David Raymond Amos @DavidRayAmos

Replying to @DavidRayAmos @wrbennettnl and 7 others

Methinks everybody and his dog knows that I "succinctly" made it a point to prove that CBC and the snobby Professor Kelly Baby Blidook pissed me off bigtime nearly 4 years ago N'esy Pas?

https://davidraymondamos3.blogspot.com/2019/04/heres-juggernaut-ches-crosbie-will-have.html

https://www.cbc.ca/news/canada/newfoundland-labrador/weekend-briefing-incumbency-1.5103144

David Raymond Amos @DavidRayAmos

Replying to @DavidRayAmos @Kathryn98967631 and 47 others

Methinks old Johnny "Never Been Good" Crosbie and a lot of fat, dumb and happy cops, lawyers, politicians and journalists in Newfoundland know why I am gonna have fun with this election N'esy Pas?

https://davidraymondamos3.blogspot.com/2019/04/heres-juggernaut-ches-crosbie-will-have.html

https://www.cbc.ca/news/canada/newfoundland-labrador/weekend-briefing-incumbency-1.5103144

Here's the juggernaut Ches Crosbie will have to fight like hell to overcome

35 Comments

Commenting is now closed for this story.

David R. Amos

Methinks I should resend an old email then call NL Alliance's Graydon Pelley to see if he remembers me N'esy Pas?

David R. Amos

Reply to @David R. Amos: Here is little Deja Vu for folks to enjoy

2005 01 T 0010

IN THE SUPREME COURT OF NEWFOUNDLAND AND LABRADOR

TRAIL DIVISION

BETWEEN: WILLIAM MATTHEWS

PLAINTIFF

AND: BYRON PRIOR

DEFENDANT

AND BETWEEN: BYRON PRIOR

DEFENDANT/PLAINTIFF BY COUNTERCLAIM

AND: WILLIAM MATTHEWS

PLAINTIFF/FIRST DEFENDANT BY COUNTERCLAIM

AND: T. ALEX HICKMAN

SECOND DEFENDANT BY COUNTERCLAIM

AND: THOMAS MARSHALL

THIRD DEFENDANT BY COUNTERCLAIM

AND: DANNY WILLIAMS

FOURTH DEFENDANT BY COUNTERCLAIM

AND: EDWARD M. ROBERTS

FIFTH DEFENDANT BY COUNTERCLAIM

AND: JOHN CROSBIE

SIXTH DEFENDANT BY COUNTERCLAIM

AND: PATTERSON PALMER

SEVENTH DEFENDANT BY COUNTERCLAIM

ORDER

Before the Honourable Chief Justice Green.

2005 01 T 0010

IN THE SUPREME COURT OF NEWFOUNDLAND AND LABRADOR

TRAIL DIVISION

BETWEEN: WILLIAM MATTHEWS

PLAINTIFF

AND: BYRON PRIOR

DEFENDANT

AND BETWEEN: BYRON PRIOR

DEFENDANT/PLAINTIFF BY COUNTERCLAIM

AND: WILLIAM MATTHEWS

PLAINTIFF/FIRST DEFENDANT BY COUNTERCLAIM

AND: T. ALEX HICKMAN

SECOND DEFENDANT BY COUNTERCLAIM

AND: THOMAS MARSHALL

THIRD DEFENDANT BY COUNTERCLAIM

AND: DANNY WILLIAMS

FOURTH DEFENDANT BY COUNTERCLAIM

AND: EDWARD M. ROBERTS

FIFTH DEFENDANT BY COUNTERCLAIM

AND: JOHN CROSBIE

SIXTH DEFENDANT BY COUNTERCLAIM

AND: PATTERSON PALMER

SEVENTH DEFENDANT BY COUNTERCLAIM

ORDER

Before the Honourable Chief Justice Green.

David R. Amos

Reply to @David R. Amos: Filed January 21, 2005

UPON HEARING Stephen J. May, of Counsel for the Plaintiff, AND UPON

READING the Application and Affidavit filed herein, IT IS HEREBY

ORDERED, until further order of the court, Byron Prior is prohibited

from publishing, causing to have published, distributing or causing

to have distributed the Statement of Defence and Counterclaim pending

the determination of the Applicant's Application to strike the

Statement of Defence and Counterclaim in its entirety, and that the

Court's file in this proceeding is not to be made available for review

by anyone other than the parties or their legal counsel pending the

determination of the Applicant's Application to strike the Statement

of Defence and Counterclaim in its entirety, and that the requirements

relating to the obligations of the Defendants to the Counterclaim to

file Defences are be waived pending the determination of the

Applicant's Application to strike the Statement of Defence and

Counterclaim in its entirety. AND IT IS FURTHER ORDERED THAT the

content of the Statement of Defence and Counterclaim shall not be

published or broadcast in any manner whatsoever until further order of

the court.

AND IT IS HEREBY FURTHER ORDERED that the Application to strike the

Statement of Defence and Counterclaim is scheduled to be heard on

January 26, 2005.

AND IT IS HEREBY FURTHER ORDERED that costs of this Application be

in the cause.

DATED at St. John's, Newfoundland and Labrador this 21st day of

January, 2005.

Signed by J. Derek Green, Chief Justice

UPON HEARING Stephen J. May, of Counsel for the Plaintiff, AND UPON

READING the Application and Affidavit filed herein, IT IS HEREBY

ORDERED, until further order of the court, Byron Prior is prohibited

from publishing, causing to have published, distributing or causing

to have distributed the Statement of Defence and Counterclaim pending

the determination of the Applicant's Application to strike the

Statement of Defence and Counterclaim in its entirety, and that the

Court's file in this proceeding is not to be made available for review

by anyone other than the parties or their legal counsel pending the

determination of the Applicant's Application to strike the Statement

of Defence and Counterclaim in its entirety, and that the requirements

relating to the obligations of the Defendants to the Counterclaim to

file Defences are be waived pending the determination of the

Applicant's Application to strike the Statement of Defence and

Counterclaim in its entirety. AND IT IS FURTHER ORDERED THAT the

content of the Statement of Defence and Counterclaim shall not be

published or broadcast in any manner whatsoever until further order of

the court.

AND IT IS HEREBY FURTHER ORDERED that the Application to strike the

Statement of Defence and Counterclaim is scheduled to be heard on

January 26, 2005.

AND IT IS HEREBY FURTHER ORDERED that costs of this Application be

in the cause.

DATED at St. John's, Newfoundland and Labrador this 21st day of

January, 2005.

Signed by J. Derek Green, Chief Justice

Gerald Niven

I got a tell ya about my political nightmare…There I was, I found myself unable to move a muscle, while I looked on as Liberals Roger Grimes, Billy Rowe, Eddie Roberts, Rossy Barbour, and Joey Smallwood were sitting around a Holiday Inn room having a séance. Old Joey was leading the séance, and a ghostly image of Chess Crosbie was emerging from a genie bottle, but then… all of a sudden, Dwit Ball appeared and pushed Joey over because Ball was in a tussle head-lock with PC Jim Morgan, better known as Jigger Jim…Then, Liberal Steve Neary of Bell Island fame started in singing Dick Nolan’s hit tune ‘Aunt Martha’s Sheep’… but, the next thing I know, John White from the TV show All Around the Circle fame was fist fisticuffs with Dick Nolan, and yelling at Dwit to let go Jigger Jim… The next thing I know Brian Tobin’s image also started coming out of the genie’s lamp, but like a ravenous wolf, old dip stick, Chess Crosbie, bit off Tobin’s head… Then, old Dwit screamed out, The Writ, the Writ… and, everybody scrambled, while an envelope of insense smoke immersed everybody in the room, and all I could hear was the fading screaming voice of Dwit yelling, “The Dwit, The Dwit”…sounding like that little midget guy from that old 1970’s TV show Fantasy Island yelling, de Plane, Boss… de Plane… Man what a hag… what a nightmare… Maybe, NL is a Fantasy Island…Anyway, fantasy or no fantasy, I’m all messed up…knowing more of who not to vote for, than who to vote for… me-old-stick-in-the-mud

Mark Mac

Reply to @Gerald Niven: what’d you eat before bed dude? magic mushrooms?

Patrick David

Reply to @Mark Mac: I wonder what material Gerald's hat is made from ?

Robert G. Holmes

Reply to @Gerald

Niven: It's an age thing Gerald. I had similar nightmare, awoke in a

sweat, and near died laughing reading your post. You didn't miss much,

other than the bog hole GHB fell into while fishing with Craiggy, boys

and girls.

David R. Amos

Reply to @Gerald Niven: Methinks many a true word is said in jest N'esy Pas?

Gerald Niven

Reply to @Mark Mac:

Well Marc, I lapped into some of that NL farmed salmon with a few

Blackhorse out in the shed the other night... I don't know if what I ate

could have had any of that infectious salmon anemia, what Gerry Byrne

calls ISA Salmon, from Gaultois, Hermitage Bay way... Could a been

that, alright... I didn't bother to look at it closely for any sea lice

or parasites... I mean Gerry Byrne in a news publication said it was fit

to eat, and if you can't believe a politician, than who can you

believe. right?... Anyway, just to be on the safe side, before I eats

anymore, I'm going to write Gerry's office and ask, if he eats any of

it..

Nfld. & Labrador·Weekend Briefing

Here's the juggernaut Ches Crosbie will have to fight like hell to overcome

Every single member of the Liberal caucus is running again

Ches Crosbie rallied supporters Wednesday night as he launched his campaign. (CBC)While never so foolish as to predict the outcome of the election, I feel comfortable stating this: Tory Leader Ches Crosbie has one massive problem to solve if he wants to turn Newfoundland and Labrador blue next month.

It's not a problem of his own making.

It's also not a problem that will be easy to fix.

It's the problem of incumbency — and not his, but rather the party he wants to unseat.

Let me explain.

Of the slate of 40 candidates that the governing Liberals will have going into the election, 27 are sitting members of the House of Assembly.

Twenty-seven.

Put another way: every single member of the Liberal caucus is running again. The works. Only one of them (Betty Parsley, in Harbour Main) faced a nomination challenge along the way.

No guarantee of success, but quite the weapon

Before we look at the Liberals' advantage, let's not forget that the Tories are going into the campaign with some key strengths.

Chief among them is the momentum that comes from winning all three byelections held since the last general election. The Tories kept seats held by Paul Davis and Steve Kent, and — significantly — Crosbie himself picked off the St. John's seat that former Liberal finance minister Cathy Bennett had held.

The issue: they have to turn 13 of them (and win all that they hold) to form a majority government.

Even people who are not fans of Dwight Ball will acknowledge that the Liberals are going into this election from a position of strength. Incumbency is a potent force in politics. It hardly guarantees success, but it does give momentum and weight to a party … and it can sap the resources of parties aiming to overturn the status quo.

The 2019 NL election is underway. The Liberals, PCs, NDP and NL Alliance all fighting for votes. http://cbc.ca/1.5101575

And we already have a front runner for greatest gif of the campaign

The risk of being arrogant

Now, that runs the risk of cockiness and arrogance — something the PCs, the NDP and the upstart NL Alliance can use to their advantage.

It's natural for a party that's just finishing its first term back in government to have a solid cadre of returning candidates.

Indeed, two of the veteran MHAs who did step down before the election was called were both Tories. Keith Hutchings, the former fisheries minister, has represented the PC stronghold of Ferryland since a 2007 byelection. Tracey Perry is retiring after representing Fortune Bay-Cape La Hune since the 2007 election.

Everyone in politics knows incumbency in politics can be a mighty factor. Satisfaction with Liberal performance has not been consistently strong in public opinion polling over the last four years, but by the same token, there are few signs of an anti-incumbent feeling in the air.

Liberals were faster out of the gate

In our office, we've been sharing notes about candidates in a spreadsheet. Even before the Liberals filled all their slots on Wednesday, they were way ahead of the competing parties. The PCs had notable gaps in their slate, including several districts held by cabinet ministers.

The NDP has had far more empty slots than filled ones. This speaks to the uphill struggle the party has, coming after a tumultuous start to the year with leader Gerry Rogers unexpectedly stepping down, Alison Coffin taking over the reins, and some clear signs of infighting with St. John's Deputy Mayor Sheilagh O'Leary squeezed out in Lorraine Michael's old district of St. John's East-Quidi Vidi.

Then there's the NL Alliance, which cleared hurdles to become a fully fledged political party in time for the vote. Leader Graydon Pelley, who ran against Ball for the PCs in Humber-Gros Morne in 2015, is running this time in the St. John's district of Mount Scio.

It'll be interesting to see how much organizational strength that Pelley, a former PC president, takes from the Crosbie camp … not to mention the other parties.

Crosbie, of all the opposition leaders, will be the one that most voters will watch. That's natural; the Tories, after all, were in power four years ago.

But amid everything the Tory campaign has to deal with — recruiting candidates, raising money, rounding up volunteers — a killer headache for the blue team is the red side's massive advantage of incumbency.

For all your weekend reading needs

It's a long weekend. Enjoy a moment to catch your breath … and some to read.

Here are some recent stories we've published that you might enjoy:

The francophone community radio station Rafale FM hasn't produced local programming in Labrador City since 2015, but the station has still been collecting ad revenue.

A couple from Holyrood thought they were incredibly lucky at a resort casino, until they realized they had fallen prey to a popular scam aimed at tourists.

Insurance costs mean another kind of road rage for many consumers; check out Lindsay Bird's feature on why fixing it is so hard.

This week's budget has no new taxes or fees, but it does have things that can affect your household's bottom line.

Doctors are seeing unnecessary appointments because income support clients need medical appointments in order to meet the qualifications for Metrobus passes.

A leaked letter shows conflicts in the women's movement months before Jenny Wright resigned as executive director of the St. John's Status of Women Council.

CBD, or cannabidiol, is widely sought for pain relief … but not by many doctors, who are still waiting for clinical evidence.

Quote of the week

— Finance Minister Tom Osborne, telling reporters on Budget Day he really, really didn't want to have a $1.9-billion surplus on the books because of the refreshed Atlantic Accord. Almost all of the money will show up over the coming decades.

And now, a moment of calm

You can find it and more beautiful things in our latest audience photo gallery.

Now they want trouble, my friend

The Mighty Morphin' Northern Rangers are a bit like the other crew from '90s TV .. but with beer boxes.

Tis it for this week. Enjoy your weekend.

Incidentally, it looks like the politicians are going to be laying a bit low over the Easter weekend, and will be in full roar on Tuesday.

Read more from CBC Newfoundland and Labrador

---------- Original message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Tue, 20 Oct 2015 21:39:49 -0400

Subject: Re: Here is my latest complaint about the SEC, Banksters and Taxmen

To: David Amos <david.raymond.amos@gmail.com>

Cc: Peter Cowan <peter.cowan@cbc.ca>, norman.doyle@sen.parl.gc.ca,

george.baker@sen.parl.gc.ca, edward@ecconway.com,

suzanne.charron@sen.parl.gc.ca

<peter.mackay@justice.gc.ca>, Ches Crosbie <ccb@chescrosbie.com>,

frank petten <tsnews@nf.aibn.com>, kblidook@mun.ca,

krista.byrne-puumala@

ken.mcdonald@live.ca, info@lorrainebarnett.ca,

info@jennifermccreath.com, fabian.manning@sen.parl.gc.ca,

cpetersen@goldblattpartners.

<gopublic@cbc.ca>

On 10/7/15, David Amos <david.raymond.amos@gmail.com> wrote:

> ---------- Forwarded message ----------

> From: Kelly Blidook <kblidook@mun.ca>

> Date: Wed, Oct 7, 2015 at 10:22 AM

> Subject: Re: Here is my latest complaint about the SEC, Banksters and

> Taxmen

> To: David Amos <david.raymond.amos@gmail.com>

>

>

> Thanks for your email.

>

> Please note, if you are familiar with “making a point”, please do it

> succinctly. My job is not to read everything from everyone who includes me

> in an email list, and I’m going to spend time trying to make rhyme or

> reason of all these unconnected things or ranty all-cap emails. I delete

> spam, but I went back and found this after getting your phone message.

>

> All the best

> Kelly

>

> ----

>> From: The Telegram telegram@thetelegram.com

>> Date: Fri, 09 May 2008 12:42:55 -0230

>> Subject: Telegram article

>> To: david.raymond.amos@gmail.com

>> Hello David:

>> Pasted below is the article you were looking for. We generally charge

>> for research services, but this one is on the house.

>> Jackie

>> Editorial Clerk

>>

>> The Telegram (St. John's)

>> Provincial, Tuesday, May 6, 2008, p. A4

>> Justice/Free Speech

>>

>> Truth matters

>>

>> Defamation law that ignores truth ruled unconstitutional

>> Peter Walsh

>>

>> The Supreme Court of Newfoundland has ruled a law that could send

>> someone to prison for defamation is unconstitutional.

>>

>> Justice Lois Hoegg made the decision Friday. Her ruling also struck

>> down a criminal case by Crown prosecutors against Byron Prior of Grand

>> Bank.

>>

>> Prior claims that in 1966, a justice official in the province raped and

>> impregnated one of his relatives. Crown attorneys say Prior wore

>> placards and distributed flyers which published the allegations.

>>

>> The Royal Newfoundland Constabulary interviewed Prior's relative in

>> 2004 and in 2007, but the alleged victim denied she had been sexually

>> assaulted or that she even knew the person Prior said had attacked her.

>> Crown prosecutors tried to convict Prior of defamation under Section

>> 301 of the Criminal Code, which says "everyone who publishes a

>> defamatory libel is guilty of an indictable offence and liable to

>> imprisonment for a term not exceeding two years."

>>

>> The problem is, Hoegg said, the Crown couldn't prove that Prior was

>> knowingly spreading lies.

>>

>> "I find that it is not justified, in our free and democratic society,

>> for the Crown to use the heavy hammer of the criminal law against a

>> subject for publishing defamatory libel when the Crown is not able to

>> show that the subject knows that his statements are false.

>>

>> "The expression of truthful, unpopular or even false statements deserve

>> protection unless expressed in a violent manner," wrote Hoegg.

>> Hoegg said if the Crown could prove Prior knowingly published

>> defamatory libel, it would have charged him under a different section

>> of the criminal code that says "everyone who publishes a defamatory

>> libel that he knows is false is guilty of an indictable offence and

>> liable to

>> imprisonment for a term not exceeding five years."

>>

>> That law has withheld court challenges. Section 301 - the law which

>> does not mention the matter of truth - has been struck down as

>> unconstitutional by three other superior courts in Canada.

>> "The sections catch different types of offender. To me, it naturally

>> follows that their purpose or objectives must be different," wrote

>> Hoegg. "I then determined that the objective (of Section 301) was

>> not so pressing and important as to override freedom of expression.

>> The section is offensive to modern day notions of justice."

>>

>> The decision only applies to criminal applications of defamation law.

>> Hoegg said Prior could possibly be sued in civil court over his

>> allegations.

>>

>> Three years ago, a federal politician filed a statement of claim in the

>> Supreme Court of Newfoundland and Labrador to have a website that

>> contained allegations about him by Prior removed. In the statement,

>> the politician said a website posted by Prior accuses him and other

>> prominent Newfoundlanders of wrongdoing.

>>

>> A website containing the allegations is still active. Prior claims to

>> be a victim of physical and sexual abuse.

>>

>> pwalsh@thetelegram.com

>> 709-364-2323

>>

>> 2005 01 T 0010

>>

>> IN THE SUPREME COURT OF NEWFOUNDLAND AND LABRADOR

>> TRIAL DIVISION

>>

>> BETWEEN:

>> WILLIAM MATTHEWS PLAINTIFF

>>

>> AND:

>>

>> BYRON PRIOR DEFENDANT

>>

>> AND BETWEEN:

>>

>> BYRON PRIOR DEFENDANT/PLAINTIFF

>> BY COUNTERCLAIM

>>

>> AND: WILLIAM MATTHEWS PLAINTIFF/FIRST DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: T. ALEX HICKMAN SECOND DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: THOMAS MARSHALL THIRD DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: DANNY WILLIAMS FOURTH DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: EDWARD M. ROBERTS FIFTH DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: JOHN CROSBIE SIXTH DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: PATTERSON PALMER SEVENTH DEFENDANT

>> BY COUNTERCLAIM

>>

>> SUMMARY OF CURRENT DOCUMENT

>> Court File Number(s):2005 01 T 0010

>> Date of Filing of Document: 25 January 2005

>> Name of Filing Party or Person: Stephen J. May

>> Application to which Document being filed relates: Amended Application

>> of the Plaintiff/Defendant by Counterclaim to maintain an Order

>> restricting publication, to strike portions of the Statement of

>> Defence, strike the Counterclaim in it's entirety, and to refer this

>> proceeding to case management.

>>

>> Statement of purpose in filing: To maintain an Order restricting

>> publication, to strike portions of the Statement of Defence, strike

>> the Counterclaim in its entirety and refer this proceeding to case

>> management.

>>

>> A F F I D A V I T

>>

>> I, Stephen J. May, of the City of St. John's, in the Province of

>> Newfoundland and Labrador, Barrister and Solicitor, make oath and say

>> as follows:

>>

>> THAT I am a Partner in the St. John's office of PATTERSON PALMER

>> solicitors for William Matthews, the Member of Parliament for

>> Random-Burin-St. George's in the Parliament of Canada.

>>

>> THAT Mr. Matthews originally retained Mr. Edward Roberts, Q.C. on or

>> about 30 April 2002 after Mr. Byron Prior, the Defendant/Plaintiff by

>> Counterclaim, had made allegations against Mr. Matthews in a

>> publication called "My Inheritance - The truth - Not Fiction: A Town

>> with a Secret". In that publication, the allegation was made that Mr.

>> Matthews had had sex with a girl who had been prostituted by her

>> mother. That girl was alleged to have been Mr. Prior's sister.

>>

>> THAT upon being retained, Mr. Edward Roberts wrote a letter to Mr.

>> Prior. That letter to Mr. Prior is attached as Exhibit "1" to my

>> Affidavit.

>>

>> THAT subsequent to Mr. Roberts' letter to Mr. Prior, Mr. Roberts

>> received a 1 May 2002 e-mail from Mr. Prior. That e-mail is attached

>> as Exhibit "2".

>>

>> THAT subsequent to Mr. Roberts receipt of the e-mail, Mr. Prior swore

>> an Affidavit acknowledging that what had been said in that publication

>> was false. That Affidavit is attached as Exhibit "3" to my Affidavit.

>> Following Mr. Roberts' receipt of that Affidavit, Mr. Matthews advised

>> that he was satisfied not to pursue the matter any further and our firm

>> closed our file.

>>

>> THAT on or about 25 October 2004, I was retained by Mr. Matthews

>> following his gaining knowledge that a web site, made a series of

>> allegations against him relating to my having sex with a girl of

>> approximately 12 years old through to an approximate age of 15 years

>> old. It also accused him of being a father of one of her children and

>> accused him of having raped that girl. Upon checking the web site I

>> saw that Byron Prior, the Defendant, had been identified as the author

>> of the material on the site.

>>

>> THAT Mr. Matthews instructed me to write Mr. Prior, to remind him of

>> the fact that the allegations had been admitted to being false through

>> a 16 May 2002 Affidavit to advise him of Mr. Matthews' intentions to

>> commence legal proceedings if the comments were not removed from the

>> web site. A copy of my letter to Mr. Prior is attached as Exhibit "4"

>> to this Affidavit.

>>

>> THAT I attach as Exhibit "5" a transcript from a 5 November 2004

>> voicemail left by David Amos, identified in the voicemail as a friend

>> of Mr. Prior.

>>

>> THAT I attach as Exhibit "6" a portion of a 6 November 2004 e-mail

>> from Mr. Amos.

>>

>> THAT until I received his voicemail and e-mail, I had never heard of

>> Mr. Amos.

>>

>> THAT Mr. Amos has continued to send me e-mail since his 5 November

>> e-mail. Including his 6 November 2004 e-mail, I have received a total

>> of 15 e-mails as of 23 January 2005. All do not address Mr. Matthews'

>> claim or my involvement as Mr. Matthews' solicitor. I attach as

>> Exhibit "7" a portion of a 12 January 2005 e-mail that Mr. Amos sent to

>> me but originally came to my attention through Ms. Lois Skanes whose

>> firm had received a copy. This e-mail followed the service of the

>> Statement of Claim on 11 January 2005 on Mr. Prior. I also attach as

>> Exhibit "8" a copy of a 19 January 2005 e-mail from Mr. Amos.

>>

>> THAT I attach as Exhibit "9" a copy of a 22 November 2004 letter

>> addressed to me from Edward Roberts, the Lieutenant Governor of

>> Newfoundland and Labrador covering a 2 September 2004 letter from Mr.

>> Amos addressed to John Crosbie, Edward Roberts, in his capacity as

>> Lieutenant Governor, Danny Williams, in his capacity as Premier of

>> Newfoundland and Labrador, and Brian F. Furey, President of the Law

>> Society of Newfoundland and Labrador. I requested a copy of this letter

>> from Government House after asking Mr. Roberts if he had received any

>> correspondence from Mr. Amos during his previous representation of Mr.

>> Matthews. He advised me that he received a letter since becoming

>> Lieutenant Governor, portions of which involved his representation of

>> Mr. Matthews. Mr. Roberts' letter also covered

>> his reply to Mr. Amos.

>>

>> THAT I attach as Exhibit "10" an e-mail from Mr. Amos received on

>> Sunday, 23 January 2005.

>>

>> THAT I swear this Affidavit in support of the Application to strike

>> Mr. Prior's counterclaim.

>>

>> SWORN to before me at

>> St. John's, Province of Newfoundland and Labrador this 24th day of

>> January, 2005.

>>

>> Signed by Della Hart

>> STEPHEN J. MAY

>> Signature STAMP

>> DELLA HART

>> A Commissioner for Oaths in and for

>> the Province of Newfoundland and Labrador. My commission expires on

>> December 31, 2009

>>

>>

>>

>>

>>

>> ---------- Forwarded message ----------

>> From: David Amos <motomaniac333@gmail.com>

>> Date: Sat, Oct 3, 2015 at 2:29 PM

>> Subject: Re: Yo Mr Baconfat Please enjoy our little debate in Fundy Royal

>> with one of your hero Harper's many minions the aptly named lawyer Rob

>> Mooore

>> To: "angela.leatherland" <angela.leatherland@edmonton.

>> sunrayzulu@shaw.ca>, "Paul.Lynch" <Paul.Lynch@edmontonpolice.ca>

>> <premier@gov.ab.ca>, premier <premier@gnb.ca>, pm <pm@pm.gc.ca>,

>> "peter.mackay" <peter.mackay@justice.gc.ca>, "marylou.babineau" <

>> marylou.babineau@greenparty.ca

>> oldmaison <oldmaison@yahoo.com>, andre <andre@jafaust.com>, sallybrooks25

>> <sallybrooks25@yahoo.ca>, patrick_doran1 <patrick_doran1@hotmail.com>,

>> lois <lois@loisjoysheplawy.com>, "rod.knecht" <

>> rod.knecht@edmontonpolice.ca>, "don.iveson" <don.iveson@edmonton.ca>,

>> "don.marshall" <don.marshall@edmonton.ca>, "geoff.crowe" <

>> geoff.crowe@edmontonpolice.ca>

>> Marianne.Ryan@rcmp-grc.gc.ca>, "Charmaine.Bulger" <

>> Charmaine.Bulger@rcmp-grc.gc.

>> whistleblower <whistleblower@finra.org>, whistle <whistle@fsa.gov.uk>,

>> oig <oig@sec.gov>

>> Cc: David Amos <david.raymond.amos@gmail.com>

>> Peter.Juk@gov.bc.ca>, radical <radical@radicalpress.com>, paul <

>> paul@paulfromm.com>, "Paul.Collister" <Paul.Collister@rcmp-grc.gc.ca

>> "roger.l.brown" <roger.l.brown@rcmp-grc.gc.ca>

>> serge.rousselle@gnb.ca>

>>

>> ---------- Forwarded message ----------

>> From: Don Marshall <don.marshall@edmonton.ca>

>> Date: Sat, 3 Oct 2015 13:28:09 -0400

>> Subject: Out of the office Re: Yo Mr Baconfat Please enjoy our little

>> debate in Fundy Royal with one of your hero Harper's many minions the

>> aptly named lawyer Rob Mooore

>> To: motomaniac333@gmail.com

>>

>> I will be out of the office at a conference the week of September 28

>> to October 2 inclusive. I will respond to your inquiry on my return.

>> If your inquiry is urgent please contact Angela Leatherland for

>> insurance/risk related issues and Clyde Lindstrom for claims related

>> issues.

>> --

>> Don Marshall, B.Ed.,CRM, FCIP

>> Director of Risk Management

>> City of Edmonton

>> 780-496-5139

>>

>>

>> On 10/3/15, David Amos <motomaniac333@gmail.com> wrote:

>> > http://youtu.be/-cFOKT6TlSE

>> >

>> > TRUST THAT NOBODY ENJOYS YOUR MINDLESS EVIL OPINION ON ANYTHING

>> >

>> >

>> https://baconfatreport.

>> >

>> > Harper is Gonna Win. Muslims Kicked Out and No One Listens to a Bimbo

>> > by baconfatreport on October 3, 2015

>> >

>>

>>

>>

>>

>

From: David Amos <motomaniac333@gmail.com>

Date: Tue, 20 Oct 2015 21:39:49 -0400

Subject: Re: Here is my latest complaint about the SEC, Banksters and Taxmen

To: David Amos <david.raymond.amos@gmail.com>

Cc: Peter Cowan <peter.cowan@cbc.ca>, norman.doyle@sen.parl.gc.ca,

george.baker@sen.parl.gc.ca, edward@ecconway.com,

suzanne.charron@sen.parl.gc.ca

<peter.mackay@justice.gc.ca>, Ches Crosbie <ccb@chescrosbie.com>,

frank petten <tsnews@nf.aibn.com>, kblidook@mun.ca,

krista.byrne-puumala@

ken.mcdonald@live.ca, info@lorrainebarnett.ca,

info@jennifermccreath.com, fabian.manning@sen.parl.gc.ca,

cpetersen@goldblattpartners.

<gopublic@cbc.ca>

On 10/7/15, David Amos <david.raymond.amos@gmail.com> wrote:

> ---------- Forwarded message ----------

> From: Kelly Blidook <kblidook@mun.ca>

> Date: Wed, Oct 7, 2015 at 10:22 AM

> Subject: Re: Here is my latest complaint about the SEC, Banksters and

> Taxmen

> To: David Amos <david.raymond.amos@gmail.com>

>

>

> Thanks for your email.

>

> Please note, if you are familiar with “making a point”, please do it

> succinctly. My job is not to read everything from everyone who includes me

> in an email list, and I’m going to spend time trying to make rhyme or

> reason of all these unconnected things or ranty all-cap emails. I delete

> spam, but I went back and found this after getting your phone message.

>

> All the best

> Kelly

>

> ----

>> From: The Telegram telegram@thetelegram.com

>> Date: Fri, 09 May 2008 12:42:55 -0230

>> Subject: Telegram article

>> To: david.raymond.amos@gmail.com

>> Hello David:

>> Pasted below is the article you were looking for. We generally charge

>> for research services, but this one is on the house.

>> Jackie

>> Editorial Clerk

>>

>> The Telegram (St. John's)

>> Provincial, Tuesday, May 6, 2008, p. A4

>> Justice/Free Speech

>>

>> Truth matters

>>

>> Defamation law that ignores truth ruled unconstitutional

>> Peter Walsh

>>

>> The Supreme Court of Newfoundland has ruled a law that could send

>> someone to prison for defamation is unconstitutional.

>>

>> Justice Lois Hoegg made the decision Friday. Her ruling also struck

>> down a criminal case by Crown prosecutors against Byron Prior of Grand

>> Bank.

>>

>> Prior claims that in 1966, a justice official in the province raped and

>> impregnated one of his relatives. Crown attorneys say Prior wore

>> placards and distributed flyers which published the allegations.

>>

>> The Royal Newfoundland Constabulary interviewed Prior's relative in

>> 2004 and in 2007, but the alleged victim denied she had been sexually

>> assaulted or that she even knew the person Prior said had attacked her.

>> Crown prosecutors tried to convict Prior of defamation under Section

>> 301 of the Criminal Code, which says "everyone who publishes a

>> defamatory libel is guilty of an indictable offence and liable to

>> imprisonment for a term not exceeding two years."

>>

>> The problem is, Hoegg said, the Crown couldn't prove that Prior was

>> knowingly spreading lies.

>>

>> "I find that it is not justified, in our free and democratic society,

>> for the Crown to use the heavy hammer of the criminal law against a

>> subject for publishing defamatory libel when the Crown is not able to

>> show that the subject knows that his statements are false.

>>

>> "The expression of truthful, unpopular or even false statements deserve

>> protection unless expressed in a violent manner," wrote Hoegg.

>> Hoegg said if the Crown could prove Prior knowingly published

>> defamatory libel, it would have charged him under a different section

>> of the criminal code that says "everyone who publishes a defamatory

>> libel that he knows is false is guilty of an indictable offence and

>> liable to

>> imprisonment for a term not exceeding five years."

>>

>> That law has withheld court challenges. Section 301 - the law which

>> does not mention the matter of truth - has been struck down as

>> unconstitutional by three other superior courts in Canada.

>> "The sections catch different types of offender. To me, it naturally

>> follows that their purpose or objectives must be different," wrote

>> Hoegg. "I then determined that the objective (of Section 301) was

>> not so pressing and important as to override freedom of expression.

>> The section is offensive to modern day notions of justice."

>>

>> The decision only applies to criminal applications of defamation law.

>> Hoegg said Prior could possibly be sued in civil court over his

>> allegations.

>>

>> Three years ago, a federal politician filed a statement of claim in the

>> Supreme Court of Newfoundland and Labrador to have a website that

>> contained allegations about him by Prior removed. In the statement,

>> the politician said a website posted by Prior accuses him and other

>> prominent Newfoundlanders of wrongdoing.

>>

>> A website containing the allegations is still active. Prior claims to

>> be a victim of physical and sexual abuse.

>>

>> pwalsh@thetelegram.com

>> 709-364-2323

>>

>> 2005 01 T 0010

>>

>> IN THE SUPREME COURT OF NEWFOUNDLAND AND LABRADOR

>> TRIAL DIVISION

>>

>> BETWEEN:

>> WILLIAM MATTHEWS PLAINTIFF

>>

>> AND:

>>

>> BYRON PRIOR DEFENDANT

>>

>> AND BETWEEN:

>>

>> BYRON PRIOR DEFENDANT/PLAINTIFF

>> BY COUNTERCLAIM

>>

>> AND: WILLIAM MATTHEWS PLAINTIFF/FIRST DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: T. ALEX HICKMAN SECOND DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: THOMAS MARSHALL THIRD DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: DANNY WILLIAMS FOURTH DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: EDWARD M. ROBERTS FIFTH DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: JOHN CROSBIE SIXTH DEFENDANT

>> BY COUNTERCLAIM

>>

>> AND: PATTERSON PALMER SEVENTH DEFENDANT

>> BY COUNTERCLAIM

>>

>> SUMMARY OF CURRENT DOCUMENT

>> Court File Number(s):2005 01 T 0010

>> Date of Filing of Document: 25 January 2005

>> Name of Filing Party or Person: Stephen J. May

>> Application to which Document being filed relates: Amended Application

>> of the Plaintiff/Defendant by Counterclaim to maintain an Order

>> restricting publication, to strike portions of the Statement of

>> Defence, strike the Counterclaim in it's entirety, and to refer this

>> proceeding to case management.

>>

>> Statement of purpose in filing: To maintain an Order restricting

>> publication, to strike portions of the Statement of Defence, strike

>> the Counterclaim in its entirety and refer this proceeding to case

>> management.

>>

>> A F F I D A V I T

>>

>> I, Stephen J. May, of the City of St. John's, in the Province of

>> Newfoundland and Labrador, Barrister and Solicitor, make oath and say

>> as follows:

>>

>> THAT I am a Partner in the St. John's office of PATTERSON PALMER

>> solicitors for William Matthews, the Member of Parliament for

>> Random-Burin-St. George's in the Parliament of Canada.

>>

>> THAT Mr. Matthews originally retained Mr. Edward Roberts, Q.C. on or

>> about 30 April 2002 after Mr. Byron Prior, the Defendant/Plaintiff by

>> Counterclaim, had made allegations against Mr. Matthews in a

>> publication called "My Inheritance - The truth - Not Fiction: A Town

>> with a Secret". In that publication, the allegation was made that Mr.

>> Matthews had had sex with a girl who had been prostituted by her

>> mother. That girl was alleged to have been Mr. Prior's sister.

>>

>> THAT upon being retained, Mr. Edward Roberts wrote a letter to Mr.

>> Prior. That letter to Mr. Prior is attached as Exhibit "1" to my

>> Affidavit.

>>

>> THAT subsequent to Mr. Roberts' letter to Mr. Prior, Mr. Roberts

>> received a 1 May 2002 e-mail from Mr. Prior. That e-mail is attached

>> as Exhibit "2".

>>

>> THAT subsequent to Mr. Roberts receipt of the e-mail, Mr. Prior swore

>> an Affidavit acknowledging that what had been said in that publication

>> was false. That Affidavit is attached as Exhibit "3" to my Affidavit.

>> Following Mr. Roberts' receipt of that Affidavit, Mr. Matthews advised

>> that he was satisfied not to pursue the matter any further and our firm

>> closed our file.

>>

>> THAT on or about 25 October 2004, I was retained by Mr. Matthews

>> following his gaining knowledge that a web site, made a series of

>> allegations against him relating to my having sex with a girl of

>> approximately 12 years old through to an approximate age of 15 years

>> old. It also accused him of being a father of one of her children and

>> accused him of having raped that girl. Upon checking the web site I

>> saw that Byron Prior, the Defendant, had been identified as the author

>> of the material on the site.

>>

>> THAT Mr. Matthews instructed me to write Mr. Prior, to remind him of

>> the fact that the allegations had been admitted to being false through

>> a 16 May 2002 Affidavit to advise him of Mr. Matthews' intentions to

>> commence legal proceedings if the comments were not removed from the

>> web site. A copy of my letter to Mr. Prior is attached as Exhibit "4"

>> to this Affidavit.

>>

>> THAT I attach as Exhibit "5" a transcript from a 5 November 2004

>> voicemail left by David Amos, identified in the voicemail as a friend

>> of Mr. Prior.

>>

>> THAT I attach as Exhibit "6" a portion of a 6 November 2004 e-mail

>> from Mr. Amos.

>>

>> THAT until I received his voicemail and e-mail, I had never heard of

>> Mr. Amos.

>>

>> THAT Mr. Amos has continued to send me e-mail since his 5 November

>> e-mail. Including his 6 November 2004 e-mail, I have received a total

>> of 15 e-mails as of 23 January 2005. All do not address Mr. Matthews'

>> claim or my involvement as Mr. Matthews' solicitor. I attach as

>> Exhibit "7" a portion of a 12 January 2005 e-mail that Mr. Amos sent to

>> me but originally came to my attention through Ms. Lois Skanes whose

>> firm had received a copy. This e-mail followed the service of the

>> Statement of Claim on 11 January 2005 on Mr. Prior. I also attach as

>> Exhibit "8" a copy of a 19 January 2005 e-mail from Mr. Amos.

>>

>> THAT I attach as Exhibit "9" a copy of a 22 November 2004 letter

>> addressed to me from Edward Roberts, the Lieutenant Governor of

>> Newfoundland and Labrador covering a 2 September 2004 letter from Mr.

>> Amos addressed to John Crosbie, Edward Roberts, in his capacity as

>> Lieutenant Governor, Danny Williams, in his capacity as Premier of

>> Newfoundland and Labrador, and Brian F. Furey, President of the Law

>> Society of Newfoundland and Labrador. I requested a copy of this letter

>> from Government House after asking Mr. Roberts if he had received any

>> correspondence from Mr. Amos during his previous representation of Mr.

>> Matthews. He advised me that he received a letter since becoming

>> Lieutenant Governor, portions of which involved his representation of

>> Mr. Matthews. Mr. Roberts' letter also covered

>> his reply to Mr. Amos.

>>

>> THAT I attach as Exhibit "10" an e-mail from Mr. Amos received on

>> Sunday, 23 January 2005.

>>

>> THAT I swear this Affidavit in support of the Application to strike

>> Mr. Prior's counterclaim.

>>

>> SWORN to before me at

>> St. John's, Province of Newfoundland and Labrador this 24th day of

>> January, 2005.

>>

>> Signed by Della Hart

>> STEPHEN J. MAY

>> Signature STAMP

>> DELLA HART

>> A Commissioner for Oaths in and for

>> the Province of Newfoundland and Labrador. My commission expires on

>> December 31, 2009

>>

>>

>>

>>

>>

>> ---------- Forwarded message ----------

>> From: David Amos <motomaniac333@gmail.com>

>> Date: Sat, Oct 3, 2015 at 2:29 PM

>> Subject: Re: Yo Mr Baconfat Please enjoy our little debate in Fundy Royal

>> with one of your hero Harper's many minions the aptly named lawyer Rob

>> Mooore

>> To: "angela.leatherland" <angela.leatherland@edmonton.

>> sunrayzulu@shaw.ca>, "Paul.Lynch" <Paul.Lynch@edmontonpolice.ca>

>> <premier@gov.ab.ca>, premier <premier@gnb.ca>, pm <pm@pm.gc.ca>,

>> "peter.mackay" <peter.mackay@justice.gc.ca>, "marylou.babineau" <

>> marylou.babineau@greenparty.ca

>> oldmaison <oldmaison@yahoo.com>, andre <andre@jafaust.com>, sallybrooks25

>> <sallybrooks25@yahoo.ca>, patrick_doran1 <patrick_doran1@hotmail.com>,

>> lois <lois@loisjoysheplawy.com>, "rod.knecht" <

>> rod.knecht@edmontonpolice.ca>, "don.iveson" <don.iveson@edmonton.ca>,

>> "don.marshall" <don.marshall@edmonton.ca>, "geoff.crowe" <

>> geoff.crowe@edmontonpolice.ca>

>> Marianne.Ryan@rcmp-grc.gc.ca>, "Charmaine.Bulger" <

>> Charmaine.Bulger@rcmp-grc.gc.

>> whistleblower <whistleblower@finra.org>, whistle <whistle@fsa.gov.uk>,

>> oig <oig@sec.gov>

>> Cc: David Amos <david.raymond.amos@gmail.com>

>> Peter.Juk@gov.bc.ca>, radical <radical@radicalpress.com>, paul <

>> paul@paulfromm.com>, "Paul.Collister" <Paul.Collister@rcmp-grc.gc.ca

>> "roger.l.brown" <roger.l.brown@rcmp-grc.gc.ca>

>> serge.rousselle@gnb.ca>

>>

>> ---------- Forwarded message ----------

>> From: Don Marshall <don.marshall@edmonton.ca>

>> Date: Sat, 3 Oct 2015 13:28:09 -0400

>> Subject: Out of the office Re: Yo Mr Baconfat Please enjoy our little

>> debate in Fundy Royal with one of your hero Harper's many minions the

>> aptly named lawyer Rob Mooore

>> To: motomaniac333@gmail.com

>>

>> I will be out of the office at a conference the week of September 28

>> to October 2 inclusive. I will respond to your inquiry on my return.

>> If your inquiry is urgent please contact Angela Leatherland for

>> insurance/risk related issues and Clyde Lindstrom for claims related

>> issues.

>> --

>> Don Marshall, B.Ed.,CRM, FCIP

>> Director of Risk Management

>> City of Edmonton

>> 780-496-5139

>>

>>

>> On 10/3/15, David Amos <motomaniac333@gmail.com> wrote:

>> > http://youtu.be/-cFOKT6TlSE

>> >

>> > TRUST THAT NOBODY ENJOYS YOUR MINDLESS EVIL OPINION ON ANYTHING

>> >

>> >

>> https://baconfatreport.

>> >

>> > Harper is Gonna Win. Muslims Kicked Out and No One Listens to a Bimbo

>> > by baconfatreport on October 3, 2015

>> >

>>

>>

>>

>>

>

https://www.cbc.ca/news/canada/newfoundland-labrador/liberals-aiming-to-catch-parties-off-guard-1.5105652

Liberals aiming to 'catch parties off guard' with election call, says MUN professor

Election call has left other parties 'scrambling,' says Kelly Blidook

With election signs sprouting from front lawns and branded busses on the roads, the 2019 provincial election is off to the races — but why is the election happening now?

Dwight Ball has said he didn't want to interfere with the federal election scheduled for late October, but Memorial University political science professor Kelly Blidook says there was also some political strategy involved in the decision.

By calling the election right before the Easter long weekend — and just a day after tabling a budget — Blidook says the Liberals are hoping to surprise their opponents, and it's left the other parties "scrambling."

"Because they are the governing party, it's easier for them to get candidates in place and lined up. They're trying to catch parties off guard if they can, they're taking what advantages they can."

One of those advantages for the Liberals is Elections NL's Thursday afternoon deadline for candidate nominations, a timeline that Blidook says will make it difficult for Ches Crosbie's Progressive Conservative party to run candidates across the province.

"You just want to be campaigning at this point, you don't want to be recruiting, and you don't want to be recruiting on the Easter weekend," he said.

"It would be detrimental, certainly, to not have the full 40 [candidates]."

After nominating six more candidates on Friday, the PCs now have 28 in place.

"This is a party that could've passed a budget, that could've given us exactly what they said they were doing, could've governed," he said.

"They've done the governing part up to the point where they feel it's advantageous and then called an election. I don't know if I'd say it's somehow unethical, but I think it does invite a cynicism."

Read more from CBC Newfoundland and Labrador

With files from Carolyn Stokes

CBC's Journalistic Standards and Practices

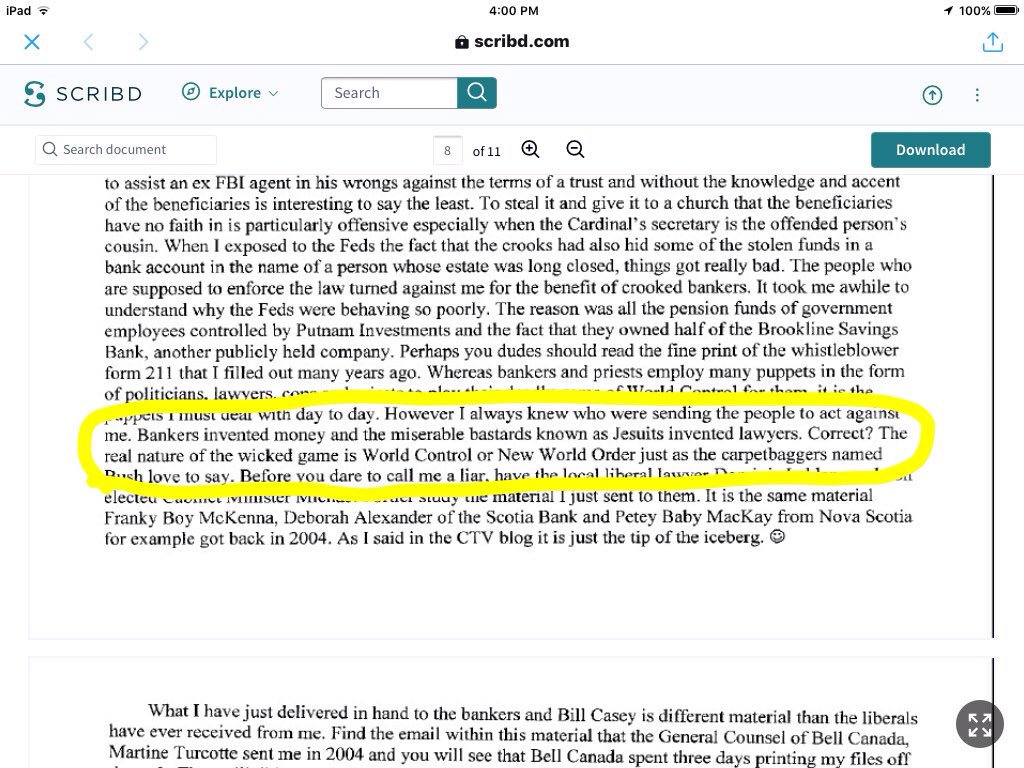

https://davidraymondamos3.blogspot.com/2018/03/unfortunately-we-have-people-who-dont.html

Tuesday, 6 March 2018

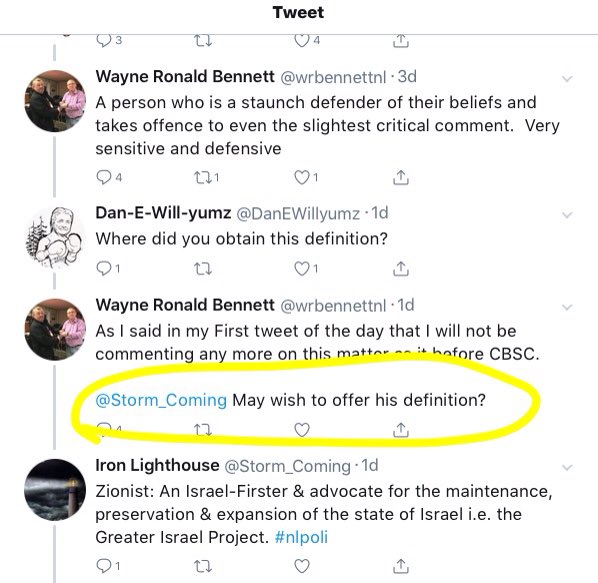

"Unfortunately, we have people who don't understand if I use certain terms."

---------- Original message ----------

From: "MinFinance / FinanceMin (FIN)" <fin.minfinance-financemin.

Date: Thu, 8 Mar 2018 18:25:35 +0000

Subject: RE: Attn Mark Gruchy I just called from 902 800 0369 Re My concerns about

From: "MinFinance / FinanceMin (FIN)" <fin.minfinance-financemin.

Date: Thu, 8 Mar 2018 18:25:35 +0000

Subject: RE: Attn Mark Gruchy I just called from 902 800 0369 Re My concerns about

Gerry Byrne et al and my comments in

CBC about Mr Bennett's concerns with the NDP

To: David Amos <motomaniac333@gmail.com>

The Department of Finance acknowledges receipt of your electronic

correspondence. Please be assured that we appreciate receiving your

comments.

Le ministère des Finances accuse réception de votre correspondance

électronique. Soyez assuré(e) que nous apprécions recevoir vos

commentaires.

---------- Original message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Thu, 8 Mar 2018 14:24:05 -0400

Subject: Attn Mark Gruchy I just called from 902 800 0369 Re My concerns about

Gerry Byrne et al and my comments in CBC about Mr Bennett's concerns with the NDP

To: mgruchy@gittenslaw.com, gerrybyrne@gov.nl.ca, premier <premier@gov.nl.ca>,

Joe Friday <Friday.Joe@psic-ispc.gc.ca>,

ethics-ethique <ethics-ethique@rcmp-grc.gc.ca

"Karen.Ludwig" <Karen.Ludwig@parl.gc.ca>, "Bill.Morneau"<Bill.Morneau@canada.ca>,

"bill.pentney" <bill.pentney@justice.gc.ca>, "jan.jensen" <jan.jensen@justice.gc.ca>,

mcu <mcu@justice.gc.ca>, "Mario.Dion" <Mario.Dion@cie.parl.gc.ca>

Cc: David Amos <david.raymond.amos@gmail.com>

http://www.gittenslaw.com/our-

http://www.cbc.ca/news/canada/

Rejected by NDP, Howley mayor threatens legal action

Wayne Bennett says he's been labelled, likens treatment to German Jews

forced to wear Stars of David

CBC News · Posted: Mar 05, 2018 11:51 AM NT

http://www.cbc.ca/news2/

---------- Forwarded message ----------

From: David Amos <david.raymond.amos@gmail.com>

Date: Tue, 5 May 2015 11:24:18 -0300

Subject: Fwd: I just called Pat Martin and Brad Butt about Commissioner Joe Friday

To: David Amos <motomaniac333@gmail.com>

The Department of Finance acknowledges receipt of your electronic

correspondence. Please be assured that we appreciate receiving your

comments.

Le ministère des Finances accuse réception de votre correspondance

électronique. Soyez assuré(e) que nous apprécions recevoir vos

commentaires.

---------- Original message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Thu, 8 Mar 2018 14:24:05 -0400

Subject: Attn Mark Gruchy I just called from 902 800 0369 Re My concerns about

Gerry Byrne et al and my comments in CBC about Mr Bennett's concerns with the NDP

To: mgruchy@gittenslaw.com, gerrybyrne@gov.nl.ca, premier <premier@gov.nl.ca>,

Joe Friday <Friday.Joe@psic-ispc.gc.ca>,

ethics-ethique <ethics-ethique@rcmp-grc.gc.ca

"Karen.Ludwig" <Karen.Ludwig@parl.gc.ca>, "Bill.Morneau"<Bill.Morneau@canada.ca>,

"bill.pentney" <bill.pentney@justice.gc.ca>, "jan.jensen" <jan.jensen@justice.gc.ca>,

mcu <mcu@justice.gc.ca>, "Mario.Dion" <Mario.Dion@cie.parl.gc.ca>

Cc: David Amos <david.raymond.amos@gmail.com>

http://www.gittenslaw.com/our-

http://www.cbc.ca/news/canada/

Rejected by NDP, Howley mayor threatens legal action

Wayne Bennett says he's been labelled, likens treatment to German Jews

forced to wear Stars of David

CBC News · Posted: Mar 05, 2018 11:51 AM NT

http://www.cbc.ca/news2/

---------- Forwarded message ----------

From: David Amos <david.raymond.amos@gmail.com>

Date: Tue, 5 May 2015 11:24:18 -0300

Subject: Fwd: I just called Pat Martin and Brad Butt about Commissioner Joe Friday

and his testimony before the OGGO

Committee on April 28th

To: info@gerrybyrne.ca, David Amos <motomaniac333@gmail.com>

---------- Forwarded message ----------

From: David Amos <david.raymond.amos@gmail.com>

Date: Tue, May 5, 2015 at 10:54 AM

Subject: Fwd: I just called Pat Martin and Brad Butt about Commissioner Joe Friday

To: info@gerrybyrne.ca, David Amos <motomaniac333@gmail.com>

---------- Forwarded message ----------

From: David Amos <david.raymond.amos@gmail.com>

Date: Tue, May 5, 2015 at 10:54 AM

Subject: Fwd: I just called Pat Martin and Brad Butt about Commissioner Joe Friday

and his testimony before the OGGO

Committee on April 28th

To: jean-francois.lafleur@parl.gc.

---------- Forwarded message ----------

From: David Amos <david.raymond.amos@gmail.com>

Date: Sat, May 2, 2015 at 12:29 PM

Subject: Fwd: I just called Pat Martin and Brad Butt about Commissioner Joe Friday

To: jean-francois.lafleur@parl.gc.

---------- Forwarded message ----------

From: David Amos <david.raymond.amos@gmail.com>

Date: Sat, May 2, 2015 at 12:29 PM

Subject: Fwd: I just called Pat Martin and Brad Butt about Commissioner Joe Friday

and his testimony before the OGGO

Committee on April 28th

To: ottawa@servingbarrie.com, "justin.trudeau.a1" <justin.trudeau.a1@parl.gc.ca>,

To: ottawa@servingbarrie.com, "justin.trudeau.a1" <justin.trudeau.a1@parl.gc.ca>,

stoffp1 <stoffp1@parl.gc.ca>, dominic.leblanc@parl.gc.ca

Cc: David Amos <motomaniac333@gmail.com>

---------- Forwarded message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Fri, May 1, 2015 at 6:26 PM

Subject: I just called Pat Martin and Brad Butt about Commissioner Joe Friday and his

Cc: David Amos <motomaniac333@gmail.com>

---------- Forwarded message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Fri, May 1, 2015 at 6:26 PM

Subject: I just called Pat Martin and Brad Butt about Commissioner Joe Friday and his

testimony before the OGGO Committee on

April 28th

To: pm@pm.gc.ca, Lampron.Raynald@psic-ispc.gc.

lachapelle.edith@psic-ispc.gc.

pat.martin@parl.gc.ca, OGGO@parl.gc.ca, manon.hardy@chrc-ccdp.ca,

"Gilles.Moreau" <Gilles.Moreau@rcmp-grc.gc.ca>

To: pm@pm.gc.ca, Lampron.Raynald@psic-ispc.gc.

lachapelle.edith@psic-ispc.gc.

pat.martin@parl.gc.ca, OGGO@parl.gc.ca, manon.hardy@chrc-ccdp.ca,

"Gilles.Moreau" <Gilles.Moreau@rcmp-grc.gc.ca>

"David.Coon" <David.Coon@gnb.ca>,

"Stephen.Horsman" <Stephen.Horsman@gnb.ca>

http://parlvu.parl.gc.ca/

---------- Forwarded message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Thu, 4 Dec 2014 13:01:14 -0700

Subject: Mr Lampron can ya tell I hate it when people call me a liar?

Furthermore why would you ignore an email from your boss?

To: Raynald Lampron <Lampron.Raynald@psic-ispc.gc.

http://parlvu.parl.gc.ca/

---------- Forwarded message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Thu, 4 Dec 2014 13:01:14 -0700

Subject: Mr Lampron can ya tell I hate it when people call me a liar?

Furthermore why would you ignore an email from your boss?

To: Raynald Lampron <Lampron.Raynald@psic-ispc.gc.

"Dion.Mario" <Dion.Mario@psic-ispc.gc.ca>,

Joe Friday <Friday.Joe@psic-ispc.gc.ca>,

"bob.paulson" <bob.paulson@rcmp-grc.gc.ca>, Clemet1 <Clemet1@parl.gc.ca>

Cc: David Amos <david.raymond.amos@gmail.com>

"bob.paulson" <bob.paulson@rcmp-grc.gc.ca>, Clemet1 <Clemet1@parl.gc.ca>

Cc: David Amos <david.raymond.amos@gmail.com>

"Randall.Garrison.c1" <Randall.Garrison.c1@parl.gc.

---------- Forwarded message ----------

From: Mario Dion <Dion.Mario@psic-ispc.gc.ca>

Date: Thu, 13 Nov 2014 06:05:25 -0500

Subject: Re: Fwd: Yo Mario Dion it been over a year since your last response and 7 years

---------- Forwarded message ----------

From: Mario Dion <Dion.Mario@psic-ispc.gc.ca>

Date: Thu, 13 Nov 2014 06:05:25 -0500

Subject: Re: Fwd: Yo Mario Dion it been over a year since your last response and 7 years

since I talked to the evil lawyer

Manon Hardy so tell me another one will ya?

To: "motomaniac333@gmail.com" <motomaniac333@gmail.com>,

"manon.hardy@chrc-ccdp.ca" <manon.hardy@chrc-ccdp.ca>,

"Clemet1@parl.gc.ca" <Clemet1@parl.gc.ca>,

"Errington.john@forces.gc.ca" <Errington.john@forces.gc.ca>,

"Christine.Salt@forces.gc.ca" <Christine.Salt@forces.gc.ca>,

"Mackap@parl.gc.ca" <Mackap@parl.gc.ca>, "bourdap@halifax.ca"

<bourdap@halifax.ca>, "Helen.Banulescu@crcc-ccetp.

<Helen.Banulescu@crcc-ccetp.

Edith Lachapelle <Lachapelle.Edith@psic-ispc.

<peter.dauphinee@gmail.com>, "upriverwatch@gmail.com"

<upriverwatch@gmail.com>, "donald.bowser@smu.ca"

<donald.bowser@smu.ca>, "kedgwickriver@gmail.com"

<kedgwickriver@gmail.com>, "oldmaison@yahoo.com"

<oldmaison@yahoo.com>, "COCMoncton@gmail.com" <COCMoncton@gmail.com>,

"Davidc.Coon@gmail.com" <Davidc.Coon@gmail.com>,

"stephen.horsman@nbliberal.ca" <stephen.horsman@nbliberal.ca>

"forest@conservationcouncil.ca

"water@ccnbaction.ca" <water@ccnbaction.ca>

Cc: "david.raymond.amos@gmail.com" <david.raymond.amos@gmail.com>

Raynald Lampron <Lampron.Raynald@psic-ispc.gc.

Joe Friday <Friday.Joe@psic-ispc.gc.ca>

I will ask my staff to verify your status and someone will get back to

you. I would appreciate it however if you could be a little bit more

polite when drafting emails adressed to me.

To: "motomaniac333@gmail.com" <motomaniac333@gmail.com>,

"manon.hardy@chrc-ccdp.ca" <manon.hardy@chrc-ccdp.ca>,

"Clemet1@parl.gc.ca" <Clemet1@parl.gc.ca>,

"Errington.john@forces.gc.ca" <Errington.john@forces.gc.ca>,

"Christine.Salt@forces.gc.ca" <Christine.Salt@forces.gc.ca>,

"Mackap@parl.gc.ca" <Mackap@parl.gc.ca>, "bourdap@halifax.ca"

<bourdap@halifax.ca>, "Helen.Banulescu@crcc-ccetp.

<Helen.Banulescu@crcc-ccetp.

Edith Lachapelle <Lachapelle.Edith@psic-ispc.

<peter.dauphinee@gmail.com>, "upriverwatch@gmail.com"

<upriverwatch@gmail.com>, "donald.bowser@smu.ca"

<donald.bowser@smu.ca>, "kedgwickriver@gmail.com"

<kedgwickriver@gmail.com>, "oldmaison@yahoo.com"

<oldmaison@yahoo.com>, "COCMoncton@gmail.com" <COCMoncton@gmail.com>,

"Davidc.Coon@gmail.com" <Davidc.Coon@gmail.com>,

"stephen.horsman@nbliberal.ca" <stephen.horsman@nbliberal.ca>

"forest@conservationcouncil.ca

"water@ccnbaction.ca" <water@ccnbaction.ca>

Cc: "david.raymond.amos@gmail.com" <david.raymond.amos@gmail.com>

Raynald Lampron <Lampron.Raynald@psic-ispc.gc.

Joe Friday <Friday.Joe@psic-ispc.gc.ca>

I will ask my staff to verify your status and someone will get back to

you. I would appreciate it however if you could be a little bit more

polite when drafting emails adressed to me.

https://twitter.com/i/notifications

- Tweets & replies Tweets & replies, current page.

- Media

NOPE You anonymous little Trolls did I just raised the stakes tis all Do

you really think that the folks don't know that the cops must know who

you are? Whereas they have allowed you to cyberbully so many people you

MUST be working with them. That ain't rocket science EH Mr Ball?

-

You Retweeted

🇺🇸FrogLips Inc.™🇨🇦 @realFrogLips

6 hours ago

Yes b'y, I did exactly the same fake Danny...He's trying to bring the FBI, CIA, RCMP, PMO into it..what a crackpot!!

YO @FBIWFO @DHSgov & @rcmpgrcpolice The chickenshit Trolls who work with the @RCMPNL & @FBIBoston asked about Uncle Willy and the Mob SO Methinks you all should enjoy listening to a real wiretap tape of the mob EH? @ryanrstack @uncledonNL #FBI #RCMP #DHS

Methinks some folks may recall that I predicted Trudeau "The Younger"

would appoint a Lucky Lady to be the RCMP Commissioner Small wonder why

CBC blocked me out of the gate today N'esy Pas? davidraymondamos3.blogspot.ca/2018/03/some-f… #FBICorruption #TrudeauMustGo #RCMP #DHS

- Turns out it was a coincidence The guy told me he heard his old boss was in the area and thought I was him He told me to check out his buddy on the Internet if I wanted to see my twin brother Now everyone who follows my Twitter feed know what the FEDS knowhttps://www.amazon.com/Richard-Marcinko-Rogue-Warrior-Autobiography/dp/B00RWQXH4G/ref=pd_lpo_sbs_14_t_0/146-4668935-5482815?_encoding=UTF8&psc=1&refRID=DPFRJBSRHATCSB8P81BF

-

You Retweeted

🇺🇸FrogLips Inc.™🇨🇦 @realFrogLips

3 hours ago

People tell me when I go quiet I get scary eyes I did not consider this a

coincidence and watched him closely as he bummed a smoke from me After

he knew I was not who he thought I was he confessed that he did not

smoke and was a professional diver working with the DHS in Beantown

In 2002 after having a little toe to toe with the Yankee Secret Service

and a herd of corrupt cops I was feeling mean so for relief I took my

kids and our dog to a lonely beach to think about things while they

played It was not long another guy turned up with his kids and a dog

When I see Frog Lips I think Frog Man Trust that all the FEDS know who

my friend Gene Stanley was He was the NSA dude who hired a lot of Navy

Seals in and out of service for the Bay of Pigs One was an acquaintance

of mine. He rode a Harley and fixed Hondas in Orlando N'esy Pas?

Clearly you and the FEDS do N'esy Pas Pervert? BTW when in Tampa do you

do much time at SOCOM like your fellow Troll Barry Winters claimed he

did? Review Paragraph 83 davidraymondamos3.blogspot.ca/2015/09/v-beha… #FBI #RCMP #DHS Then look for an obituary for your fellow Troll

http://www.cbc.ca/news/canada/edmonton/barry-winters-kris-wells-lgbtq-edmonton-hate-charges-1.4201914

Who GAF what you think PSYCHOPATH??....NOOOOOOBODY!!!!!

I'm confused. Who's crossing the line; Jeff, Storm or Amos? And why do you keep throwing the latter two into all your Tweets?

-

David is on CBC website, he always posts in the most liked comments section riding the coattails of top comments just before the stories close. This way if you scroll down you see his name and some comment he makes under every post. He must time it so it works out for him..lol

I'm confused. Who's crossing the line; Jeff, Storm or Amos? And why do you keep throwing the latter two into all your Tweets?

- 🇺🇸FrogLips Inc.™

-

- 🇺🇸FrogLips Inc.™🇨🇦 @realFrogLips 20 minutes ago

-

-

-

-

-

-

-

For some reason, Wayne interjected him out of the blue into a thread.

Both seem to be of the same orientation. I'm so confused and I need a

break.

Sounds good Froggy... Will be over in two shakes of a Kosher lamb's

tail.

You're really scraping the bottom of the Barrel fake Danny b'y. Come

over we takes another run to the Luscious Lizard in Lauderdale. You need

a break from the cracked crowd!

You caught me red handed. :-(

Took a while to wade through the "asses" and "bastards" and "boobs" to

get to the meat of this 22 page rambling 14 year old document. What's

it got to do with @wrbennettnl ?

& how's Uncle Willy?

Give it a rest!

Wha? Where did a crown Corp come into this convo?

Ease up on him Wayne; you already added him to this thread several tweets ago. Still don't know why.

So this is the writing of the Amos guy you've added to this conversation! Well played Wayne. It's all coming together.

Who the hell is this Amos guy and what does he have to do with this?

2/2

Who is doing the labelling? @DavidRayAmos

1/2

As Peckford said to Trudeau: do not put words into my mouth. @DavidRayAmos

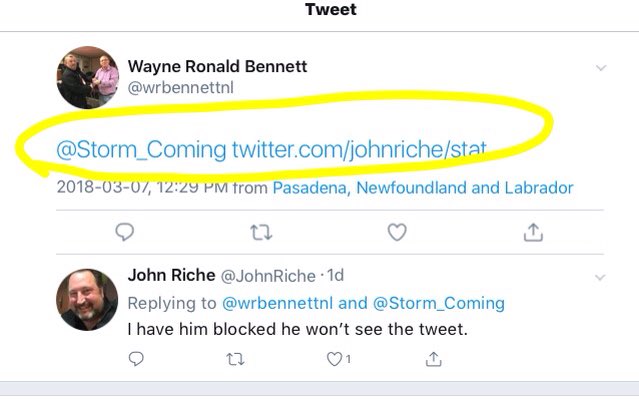

https://twitter.com/wrbennettnl

Wayne Ronald Bennett

@wrbennettnl Follows you

Naval Veteran,

Howley Mayor, Past Leader NL 1st, Vol Firefighter, Secretary HVFD,

Knight, Legionnaire, Disqualified NL PC Leadership Candidate &

Advocate

Howley NL 639.5350

639 5350 Is that your phone number? Mine is 902 800 0369 Perhaps we should

Wayne Ronald Bennett @wrbennettnl

Wayne Ronald Bennett @wrbennettnl

Cry me a river!

639 5350 Is that your phone number? Mine is 902 800 0369 Perhaps we should talk ASAP

I believe you and I spoke years ago correct?

Perhaps you should call a certain former member of the Newfoundland and

Labrador First Party who lived in Gagetown NB in 2006 when I ran for a

seat in the 39th Parliament start reading the comment section of CBC

ASAP? nl-outsidethebox.blogspot.ca/2006/01/ #nlpoli

1 reply

0 retweets

0 likes

Rejected by NDP, Howley mayor threatens legal action

Wayne Bennett says he's been labelled, likens treatment to German Jews forced to wear Stars of David

CBC News · Posted: Mar 05, 2018 11:51 AM NT

The mayor of Howley says if the Newfoundland and Labrador New

Democratic Party doesn't allow him to be a member, he'll take the party

to court.

It's the second time Wayne Ronald Bennett has been embroiled in a battle with a political party over membership rights.

In 2014, Bennett was bounced from the PC leadership race after that party ruled he had made racist and defamatory comments, and openly supported a New Democrat candidate in a St. John's byelection.

Bennett, who later obtained a membership in the NDP, has now fallen out with that party.

On Friday, he posted on Twitter a letter from NDP president Mark Gruchy rejecting his application to renew his party membership.

Gruchy cited comments by Bennett on social media and in interviews, including 2014 remarks which he said were anti-Muslim.

The rejection letter also noted Bennett's comments on Twitter in which he mocks the NDP, and uses crude and lewd language to describe government in general.

It also referenced his assertion that the Beothuk are the only Indigenous group with any inherent or land rights on this island, "which is not aligned with the long-held position of the NL NDP and its members."

Mark Gruchy cited several comments made by Bennett as to why his party membership was not renewed. (Glenn Payette/CBC)

Bennett responded on Saturday, threatening legal measures and encouraging current NDPers to give up their memberships.

Mark Gruchy cited several comments made by Bennett as to why his party membership was not renewed. (Glenn Payette/CBC)

Bennett responded on Saturday, threatening legal measures and encouraging current NDPers to give up their memberships.

According to Bennett, he wants to appeal the party's decision, and is asking for more information about how the decision was made, including minutes of the meeting where the decision was made.

"I want to see the evidence, and based on the evidence, then myself or my lawyer will, if allowed, launch an appeal. And if not allowed, then we'll go to court and challenge the decision."

Responding to a union activist who said she was happy the party rejected him, Bennett said she was making assumptions about him without meeting him.

"I call this labelling or Stars of David," he tweeted. Asked by CBC what he meant by that, Bennett responded with an answer he'd given VOCM host Jonathan Richler, who'd asked the same thing.

"Hitler put Stars of David on the Jews so that they'd be identified and so that they could be hated and ridiculed," he said. "I thought that after World War II the world would not have done that again, but unfortunately, we do the same thing.

Asked if he thought the treatment of Jewish people in Nazi Germany compared to being rejected by a political party, Bennett said he wasn't saying that.

"No, I wasn't saying that … I've said it many times in my lifetime, is that we label people, and I call that Stars of David, and then the hate takes place," he said.

"Unfortunately, we have people who don't understand if I use certain terms."

Contacted by CBC on Sunday, Gruchy said he hadn't yet seen Bennett's comments and would be responding later.

It's the second time Wayne Ronald Bennett has been embroiled in a battle with a political party over membership rights.

In 2014, Bennett was bounced from the PC leadership race after that party ruled he had made racist and defamatory comments, and openly supported a New Democrat candidate in a St. John's byelection.

- Wayne Bennett bounced from PC leadership race

- Wayne Bennett can join NDP, but members will decide if he can run: party VP

Bennett, who later obtained a membership in the NDP, has now fallen out with that party.

On Friday, he posted on Twitter a letter from NDP president Mark Gruchy rejecting his application to renew his party membership.

The rejection letter also noted Bennett's comments on Twitter in which he mocks the NDP, and uses crude and lewd language to describe government in general.

It also referenced his assertion that the Beothuk are the only Indigenous group with any inherent or land rights on this island, "which is not aligned with the long-held position of the NL NDP and its members."

According to Bennett, he wants to appeal the party's decision, and is asking for more information about how the decision was made, including minutes of the meeting where the decision was made.

"I want to see the evidence, and based on the evidence, then myself or my lawyer will, if allowed, launch an appeal. And if not allowed, then we'll go to court and challenge the decision."

'Stars of David'

Responding to a union activist who said she was happy the party rejected him, Bennett said she was making assumptions about him without meeting him.

"I call this labelling or Stars of David," he tweeted. Asked by CBC what he meant by that, Bennett responded with an answer he'd given VOCM host Jonathan Richler, who'd asked the same thing.

"Hitler put Stars of David on the Jews so that they'd be identified and so that they could be hated and ridiculed," he said. "I thought that after World War II the world would not have done that again, but unfortunately, we do the same thing.

Asked if he thought the treatment of Jewish people in Nazi Germany compared to being rejected by a political party, Bennett said he wasn't saying that.

"No, I wasn't saying that … I've said it many times in my lifetime, is that we label people, and I call that Stars of David, and then the hate takes place," he said.

"Unfortunately, we have people who don't understand if I use certain terms."

Contacted by CBC on Sunday, Gruchy said he hadn't yet seen Bennett's comments and would be responding later.

With files from Daniel MacEachern

Comments

Commenting is now closed for this story.

David Amos

Oh my my the first question I have is who is the all knowing lawyer?

"I or my legal counsel will be replying to these comments when, at the request of the President of the NDP, he replies to my question ref appeal and the furnishings of minutes/evidence/attendees that the Executive used to render their decision."

"I or my legal counsel will be replying to these comments when, at the request of the President of the NDP, he replies to my question ref appeal and the furnishings of minutes/evidence/attendees that the Executive used to render their decision."

Content disabled.

David Amos

@David Amos Methinks the

unnamed lawyer and many other Newfies should call former members of the

Newfoundland and Labrador First Party and ask a few questions (One in

particular lived in Gagetown NB at Xmass Time of 2005 he teased me when I

was running for a seat in the 39th Parliament) If they play dumb just

tell them to start reading the comment sections of my old blog called

"Just Dave" or simply give me a call N'esy Pas?

Jackie Barrett

Just shows that Newfoundland

and Labrador's political parties can be hypocritical as Randy Simms made

hateful comments against an Innu leader, Simeon Tshakapesh, on his VOCM

"Open Line" Radio Show in February 2013, but was allowed to run as a

Liberal candidate for Mount Pearl North in November 2015, but Wayne

Bennett made hateful comments in the past but not allowed to run for NDP

Leadership.

Definitely shows a double standard if Randy Simms can run for a seat in a traditional Left Wing party like the Liberals, but Wayne Bennett can't run for leadership with a party in a similar political spectrum like the NDP.

Source; PressReader "Innu Leader Not Accepting Simms' Apology" - https://www.pressreader.com/canada/the-telegram-st-johns/20130201/281496453664200

Definitely shows a double standard if Randy Simms can run for a seat in a traditional Left Wing party like the Liberals, but Wayne Bennett can't run for leadership with a party in a similar political spectrum like the NDP.

Source; PressReader "Innu Leader Not Accepting Simms' Apology" - https://www.pressreader.com/canada/the-telegram-st-johns/20130201/281496453664200

Martin Clark

@Jackie Barrett

Perhaps it has to do with willingness to acknowledge and to change.

This guy seems to not be willing to do either of those.

Perhaps it has to do with willingness to acknowledge and to change.

This guy seems to not be willing to do either of those.

David Amos

@Martin Clark Why should he?

Hugh MacDonald

Rejected by NDP,...

He should be thankful because they're doing him a favor.

He should be thankful because they're doing him a favor.

David Amos

@Hugh MacDonald LOL

Sean Flynn

Pretty sad what lack of

talent remains in rural Newfoundland, if this is the best they can do

for a mayor. One reason the place is such poor shape. Then more talent

leaves because of its poor shape, and the cycle continues.

David Amos

@Sean Flynn Oh Dear Methinks you are somewhat bitter about something N'esy Pas?

Sean Flynn

@David Amos and there is your proof.

George Ryan

The Howling Mayor, has also filed a complaint with A local radio station against one of the talk show personalities.

David Amos

@George Ryan Ain't that rather special?

james fryday

Try the Liberals ,then if

they won't accept you go to the greens. If they won't accept you look

into a mirror and see the problem.

David Amos

@james fryday We should all

look in the mirror now and then. Methinks It goes under the old Bard's

rule "To Thine Ownself Be True" N'esy Pas?

McKenzie King

The NDP is an irrelevant

party anyway, especially because of it's leadership. Don't know why

someone would want to be a member in the first place.

David Amos

@McKenzie King I wonder the same thing about all the political parties

Lee Philip Gilbert

Wayne back in the spotlight.

It's scary that had he kept his mouth closed and just stayed in the race

years ago.....he could have been Premier.

David Amos

@Lee Philip Gilbert I doubt that The writing was on the wall that the liberals were gonna win bigtime.

Thomas Carter

@David Amos You are

forgetting the PC leadership race between Bennett, Coleman, and Barry.

The winner of the race would take over the governing PCs and become

Premier. This was before the 2015 election. Both Barry and Coleman

dropped out of the race. Had Bennett not gotten booted out he would have

won the leadership and had become premier by default.

---------- Original message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Thu, 8 Mar 2018 13:51:34 -0400

Subject: Hey Gerry Byrne and Dwight Ball Enjoy a little Deja Vu

To: mgruchy@gittenslaw.com, gerrybyrne@gov.nl.ca, premier <premier@gov.nl.ca>

Cc: David Amos <david.raymond.amos@gmail.com>

http://davidraymondamos3.

Tuesday, 6 March 2018

"Unfortunately, we have people who don't understand if I use certain terms."

---------- Forwarded message ----------

From: David Amos <motomaniac333@gmail.com>

Date: Tue, 6 Mar 2018 18:16:59 -0400

Subject: Attn Richard Orser (506 323-2477) Re Our talk about The Scotia Bank and Hartland

To: orserrichard@gmail.com

Cc: David Amos <david.raymond.amos@gmail.com>

http://www.cbc.ca/news/canada/

Hartland hopes its only bank will rethink abandoning town

Scotiabank decision will hurt residents, businesses in town and

surrounding areas, chamber says

CBC News · Posted: Mar 06, 2018 4:42 PM AT

Residents of Hartland are meeting tonight to discuss the impending

closure of the town's only bank.

Richard Orser, president of the Central Carleton Chamber of Commerce,

says Scotiabank advised residents in early February the branch will

close Oct. 4.

"It was a little heartbreaking, disappointing — and the same with the

citizens of the town and the surrounding communities," Orser said

Tuesday of getting the news.