finance Minister Chrystia Freeland also downplayed inflation fears, saying the Bank of Canada's aggressive rate hikes have tamed inflation and Canada is on a more solid footing now.

"We've done the hard work we needed to do to get inflation down," Freeland said.

Asked about the fiscal implications of the multi-billion dollar injection, Trudeau said the government has the capacity to implement these measures "because Canada has one of the strongest balance sheets in the world."The federal debt has doubled over the last nine years to $1.4 trillion. The cost to service that debt is projected to be $54.1 billion in 2024-25.

When asked whether it's appropriate to slash the GST on products that could be considered luxury goods, like pricey video game consoles, Trudeau said most of the government's affordability measures to this point have been more targeted, like GST rebates for low-income people and an OAS boost for seniors. He argued it's time to give to everyone some relief.

"It's time for people to get a bit of a break," Trudeau said.

Prime

Minister Justin Trudeau and Deputy Prime Minister Chrystia Freeland

visit Vince’s Market, a grocery store in Sharon, Ontario, on Nov. 21.

The government on Thursday announced a sweeping promise to make goods

like groceries, children's clothing, Christmas trees and restaurant

meals free from GST/HST between Dec. 14 and Feb. 15. (Chris Young/Canadian Press)

Conservative Leader Pierre Poilievre said Trudeau's tax measures are "a trick" because it's only temporary relief before the government goes ahead with a permanent carbon tax hike in the spring.

He said that on Trudeau's watch, housing costs have doubled, food bank use has skyrocketed and the federal carbon tax is making it more expensive for people to heat their homes. He raised the spectre of these latest measures fanning the inflationary flames.

"That's the misery you get with massive socialist money-printing and what I'm proposing is a common sense alternative," Poilievre said, while touting his plan to scrap the carbon tax and the GST on new home sales.

"Nobody believes Justin Trudeau and Jagmeet Singh after they've impoverished our people and made life worse off."

Poilievre would not say how Conservative MPs would vote on the proposal, adding he needs to see the details.

"I don't vote for press releases and press conferences," he said. "Let's see what they put before us."

NDP to support affordability measures

Speaking to reporters after Trudeau's announcement, NDP Leader Jagmeet Singh said his party will support the affordability measures in Parliament."We want to see this bill passed as quickly as possible," Singh said. "We know middle class families need a break. We're not going to oppose getting people some help."

Toys

sit on a shelf at the Swag Sisters' Toy Store in Toronto in December

2023. The Liberals plan to introduce a two-month GST vacation on certain

items before the holiday season, including toys. (Chris Young/The Canadian Press)

Toys

sit on a shelf at the Swag Sisters' Toy Store in Toronto in December

2023. The Liberals plan to introduce a two-month GST vacation on certain

items before the holiday season, including toys. (Chris Young/The Canadian Press)

Singh said the NDP will work with the Liberals to temporarily lift the logjam in Parliament to get the bill through in a single day before then allowing an ongoing filibuster to resume.

Parliament has been paralyzed for the last six sitting weeks by a standoff over documents related to a federal green technology program plagued by scandal.

Opposition MPs passed a motion demanding the government release all internal documents related to that scheme and hand them over to the police in an unredacted form. The Liberals have so far refused. Parliament has been deadlocked as a result.

Last week, the NDP promised to go even further to improve Canadians' purchasing power if elected.

Singh said he would permanently eliminate the GST on essentials such as grocery store meals and snacks, internet and cell phone bills, diapers and children's clothing, and home heating.

This measure would deprive the government of $5 billion in tax revenues each year, the NDP estimates, and would be offset by revenues from a proposed tax on excessive corporate profits.

The NDP will support the temporary measure proposed by the Liberals, even if it is deemed insufficient.

But Singh said the party "will campaign hard on permanently scrapping the GST on daily essentials and monthly bills, like we already promised."

- Is Justin Trudeau's tax break on groceries enough? How are you cutting food costs at home? That's the first topic on Cross Country Checkup this Sunday. Leave your reply here and we may read it on the Nov. 24 show.

With files from Radio-Canada's Louis Blouin

No comments:

Post a Comment