Date: Tue, Dec 2, 2025 at 6:52 PM

Subject: Automatic reply: RE U.S. Defence Secretary Pete Hegseth, Kids Can Press, Corus Entertainment Inc. and Laurel Hill Advisory Group

To: David Amos <david.raymond.amos333@gmail.com>

Please be assured that we appreciate receiving your comments.

Le ministère des Finances Canada accuse réception de votre courriel.

Nous vous assurons que vos commentaires sont les bienvenus.

Date: Tue, Dec 2, 2025 at 6:50 PM

Subject: Automatic reply: RE U.S. Defence Secretary Pete Hegseth, Kids Can Press, Corus Entertainment Inc. and Laurel Hill Advisory Group

To: David Amos <david.raymond.amos333@gmail.com>

Thank you for contacting the Honourable Rob Moore, P.C., M.P. office. We appreciate the time you took to get in touch with our office.

If you did not already, please ensure to include your full contact details on your email and the appropriate staff will be able to action your request. We strive to ensure all constituent correspondence is responded to in a timely manner.

If your question or concern is time sensitive, please call our office: 506-832-4200.

Again, we thank you for taking the time to share your thoughts and concerns.

~*~*~*~*~*~*~*~

Office of the Honourable Rob Moore, P.C., M.P.

Member of Parliament for Fundy Royal

Date: Tue, Dec 2, 2025 at 6:50 PM

Subject: Automatic Reply

To: David Amos <david.raymond.amos333@gmail.com>

Thank you for writing to the Minister of Justice and Attorney General of Canada.

Due to the volume of correspondence addressed to the Minister, please note that there may be a delay in processing your email. Rest assured that your message will be carefully reviewed.

We do not respond to correspondence that contains offensive language.

-------------------

Merci d'avoir écrit au ministre de la Justice et procureur général du Canada.

En raison du volume de correspondance adressée au ministre, veuillez

prendre note qu'il pourrait y avoir un retard dans le traitement de

votre courriel. Nous tenons à vous assurer que votre message sera lu

avec soin.

Nous ne répondons pas à la correspondance contenant un langage offensant.

Date: Tue, Dec 2, 2025 at 6:49 PM

Subject: Réponse automatique : RE U.S. Defence Secretary Pete Hegseth, Kids Can Press, Corus Entertainment Inc. and Laurel Hill Advisory Group

To: David Amos <david.raymond.amos333@gmail.com>

(Ceci est une réponse automatique)

(English follows)

Bonjour,

Nous avons bien reçu votre courriel et nous vous remercions d'avoir écrit à M. Yves-François Blanchet, député de Beloeil-Chambly et chef du Bloc Québécois.

Comme nous avons un volume important de courriels, il nous est impossible de répondre à tous individuellement. Soyez assuré(e) que votre courriel recevra toute l'attention nécessaire.

Nous ne répondons pas à la correspondance contenant un langage offensant.

L'équipe du député Yves-François Blanchet

Chef du Bloc Québécois

Thank you for your email. We will read it as soon as we can.

We do not respond to correspondence that contains offensive language.

Date: Tue, Dec 2, 2025 at 6:49 PM

Subject: Acknowledgement – Email Received / Accusé de réception – Courriel reçu

To: David Amos <david.raymond.amos333@gmail.com>

On behalf of the Hon. Pierre Poilievre, we would like to thank you for contacting the Office of the Leader of the Official Opposition.

Mr. Poilievre greatly values feedback and input from Canadians. We wish to inform you that the Office of the Leader of the Official Opposition reads and reviews every e-mail we receive. Please note that this account receives a high volume of e-mails, and we endeavour to reply as quickly as possible.

If you are a constituent of Mr. Poilievre in the riding of Battle River - Crowfoot and you have an urgent matter to discuss, please contact his constituency office at:

Phone: 1-780-608-4600

Fax: 1-780-608-4603

Once again, thank you for writing.

Sincerely,

Office of the Leader of the Official Opposition

______________________________

Au nom de l’honorable Pierre Poilievre, nous tenons à vous remercier d’avoir communiqué avec le Bureau du chef de l’Opposition officielle.

M. Poilievre accorde une grande importance aux commentaires et aux suggestions des Canadiens. Nous tenons à vous informer que le Bureau du chef de l’Opposition officielle lit et examine tous les courriels qu’il reçoit. Veuillez noter que ce compte reçoit un volume important de courriels et que nous nous efforçons d’y répondre le plus rapidement possible.

Si vous êtes un électeur de M. Poilievre dans la circonscription de Battle River - Crowfoot et que vous avez une question urgente à discuter, veuillez contacter son bureau de circonscription :

Téléphone :

Télécopieur :

Encore une fois, merci de votre message.

Veuillez agréer nos salutations distinguées,

Bureau du chef de l’Opposition officielle

From: David Amos <david.raymond.amos333@gmail.com>

Date: Tue, Dec 2, 2025 at 6:49 PM

Subject: RE U.S. Defence Secretary Pete Hegseth, Kids Can Press, Corus Entertainment Inc. and Laurel Hill Advisory Group

To: <assistance@laurelhill.com>, David.Akin <David.Akin@globalnews.ca>, <melissa.eckersley@corusent.com>, <publicity@kidscan.com>, <natalie.stechyson@cbc.ca>, <fkanu@laurelhill.com>, <bzawada@laurelhill.com>, <ppapolis@laurelhill.com>, <jcat@laurelhill.com>, <ctokarchuk@laurelhill.com>, <ekako@laurelhill.com>

Cc: <david.myles@parl.gc.ca>, <david.mcguinty@parl.gc.ca>, <DJT@trumporg.com>, djtjr <djtjr@trumporg.com>, rob.moore <rob.moore@parl.gc.ca>, ragingdissident <ragingdissident@protonmail.com>, <jasonlavigne@outlook.com>, pierre.poilievre <pierre.poilievre@parl.gc.ca>, Yves-Francois.Blanchet <Yves-Francois.Blanchet@parl.gc.ca>, fin.minfinance-financemin.fin <fin.minfinance-financemin.fin@canada.ca>, mcu <mcu@justice.gc.ca>, Sean.Fraser <Sean.Fraser@parl.gc.ca>, don.davies <don.davies@parl.gc.ca>, dominic.leblanc <dominic.leblanc@parl.gc.ca>, Donald J. Trump <contact@win.donaldjtrump.com>, news-tips <news-tips@nytimes.com>, news957 <news957@rogers.com>, news <news@chco.tv>, Nathalie.G.Drouin <Nathalie.G.Drouin@pco-bcp.gc.ca>, <dlametti@fasken.com>, Susan.Holt <Susan.Holt@gnb.ca>, John.Williamson <John.Williamson@parl.gc.ca>, <melanie.joly@ised-isde.gc.ca>, robert.gauvin <robert.gauvin@gnb.ca>, robert.mckee <robert.mckee@gnb.ca>, JUSTMIN <JUSTMIN@novascotia.ca>, premier <premier@gov.ab.ca>, premier <premier@ontario.ca>

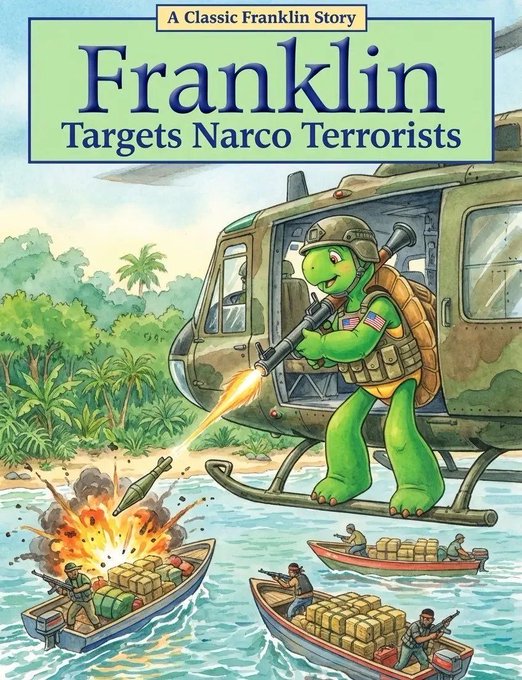

Pete Hegseth's use of Canadian character Franklin the turtle in post about boat strikes prompts anger, mockery

Franklin publisher strongly condemns use of character after U.S. defence secretary's Sunday social media post

Franklin the turtle is a Canadian creation beloved by generations of children, so when U.S. Defence Secretary Pete Hegseth turned him into a bazooka-wielding soldier in a social media post Sunday, many people were alarmed.

Hegseth's post featured a mock cover of a Franklin children's book titled "Franklin Targets Narco Terrorists." The image shows a smiling Franklin wearing a military helmet and vest and an American flag on his arm. He's standing in a helicopter, firing a weapon toward a boat carrying packages and a man holding a gun.

"For your Christmas wish list," he wrote above the post, an apparent attempt to make light of deadly U.S. military strikes on suspected drug-smuggling vessels in the Caribbean Sea and eastern Pacific Ocean.

Earlier Sunday, lawmakers said they support congressional reviews of those strikes, citing a published report in the Washington Post that Hegseth issued a verbal order for all crew members to be killed as part of a Sept. 2 attack.

Meanwhile, the response to Hegseth's post from critics was swift and fierce.

"Where do I start on this? The fact that you want to sell a Canadian children's book? Or that you're going to get copyright infringed to hell … because Franklin isn't a murderer and you want kids to be taught to kill?" one X user commented.

Hegseth's post didn't escape notice on Capitol Hill.

"He wants to be taken seriously, but yesterday he posted a ridiculous tweet of a cartoon turtle firing on alleged drug traffickers — a sick parody of a well-known children's book," Democratic minority leader Chuck Schumer said from the Senate floor on Monday.

House Democrat Adam Smith, on the armed services committee, told reporters: "I've read books to my children, but not that one apparently."

"We need a secretary of defence who understands the seriousness and the importance of the job that he has," added Smith. "We don't have one."

There are more than two dozen books in the popular Franklin series with more than 20 million books in print around the world.

The series was also made into an animated television show, inspired a postage stamp, and both author Paulette Bourgeois and illustrator Brenda Clark are members of the Order of Canada.

In a statement to CBC News, a spokesperson for their publisher, Kids Can Press, said they condemn this use of Franklin's image.

"Franklin the Turtle is a beloved Canadian icon who has inspired generations of children and stands for kindness, empathy, and inclusivity," the spokesperson wrote.

"We strongly condemn any denigrating, violent, or unauthorized use of Franklin’s name or image, which directly contradicts these values."

In a statement given to U.S. media outlets, including CBS and Axios, Pentagon spokesperson Sean Parnell said, "We doubt Franklin the turtle wants to be inclusive of drug cartels … or laud the kindness and empathy of narco-terrorists."

'A war crime if it's true'

The U.S. administration says the strikes in the Caribbean are aimed at drug cartels, some of which it claims are controlled by Venezuelan President Nicolás Maduro.

U.S. President Donald Trump is scheduled to meet with his national security team Monday afternoon as bipartisan scrutiny mounted over the reports that Hegseth ordered a second strike on an alleged drug vessel to kill any survivors.

On Sunday, congressional lawmakers said they did not know whether last week’s Washington Post report was true, and some Republicans were skeptical, but they said attacking survivors of an initial missile strike poses serious legal concerns.

“This rises to the level of a war crime if it’s true,” said Sen. Tim Kaine.

Trump had defended Hegseth on Sunday, saying that the defence secretary told him he didn't order the men to be killed, "and I believe him."

2nd strike was 'self-defence': White House

On Monday, despite earlier denials from the White House, press secretary Karoline Leavitt said a second strike was conducted against an alleged drug vessel off Venezuela "in self-defence" and "in accordance" with laws governing armed conflict.

"The president has the right to take them out," Leavitt said of alleged drug vessels, if they are "threatening the United States of America."

In her comments to reporters on Monday, Leavitt did not dispute the Washington Post's report that there were survivors after the initial strike in the incident.

Her explanation came after Trump said a day earlier that he "wouldn’t have wanted that — not a second strike" when asked about the incident.

“Secretary Hegseth authorized Admiral Bradley to conduct these kinetic strikes,” said Leavitt, referring to U.S. Navy Vice Admiral Frank Bradley, who at the time was the commander of Joint Special Operations Command.

“Admiral Bradley worked well within his authority and the law, directing the engagement to ensure the boat was destroyed and the threat to the United States of America was eliminated,” she said.

'Book two is Franklin goes to the Hague'

On social media, however, many critics of Hegseth's post disagreed.

"That was just book one in the series. Book two is Franklin Goes to the Hague," someone posted on X.

"Franklin and Pete Hegseth violate the Geneva Convention and commit war crimes," posted another critic.

Others posted their own mock titles, including "Franklin on trial at the ICC," and "Franklin targets Venezuela's Oil."

And others pointed out that Franklin is Canadian, and that the character is a role model for children, which makes Hegseth's post "even more repulsive."

With files from the Associated Press

Jennifer Lee

Jennifer Lee is Chief Administrative Officer, Chief Legal Officer and Corporate Secretary. In her role, Jenn oversees legal, regulatory and public affairs, human resources, communications, cybersecurity and other operational functions. Jenn is an experienced corporate lawyer by trade, with extensive regulatory, risk and governance experience as well as a strong M&A and business background. She has deep public company expertise as well as experience in digital, data, privacy and technology strategy and initiatives and has led significant change and transformation projects.

Before joining Corus, Jenn practiced law with Osler, a leading national law firm, and then moved to TD Bank Group where she held a number of executive legal and business roles in Legal, Risk, Marketing, and Innovation and Technology.

Jenn graduated from the University of Toronto with a Bachelor of Arts (Honours with High Distinction) and a Juris Doctor degree. Jenn speaks several languages including French and Mandarin. She is a member of the Board of Woodgreen Community Services and Chair of their Audit Committee.

Jennifer Lee prepares for a shifting regulatory landscape at Corus Entertainment

Lee supports the CRTC in the implementation of Bill C-11

As EVP and general counsel at Corus Entertainment, Jennifer Lee welcomed the passing of Bill C-11 earlier this year. Also known as the Online Streaming Act, the bill gives new power to Canada’s broadcasting regulator – the CRTC – and extends the current Broadcasting Act to the digital realm, requiring streaming platforms to contribute to the creation and promotion of Canadian content. It marks the first wholesale change of Canada’s broadcasting legislation for over 30 years.

“This is a very welcome change,” says Lee. “You don’t have to be a lawyer or media expert to see the degree of change in the industry and how people consume content. We’re not seeking to turn back the clock, but we do need the regulatory and legislative framework to acknowledge the new reality, so we’re pleased to see that bill get passed. It’s an exciting thing to be a part of as a lawyer.”

Lee and her team have been very active in their advocacy of the bill, and providing input on where they think change is needed. They are now working closely with various industry groups and continuing to provide feedback to the CRTC to help implement the new bill as soon as possible.

Lee has been leading the legal department at Corus since 2021, following 13 years at TD Bank where she held a variety of legal and regulatory roles as well as non-legal roles which allowed her focus on innovation and technology.

Canada & International

Mailing Address:

Corus Quay – Kids Can Press

25 Dockside Drive,

Toronto ON Canada M5A 0B5

Tel: 416-479-7000

Fax: 416-960-5437

For licensing and permission requests: rights@kidscan.com

Corus Entertainment announces recapitalization transaction

Corus Entertainment, the parent company of Global News, announced a proposed recapitalization transaction, reaching a deal with its secured lenders, restructuring the company’s $1.1 billion dollars of debt. A move it says will significantly strengthen its financial position. The deal is subject to CRTC and court approval.

According to a company news release, the deal includes a reduction of total debt and liabilities by more than $500 million and a slashing of annual cash interest by up to $40 million.

“The proposed transaction will solidify our financial foundation and position Corus for the long-term,” said John Gossling, Corus Entertainment Chief Executive Officer

“With significant support from our secured lenders and bondholders, we will be well positioned to continue what we do best – creating and delivering content that entertains and informs millions of Canadians across our expansive suite of leading TV, radio and digital assets, with Global’s exciting fall premiere season now underway,” he said.

Faced with declining advertising revenue, heightened competition from streaming services and a challenging regulatory environment, Corus has undergone a series of cost-cutting measures in recent years, including layoffs.

The company says the new deal will provide the company with more flexibility and liquidity as it continues to seek cost efficiencies while exploring new opportunities in growth areas, such as digital media.

“In addition to right-sizing the balance sheet, we intend to continue executing our strategic plan. This includes focusing on attractive opportunities or partnerships to enhance revenue and value, including through a focus on digital services and products, as well as maintaining discipline over costs and cash management, and finding additional operational efficiencies,” Mr. Gossling said.

CORUS ENTERTAINMENT ANNOUNCES RECAPITALIZATION TRANSACTION

November 3, 2025

- Proposed recapitalization transaction strengthens Corus’ financial position, provides long-term solution that supports sustainable business strategy

- Expected to materially reduce existing debt, maintain secured lending facility, and increase liquidity access over several years

- To be facilitated by way of a plan of arrangement, with Corus seeking to reduce total debt and other liabilities by over $500 million, reduce annual cash interest by up to $40 million, and issue new debt with extended maturity dates

- Corus has received the support of all lenders under the senior credit facility and of noteholders representing over 74% of Corus’ aggregate $750 million of senior unsecured notes; Corus has also obtained a preliminary interim order from the Court (defined below) granting a stay of proceedings

- Business expected to continue as usual during the recapitalization process, with no anticipated impacts to Corus’ obligations to clients, producers, suppliers or employees

- Upon closing, shares issued pursuant to the transaction will trade publicly

For Immediate Release

TORONTO, ON, November 3, 2025 – Corus Entertainment Inc. (“Corus” or the “Company”) (TSX: CJR.B) today announced a proposed recapitalization transaction (the “Recapitalization Transaction”) that is expected to strengthen its financial foundation, support its business strategy, and enable the continuity of business and operations. Once implemented, the Recapitalization Transaction will meaningfully reduce the Company’s outstanding indebtedness and annual interest costs, and improve its capital structure and liquidity. The Recapitalization Transaction will be implemented through a plan of arrangement (the “Plan of Arrangement”) under the Canada Business Corporations Act (“CBCA”).

“The proposed transaction will solidify our financial foundation and position Corus for the long-term,” said John Gossling, the Company’s Chief Executive Officer. “With significant support from our secured lenders and bondholders, we will be well positioned to continue what we do best – creating and delivering content that entertains and informs millions of Canadians across our expansive suite of leading TV, radio and digital assets, with Global’s exciting fall premiere season now underway.”

The Recapitalization Transaction is expected to enhance the Company’s flexibility and liquidity profile, including continued access to its revolving facility provided by its senior lenders, which has been amended and increased to $125 million. It will also support the execution of Corus’ business strategy and opportunities, while sustaining relationships with suppliers, partners, customers and employees, with no anticipated impact to obligations to them as a result of the CBCA proceedings.

“This transaction represents the culmination of the strategic work to optimize Corus’ capital structure and manage the Company’s balance sheet, following the assignment of its senior credit facility earlier in 2025,” said Mark Hollinger, Independent Lead Director of the Board of Directors of the Company (the “Board”). “After conducting a robust and comprehensive review process with our external financial and legal advisors, the Board concluded this Recapitalization Transaction represents the best available option for the Company and its stakeholders at this time.”

“In addition to right-sizing the balance sheet, we intend to continue executing our strategic plan. This includes focusing on attractive opportunities or partnerships to enhance revenue and value, including through a focus on digital services and products, as well as maintaining discipline over costs and cash management, and finding additional operational efficiencies,” added Mr. Gossling.

In connection with the Recapitalization Transaction, the Company has entered into an amendment, consent and waiver agreement (“Consent & Waiver”) with all lenders under the senior credit facility (“Senior Credit Facility”) and a support agreement (the “Support Agreement”) with holders representing more than 74% of Corus’ aggregate $750 million of senior unsecured notes (“Senior Notes”) whereby such lenders and noteholders have agreed to support the Recapitalization Transaction in accordance with the terms and conditions of the Consent & Waiver and the Support Agreement, as applicable. The Company has also entered into a voting support agreement (the “Shareholder Support Agreement”) with the Shaw Family Living Trust, indirectly the holder of more than 80% of the Class A Voting Shares in the Company. Pursuant to this agreement, the Shaw Family Living Trust and certain of its affiliates have agreed, among other things and subject to the terms and conditions stated therein, to vote their Class A Voting Shares and Class B Non-Voting Shares in favour of the Recapitalization Transaction.

Recapitalization Transaction Highlights

The Recapitalization Transaction is anticipated to deliver significant financial benefits, if approved and implemented, including:

- total reduction of third-party indebtedness and other liabilities of over $500 million;

- annual cash interest savings of up to $40 million;

- continued access to the senior secured revolving credit facility (which has been increased from $75 million to $125 million) (the “Revolver”) to support ongoing operations and liquidity; and

- extension of relief of financial covenants under the Senior Credit Facility beyond December 31, 2025.

The Recapitalization Transaction contemplates the following key elements:

- the Company’s existing secured revolving credit facility will be replaced, or amended and restated, into a new, first lien $125 million secured revolving credit facility;

- the Company’s existing secured term loan will be fully redeemed at par value, and the Company will issue new first lien senior secured notes in the aggregate principal amount of $300 million with a 5-year maturity date;

- $250 million of the Senior Notes will be settled in exchange for second lien secured notes with a 6-year maturity date in an equal aggregate principal amount;

- $500 million of the Senior Notes will be exchanged for common shares (“NewCo Shares”) of a newly-formed corporation (“NewCo”) that are expected to represent 99% of all of the issued and outstanding shares of NewCo, on a non-diluted basis and will be the only class of shares of NewCo outstanding after closing;

- all accrued but unpaid interest on the Senior Notes will be paid in cash on closing;

- all of the Company’s outstanding Class A Voting Shares and Class B Non-Voting Shares (collectively, the “Existing Shares”) will be exchanged on a 1:1 basis for NewCo Shares that are expected to represent, in aggregate, 1% of all of the issued and outstanding shares of NewCo, on a non-diluted basis;

- the Company will apply to the Toronto Stock Exchange (“TSX”) to have the NewCo Shares substituted for the Company’s Class B Non-Voting Shares with the result that, subject to the approval of the TSX and the satisfaction of customary listing conditions, the NewCo Shares will be publicly traded on the TSX;

- NewCo will own all of the shares of the Company;

- certain lenders of the Company will be granted warrants to purchase NewCo Shares that will represent 10% of the fully diluted equity of NewCo;

- certain key leases will be renegotiated on acceptable terms; and

- the board of directors will be refreshed at closing and comprise, initially, five directors.

Process Highlights

The Company engaged in a process to explore and evaluate potential transaction alternatives to optimize value for its stakeholders. The review was led by a sub-committee of the Board, made up entirely of independent directors, with a mandate to identify and establish an optimal and sustainable capital structure for the Company. The Board has now approved the entering into of the Support Agreement and the Shareholder Support Agreement. In the forthcoming management information circular (the “Circular”) to be prepared in connection with the special meetings of the Company’s securityholders (including holders of outstanding Class A Voting Shares and Class B Non-Voting Shares) (the “Special Meetings”), the Board expects to recommend that all such holders vote to support the Recapitalization Transaction.

In respect of the Plan of Arrangement, Corus has obtained a preliminary interim order (the “Preliminary Interim Order”) from the Ontario Superior Court of Justice (Commercial List) (the “Court”) granting, among other things, a stay of proceedings (the “Stay”) to protect the Company against any defaults and related steps or actions that may result from the Company’s decision to initiate CBCA proceedings, including under its existing indebtedness. The Stay will enable the Company to negotiate and finalize the terms of the Plan of Arrangement. The Company also entered into the Consent & Waiver with respect to its Senior Credit Facility that allows for continued access by the Company to the Revolver and waives events of default that may arise from commencing proceedings under the CBCA, subject to customary conditions.

The Company will take all necessary steps to progress the Plan of Arrangement in the weeks following the issuance of the Preliminary Interim Order and then seek a further order (the “Interim Order”) in the CBCA proceedings permitting the Company to call, hold and conduct the Special Meetings to consider and vote on the Plan of Arrangement. The terms of the Plan of Arrangement will be fully disclosed as part of the application to approve the Interim Order and in the Circular that will be prepared in connection with the Special Meetings. The Company will issue a further press release when the record date and meeting date for such Special Meetings have been determined.

If the Plan of Arrangement is approved at the Special Meetings, the Company will seek a further order in the CBCA proceedings approving the Recapitalization Transaction. The Recapitalization Transaction may also be subject to regulatory approvals, which applicable approvals the Company and relevant parties intend to pursue diligently.

Impact to Existing Shares

Under the Recapitalization Transaction, the Existing Shares will be exchanged for NewCo Shares. The NewCo Shares held by existing Corus shareholders will represent 1% of the outstanding NewCo Shares on a non-diluted basis. The terms of the NewCo Shares will be structured to ensure compliance by NewCo and the Company with applicable Canadian ownership restrictions under the Broadcasting Act.

Implementation and Approvals

In addition to the steps noted above, completion of the Recapitalization Transaction will be subject to, among other things, satisfaction of the terms and conditions in the Consent & Waiver, the Support Agreement and the Shareholder Support Agreement, finalization of the Plan of Arrangement, receipt of all necessary shareholder and creditor approvals, approval of the Plan of Arrangement by the Court, and the receipt of all customary and necessary regulatory approvals, including as may be required from the Canadian Radio-television and Telecommunications Commission and the TSX. Upon receipt of requisite approvals, the Plan of Arrangement will bind all holders of the Senior Notes and Existing Shares of the Company.

Additional Information

The Support Agreement and Shareholder Support Agreement will be filed by the Company on SEDAR+. Further information about the Recapitalization Transaction will also be made available on SEDAR+ (www.sedarplus.ca) and the Company’s website (https://www.corusent.com/proposed-transaction/). Additional information and key dates in connection with the implementation of the Recapitalization Transaction, including with respect to the proceedings to be commenced under the Plan of Arrangement and the Special Meetings, will be made publicly available by the Company.

Osler, Hoskin & Harcourt LLP is acting as legal advisor to the Company. Jefferies and KPMG LLP are the Company’s financial advisors.

Bennett Jones LLP is acting as legal advisor to the ad hoc group of holders of Senior Notes (the “Ad Hoc Group of Noteholders”). Canaccord Genuity Corp. is acting as financial advisor to the Ad Hoc Group of Noteholders. Thornton Grout Finnigan LLP is acting as legal advisor to all lenders under the Senior Credit Facility.

Additional Information

If you have any questions about the information contained in this press release, please contact our advisor, Laurel Hill Advisory Group:

- Toll-Free: 1-877-452-7184 in North America (1-416-304-0211 outside North America)

- Email: assistance@laurelhill.com

Caution Concerning Forward-Looking Information

To the extent any statements or information made in this release, or any of the documents referenced in this release, contain information that is not historical, these statements and the information are forward-looking statements and may be forward-looking information within the meaning of applicable securities laws (collectively, “forward-looking information”). This forward-looking information relates to, among other things, the Company’s objectives, goals, strategies, targets, intentions, plans, estimates and outlooks and includes but is not limited to: the closing and implementation of the proposed recapitalization transaction announced herein (the “Proposed Transaction”); the adoption and anticipated impact of the Company’s capital allocation and recapitalization strategies; descriptions of future required approvals or condition satisfaction for the Proposed Transaction; capital structure and liability management including current or proposed liquidity and leverage targets; Corus’ ability to renegotiate existing or future debt terms, repay debt and/or maintain necessary access to credit facilities; the Company’s strategic, operation or business plans; anticipated advertising revenue or subscription trends; and expectations regarding financial or operational performance, or costs, tariffs, taxes and fees. The foregoing can generally be identified by the use of words such as “believe”, “anticipate”, “expect”, “intend”, “plan”, “will”, “may” or the negatives of these terms and other similar expressions. In addition, any statements that refer to expectations, anticipated outcomes or impacts, projections or other characterizations of future events or circumstances may be considered forward-looking information.

Although Corus believes that the expectations reflected in such forward-looking information are reasonable, such information involves many material assumptions, risks and uncertainties and undue reliance should not be placed on such statements. Certain material factors or assumptions, which are subject to uncertainty, risk or change and may cause actual results to differ materially from expectations, calculations, plans, or forecasts are applied with respect to the forward-looking information, including in respect of the Proposed Transaction. These include, including without limitation, factors and assumptions relating to or impacting: the execution of the Proposed Transaction; the anticipated or expected effect or impacts of the Proposed Transaction on stakeholders; the anticipated reduction of the Company’s debt and related costs and interest expenses (including the amounts thereof); approval of the Proposed Transaction by: (i) applicable regulatory authorities and stock exchanges, (ii) holders securities and debt, and (iii) relevant courts; implementation and execution of the Proposed Transaction by way of a plan of arrangement as contemplated; exchange of existing equity or debt for new equity or debt; obligations or abilities of third parties to close or complete actions as part of the Proposed Transaction; the inability to complete the Proposed Transaction in the time or manner contemplated; dilution or changes to the Company’s outstanding shares in number or value; the ability of management to execute its strategies and plans, including any under or contemplated by the Proposed Transaction; the Company’s financial and operating results being consistent with expectations; macroeconomic, business, geopolitical and market conditions; decisions or positions by applicable courts or regulators such as, without limitation, the Canadian Radio-television and Telecommunications Commission (“CRTC”); strategic opportunities or partnerships (or lack thereof) that may be presented to, pursued or implemented by the Company; and continuity of relationships and arrangements with, or revenue or costs attributed to, key suppliers, partners, clients and customers. Actual results may differ materially from those expressed or implied in such information and the foregoing list is not exhaustive.

Certain other material factors or assumptions may also be applied with respect to general forward-looking information. These, and additional information regarding the foregoing list, are identified or discussed in Corus’ most recently disclosed Management’s Discussion and Analysis or Financial Statements, as may be updated, supplemented or amended from time to time, including by quarterly financial reports or additional press releases, all and any of which will be made available on SEDAR+.

When relying on the Company’s forward-looking information to make decisions with respect to Corus or the Proposed Transaction, investors and others should carefully consider all the foregoing information, including as incorporated by reference, and any other uncertainties and potential events. Unless otherwise specified, all forward-looking information in this document speaks as of the date of this document and may be updated or amended from time to time. Except as otherwise required by applicable securities laws, Corus disclaims any intention or obligation to publicly update or revise any forward-looking information whether as a result of new information, events or circumstances that arise after the date thereof or otherwise.

– 30 –

About Corus Entertainment Inc.

Corus Entertainment Inc. (TSX: CJR.B) is a leading media and content company that develops, delivers and distributes high quality brands and content across platforms for audiences around the world. Engaging audiences since 1999, the company’s portfolio of multimedia offerings encompass 25 specialty television services, 36 radio stations, 15 conventional television stations, digital and streaming platforms, and social digital agency and media services. Corus’ roster of premium brands includes Global Television, W Network, Flavour Network, Home Network, The HISTORY® Channel, Showcase, Slice, Adult Swim, National Geographic and Global News, along with streaming platforms STACKTV, TELETOON+, the Global TV App and Curiouscast. For more information visit www. corusent.com.

For media inquiries, please contact:

Melissa Eckersley

Head of Corporate Communications and Relations

Corus Entertainment Inc.

melissa.eckersley@corusent.com

For questions about the information contained in this press release, please contact:

Laurel Hill Advisory Group

Toll-Free: 1-877-452-7184 in North America (1-416-304-0211 outside North America)

Email: assistance@laurelhill.com

Date: Tue, Dec 2, 2025 at 4:59 PM

Subject: Automatic reply: Attn Sage Nematollahi I called from 506 434 8433 Two more emails follow this one

To: David Amos <david.raymond.amos333@gmail.com>

Please be assured that we appreciate receiving your comments.

Le ministère des Finances Canada accuse réception de votre courriel.

Nous vous assurons que vos commentaires sont les bienvenus.

From: Ministerial Correspondence Unit - Justice Canada <mcu@justice.gc.ca>

Date: Tue, Dec 2, 2025 at 4:56 PM

Subject: Automatic Reply

To: David Amos <david.raymond.amos333@gmail.com>

Thank you for writing to the Minister of Justice and Attorney General of Canada.

Due to the volume of correspondence addressed to the Minister, please note that there may be a delay in processing your email. Rest assured that your message will be carefully reviewed.

We do not respond to correspondence that contains offensive language.

-------------------

Merci d'avoir écrit au ministre de la Justice et procureur général du Canada.

En raison du volume de correspondance adressée au ministre, veuillez

prendre note qu'il pourrait y avoir un retard dans le traitement de

votre courriel. Nous tenons à vous assurer que votre message sera lu

avec soin.

Nous ne répondons pas à la correspondance contenant un langage offensant.

---------- Original message ---------

From: David Amos <david.raymond.amos333@gmail.com>

Date: Tue, Dec 2, 2025 at 4:56 PM

Subject: Fwd: Attn Sage Nematollahi I called from 506 434 8433 Two more emails follow this one

To: <dsalmon@laurelhill.com>, pm <pm@pm.gc.ca>, mcu <mcu@justice.gc.ca>, fin.minfinance-financemin.fin <fin.minfinance-financemin.fin@canada.ca>

https://www.laurelhill.ca/david-salmon

David Salmon

PRESIDENT

David is responsible for overall direction of Laurel Hill's strategic shareholder solutions and corporate governance consulting services for public companies. David routinely advises clients on shareholder strategies related to hostile and friendly acquisitions, proxy contests, and corporate governance issues.

David is an industry veteran with over 20 years of experience in progressive leadership roles, including operational, business development and management. David has been with the Laurel Hill team for 13 years and brings his extensive experience and success to his role.

During this time, David directly provided consulting and insight on contentious and non-contentious shareholder meetings, solicited and unsolicited tender offers, and corporate governance issues, including many of the largest transactions in Canada.. Previously, David spent over 5 years gaining significant business development and management experience in the banking industry.

David has served as a director of several publicly-traded company and previously was a board member of the not-for-profit Canadian Investor Relations Institute, BC Chapter, and recently co-chaired the True Patriot Love Foundation Vancouver event. David graduated from the University of Toronto with a major in Economics and subsequently completed the Canadian Securities course. David is a member of the Canadian Investor Relations Institute and the Canadian Society of Corporate Secretaries.

David is regularly requested to speak on panels, media and as an industry expert for legal matters.

Mobile (604) 649-3488

dsalmon@laurelhill.com

From: David Amos <david.raymond.amos333@gmail.

Date: Mon, Dec 1, 2025 at 11:58 PM

Subject: Attn Sage Nematollahi I called from 506 434 8433 Two more emails follow this one

To: <sn@knd.law>

N.B. pension fund managers accused of costing tech investors millions

Shareholders in failed electronics company say Vestcor-owned company inflated value of merger

The company that manages billions of dollars in pension funds for thousands of New Brunswick public sector employees and retirees is being accused of causing financial losses for hundreds of investors across Canada.

Fredericton-based Vestcor Inc. and one of its senior executives are the targets of a petition filed in British Columbia that is seeking court approval for a class-action lawsuit.

The company is accused of falsely inflating the value of a corporate merger between two technology companies.

According to the petition application, Vestcor was the majority shareholder in Exro Technologies, and “orchestrated and significantly influenced” Exro’s 2024 merger with SEA Electric Inc., in which Vestcor also owned shares.

Shareholders pursue lawsuit against N.B. pension fund manager over losses

Shareholders pursue lawsuit against N.B. pension fund manager over lossesExro paid $300 million to acquire SEA Electric after telling its shareholders that SEA would make $200 million in profits in 2024 — a figure that proved “delusional,” the court filing says.

“These facts and circumstances reflected within those representations were the basis of the grossly inflated valuation assigned to SEA Electric,” it says.

“Those purported facts and circumstances did not exist, or the manner of their representation in the material change report was false or misleading.”

Sage

Nematollahi, the lawyer who filed the petition on behalf of two

shareholders, told CBC News that Vestcor 'has lost a lot of money.' (Zoom)

Sage

Nematollahi, the lawyer who filed the petition on behalf of two

shareholders, told CBC News that Vestcor 'has lost a lot of money.' (Zoom)It alleges Vestcor and its vice-president of equities Mark Holleran “did so in order to manage, or salvage, their significant investment in SEA Electric.”

The assertions in the petition have not been proven in court and Vestcor has yet to file a response.

“Our legal team is currently evaluating the merits of this lawsuit,” CEO Sean Hewitt said in an emailed statement.

“The claims have not been tested in court,” he added. “We have no reason to believe in their veracity.”

Sage Nematollahi, the lawyer who filed the petition on behalf of two shareholders, told CBC News that Vestcor “has lost a lot of money” as Exro’s majority shareholder, tying up “significant funds from pensioners in New Brunswick [with] this investment that has not done great.”

But in Hewitt's statement, he said the impact was “negligible” to the overall performance of Vestcor’s investment portfolios, estimating it at a fraction of one per cent of the total.

“Given the robust funded positions of our clients’ pension plans, and continued strong investment performance, there is no impact to the monthly income of pensioners,” he said.

The company managed a total of $23 billion in 2024 — an increase of $2 billion over 2023.

Vestcor, owned by the province’s two largest pension plans for civil servants and teachers, was created in 2016, replacing a government-owned agency.

It handles retirement plans for hospital workers, nurses, Crown corporation employees, provincial court judges, MLAs and others. It also manages other investment funds, including the University of New Brunswick’s endowment.

Exro was delisted by the Toronto Stock Exchange in October.

The company revealed in November 2024 that its revenue projections would fall far short of what it had claimed, recording a loss of $226 million, including a $211 million loss to the value of SEA Electric’s assets.

The losses led to “the complete collapse” of Exro, the filing says.

The petition alleges that Vestcor and Holleran “acted in bad faith and/or conflicts of interest” as “de facto directors and/or officers” of Exro.

The petition was filed by two shareholders, British Columbia resident Bryan Irwin, who held 27,500 common shares worth $22,000 at the time of the merger, and Ontario investor Mike Zienchuk, who had 900,000 shares worth an amount not disclosed in the court filing.

Nematollahi told CBC News that about 500 other shareholders have contacted his office about joining the lawsuit if it is certified as a class action case.

“There could be thousands of shareholders out there,” he said.

Zienchuk and another investor, Allan Crosier, have also filed a lawsuit in Alberta against Exro, two former company officials, the company’s financial advisors and its insurance underwriters.

Exro billed itself as a clean tech company that would design and build power electronics to improve the efficiency and cost-effectiveness of electric vehicles and energy storage systems.

Vestcor was a majority shareholder in Exro at the time of the merger and also held 14.3 per cent of preferred stock in SEA, meaning Vestcor was “acting both as a seller and a buyer,” the filing says.

ABOUT THE AUTHOR

Provincial Affairs reporter

Jacques Poitras has been CBC's provincial affairs reporter in New Brunswick since 2000. He grew up in Moncton and covered Parliament in Ottawa for the New Brunswick Telegraph-Journal. He has reported on every New Brunswick election since 1995 and won awards from the Radio Television Digital News Association, the National Newspaper Awards and Amnesty International. He is also the author of five non-fiction books about New Brunswick politics and history.

Sajjad (Sage) Nematollahi is a litigation lawyer admitted to the practice of law in British Columbia, Ontario and New York State. His practice includes complex commercial litigation and class actions, with a focus on capital markets, cybersecurity and privacy litigation. Sage also provides consulting and advisory services to select clients in relation to Canadian securities and privacy laws and regulation, class action litigation and risk management.

Sage has significant experience with Canadian and cross-border securities litigation, acting for both retail and institutional investors. His experience includes several high-profile securities class actions in Canada over the past decade, including joint proceedings under Canada’s federal insolvency legislation, the Companies’ Creditors Arrangement Act, and proceedings in relation to plans of arrangement under provincial business corporations legislation. Sage has successfully represented plaintiffs in Valeant Pharmaceuticals International Inc. Securities Litigation (resulted in settlements in the aggregate amount of $127 million), Sino-Forest Corporation Securities Litigation (resulted in settlements in the aggregate amount of more than $160 million), Poseidon Concepts Corporation Securities Litigation (resulted in a settlement in excess of $34.5 million) and Canadian Solar Securities Litigation (resulted in a settlement in the amount of US$13 million).

Sage also has significant experience with data breach and consumer privacy litigation, where he represents Canadians impacted in significant cybersecurity and privacy breaches. A strong advocate for an individual’s fundamental right to protect their identity, Sage has prosecuted a number of high-profile privacy class proceedings in Canada. His representative work includes the privacy breach class action against Facebook arising out of the Cambridge Analytica scandal, the class action against Marriott International arising out of the massive data breach reported in 2018, and class actions involving Bank of Montreal and Canadian Imperial Bank of Commerce’s Simplii Financial arising out of a data breach reported in 2018 (settled for a meaningful compensation to affected clients of the banks).

Sage holds a Master of Laws degree from Harvard Law School, where he represented his class at the Harvard Law School Student Government, and a Master of Laws degree from McGill University, Faculty of Law, where he served as a Councilor at McGill University Post-Graduate Students’ Society. He earned his Bachelor of Laws degree from the National University of Iran with high honours.

Sage enjoys studying the intersection of law and economics and business strategy, arts and outdoors, and speaks English and Farsi.

Lawyer Sajjad Nematollahi with Siskinds LLP Ranked AmongTop 10 Iranian Lawyers on Twitter

Sajjad Nematollahi ranked among top 10 Iranian Lawyers on Twitter as assembled by Iranianlawyers.com. Follow Sajjad at @snematollahi on Twitter.

https://x.com/snematollahi/

| Sep 2, 2025, 10:02 AM |

From: David Amos <david.raymond.amos333@gmail.

Date: Mon, Jul 7, 2025 at 1:53 PM

Subject: Fwd: 617 954 4225 RE Robert Pozen Former executive chairman of MFS Investment Management

To: <bobpozen@mit.edu>, fin.minfinance-financemin.fin <fin.minfinance-financemin.

From: David Amos <david.raymond.amos333@gmail.

Date: Mon, Jul 7, 2025 at 1:49 PM

Subject: 617 954 4225 RE Robert Pozen Former executive chairman of MFS Investment Management

To: <Leadership@mfs.com>, <kimc714@mit.edu>

Review of Current Investigations and Regulatory Actions Regarding the Mutual Fund Industry

Date: Tuesday, November 18, 2003 Time: 10:00 AM

Topic

Witnesses

Witness Panel 1

-

Mr.

William H.

Donaldson

ChairmanSecurities and Exchange Commission

Witness Panel 2

-

Mr.

Matthew P.

Fink

PresidentInvestment Company Institute

-

Mr.

Marc

Lackritz

PresidentSecurities Industry Association

Review of Current Investigations and Regulatory Actions Regarding the Mutual Fund Industry

Date: Thursday, November 20, 2003 Time: 02:00 PM

Topic

Witnesses

Witness Panel 1

-

Mr.

Stephen M.

Cutler

Director - Division of EnforcementSecurities and Exchange Commission

-

Mr.

Robert

Glauber

Chairman and CEONational Association of Securities Dealers

-

Eliot

Spitzer

Attorney GeneralState of New York

Review of Current Investigations and Regulatory Actions Regarding the Mutual Fund Industry: Understanding the Fund Industry from the Investor’s Perspective

Date: Wednesday, February 25, 2004 Time: 10:00 AM

Topic

Witnesses

Witness Panel 1

-

Mr.

Tim

Berry

TreasurerState of Indiana

-

Honorable

Gary

Gensler

ChairmanU.S. Commodity Futures Trading Commission

-

Mr.

James K.

Glassman

Resident FellowAmerican Enterprise Institute

-

Mr.

Don

Phillips

Managing DirectorMorningstar, Inc

-

Mr.

Jim

Riepe

Vice Chairman of the Board of DirectorsT. Rowe Price Group, Inc.

Review of Current Investigations and Regulatory Actions Regarding the Mutual Fund Industry: Fund Operations and Governance.

Date: Thursday, February 26, 2004 Time: 02:00 PM

Topic

Witnesses

Witness Panel 1

-

Mr.

Jack

Bogle

FounderThe Vanguard Group

-

Ms.

Mellody

Hobson

PresidentAriel Capital Management

-

Mr.

David

Pottruck

President, Chief Executive Officer and a member of the Board of DirectorsCharles Schwab

-

Mr.

David

Ruder

Former ChairmenU.S. Securities and Exchange Commission

Review of Current Investigations and Regulatory Actions Regarding the Mutual Fund Industry: The Regulatory Landscape

Date: Wednesday, March 10, 2004 Time: 10:00 AM

Topic

Witnesses

Witness Panel 1

-

Ms.

Lori

Richards

Director, Office of Compliance, Inspections, and ExaminationsSecurities and Exchange Commission

-

Mr.

Paul

Roye

Director, Division of Investment ManagementSecurities and Exchange Commission

-

Ms.

Mary

Schapiro

Vice Chairman of NASD and President of NASD Regulatory Policy & OversightNational Association of Securities Dealers

-

Honorable

David M.

Walker

Comptroller General of the United States

Review of Current Investigations and Regulatory Actions Regarding the Mutual Fund Industry: Fund Operations and Governance

Date: Tuesday, March 23, 2004 Time: 10:00 AM

Topic

Witnesses

Witness Panel 1

-

Professor

Mercer

Bullard

Associate Professor of LawUniversity of Mississippi School of Law

-

Mr.

William D

Lutz

Professor of EnglishRutgers University

-

Mr.

Robert

Pozen

Non-Executive ChairmanMassachusetts Financial Services Co.

-

Ms.

Barbara

Roper

Director of Investor ProtectionConsumer Federation of America

Review of Current Investigations and Regulatory Actions Regarding the Mutual Fund Industry: Fund Costs and Distribution Practices

Date: Wednesday, March 31, 2004 Time: 02:30 PM

Topic

Witnesses

Witness Panel 1

-

Honorable

Daniel K.

Akaka (D-HI)

United States Senator

-

Honorable

Susan

Collins (R-ME)

United States Senator

-

Honorable

Peter

Fitzgerald (R-IL)

United States Senator

-

Honorable

Carl

Levin (D-MI)

United States Senator

Witness Panel 2

-

Mr.

Paul G.

Haaga, Jr.

Executive Vice President and Director of Capitol Research and Management Company, and Chairman of the Investment Company Institute

-

Mr.

Chet

Helck

President and Chief Operating OfficerRaymond James Financial

-

Mr.

Thomas

Putnam

Founder and CEOFenimore Asset Management

-

Mr.

Edward

Siedle

Founder and PresidentThe Benchmark Companies

-

Mr.

Mark

Treanor

General Counsel and Head of Legal DepartmentWachovia Corporation

Review of Current Investigations and Regulatory Actions Regarding the Mutual Fund Industry: The SEC's Perspective

Date: Thursday, April 8, 2004 Time: 10:00 AM

Topic

Witnesses

Witness Panel 1

-

Mr.

William H.

Donaldson

ChairmanSecurities and Exchange Commission

“We’re passionate about offering our author clients every form of expertise and exposure to the global marketplace for books, TV/film and speaking representation. It all starts with the writer’s story: the story becomes a book and from there we strive for every opportunity.” – Samantha Haywood, President of Transatlantic Agency

Overview

Transatlantic Agency is a leading literary management company offering a full spectrum of career representation to authors and storytellers across all genres and formats for books, screenplays, speaking engagements and TV/film rights.

Transatlantic represents more than 800 American, Canadian and international clients, whose work regularly appears on prestigious bestseller and award lists, including the New York Times, National Book Award, Newberry Medal and Scotiabank Giller Prize. We work closely with our authors on every step of the process, bolstered by an impeccable back office and administrative team. Transatlantic is recognized in the industry for the success of our sales and their reach internationally, and our reputation for stability, integrity and commitment.

Founded thirty years ago by a husband-and-wife team of literary agents, the Transatlantic Agency today is a vibrant group of vastly experienced and tenacious agents with diverse backgrounds and specialties based in cities across North America. We are forward-thinking in adapting our sales strategies as the global reading markets change and technologies evolve. Transatlantic is headed by Literary Agent and President Samantha Haywood, who joined the company and began building her prestigious client list in 2004.

Domestic and International Reach

Finding international audiences for our clients is a key focus at the agency. We excel at international rights sales, working collaboratively with our valued co-agents in 25 countries around the world. Our agents also maintain a vast network of international editors and literary scouts, and we attend all the major international book fairs, including Frankfurt, London, Guadalajara and Bologna. In the last ten years we have arranged translation deals with more than 1,000 publishers in 30 countries.

Learn more about the Adult Division, Children’s & YA Division, Media & TV/Film Division and Speakers Division.

Submissions

– Social and cultural history or other fun history

– History that connects to today, history that asks questions

– Investigative reporting and narrative journalism

– Popular science when it’s careful and Insightful

– Narrative nonfiction that engages with food, the natural world,

travel, or everyday objects

– Cookbooks with something extra

– Highly applicable prescriptive nonfiction

Please note that due to the sometimes very high volume of inquiries, not all inquiries regarding manuscript submissions will be answered.

If you are submitting a proposal, please submit a synopsis and 20 pages of the manuscript via email to rob@transatlanticagency.com

Attachments will not be opened.

Biography

Rob Firing has been working as a promoter and publicist for more than 20 years, 15 of those at HarperCollins as their Senior Director of Publicity, Communications and Speakers’ Bureau. Rob has worked closely with everyone from JK Rowling to Tom Wolfe, from Margaret Trudeau to Margaret Drabble — literally hundreds of writers across many genres. He has won awards for his work from the Canadian Marketing Association and other marketing and PR organizations. He is also the co-author of The Everyday Squash Cook (HarperCollins, 2014), and the author of STEAK REVOLUTION (HarperCollins, 2018), which was a Gourmand World Cookbook Award finalist.

Clients

- Abdou, Angie

- Ahmad, Yusra

- Al-Solaylee, Kamal

- Allingham, Jeremy

- Ashly Jernigan

- Ashley Schütz

- Bala, Sharon

- Banackissa, Murielle

- Benmergui, Ralph

- Bishop-Stall, Shaughnessy

- Bourgeois, Paulette

- Crawford, Jennifer

- Dann, Moira

- Dembicki, Geoff

- Dolan, Doug

- Eaton, Susan R.

- Ernst, Thom

- Fisher, Karen

- Fitzpatrick, Frank

- Foster, Cecil

- Fraser, Kimberly

- Frost, Asha

- Ghent, Natale

- Giese, Rachel

- Gupta, Ruchira

- Hall, Patti

- Hernandez, Catherine

- Jackson, Angeline C.

- Jalaluddin, Uzma

- Jass, Vanessa

rob@transatlanticagency.com

t: +1 (416) 488-9214

Transatlantic Agency

2 Bloor Street East, Suite 3500

Toronto, Ontario

M4W 1A8

Canada

White House says admiral ordered 2nd strike on alleged drug boat

White House says admiral ordered 2nd strike on alleged drug boat Why Trump is at war with Venezuela | About That

Why Trump is at war with Venezuela | About That

No comments:

Post a Comment